Martin & Harris Laboratories, the pharmaceutical arm of Apeejay Group, has announced its results for the financial year ended on March 31, 2021.

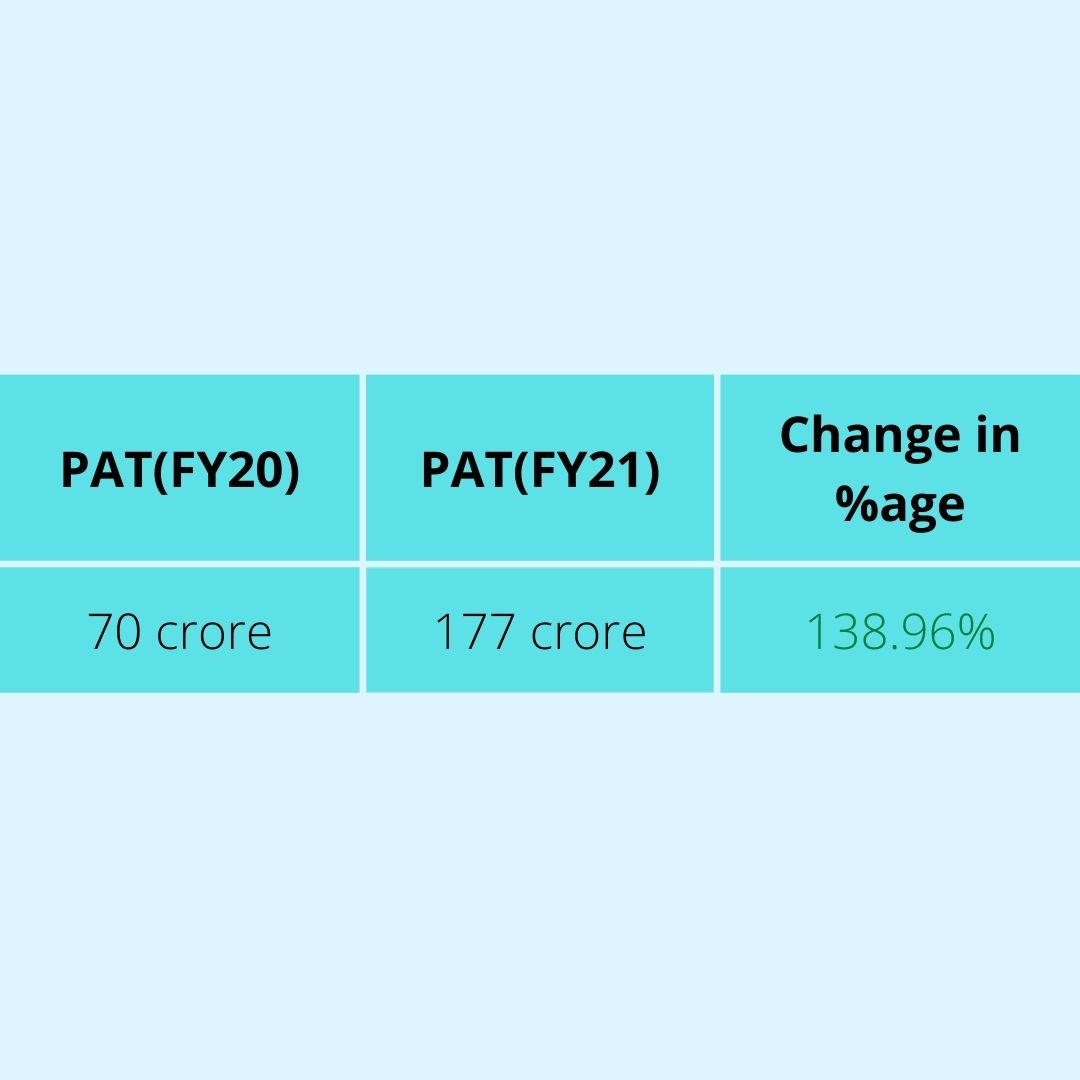

In the financial year 2020-21, Martin & Harris Laboratories clocked a profit after tax (PAT) of Rs 177 crore, a rise of 138.96 per cent against a net profit of Rs 70 crore in the financial year 2019-20.

In the last seven years, the revenue of the company has grown at a CAGR of 30 per cent and from Rs 67 crore to 336 crore, whereas PAT has surged at a CAGR of 61 per cent to Rs 177 crore.

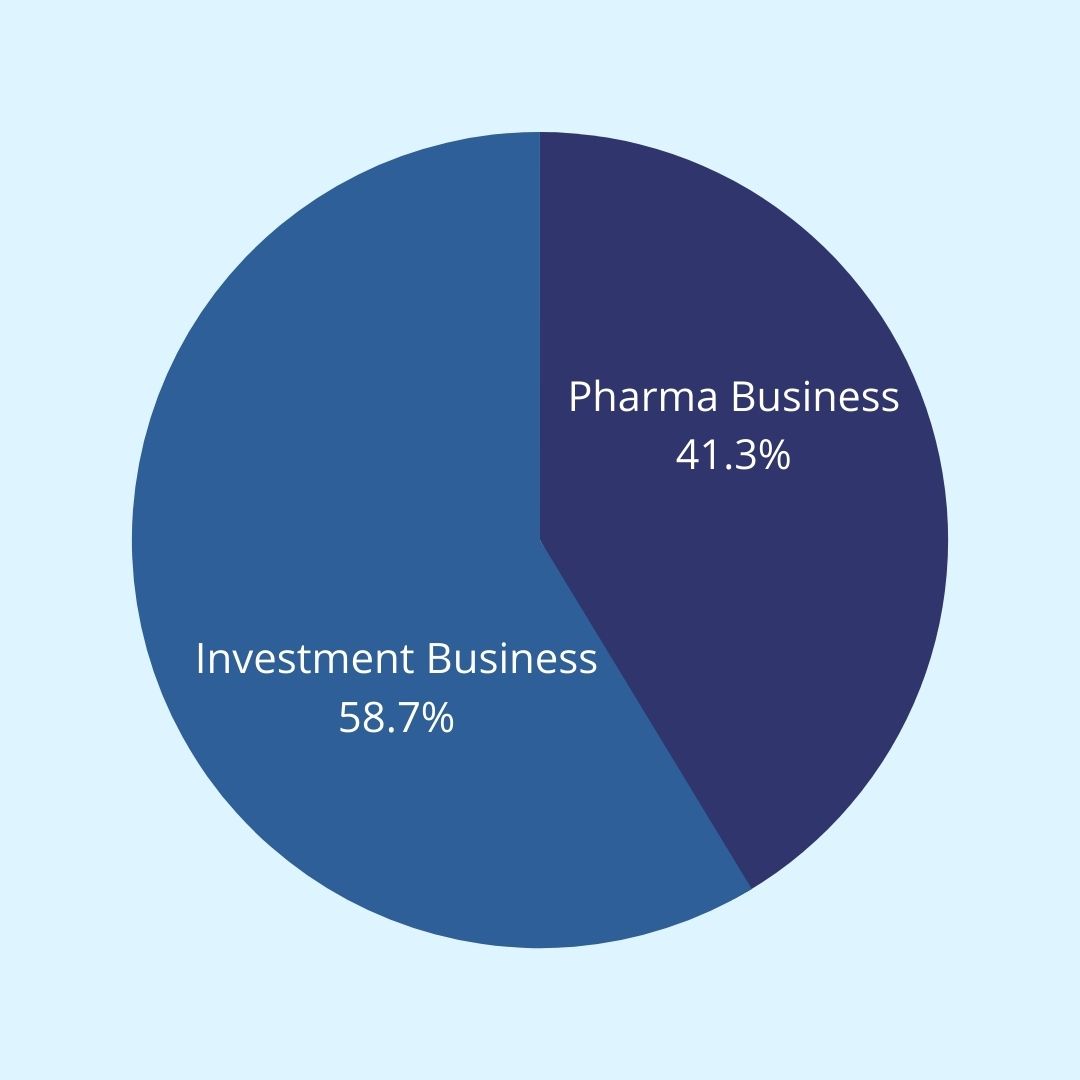

The total income for the FY 2020-21 includes Rs 138 crore from pharma business and Rs 196 crore from investment business. Earnings per share (EPS) of the company zoomed to 443 in FY21 against an EPS of 180 in FY20.

In FY21, Delite Infrastructure an investment arm of Martin and Harris Laboratory has generated EBIT of 160 Crores on capital of 400 Crores, which is 40 per cent return on capital. And, though period and portfolio is large, if we benchmark this with Warren Buffet’s investment company Berkshire Hathaway, same has generated 20 per cent CAGR return in the last 40 years. This shows that investment arm of Martin and Harris Laboratory is generating handsome return to shareholders.

Martin & Harris Laboratories have a couple of manufacturing facilities in Roorkee (Uttarakhand) and Una (Himachal Pradesh) wherein they manufacture some famous medicines like Drotin Plus, Amclox, Venusmin and Tamsin etc which are having high demand in the market. The company is constantly taking steps to modernize and expand its manufacturing units to meet international standards.

Apeejay Group was established in 1910 by Pyare Lal, which today has an annual turnover of more than Rs 2,500 Cr. From starting its journey in Jalandhar to manufacture steel goods for the domestic agriculture industry, today Apeejay Group has ventured into hotels, real estates, constructions, shipping and pharmaceuticals. Later on the legacy of Pyare Lal was being carried out by his sons Surrendra and Stya. And, accordingly, the group was divided into two parts i.e. Apeejay Surrendra and Apeejay Stya Group.

Today, Apeejay Stya Group manages Martin and Harris Laboratory i.e. Pharma Business along with Apeejay Education Society and the Apeejay Stya Universities. Dr Stya Paul’s legacy of excellence is being carried forward by his daughter and only child, Sushma Paul Berlia, Chairman of the Apeejay Education Society.

Apeejay Surrendra Group business activities are presently oversee by his son and daughters i.e. Priya, Priti and Karan Paul.

Valuation

In the pre IPO market, the shares of Martin & Harris Laboratories are trading at Rs 2900-3000 apiece. With an average EPS of Rs 270 for the last three years, it commands a price to earnings (P/E) ratio little more than 10.75 to 11.11x.

On a standalone basis, the company’s pharma arm generated a net profit of Rs 40 crore in FY 2020-21 with an average EPS of Rs 102 for the last three years, it is trading at a P/E ratio of 28x. Nifty Pharma index is trading at a P/E ratio of 33x, there is ample upside left in the company.

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

To know, more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

You can also checkout the list of Best 5 Unlisted Shares to Buy in India

For Direct Trading, Visit – https://altiusinvestech.com/companymain.

To know more about How to apply for an IPO? Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/