Exploring NSE IPO: Insights and Market Expectations

Indian investors are eagerly anticipating the much-anticipated Initial Public Offering (IPO) of the National Stock Exchange (NSE). However, before the NSE can make its market debut, the Securities and Exchange Board of India (SEBI) has laid down crucial conditions to ensure a seamless and transparent offering.

Regulatory Conditions for NSE IPO

SEBI, the market regulator, has set forth key conditions for the NSE to meet before launching its IPO. These include:

- Glitch-Free Operations: The NSE must maintain a glitch-free operation for at least a year, ensuring reliability and stability in its systems.

- Technological Infrastructure Enhancement: SEBI mandates an upgrade of NSE’s technological infrastructure to meet the evolving demands of the market.

- Corporate Governance Improvement: The NSE is required to enhance its corporate governance structure, addressing concerns raised in the past and ensuring transparency in its operations.

- Resolution of Legal Matters: Pending legal matters, including issues related to co-location facilities and preferential access, must be resolved before proceeding with the IPO.

NSE’s Listing Journey

The NSE’s journey to listing has been marked by delays, primarily due to corporate governance issues and regulatory investigations.

The co-location scam in 2015, involving its former CEO Chitra Ramkrishna, and technological failures in 2021 contributed to the postponement of its IPO.

Financial Performance and Shareholding Pattern

As of September 30, the NSE reported a robust financial performance. The consolidated net profit grew by 13% YoY, reaching ₹1,999 crore, with a 24% increase in consolidated income from operations, standing at ₹3,652 crore.

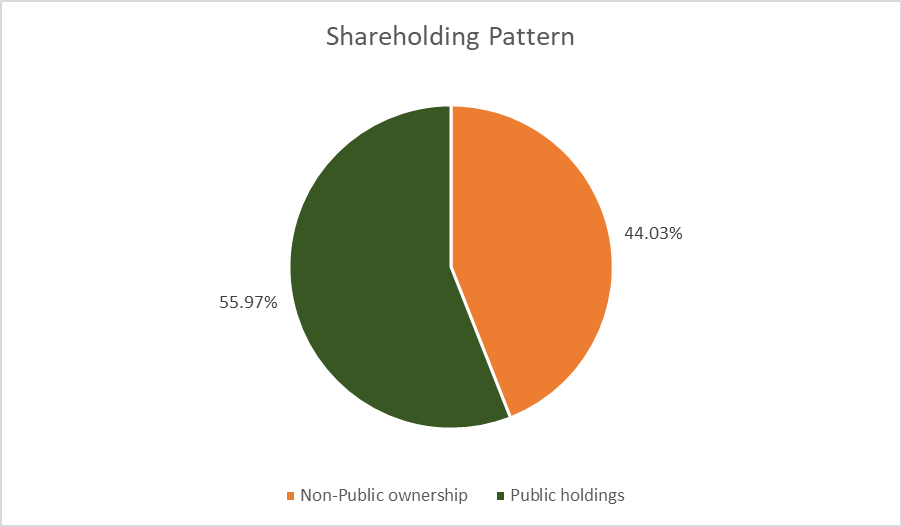

The shareholding pattern revealed that non-public ownership stood at 44.03%, slightly below the 49% threshold, while public holdings constituted 55.97%, surpassing the mandated minimum of 51%.

In the latest proposed auction, NSE’s shares were valued at ₹3,150.

Market Outlook and CEO’s Perspective

Despite challenges, Ashishkumar Chauhan, Managing Director and CEO at NSE, expressed optimism, stating that SEBI’s confidence in their processes, technology, and intentions is crucial.

The increasing number of investors in India further underscores the need for a reliable and transparent stock exchange.

IPO Timeline and Structure

In December 2016, the NSE submitted preliminary documents to SEBI for its IPO. The anticipated proceeds from the IPO were estimated to be ₹10,000 crore.

The IPO is structured as a comprehensive offer-for-sale (OFS), with existing shareholders intending to divest NSE’s shares.

Conclusion

As India’s financial landscape evolves, the NSE’s IPO holds significant promise. SEBI’s conditions aim to ensure a smooth and credible market entry for the NSE, reflecting the importance of robust governance and technological capabilities in the dynamic world of stock exchanges.

Investors and market enthusiasts await further developments as the NSE inches closer to realizing its IPO aspirations. Buy NSE unlisted shares from Altius Investech.

Read our other blogs

Get in Touch with us

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

To know, more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

You can also checkout the list of Best 5 Unlisted Shares to Buy in India

For Direct Trading, Visit – https://trade.altiusinvestech.com/.

To know more about How to apply for an IPO? Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/