Droom Technology Limited is an Indian company that maintains an online marketplace for buying and selling used and new automobiles.

The company was incorporated on 9 September, 2014, and first launched in Delhi on 21 November 2014 as a platform for used cars. Later, the company also added the buying and selling features for used cars and two-wheelers on its site and by 2015, it had operations in 100 cities across India.

In 2016, the company entered in a partnership with Cash Care and incorporated the orange Book value pricing engine into its platform that helps in determining the fair market value of used automobiles.

In December of the same year, the company introduced Droom History, a national repository for vehicle history which provides used vehicle history by generating a vehicle history report.

In 2018, Droom became the official sponsor of the MTV reality TV show Roadies’ 16th edition. In October, the company launched its platform in Malaysia, Singapore in December, and Thailand in April 2019.

Droom Technology Ltd is a cool tech company that helps people buy and sell cars and bikes online. They use fancy technology and data science to make it super easy. It is like a modern way to shop for cars and bikes on the internet. They have a big collection of over 1.15 million vehicles, including used and new cars and bikes. You can do everything online, from searching for a vehicle to finding the best price, and even getting it delivered to your doorstep. It is like online shopping but for awesome rides!

Objects of The Issue:

The offer comprises of an offer for sale of up to ₹1000 Cr and fresh issue amounting to ₹2,000 Cr. Out of the fresh issue, ₹1,150 Cr would be used for funding their organic growth initiatives, ₹400 Cr would be used for funding their inorganic growth initiatives and the balance amount is attributable to general corporate purposes.

Droom had however placed its IPO plans on the back burner in light of weakened macroeconomic sentiments.

They may restart work on the IPO sometime in 2024.

Financial Overview:

Droom spent Rs 527.2 crore in FY22, up 158% from the previous year, primarily due to impairment losses on financial assets and “other expenses” that include advertising and promotional expenses.

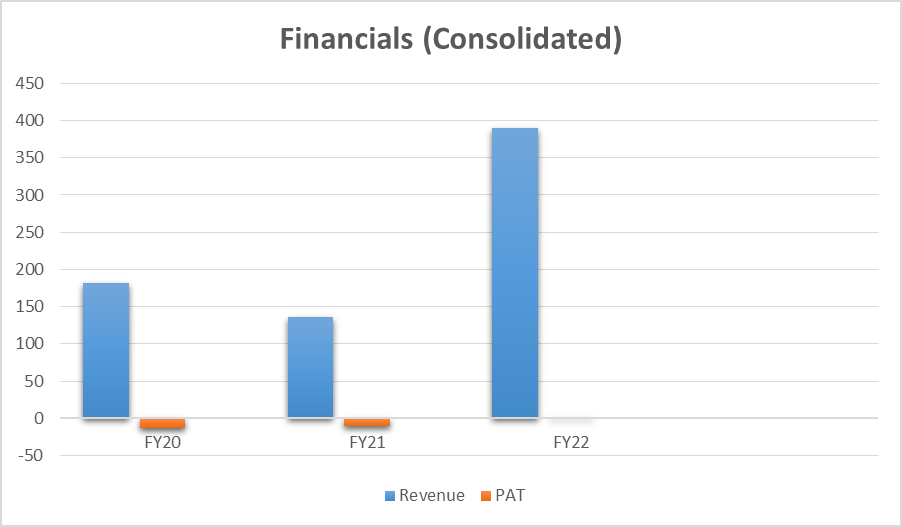

₹ in Crore

| FY20 | FY21 | FY22 | |

| Revenue (Consolidated) | 181.36 | 135.5 | 390.1 |

| PAT(Consolidated) | (12.79) | (9.83) | – |

Competitive Analysis: Market Peers

Droom Technologies is India’s pioneering automobile e-commerce platform and is all set to make its debut on the stock exchanges.

There are other listed companies that are working in similar segments. Let us get familiar with their names and market capitalizations as Droom gets ready for its IPO.

| Competitors | Market Capitalisation |

| Droom Technologies | ₹10,000 Crore |

| Spinny.com | ₹15,000 Crore |

| Cars24 | ₹27,509 Crore |

| CarDekho | ₹10,000 Crore |

| TrueCar | ₹2,000 Crore |

| QuikrCars | ₹12,249 Crore |

Competitive Strength:

- Market Leader: Droom Technology Ltd is a leading automobile e-commerce platform in India, known for its high Gross Merchandise Value (GMV) and being the primary player offering a fully online end-to-end experience.

- Technology-Driven Approach: The company relies on proprietary technology and data science, offering an asset-light, scalable platform. This approach allows them to control critical operations, ensuring a fast, simple, and consistent user experience.

- Wide Reach and Selection: Droom’s platform covers 11 vehicle categories, with over 278,807 used vehicles listed across 1,151 cities in India. They cater to both individual sellers and auto dealers, offering a diverse selection at various price points.

- Economies of Scale and Scope: Their platform is category, condition, seller, price, and geography agnostic, ensuring trade velocity and benefiting from economies of scale and scope. This minimizes costs and reduces risks associated with inventory.

- Technology and Data Products: Droom has developed a suite of proprietary technology-driven products, including OBV (used vehicle pricing engine), ECO (AI-based vehicle inspection), History (historical vehicle records database), Droom Discovery (vehicle research tool), and Droom Credit (automobile lending platform).

- Network Effects and Operating Leverage: Investments in technology and infrastructure, combined with a range of products, create a self-reinforcing cycle. The platform benefits from strong local network effects, driving user engagement, conversions, and loyalty, ultimately reducing marketing expenses.

- Financial Strength: Droom has robust unit economics, a lean cost structure, and an asset-light model. They do not own listed vehicles, making them capital-efficient. Since inception, they have facilitated the sale of 373,867 vehicles, with a steady increase in the number of auto dealers on their platform.

Competitive Weakness:

- Priority on Brand Image: Keeping a positive brand image is crucial for the company’s long-term success.

- Financial Challenges: The company has faced negative cashflows and losses previously. Also, possibility of future financial difficulties remains.

- Vulnerability to External Factors: The business is susceptible to disruptions caused by events like a pandemic or lockdowns.

- Sustainability Concerns: Ensuring the company’s sustainability involves addressing both financial issues and external uncertainties.

- Proactive Measures Needed: Taking proactive steps to manage finances and prepare for external challenges is essential for the company’s resilience.

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

To know, more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

You can also checkout the list of Best 5 Unlisted Shares to Buy in India

For Direct Trading, Visit – https://altiusinvestech.com/companymain/.

To know more about How to apply for an IPO? Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/