Waaree and Vikram Solar Establish Module Units in USA, Incentives Double Those in India

One shouldn’t wonder why an Indian corporation would prefer to manufacture elsewhere. Unless it’s a company that manufactures solar modules.

Solar manufacturing is one of the top five industries with the most money on the line out of the 14 sectors India is accelerating through the production-linked incentive (PLI) plan.

PLI plan

The government has set aside almost Rs 2 lakh crore ($24.3 billion). Rs 24,000 crore ($2.9 billion) of that is allocated for solar modules and their parts.

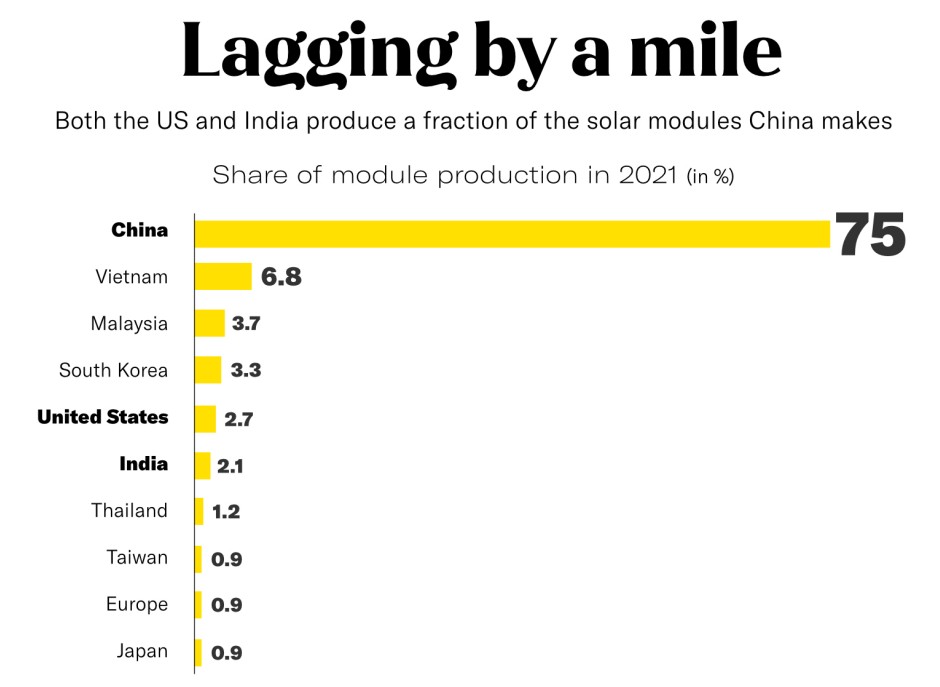

By imposing a 40% tax on Chinese businesses’ modules, India has also reduced their market dominance. That demonstrates how eager the nation is to use home manufacturing to support its energy transformation.

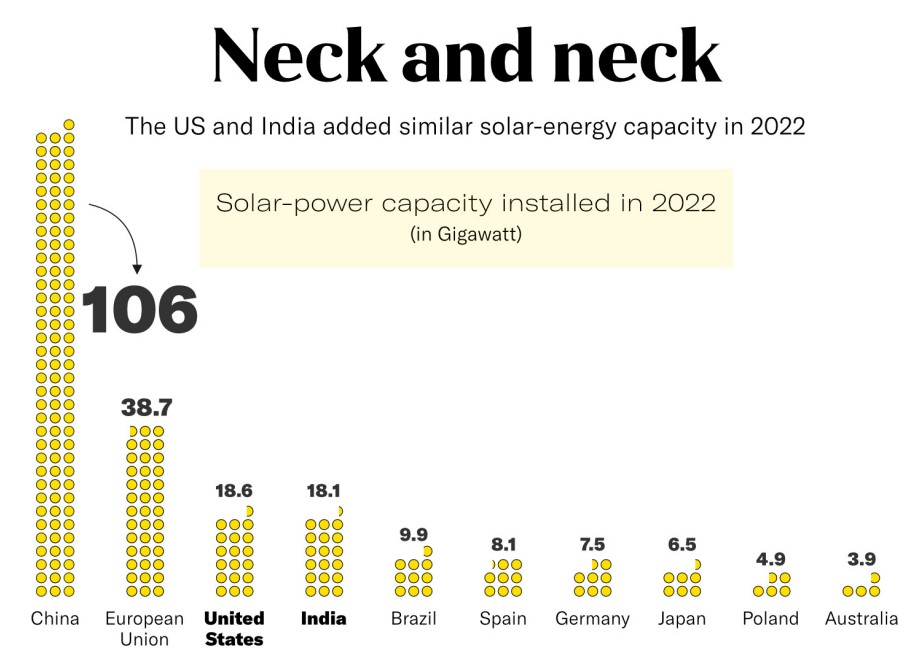

Then there’s demand for modules, which is ample. Last year, India added 18GW of solar-energy capacity, roughly equal to its operational module-manufacturing capacity, according to the International Energy Agency. That number is set to rise—India has to add 30GW annually to reach its target of 280GW of installed solar-energy capacity by 2030.

Indian module manufacturers finally have the potential to increase their market share at home after years of brutal competition from Chinese rivals.

However, the second- and third-largest module manufacturers in India, Waaree Energies and Vikram Solar Ltd., are getting ready to start producing in the US.

With ambitions to eventually add 4GW of ingots, wafers, and cells, Kolkata-based Vikram Solar recently launched a joint venture (JV) called VSK Energy LLC, which would invest ₹1500 Crore to first construct a 2GW module factory in the US. Additionally, Waaree is said to build a 2GW facility nearby, bringing the total capacity to 5GW.

Both Vikram Solar and Waaree, two of the 11 recipients of the solar PLI programme, have been exporting to the US for some time, but choosing to start manufacturing there would be a significant change.

When you take into account this one basic aspect, though, their seemingly baffling choice begins to make sense. The incentives in the US are PLI on steroids. In other words, compared to what module producers invest, the sops there may be at least 10X PLI.

However, this is not the only aspect. US module buyers don’t haggle as aggressively as their Indian counterparts. According to a top official connected to Vikram Solar, “Developers in the US are only concerned about their assured returns.” But in India, they’d like to have the chance to renegotiate when module prices fall.

The senior executive and a few other people who were mentioned in the article did not want their names to be used, either because they did not want to be perceived as criticising module manufacturers or because they were not licenced to speak to the media.

For Indian module makers, the desire to have a US presence is an exciting development. If the government had not provided protection against Chinese imports, the majority wouldn’t have even survived. Additionally, they have a poor reputation among some renewable energy developers.

How many of them, with all due respect, have a healthy balance sheet? According to the CEO of a mid-tier solar power producer. Will they be able to perform their duties if the warranty for their modules is triggered?

Too excellent to ignore

The fact that the US despises Chinese imports as much as it does Indian imports is at the heart of its ₹ 4,000 Crore clean energy stimulus programme, which includes grants, loans, and tax credits.

In 2018, Chinese modules and cells were subject to 25–30% tariffs from the US and India. The US imposed strict restrictions on imports from China’s Xinjiang region, famed for its suspected use of forced labour, while India followed it up in 2022 with a 40% levy on modules and 25% duty on cells.

However, neither nation stopped at merely excluding Chinese rivals.

India upped its PLI plan funding allotment for solar manufacturing by 5X last year. With its historic Inflation Reduction Act (IRA), the US went even further by rewarding homeowners, clean-energy generators, and solar manufacturers.

An Indian manufacturer of solar modules would receive Rs 25 ($0.3) in production-linked incentives over five years for every Rs 100 ($1.2) in capital expenditures. According to a senior executive close to Vikram Solar, tax credits in the US might be as high as Rs 250 ($3) for every Rs 100 of investment over the same time. “You simply file your tax returns to receive tax credits as incentives. The beauty of it is that.

On the other side, a small number of businesses are picked from a list of applicants under the PLI scheme.

Given these alluring incentives, it’s surprising that more Indian solar producers haven’t already jumped on the US bandwagon. The tax credits’ ten-year availability—twice as long as the PLI program—tips the scales even more in the US’s favour.

Manufacturers are also qualified for state-level government incentives, such as the $9 million in tax credits Colorado is providing to VSK Energy in exchange for the 900 jobs the company will be creating at the state’s 2GW module facility by the end of 2024.

None of Vikram’s competitors moving to the US have revealed information about their plants’ locations, investment amounts, or timelines. “Indian companies announce a number of stuff, including modules and green hydrogen. However, talking and actually doing something are two very different things, as the CEO of a mid-tier solar power producer previously stated.

Vikram Solar opted not to respond. Additionally, The Ken’s attempts for response from Waaree CFO Hitesh Mehta, Saatvik CEO Prashant Mathur, and Rayzon Solar founder and managing director Chirag Nakrani were not answered.

Waaree submitted an offer sheet with the Securities and Exchange Board of India in September 2021 in anticipation of going public. But Waaree chose to ditch its listing for private fundraise last year. Sebi’s approval for Vikram Solar’s flotation expires this month.

But when they try their luck at a share sale again, the prospect of yearslong sops in the US will certainly draw investors.

Cheese and chalk

Although the two businesses may be new to US manufacturing, the market is not. The country provides 25–30% of their income. Vikram reported sales of Rs 1,730 crore ($210 million) and a net loss of Rs 63 crore ($7.7 million) for the fiscal year that ended in March 2022. On sales of Rs 2,850 crore ($345 million) in the same period, Waaree generated a profit of Rs 80 crore ($9.7 million).

In the fiscal year that ended in March 2023, India exported modules and cells worth over $1 billion, with 97% of that going to the US. It is clear from the earnings why Indian module manufacturers are drawn to the US market.

“When you sell to an Indian customer, your net margins are 2-3%, but when you sell in the US, it’s twice as much, conservatively,” said Mirunalini Chellappan, director at Swelect Energy Systems Ltd, a Chennai-based module manufacturer.

Besides the tax breaks, the nature of clients in the US is a key factor in Vikram’s decision to manufacture there.

Power producers must have ordered the modules before they may obtain financing for a solar farm in the US. The senior executive of Vikram Solar added,

“Funders want to see committed procurement to ensure there are no variable expenses. They reserve modules as a result within the first six months.

To add to the uncertainty for manufacturers, power companies in India only place orders in the last three months of their 18-month execution period.

Without knowing whether you have the land or whether the substation is ready, you can’t have your modules. The CEO previously quoted stated that modules make up 60% of the project’s cost. Their company bagged a project through a state-government tender a year ago and is yet to receive the letter of award, let alone assurance on who will buy the electricity from the project.

It’s a dog-eat-dog market in India where power producers compete to win the right to develop sizable solar farms by offering the lowest tariff. Projected project returns can be off if a bidder is obliged to submit a bid that is even two pence lower than anticipated.

This means that the businesses must make the biggest possible module savings. They have every motivation to wait as long as possible to purchase modules if they believe that their prices will eventually decline.

The ability of Chinese module manufacturers to deliver large volumes quickly helps power companies do this. “Indian capacities are not such that you can get 200-300 megawatts in a month, which you can get from China,” a senior executive close to Vikram Solar said.

According to a top executive of a private equity-backed clean energy firm, huge Chinese solar producers may undercut their rivals in India despite import restrictions because of their scale.

Power providers are taking their time purchasing modules, even for solar farms developed expressly for industrial clients.

“From start to finish, it takes us a year. According to a corporate officer with a major power developer, the first three months are used to locate the land, do due diligence, and sign PPAs. “We order modules between the fourth and seventh month,” the statement reads.

Some of the issues affecting Indian solar manufacturers, such as slow land acquisition, arbitrary bid cancellations, and aggressive tariffs, are not an issue in the US. So, it’s a no-brainer for Indian module makers to seek customers there.

They can, of course, supply the modules from India, but it would be unwise to turn a blind eye if they are getting paid generously for manufacturing near to where their clients are.

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

Buy Waaree Energies unlisted shares.

Buy Vikram Solar Unlisted Share

To know, more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

You can also checkout the list of Best 5 Unlisted Shares to Buy in India

For Direct Trading, Visit – https://trade.altiusinvestech.com/.

To know more about How to apply for an IPO? Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/

To know more about Waaree – https://altiusinvestech.com/blog/waaree-energies-raises-%e2%82%b91000-crore/

To know more about Vikram Solar – https://altiusinvestech.com/blog/vikram-solar-ipo-overview/