Blog Highlights

- Who is Radhakishan Damani?

- Damani’s Investment Strategy

- Radhakishan Damani Portfolio Breakdown

- Top 5 Companies for Damani’s Share Holdings

- Damani strategic investment in Chennai Super Kings

- Radhakishan Damani Net Worth $20.3 Billion (207 Crores)

- Investment Strategies and Lifestyle

A look inside Radhakishan Damani Portfolio & Net Worth in 2024

Radhakishan Shivkishan Damani is a renowned retail pioneer and investor in India. His investment strategies and portfolio amplification make him iconic and one of the most successful entrepreneurs in the country. He started investing at 32, where his investment preferences included a long-term perspective, and purchasing quality stocks, which could promptly diversify his portfolio. Other than investing, his retail endeavor called Avenue Supermart runs over 200 DMart stores in the country.

Who is Radhakishan Damani?

Radhakishan Damani was born into a Marwari Hindu family, where he faced humble beginnings in a small apartment in Mumbai. He studied Commerce for about a year till he dropped out.

After his father’s death, Damani left his ball-bearing trade to become a stock market investor and broker. He earned profits through short-selling stocks primarily in the 1990s, where eventually he became the largest individual shareholder in HDFC Bank, as it became public in the year 1995.

The earnings happened to increase after 1992’s Harshad Mehta Scam for short-selling activities. In the year 1999, he tried to run a franchise of Apna Bazaar, a cooperative department store, as he figured this business model could not convince him. The year 2000 found Damani leaving stocks to start Dmart, his hypermarket chain, with its first Powai store, which rapidly expanded.

Damani’s Success Story

Radhakishan Damani was born in 1954 in Bikaner, Rajasthan, India. The University of Bombay made him gain a profound foundation. His early interest in stocks and the share market was evident to pave the way for future success. The diligent research and tenacity made Damani score a name for himself in the community of Indian investors.

His entry into the stock market led to his transformation into a respected investor. He gained recognition for his ability to identify undervalued stocks and wisely implement well-timed decisions of investment. His analytical prowess was fundamental in setting him apart, allowing him to accumulate enormous wealth, and establish himself as a notable investor in the country.

DMart- Damani founded Dmart which entirely revolutionized the retail sector. This occurred as high-quality products were sold at affordable prices. It is the most profitable retail chain, testifying to his belief in customer satisfaction.

Examining Damani’s Investment Strategies

Damani’s investment philosophy highlights a commitment to value investing. Radhakishan finds undervalued stocks that have strong growth potential and holds them tactfully for a long time. It means he tries to find stocks that trade below their actual intrinsic value.

He has been researching diligently and focusing on basic analyses of robust financials and solid business models. Adhering to the approaches of value investment made Damani consistently generate substantial returns.

The investment strategies visibly characterize focusing on high-quality businesses as well as a long-term investment horizon. Concentrating on a business that has competitive advantages and solid fundamentals, instead of market sentiment or price movements, Damani has aimed to build wealth only with time.

The Contrarian approach allows him to recognize undervalued stocks that investors have overlooked, thereby capitalizing on various market inefficiencies.

He has not chased short-term achievements or losses. He believes in investing for the long term so that he can benefit from the power of compounding and attain high returns.

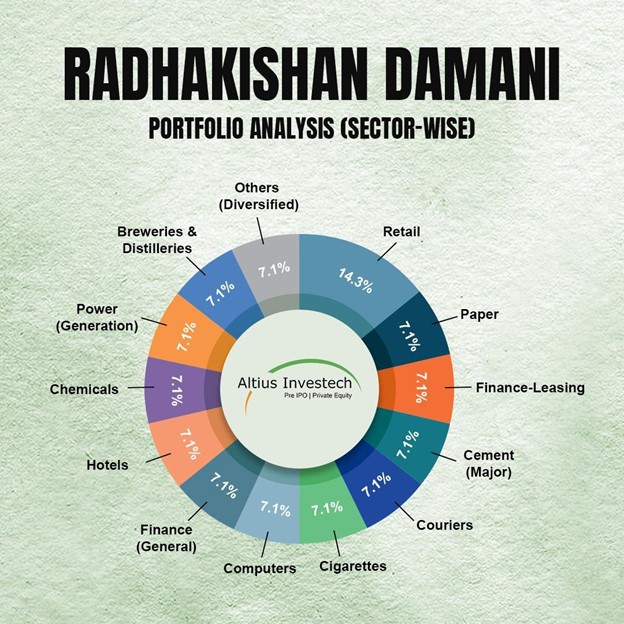

Radhakishan Damani Portfolio Breakdown

If you are wondering if you would replicate Radhakishan’s portfolio and strategies to reach the heights he did, then it is quite a leap! It is because people like us often adjust our investments based on market conditions and risk weights. By the time an average investor becomes aware of the changes, they quite possibly have already missed the bus.

Damani’s diverse portfolio contains stocks from different sectors like retail, finance, healthcare, cement, and finance. His significant stakes include the ones in VST industries, Trent, India Cements, Sundaram Finance, and Blue Dart Express.

Radhakishan Damani portfolio successes remain attributed to his mentors, Chandrakant Sampat and Manu Manek, who taught him the art of value investing alongside the principles of long-term wealth.

Major holdings in Radhakishan Damani Portfoli includes

- Avenue Supermarts Ltd- Shareholding of 67.24%

- VST Industries Ltd- Shareholding of 30.71%

- India Cements Ltd- Shareholding of 20.78%

There are 12 active stocks out of the 15 stocks that Radhakishan Damani owns in 2024

In no particular order, here’s a list of the shares he has invested in along with their holding percentages and Valuation in Crores, for March 2024. The inactive stocks are placed at the last for a better understanding.

Damani publicly holds 14 stocks in his total investment portfolio, where the total value of his stock portfolio as of 2023 is approximately 178572 Crores ($22 Billion).

12 Active Stocks he owns

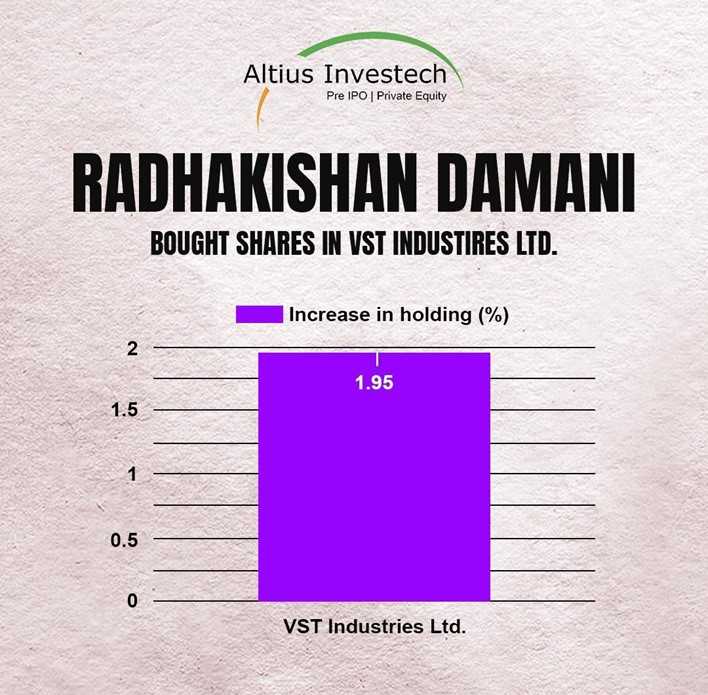

- VST Industries Ltd- The holding percentage for VST Industries is 32.66, where the valuation is 1971.36 Crores, as per current data.

- United Breweries Ltd- The holding percentage for United Breweries is 1.23, where the valuation is 636.78 Crores, as per current data.

- India Cements Ltd- The holding percentage for India Cements is 20.78, where the valuation is 1338.19 Crores, as per current data.

- Sundaram Finance Ltd- The holding percentage for Sundaram Finance Ltd is 2.37, where the valuation is 1186.21 Crores, as per current data

- Sundaram Finance Holdings Ltd- The holding percentage for Sundaram Finance Ltd is 1.88, where the valuation is 94.15 Crores, as per current data.

- Mangalam Organics Ltd- The holding percentage for Mangalam Organics Ltd is 2.17, where the valuation is 6.78 Crores, as per current data.

- Blue Dart Express Ltd– The holding percentage for Blue Dart Express Ltd is 1.29, where the valuation is 219.71 Crores, as per current data.

- BF Utilities Ltd- The holding percentage for BF Utilities is 1.01, where the valuation is 32.84 Crores, as per current data.

- Avenue Supermarts Ltd- The holding percentage for Avenue Supermarts Ltd is 67.24, where the valuation is 211172.06 Crores, as per current data.

- Aptech Ltd- The holding percentage for Astra Microwave Products Ltd is 3.03, where the valuation is 40.67 Crores, as per current data.

- Advani Hotels and Resorts Ltd- The holding percentage for Advani Hotels and Resorts Ltd is 4.18, where the valuation is 30.49 Crores, as per current data.

- 3M India Ltd- The holding percentage for 3M India Ltd is 1.48, where the valuation is 482.41 Crores, as per current data.

3 Inactive Stocks

- Trent Ltd

- Astra Microwave Products Ltd

- Andhra Paper Ltd

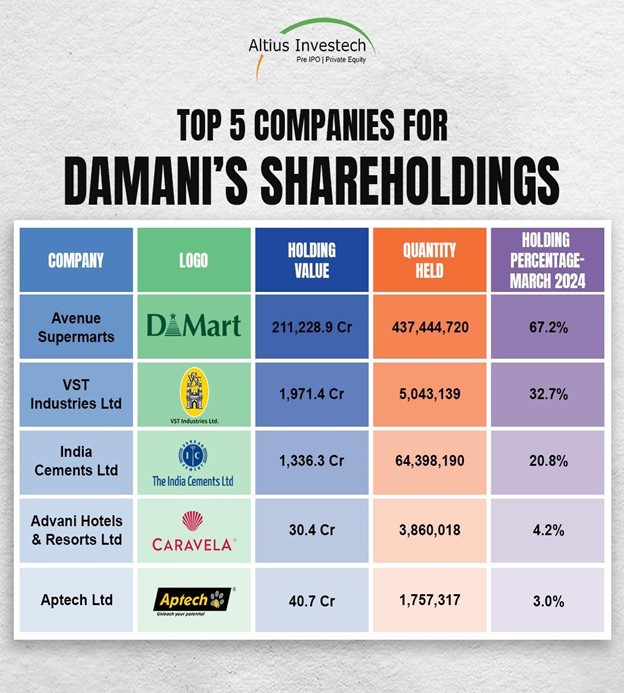

Top 5 Companies for Damani’s Share Holdings

1.Avenue Supermarts Ltd. – Avenue Supermarts, operating under the brand D-Mart, is a significant part of Damani’s investment portfolio. Known for its efficient operations and profitability, it remains a favored choice among steady-growth seekers.

2. VST Industries Ltd. – Holding a strong position in the tobacco industry, VST Industries is noted for its solid distribution network and consistent performance, making it a stable investment.

India Cements Ltd. – A strategic investment reflecting Damani’s confidence in the infrastructure sector, India Cements benefits from the anticipated growth in construction and infrastructure projects.

Advani Hotels & Resorts Ltd. – This investment in the hospitality industry taps into the potential of tourism and corporate travel, capitalizing on post-pandemic recovery trends.

Aptech Ltd. – Aptech represents Damani’s foray into the education sector, focusing on digital learning and training solutions, poised for growth with the rise in edtech demand.

Other than that, he has shareholdings in Astra Microwave products, Kaya, Prozone Intu Properties, and Simplex Infrastructures. Investing early and wisely becomes key to significant wealth creation, a principle exemplified by the legendary investor. In 2020, he made a strategic move by acquiring about 78 lakh shares of the NSE or National Stock Exchange at around Rs 1050 per share, securing a 1.58% stake in the company.

NSE unlisted shares prices starts from ₹ 3199 . Start investing now!

The visionary investment has spectacularly paid off with share prices soaring to Rs 6000, delivering about 6x returns. This remarkable achievement underscores the power of strategic investing and foresight. To better understand, IN FY24 NSE’s revenue has grown at a CAGR of 28% whereas PAT has grown by 13%.

| Particulars | FY-24 | FY-23 | FY-22 |

| Total Revenue | 16352 | 12765 | 8874 |

| EBITDA | 11611 | 9428 | 6500 |

| PAT | 8306 | 7356 | 5199 |

| EPS | 167.80 | 148.6 | 105 |

| DPS | 90 | 80 | 42 |

Along with the dividend NSE also announced a bonus issue of 4 shares for every 1 share. Read more about National Stock Exchange (NSE) Bonus issue.

As of May 2024, NSE is currently trading at a market cap of 2,97,000 crores and a P/E of 36 in respect to BSE which is trading in the stock exchange at a market cap of 37,800 crores and a P/E of 90.

BSE can be acquired easily from the stock exchange but so can NSE through our platform for unparalleled revenue gains.

Damani strategic investment in Chennai Super Kings

Damani has also invested in Chennai Super Kings – an IPL franchise backed by India Cements Limited. With an illustrious history, they have participated in a record 10 finals, won a record five IPL titles in 2010, 2011, 2018, 2021, and 2023, and qualified for the playoffs 12 times out of the 14 seasons they have played in, which is more than any other franchise.

They are one of the most valuable IPL franchises with a valuation of roughly $1.15 billion(as per Forbes) as of 2022. Read more aboutChennai Super Kings – FY2022 Highlights. During the year the company made a profit of 52 crores on a standalone basis. Also read more about CSK Pre-IPO share price.

Still, its subsidiaries SuperKing Ventures Private Limited and Joburg Super Kings Ltd. incurred a loss of 6 crores and 32 crores respectively. Losses from these 2 subsidiaries led the profitability to around 14 crores on a consolidated basis.

Ace investor and Dalal Street veteran Radhakishan Damani has held around 2.4% stake in CSK since March 2019. Shares of CSK have rallied almost 300% from the level of 67 in FY-21 to the level of 190 in FY-24.

To have your hands-on gains that we can vouch for, buy csk unlisted shares from Altius Investech starting from just ₹ 153. CSK unlisted share price has gone from Rs.20 to Rs 200 a 10X increase in barely 3 years .

The investments highlight his penchant for focusing on a few high-conviction bets instead of spreading the investments thinly across multiple assets.

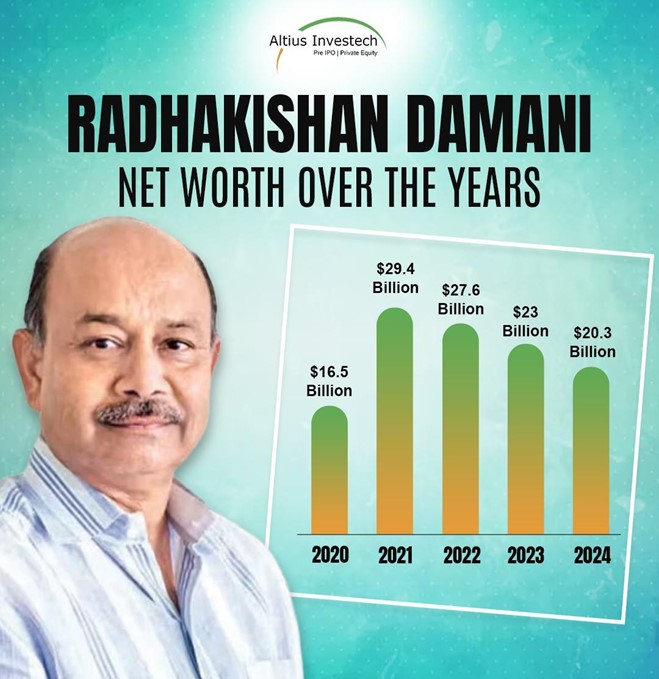

Radhakishan Damani Net Worth and Financial Insights

Radhakishan Damani’s net worth has been estimated to be $20.3 Billion (207 Crores) as of the year 2024 according to Forbes. As per the Bloomberg Billionaires Index, his net worth has been noted to be $18.3 Billion as of Jan 2024.

In 2023, the estimation was approximately $19.1 Billion. The financial success has been largely attributed to his choices of strategic investment, alongside the exponential growth of Dmart, which became public in the year 2017. It illustrated his ability to blend his investment acumen with entrepreneurial zeal.

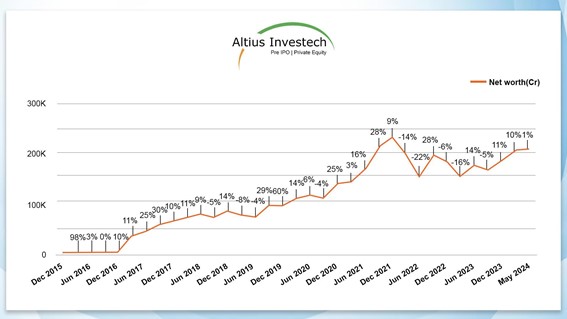

Net Worth Over the Years

Damani’s wealth of over Rs 1.75 lakh crore makes the 69-year-old move up two ranks to gain the 5th spot in the richest people list, as dominated by Mukesh Ambani and Gautam Adani. The last 5 years have found Damani’s wealth to increase by 280% or Rs 128800 Crore. Data from the richest people list shows that he has earned around 57 Crore every day, where his wealth has jumped 13% in the last year.

Damani has been found to hold stakes in different organizations, from tobacco firms known as VST Industries to renowned cement producers “India Cements”. He picked up about 15% stake in May 2020 in India Cements, where he took his investment up to 19.89%.

Damani publicly holds 14 stocks in his total investment portfolio, where the total value of his stock portfolio as of 2023 is approximately 178572 Crores ($22 Billion).

Lifestyle of a Billionaire Investor

Damani has an overall private life, which is highlighted through his simplicity. Despite being the owner of immense wealth, he has a modest lifestyle and is known to reside in Mumbai with his family. His philanthropic efforts and personal interests remain less publicized, reflecting his low-life personality.

Damani and his brother GopiKishan have bought a home in South Bombay in the year 2021, which costs more than $100 Million. His property portfolio also includes a lavish 156-room Radisson Blu Resort in Alibag, that allows a getaway close to the city of dreams. In early 2023, both brothers paid $155 Million for about 28 apartments in a luxury tower, developed by Vikas Oberoi, another fellow billionaire.

Conclusion

Damani’s journey from a stock market beginner to a successful retail magnate as one of the country’s richest men proves to give compelling insights into effective strategies of investment. The story showcases a testament to the power of combining market understanding in depth, with a disciplined approach to investment. It offers valuable insights for investors trading at all levels. We hope you found this overview of Radhakishan Damani portfolio insightful. Be sure to explore our other blogs for more investment tips.

FAQ

Radhakishan Damani, a prominent Indian investor, has significant investments in several key companies. As of the latest available data, the top five companies in his portfolio include : Avenue Supermarts Ltd , VST Industries Ltd , India Cements Ltd , Advani Hotels & Resorts Ltd , Aptech Ltd

Radhakishan Damani’s net worth has been estimated to be $20.3 Billion (207 Crores) as of the year 2024 according to Forbes.

Damani’s investment philosophy highlights a commitment to value investing. Radhakishan finds undervalued stocks that have strong growth potential and holds them tactfully for a long time. It means he tries to find stocks that trade below their actual intrinsic value.

Real owner of DMart is Radhakishan Damani

Radhakishan Damani has invested in a diverse portfolio of companies across various sectors. Here are some of the stocks he holds VST Industries Ltd, United Breweries Ltd, India Cements Ltd, Sundaram Finance Ltd, Sundaram Finance Holdings Ltd, Mangalam Organics Ltd, Blue Dart Express Ltd, BF Utilities Ltd, Avenue Supermarts Ltd, Aptech Ltd, Advani Hotels and Resorts Ltd, 3M India Ltd.

Radhakishan Damani left the stock market in 2000 to establish his hypermarket chain, DMart, launching the first store in Powai in 2002. By 2010, the chain expanded to 25 stores. The company’s rapid growth led to a successful public listing in 2017. By 2020, Damani had become the fourth-richest Indian, amassing a net worth of $16.5 billion

GET IN TOUCH WITH US

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

Click here to connect with us on WhatsApp

For Direct Trading, Visit – https://trade.altiusinvestech.com/.