IKF Finance: About the Company

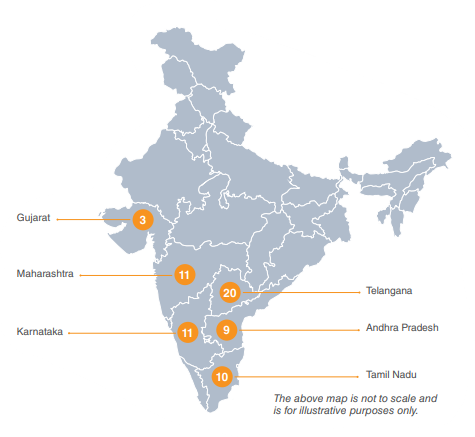

IKF Finance, established in 1991, is a leading Non-Banking Finance Company (NBFC) specializing in tailored financing solutions for commercial vehicles, cars, MUVs, three-wheelers, tractors, construction equipment, and secured MSME loans. Over three decades, IKF has demonstrated a steadfast commitment to customer satisfaction, transparency, and innovation, leveraging digital technology for a sustainable competitive advantage. With a presence in 9 states through 134 branches, the company is known for its inclusive work culture and strong partnerships, solidifying its position in the financial landscape. Moving forward, IKF remains dedicated to upholding high standards of service, enhancing shareholder value, and fostering fruitful relationships with business associates.

| Company Name | IKF Finance Limited |

| Company Type | Unlisted Public Company |

| Industry | Finance |

| Founded | 1991 |

| Headquarters | Andhra Pradesh, India |

| Website | www.ikffinance.com |

Products offered by IKF Finance:

| Commercial Vehicle Loans |

| Construction Equipment Loans |

| Cars & MUV Loans |

| Tractor Loans |

| Three-Wheeler Loans |

| MSME Loans |

Their product portfolio is customized to accommodate the needs of financially underserved self-employed customers. Since its inception, they have grown rapidly on the foundations of its commitment to customer service, transparent business practices, a well-organized team, secure financial policies, and a loyal customer base. They are also defined by their adoption of digital technology, as they have been continuously automating towards building a sustainable competitive advantage.

Despite two years of significant volatility and business disruptions, they have steadily progressed in their growth journey. In over three decades of experience in asset financing, they have built a robust base in terms of geographic presence, diversified product portfolio and customer segments, strong credit and risk assessment framework, well-established systems and processes, and integrated technology platform.

The key Business Insights for IKF Finance are as follows:

| Years of operation | 32 |

| Assets under Management | 2,452 Cr |

| Active Customers | 62922 |

| No. of Employees | 1184 |

| Rating | Rated A (Stable) |

IKF is among the few lending companies to have demonstrated consistent growth and profitability throughout different economic cycles. Despite challenges such as COVID and other macroeconomic headwinds, IKF has achieved robust growth of over 40% in recent years, alongside a steady return on equity of around 14%, as per a media release from the NBFC.

IKF Finance’s Vision, Mission and Core Values

Vision

To be one of the premier leagues of asset financing NBFCs by focusing on customer service and maintaining long-standing and fruitful relationships with all our stakeholders, be it lenders, shareholders, debenture holders, customers or business associates.

Mission

To build strong, profitable relationships with a broad spectrum of stakeholders

Core Values

• Ethical business practices

• Business prudence

• Dedication

• Transparency

• Excellence in customer service

Subsidiary Companies

| Name | State | Incorporation Year | Paid Up Capital |

| IKF Home Finance Limited | Andhra Pradesh | 2002 | 62.14 Cr |

Management of the Company

Board of Directors

Mr. VGK Prasad: Founder & Chairman

Mr. VGK Prasad is a veteran in the Vehicle Finance business. He founded IKF in 1991 and has partnered with industry giants such as BHPC (Bureau of Hire Purchase and Credit) of TELCO, HDFC Bank, Sundaram Finance, etc.

He has served as the President of Krishna District Auto Financiers Association & Federation of Indian Hire Purchase Associations (FIHPA), the apex body of Asset Financing Companies.

Apart from IKF Finance, he has promoted IKF Home Finance, the subsidiary of IKF Finance.

.

Ms K Vasumathi Devi: Managing Director

Equipped with a BE (Electronics & Communications) and an MBA (Global Management) (USA), Ms K Vasumathi Devi has been associated with the company for the past 15 years. She leads the overall vehicle financing business and specifically focuses on credit, systems, and technology.

She expanded IKF Finance to western and central India and has undertaken the upgradation of IT infrastructure and automation of various processes.

She has prior experience of over 10 years in IT and Telecommunications in the US.

.

Senior Management Team

Mr. Rama Raju: Chief Executive Officer

Mr. Rama Raju, the ex-CEO of AML Finance (a wholly-owned subsidiary of Automotive Manufactures Ltd) holds overall 3 decades of Industry experience in the Retail Asset Financing business specializing in Auto loans, Commercial vehicles, Construction equipment, and SME financing business. He specializes in designing and implementing business plans & strategy, driving profitability & top line, and mentoring the teams to achieve overall organizational goals. He has also handled larger teams and portfolios of Retail Asset Financing businesses and worked with large private sector banks and NBFCs.

Expanding Home Financing Outreach

IKF Finance is committed to expanding its home financing outreach in cities where its asset financing business has a strong presence. Leveraging its considerable market expertise and high customer trust, the company aims to cater to a large borrower base and assist in fulfilling their dreams of homeownership.

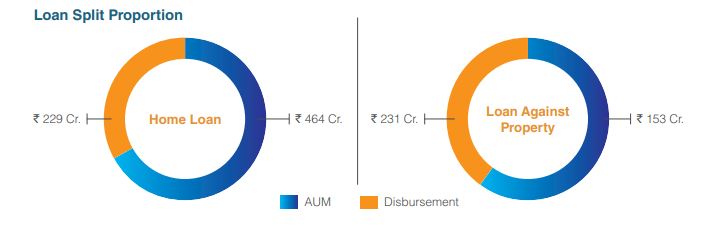

Loan Split Proportion

IKF Finance’s Digitization Initiatives

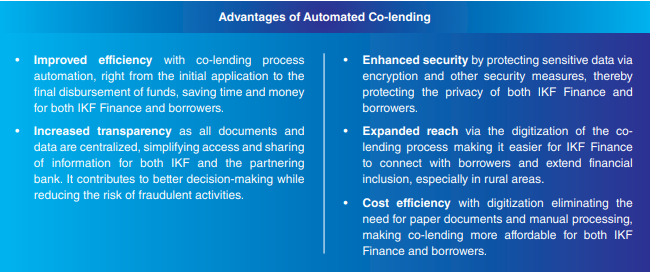

- Co-lending Automation: The company embraced co-lending as a collaborative approach with banks to provide loans to borrowers. By leveraging platforms like Knight Fintech’s Utopia Platform, IKF aimed to automate processes, streamline accounting, and ensure smooth reconciliation between systems, enhancing efficiency and transparency.

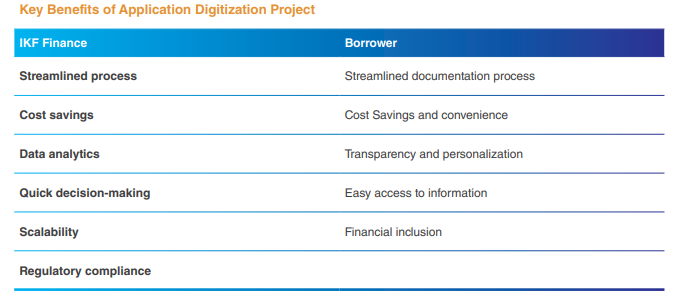

- Digitizing Applications: The company is enhancing its loan origination system (LOS) to streamline application processing. This initiative aims to simplify documentation, improve data analytics for personalized services, ensure regulatory compliance, and provide borrowers with quick access to information.

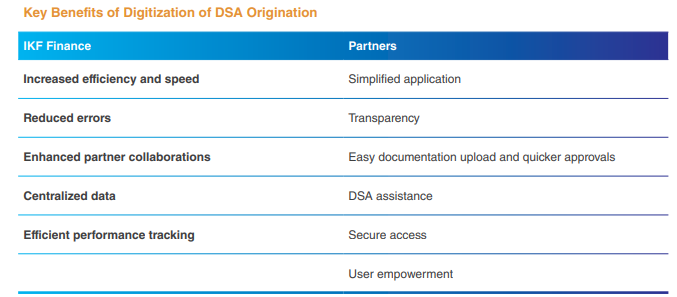

- Partner Portal – Digitizing DSA Origination: By digitizing Direct Selling Associations (DSAs), it aims to enhance efficiency, reduce errors, improve collaboration with partners, and empower users with simplified application processes and secure access to centralized data. This initiative underscores IKF’s commitment to staying competitive and relevant in the digital age.

Peer Comparison

| Particulars | IKF Finance | CSL Finance | PNB Gilts |

| Revenue | 374.44 | 117 | 927 |

| PAT | 61.52 | 62 | -77 |

Recent News

IKF Finance Secures ₹2.5 Billion Funding from Accion’s Digital Transformation Fund

(April 5, 2023) IKF Finance has raised ₹2.5 billion from Accion’s Digital Transformation Fund and other investors to enhance its technology infrastructure, improve customer experience, and expand reach to underserved populations. Accion led the funding with ₹1.2 billion. This investment will support IKF’s growth, particularly in commercial vehicle loans, MSME finance, and affordable housing loans. Vasumathi Koganti, Promoter & MD, expressed enthusiasm about the partnership with Accion, recognizing IKF’s strong foundation built over three decades in asset financing.

IKF Finance Proposed Share Issuance in August 2023

(August 2023) IKF Finance Limited sought approval from its members for a significant move. The company aimed to issue up to 65,00,000 new shares through a private placement, intending to raise funds to support its ongoing operations and future expansion. This proposal underscored the company’s commitment to growth and financial stability. All members were encouraged to participate in the meeting and vote on this crucial decision.

Key Milestones in Their Strategic Journey

2018-2020:

- Experienced a second round of equity infusion.

- Consolidated assets under management (AUM) crossed ₹1,500 crore.

2021:

- Achieved a consolidated AUM of ₹1,743 crore by March 2021.

2022:

- Consolidated AUM surpassed ₹2,143 crore.

- Received equity infusion of ₹7.14 crore from promoters.

2023:

- Achieved a consolidated AUM exceeding ₹3,147 crore.

- Received significant equity infusion of ₹255 crore led by Accion.

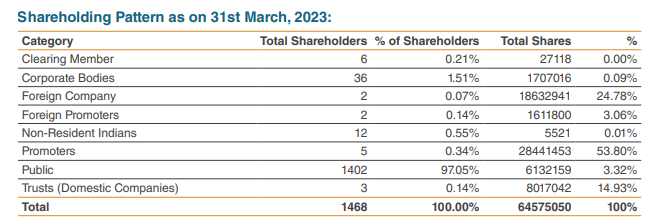

Shareholding Pattern as of 31st March 2023:

IKF Finance Limited Share Price (as of 04.03.2024)

- The buy price of IKF Finance varies based on quantity, ranging from 225 for quantities between 100 – 249 shares to 216 for quantities between 1000 – 2500 shares, with corresponding rates per share.

- The 52-week high is 235, and the 52-week low is 213 indicating the range of fluctuations in the share price. Additionally, the sell price of IKF Finance is fixed at 180.

Currently, IKF Finance Limited’s Share Price is trading around Rs. 219/Share. CLICK HERE to Invest.

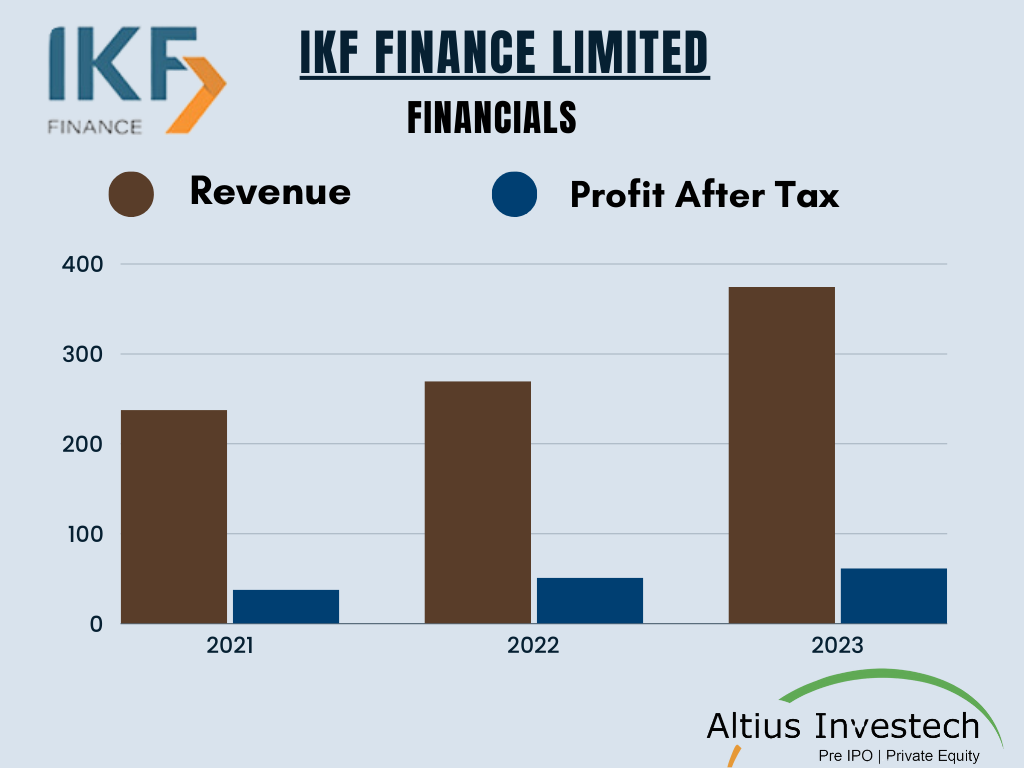

Financials

₹ (in crores)

| Particulars | March 31st, 2023 | March 31st, 2022 | March 31st, 2021 |

| Revenue | 374.44 | 269.61 | 237.51 |

| Profit After Tax | 61.52 | 51.13 | 37.90 |

| Earning Per Share | 11.46 | 9.89 | 7.54 |

| Gross Non-Performing Assets | 2.83% | 2.72% | 2.98% |

| Net Non-Performing Assets | 2.25% | 1.84% | 2.19% |

REVENUE CAGR: 22.55%

PROFIT AFTER TAX CAGR: 31.27%

In the fiscal year ending March 31st, 2023, the company experienced remarkable growth in its financial performance, with revenue showing a Compound Annual Growth Rate (CAGR) of 22.55% and Profit After Tax (PAT) demonstrating a substantial CAGR of 31.27% over the period. This robust growth signifies the company’s strong market position and effective business strategies. Additionally, the company maintained stable levels of Gross Non-Performing Assets (GNPA) and Net Non-Performing Assets (NNPA), reflecting sound asset quality management.

Valuations

| Valuation | March 4th, 2024 |

| Share Price | 216 |

| Outstanding shares | 6,45,75,050 |

| Market Capital | ₹ 1394.82 Cr |

| P/E Ratio | 18.85 |

| P/S Ratio | 3.72 |

| P/B Ratio | 2.94 |

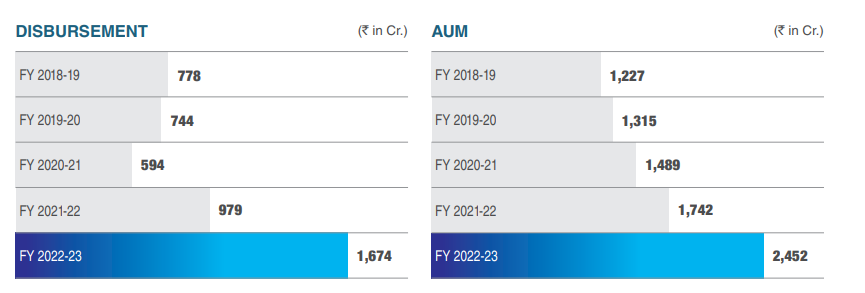

Disbursements & AUM

Disbursements grew to 1674 Cr. in FY 2022-23 compared to 979 Cr. in the previous year, a robust increase of 71%.

This resulted in a total AUM increase of 41% to 2,452 Cr. from 1,742 Cr. reported in FY 2021-22.

Conclusion

- Financial Strength: the company shows robust growth in revenue and profit after tax, reflecting effective strategies.Stable asset quality management is evident despite economic challenges.

- Market Position: With a market capitalization of ₹1,394.82 Cr, it holds a significant position. Investor confidence is strong, as indicated by share price and valuation metrics.

- Digitization Initiatives: the comapny digital initiatives enhance efficiency and customer experience. Automation streamlines operations, ensuring compliance and improving service.

- Future Outlook: Recent funding and proposed share issuance support growth plans. The company remains committed to building relationships and upholding core values.

- Get in Touch with us

- For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

- To know, more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

- For Direct Trading, Visit – https://altiusinvestech.com/companymain.

- You can also checkout the list of Best 5 Unlisted Shares to Buy in India