Incred Financial Holdings Limited:Company Overview

InCred Group is a prominent player in the financial services sector, boasting expertise across Financing, Investment Banking, Wealth Management, Asset Management, and Institutional Equities. Established in 2011 as KKR Capital Markets India Limited, it underwent a significant transformation through a merger with KKR India Financial Services in July 2022, resulting in its rebranding as InCred Holdings Limited. Operating as a dual-entity structure, InCred Holdings serves as the parent company, while its subsidiary, InCred Financial Services Limited, directly engages with borrowers. Acting as the financial backbone, InCred Holdings provides vital support and strategic direction, enabling its subsidiary to offer a comprehensive range of financial products and services to its clients.

| Company Name | INCRED HOLDING LIMITED (formerly known as KKR Capital Markets India Limited) |

| Company Type | Unlisted Company( Buy Incred unlisted share) |

| Industry | Financial Service |

| Founded | 2011 |

| Registered Address | Mumbai, Maharashtra, India |

| Website | incred.com |

Vision & Mission

Their vision is to create a trustworthy, transparent, and highest integrity financial institution that positively advances the socio-economic well-being of lower-middle-class to middle-class Indian households while protecting the interests of all stakeholders. Their mission is to be relentless in inculcating and nurturing a culture of continuous innovation and execution excellence by combining cutting-edge technology, data science, and deep financial domain expertise and delivering the best-suited profitable product in the most dignified experience for every customer.

Values

Business Entities

InCred operates through three main business entities, each catering to a specific financial service area:

InCred Finance: offering personal loans, education loans, and SME business loans. They leverage technology and data analytics to provide these lending services.

InCred Capital: This arm deals with wealth management, investment banking, and equities.

InCred Money: This entity focuses on retail bonds and alternative investment products.

Product Offerings

……………………………………………………………………………………………………………………………………………………………………………

Educational Loan

Personal Loan

Business Loan

Merchant Loan

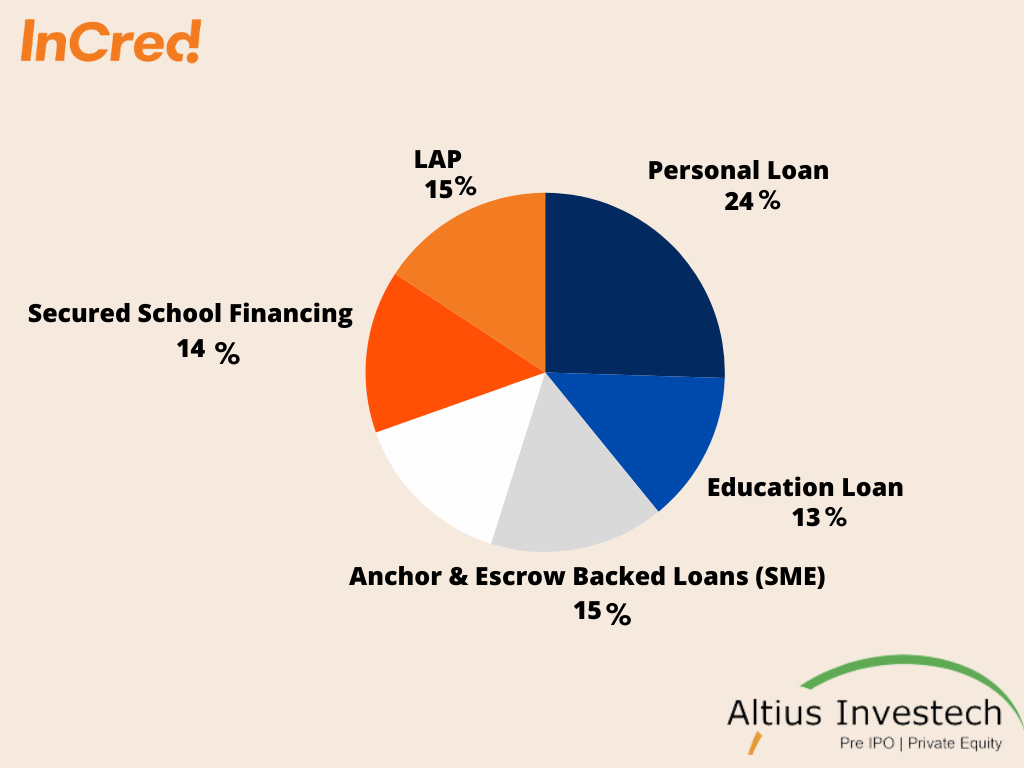

Product Mix

*As of H1 FY24

| Type | AUM (in Cr) | Yield |

| Personal Loan | 3187.5 | 24.3% |

| Education Loan | 1684 | 13% |

| Anchor & Escrow Backed Loans (SME) | 1367 | 15% |

| Lending to FIs | 623 | 14.2% |

| Secured School Financing | 322 | 14.5% |

| LAP | 179 | 15% |

| Total | 7364 |

Awards & Recognition

In 2023, InCred received several prestigious awards and recognitions:

- IGBC Green Interior Award 2023: Felicitating for the best workplace to work for 2022-23, this award highlights InCred’s commitment to providing a sustainable and environmentally friendly work environment, contributing to employee well-being and productivity.

- ET Best Brands Award 2023: InCred was honored as ET Best Brands for four consecutive years. Recognized as the Most Preferred workplace 2022-23 in the BFSI sector, this award underscores InCred’s dedication to creating a positive and supportive work culture that attracts and retains top talent.

- Social Impact Award 2023: InCred’s CSR campaign on the International Day of the Girl Child was recognized at the ACEF Asian Leaders Awards 2023 for Branding, Marketing, Rural, CSR & Content Creation. This award acknowledges InCred’s efforts to make a meaningful social impact by empowering and supporting girls’ education and well-being in rural communities.

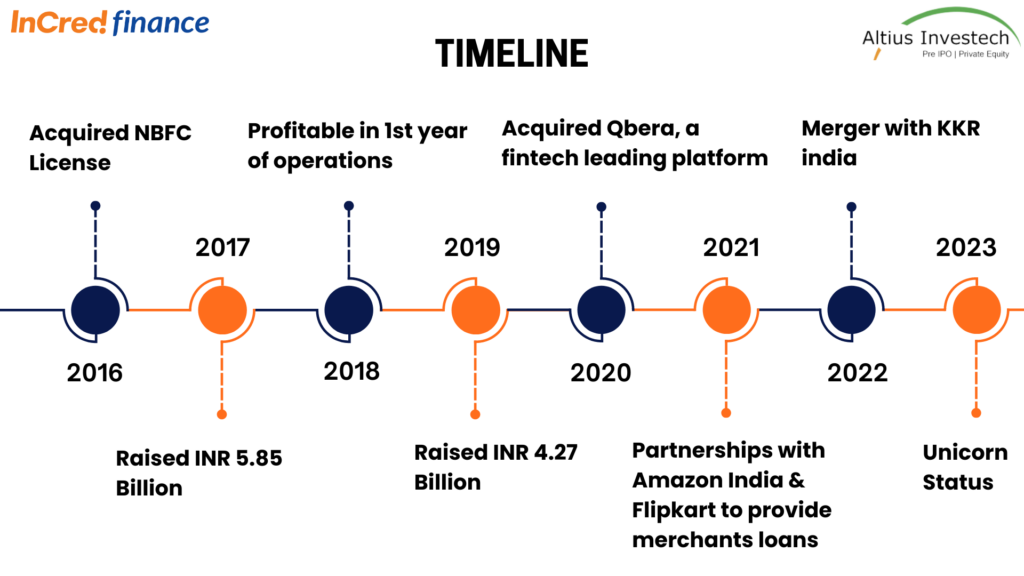

Key Milestones

- Founding and Inception: InCred was established with a core focus on innovation and customer-centricity, aiming to address existing gaps within the conventional lending sector.

- Diversification of Product Portfolio: Over time, InCred has broadened its range of financial offerings, presenting a comprehensive suite of solutions to cater to the varied needs of its clientele effectively.

- Embracing Technological Innovations: InCred has consistently embraced cutting-edge technology to streamline operations, elevate customer experience, and refine risk management practices. Integration of advanced analytics and digital platforms has notably distinguished the company in the competitive financial services landscape.

- Forge Strategic Partnerships: InCred has forged strategic alliances with diverse stakeholders, including financial institutions, technology enterprises, and other significant entities within the financial ecosystem. These partnerships aim to extend the company’s reach and augment its capabilities.

- Expanding Market Presence: InCred has successfully expanded its footprint, serving clients across various regions within India and possibly exploring avenues for growth beyond national borders.

Management of the Company

Mr. Bhupinder Singh: Whole Time Director & Chief Executive Officer

Mr. Bhupinder Singh, the Founder of the InCred Group, serves as the Wholetime Director & CEO. Prior to establishing InCred, he held significant leadership roles at Deutsche Bank, where he co-headed the Investment Banking and Securities division for the Asia Pacific region, overseeing a USD 3 billion top line. In this capacity, he managed the bank’s Fixed Income, Equities, and Investment Banking divisions. Additionally, Mr. Singh served as the head of the Corporate Finance division for Deutsche Bank in the Asia Pacific region, where he was responsible for managing the bank’s corporate coverage, investment banking, capital markets advisory, and treasury solutions businesses. His extensive experience and expertise in the financial sector have been instrumental in shaping InCred’s strategic direction and success.

Mr. Vivek Bansal: Whole Time Director & Chief Financial Officer

Mr. Vivek Bansal, Wholetime Director & CFO of the Company, brings with him over two decades of invaluable experience in the field of banking and finance. Previously associated with Yes Bank, where he served from 2011, his last designation being Deputy Chief Financial Officer. During his tenure at Yes Bank, Mr. Bansal held a pivotal role in overseeing overall financial management, including cost accounting, budgeting, financial control and profitability, regulatory reporting, procurement, and investment allocations. Additionally, he actively contributed to capital raising initiatives, managed investor relations, and maintained relationships with rating agencies. Mr. Bansal’s extensive expertise and strategic insights have been instrumental in driving financial excellence and growth within the organization.

Mrs. Rupa Vora : Independent Director

Ms. Rupa Vora has an experience of over 3 decades with 11 years spent with IDFC Group managing Finance, Risk Management, Audit, Tax and Compliance in the capacity of Group Director & Chief Financial Officer – IDFC Alternatives Ltd.Prior to IDFC,she was associated with Antwerp Diamond Bank N.V. in the capacity of Chief Financial Officer. Her earlier banking experience was with KBC Bank N.V., Calyon Bank etc. Before joining the corporate world, she ran an independent practice as a Chartered Accountant for almost a decade.

.

.

.

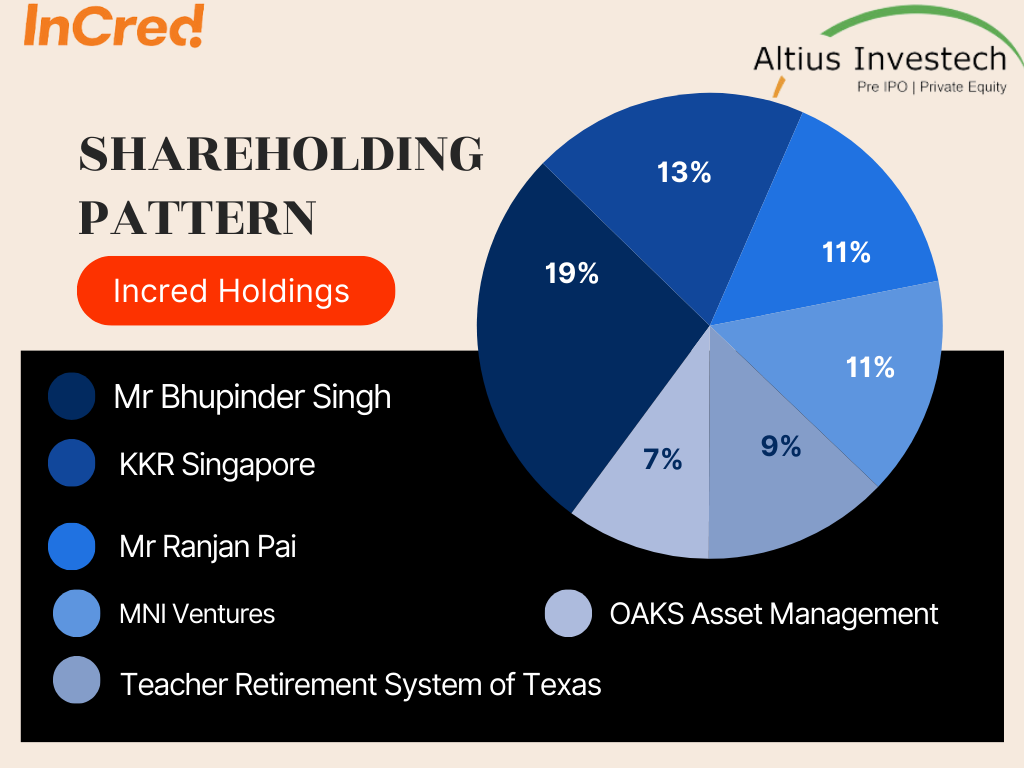

Shareholding Pattern

| Particulars | % of Shareholding |

| Mr Bhupinder Singh | 18.9 |

| KKR Singapore | 13.4 |

| Mr Ranjan Pai | 10.7 |

| MNI Ventures | 10.6 |

| Teacher Retirement System of Texas | 9 |

| OAKS Asset Management | 7 |

Merger with KKR

In 2021, InCred Finance merged with KKR India Financial Services Ltd in an all-stock deal, as announced in a joint statement by the companies. The merger resulted in the creation of a formidable Non-Banking Financial Company (NBFC) boasting a balance sheet of $600 million (approximately ₹4,700 crore) and an equity base of $300 million. Per the merger terms, KKR, along with two other prominent investors, Teacher Retirement System of Texas and Abu Dhabi Investment Authority, collectively hold a 35% stake in the merged entity, with KKR alone holding a 15-16% stake in the consortium. This transaction not only underscores the robustness and quality of InCred Finance’s retail lending platform but also highlights its sharp focus on robust risk management and collections practices, coupled with the integration of innovative technology solutions to enhance operational efficiencies.

Fundraising

In November 2023, InCred achieved a valuation exceeding $1 billion after a successful funding round, raising $60 million. This brought the company’s valuation to 8800 Crores. The equity capital will be strategically allocated across its primary business segments: consumer loans, student loans, and lending to micro, small, and medium enterprises (MSMEs). The funding round was led by notable investors:

- Ranjan Pai of MEMG contributed $9 million.

- Ravi Pillai, the chairman of RP Group of Companies, infused $5.4 million.

- Ram Nayak, Head of Fixed Income & Currencies at Deutsche Bank, invested $1.2 million.

- Varanium Capital Advisors and Sattva Group also participated in the funding.

Incred Finance

InCred Financial Services Ltd. is a non-banking financial company (NBFC) that offer a diverse portfolio of loans products including personal loans, education loans, SME (small and medium enterprise) business loans, and merchant loans to meet the varied credit needs of emerging India.

InCred is known for using technology and data science to make the loan application process quick and easy, with many loans being approved online. They aim to provide a more streamlined lending experience compared to traditional lenders

Incred Finance: Timeline

Recent News

InCred Holdings Attained Unicorn Status in 2023, Becoming Second Indian Startup to Join Prestigious Club

InCred Holdings achieved unicorn status in 2023, becoming the second startup in India to do so after Zepto. The valuation exceeded $1 billion after successfully raising Rs 500 crore from various investors including a global private equity fund, corporate treasuries, family offices, and ultra-high net worth individuals. This milestone highlights InCred’s growing prominence and investor confidence in its fintech offerings and business model.

InCred Partners with Amazon India to Offer Working Capital Loans to Merchants in 2021

In 2021, InCred had partnered with Amazon India to offer working capital loans of up to Rs 50 lakh to Amazon merchants, aiming to ease financial constraints exacerbated by the surge in e-commerce during the pandemic. The partnership provided quick, low-interest loans based on sellers’ revenues, enabling them to expand capacity or manage immediate business needs. Initially available in 10 states, the program planned to expand gradually. Saurabh Jhalaria, CEO – SME business, InCred, had stressed the importance of sustaining the economy during challenging times, while Vikas Bansal, Director – Amazon Pay India, had emphasized the program’s role in meeting sellers’ growth and working capital requirements.

Incred Holdings Share Price (as of 13.05.2024)

- The buy price of Incred Holdings varies based on quantity, ranging from ₹165 for quantities between 100 – 499 shares to ₹159 for quantities between 2000 – 4999 shares, with corresponding rates per share.

- The 52-week high is 153, and the 52-week low is 109 indicating the range of fluctuations in the share price.

Currently, the Incred Holdings Share Price is trading at around Rs. 160 /share. CLICK HERE to Invest.

Financial Metrics for Incred Holdings FY 23

(as of 13.05.2023)

| Particulars | Amount |

| Price to Earning Ratio (P/E) | 86.89 |

| Price to Sales Ratio (P/S) | 10.94 |

| Price to Book Value (P/B) | 3.85 |

| Industry PE | – |

| Face Value | ₹ 10 |

| Book Value | ₹ 41.3 |

| Market Cap | ₹ 9464.24 Cr |

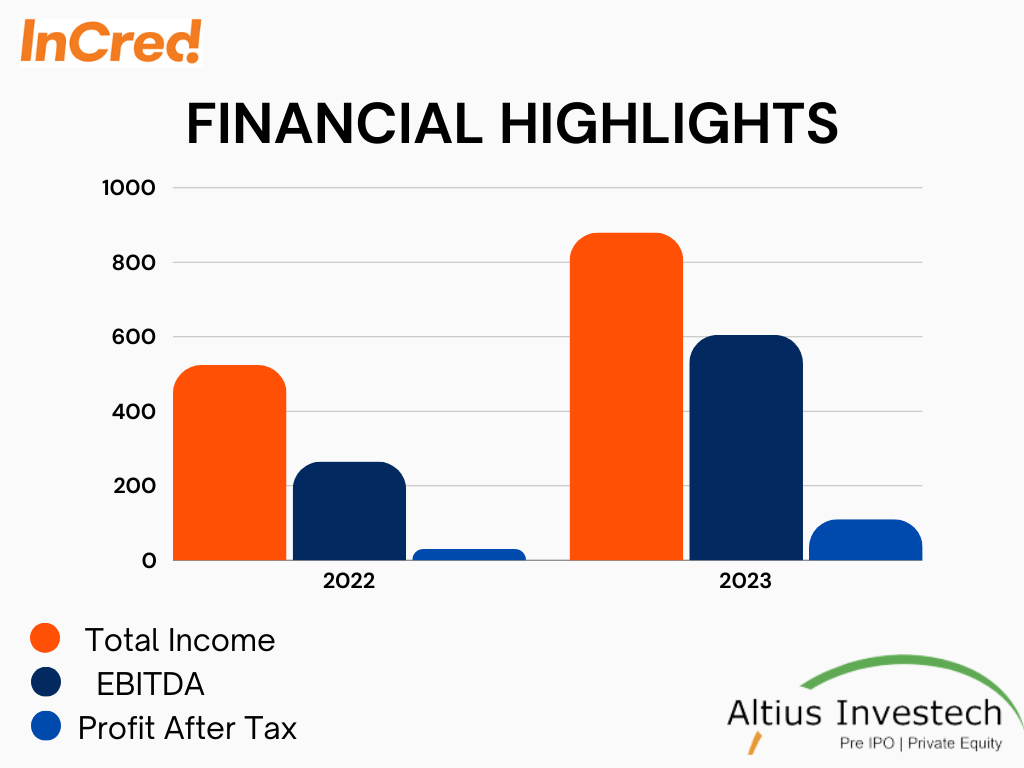

Financial Highlights

₹ (in crores)

| Particulars | 2022-2023 | 2021-2022 | y-o-y growth |

| Total Income | 880 | 524 | 68% |

| EBITDA | 605 | 265 | 128% |

| PAT | 110 | 30 | 267% |

| EPS | 1.85 | 0.8 | – |

Dividend

In the fiscal year 2022-2023, Incred Holding Limited did not declare any dividends.

ESOP

During the fiscal year 2022-23, the Company’s prevalent Employee Stock Options Scheme saw significant participation, with employees exercising a total of 37,31,310 ESOPs. As per the scheme, these exercised options resulted in the allotment of shares to the employees. Employee Stock Options (ESOPs) serve as a valuable tool for companies to incentivize and retain talent by offering employees the opportunity to purchase shares of the company at a predetermined price. This initiative not only aligns the interests of employees with those of shareholders but also fosters a sense of ownership and commitment among employees towards the company’s growth and success.

IPO Plans

As of now, Incred Holdings has not made any official statements regarding its IPO. However, industry speculation suggests that it could potentially occur within the next 2 to 3 years.

Key Indicators

*As of H1FY24

| Asset Under Management | INR 7469Cr |

| GNPA | 2.6% |

| NNPA | 1.2% |

| DE Ratio | 1.8x |

| Provision Coverage Ratio (PCR) | 53% |

| Cost to Income Ratio | 44% |

| Capital to Risk Asset Ratio (CRAR) | 31% |

| Capital Adequacy Ratio (CAR) | 33.4% |

| Collection Effeciency | 98% |

| NIM | 8.1% |

- AUM at INR 7469 Cr indicates a substantial size of the portfolio

- GNPA & NNPA metrics are indicators of the quality of the loan book and the underlying risk. It shows that the company has made adequate provisions to cover potential losses, highlighting prudent risk management.

- PCR means that over half of the gross NPAs are covered by provisions, which is a healthy sign of asset quality and financial resilience

- Cost to Income Ratio indicates that the NBFC spends 44% of its income on operational costs. It’s a reasonable figure that suggests the company is managing its expenses well relative to its income

- CRAR and CAR both these ratios are well above the regulatory requirements, indicating a strong capital position to absorb potential losses and support its growth

- Collection Efficiency at 98% suggests that the majority of borrowers are repaying their loans on time, which is crucial for the liquidity and profitability

Borrowings

₹ (in crores)

| Type | O/S as of FY 2023 | Raised in FY 2023 |

| Term Loan including external Commercial Borrowings (eCBs) | 2733 | 1584 |

| Non-Convertible Debentures including Market Linked Debentures | 1144 | 457 |

| Cash Credit, Commercial Paper & Inter Corporate Deposits | 10 | 355 |

Peer Comparison

₹ (in crores)

| Particulars | Revenue | PAT | EPS | CMP (22/04) | MCAP | P/E | P/B |

| InCred Holdings | 880 | 110 | 1.85 | ₹153 | ₹9107Cr | 84 | 3.85 |

| Fedbank Financial Servcies Ltd | 1179 | 192 | 5.6 | ₹128 | ₹4120Cr | 21.5 | 3 |

| PTC Financial Servcies Ltd | 797 | 176 | 2.75 | ₹43 | ₹2768Cr | 20 | 1 |

Revenue Split From Subsidiaries

₹ (in crores)

| Subsidiary | % of Shareholding | Revenue | PAT |

| InCred Financial Services Limited | 100 | 877.5 | 121 |

| InCred Prime Finance Limited | 59.37 | 2 | 0.02 |

| *InCred Management and Technology Services Private Limited | 100 | 0.15 | -3.75 |

| *Booth FintechPrivate Limited | 100 | 0 | -14.85 |

| *InCred.AI Limited | 100 | 0 | 0 |

| *mValu Technology Services Private Limited | 75.82 | 0.72 | -3 |

*Companies are a step-down subsidiary of InCred Financial Services Limited

Conclusion

InCred Group, formerly known as KKR Capital Markets India Limited, has emerged as a prominent player in the financial services sector, offering a diverse portfolio of solutions ranging from lending to wealth management and retail bonds. The company’s strategic evolution through a merger with KKR India Financial Services in 2022 has solidified its position in the market. InCred’s commitment to innovation and customer-centricity is reflected in its vision to create a trustworthy and transparent financial institution.

With a robust financial performance, the company reported a total income of ₹880 crores in the fiscal year 2022-2023, representing a substantial 68% year-on-year growth. Its EBITDA surged to ₹605 crores, marking a 128% increase from the previous year, while the profit after tax (PAT) reached ₹110 crores, showing a remarkable 267% growth. With an asset under management (AUM) of ₹7,469 crores, InCred has demonstrated prudent risk management, as indicated by its gross and net non-performing asset (NPA) ratios of 2.6% and 1.2%, respectively. The company’s strong capital position reflected in its capital adequacy ratio (CAR) of 33.4%, positions it well for future growth and expansion initiatives.

ALSO READ OUR OTHER BLOGS

GET IN TOUCH WITH US:

- For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

- To know, more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

- For Direct Trading, Visit – https://altiusinvestech.com/companymain.

- You can also checkout the list of Best 5 Unlisted Shares to Buy in India