We haven’t yet ended the first half of 2022, and already 17 companies have become Unicorns (valued at $1 billion or more), bringing India’s total to 103. By 2025, India is estimated to have produced 250 unicorns. For context, there are 1066 Unicorns in the globe, with 460 in the United States and 301 in China, with India coming in third. Another 100+ start-ups are’soonicorns,’ with the potential to become unicorns in a year. As an investor, seeing one’s capital double is surely exhilarating, so why would I write an article titled how to burst one?

Unicorns are not ‘too-big-to-fail’

For starters, unicorns are not the same as ‘too-big-to-fail’ corporations whose near-collapse triggered the 2008 financial crisis. If they falter, the market will abandon them. Second, despite their size, they are not exceptional; they are subject to the same market forces and regulations as everyone else. Third, names like Tesla, Solyndra, Theranos, Housing.com, PayTM, and Oyo might give investors nightmares, even though not all of them have failed. Indeed, with their internal finances and culture under question, several of India’s most known companies – Zomato, Housing, Grofers (formerly BlinkIt), Snapdeal, and Flipkart – are not the same as those that inspire confidence in investors.

Having no strategy is an issue, even if culture hasn’t eaten strategy for breakfast. PayTM is a prime example. It did well while e-wallets were popular in the mid-2010s, but as UPI became available in 2016, it progressively lost its key differentiator. PayTM changed to doing this and then doing that as virtual wallets decreased (when was the last time you used one? ), resulting in a corporation whose viability was questioned by investors. This is the controversial IPO from 21. PayTM put another old proverb to the test: no one will buy your sizzle if there is no sausage at the end of it. Perhaps it will yet find its way. Many unicorns have become downicorns and then returned. Leaving room for an industry making -icorn words.

Having your money in order is a different story, but that’s for another day. If you’re thinking about investing in a unicorn (which is generally a smart idea if done correctly), ask yourself some questions as follows:

Is there a real product that people want from the start-up?

The story of Juicero, the juice press maker, is one of the contemporary world’s cautionary fables. Who needs a machine to squeeze juice packets when you can, uh, squeeze them by hand? On the other hand, governments will force you to buy electric cars in order to reduce your carbon footprint, thus anyone in that company has long-term viability even if they are experiencing short-term difficulties. After all, it’s a basic concept: if a company continues to sell to new and repeat customers, it will eventually generate a profit.

Is there a business model for the unicorns?

Will its products be profitable in the long run, or will it continue to lose money? Is it providing a value proposition to clients that competitors cannot match? Don’t be concerned about momentary hiccups, but rather about the founders’ or executives’ abilities to resolve them.

Is there a ready and sustainable market for the unicorns?

We all tried Pepsi Atom once and didn’t like for it, so Pepsi had to stop it after a year. Start-ups, like large corporations, can fail. When was the last time you refilled your PayTM wallet instead of merely utilising it as a UPI interface?

Is the startup’s supply chain dependable?

This is true for both obtaining raw resources and distributing finished goods. Of fact, many tech unicorns can escape this.

Is the startup ethical?

I realise this seems woke, but it’s a legitimate question. Some have been investigated by the authorities for harassing clients (like easy loan apps)

Is there a problem with governance at the start-up?

If the unicorn’s consumers are unhappy, this is a terrible indicator. If the founders are being investigated for questionable financial practises (as was the case with Theranos and Zilingo), this is a warning flag. Avoid the company if it is known more for its drama than its balance sheet.

We have long believed that the New Economy is nothing more than the old one dressed up with new technobabble. The six questions I pose apply to any business. If a company responds adequately, it’s a terrific investment since the company knows how to create money and deliver value. It may experience temporary turbulence, but if you stick with it, you will enjoy the benefits. If the company is essentially a cash machine for investors, with no solid business model, cut your losses and say goodbye.

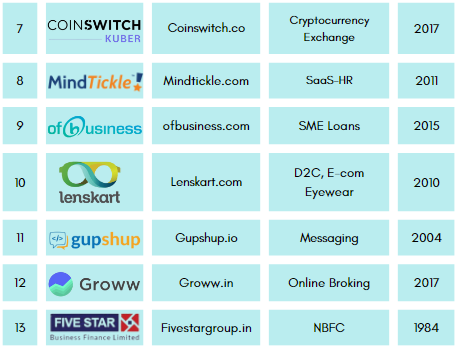

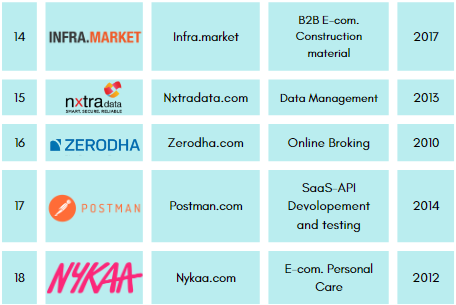

What are the top 23 profitable Unicorns?