Before following the instructions below please do the following:

To transfer securities from your demat account using CDSL Easiest, follow these steps:

1. Register on CDSL.

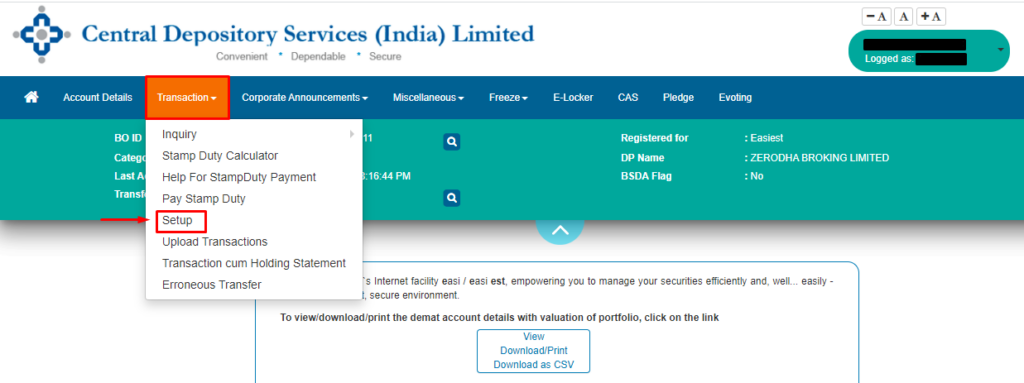

2. Log in to web.cdslindia.com/myeasitoken/home/login and click on Setup under Transactions.

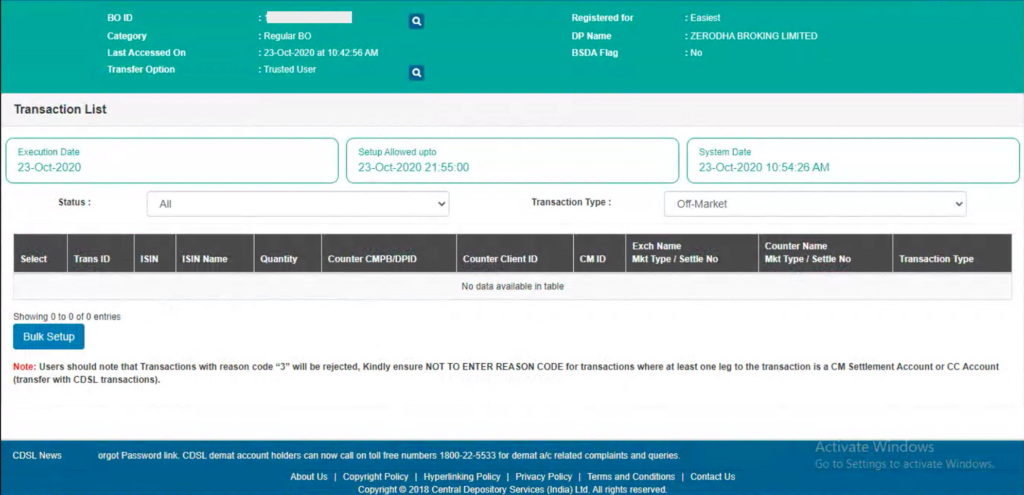

3. Click on Bulk Setup.

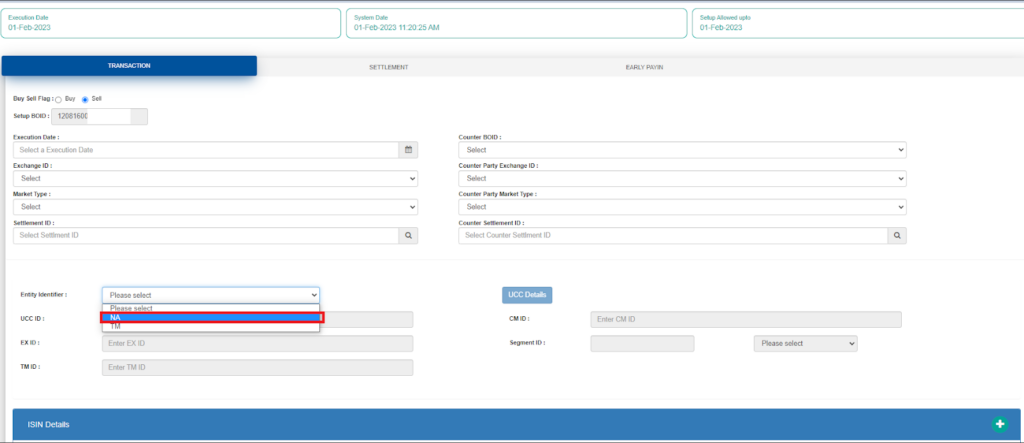

4. Click on Transaction and enter the execution date and enter the Beneficiary owner ID (BOID) of the person to whom the securities are to be transferred. To learn how to add a trusted beneficiary account, see How to add a trusted account on CDSL Easiest? Select NA from the drop-down in the Entity Identifier.

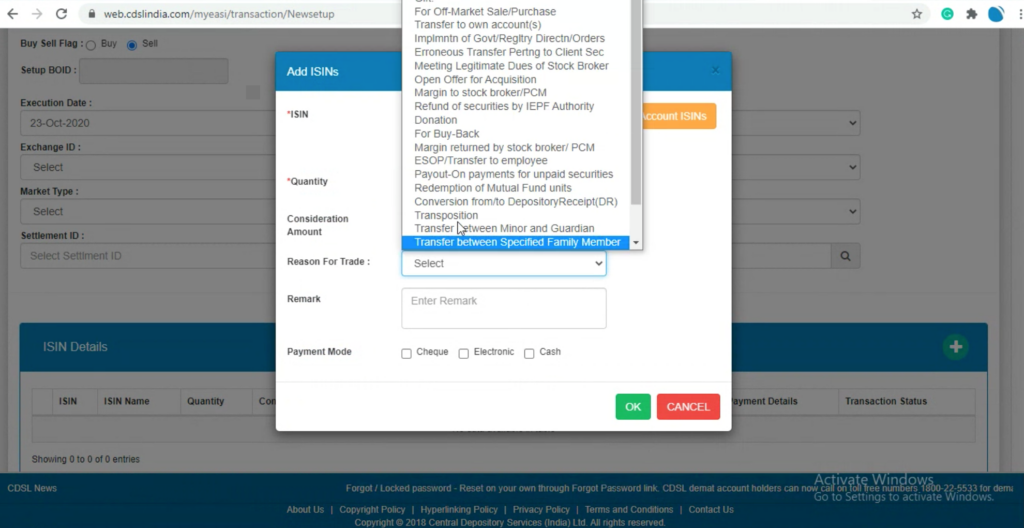

5. Click on Account ISINs and select the ISINs in the holdings from the list. Enter the quantity and select the reason for the trade. If the off-market transfer is not a gift or self-transfer and involves a consideration, stamp duty must be paid to CDSL online before making the transfer.

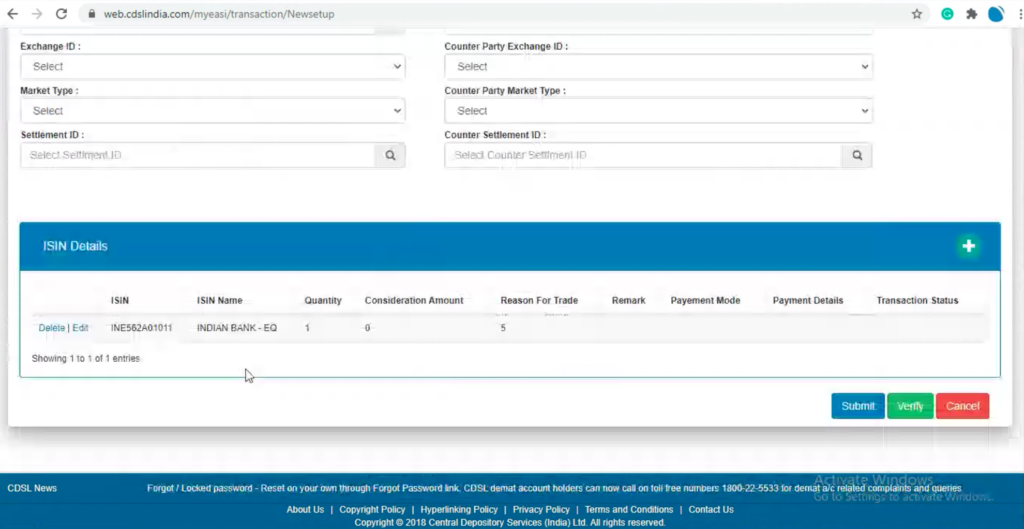

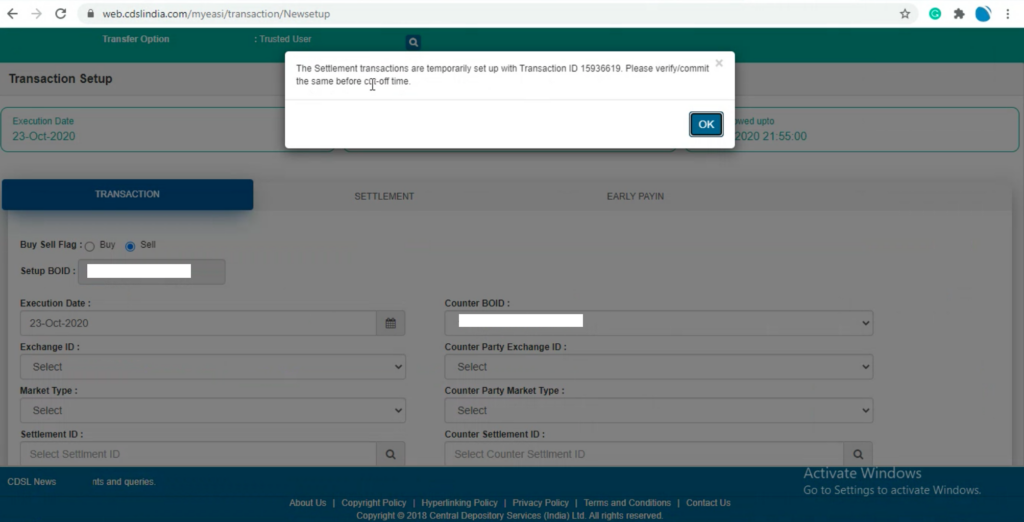

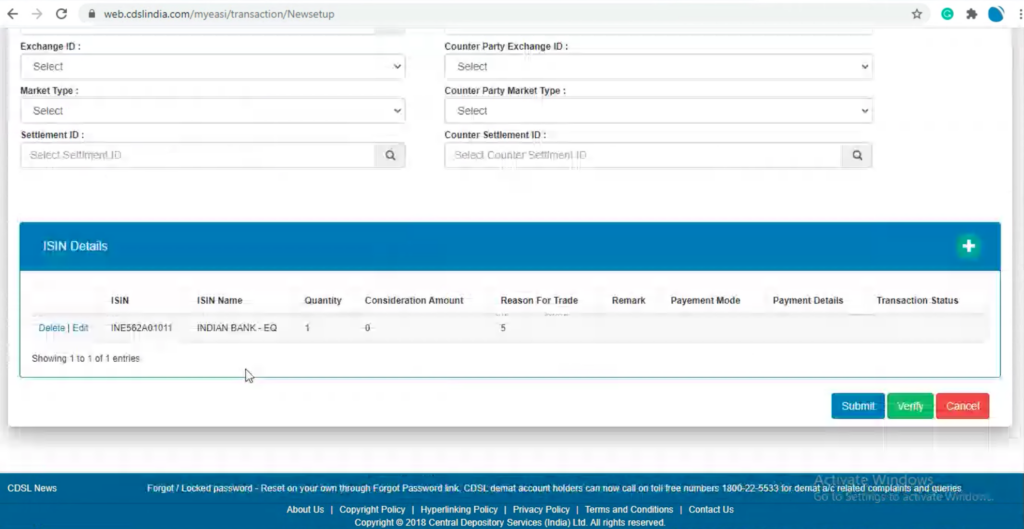

6. Click on Submit.

7. Click on Verify. Exchange ID, Counter Party Exchange ID, Market Type, Counter Party Market Type, Settlement ID and Counter Settlement ID need not be filled in for off-market transactions.

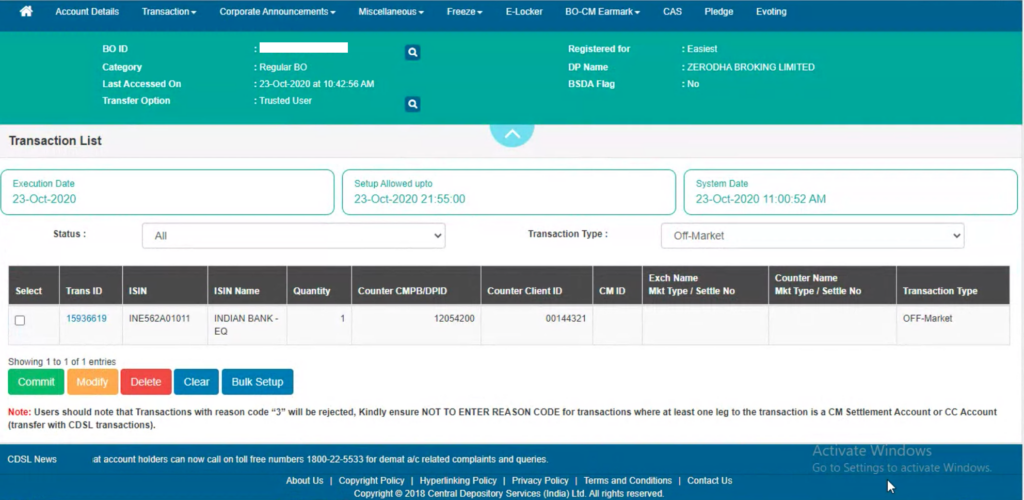

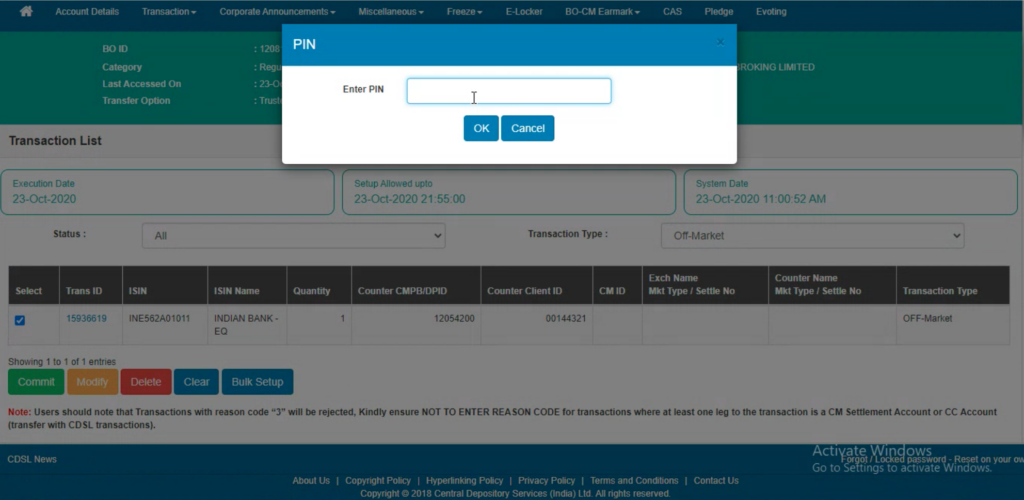

8. Click on Commit and then enter the OTP received on the registered mobile number and email.

9. Enter the 8-digit alphanumeric CDSL easiest PIN received on the registered email ID. Do not enter the 6-digit CDSL TPIN. First-time users must change the default PIN by visiting web.cdslindia.com/myeasitoken/home/login and, clicking on Miscellaneous, and then on Change PIN.

If the PIN was not received or forgotten, visit web.cdslindia.com/myeasitoken/home/login , click on Miscellaneous and then on Reset PIN.

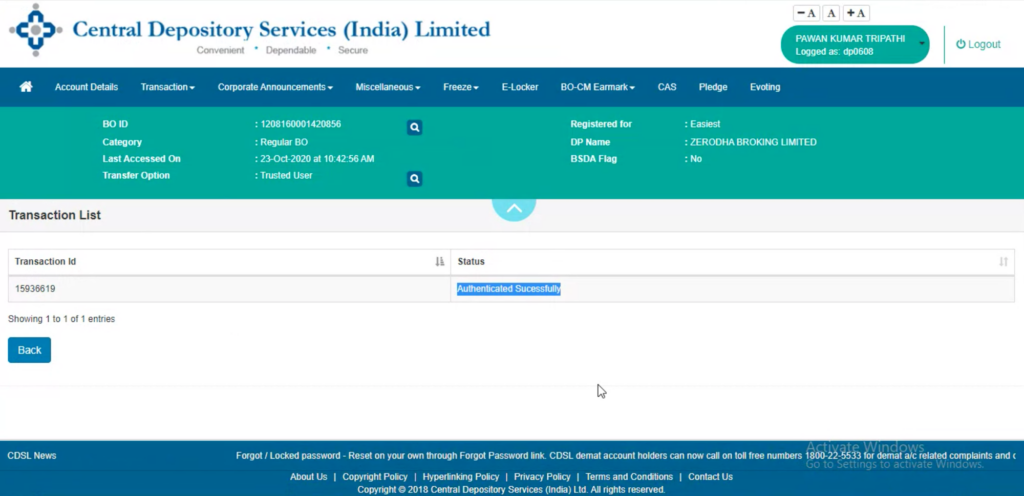

This is now sent to the Depository Participant (DP) for confirmation. The request is approved on confirmation, and the transfer will be done.

Did you know?

- Transfer requests are not processed immediately because your DP needs to verify the availability of shares in the customer’s demat account. This verification is necessary because there may be instances where the client has initiated a transfer request for a security and sold it on the same day. Off-market transfer requests submitted before 6 PM on trading days will be processed on the same day. However, any requests placed after 6 PM will be rejected.

- Shares and mutual funds under lock-in cannot be transferred using this flow.

- The charges to transfer shares in an off-market transaction are 0.03% of the transfer value or ₹25 per ISIN, whichever is higher, + 18% GST. Clients must maintain the required balance for the charges to be debited.

- To avoid rejection of share transfer, do not sell shares being transferred before the approval of the easiest transaction. In rare cases, the sale transaction may not be rejected and can go to auction. In these cases, auction charges are to be borne by the client. The share transfer will also be rejected if the balance in the trading account is negative.