Before filling the DIS, you must add beneficiary account in CDSL/NSDL:

- How to add a beneficiary to transfer securities in NSDL?

- How to add a beneficiary to transfer securities in CDSL?

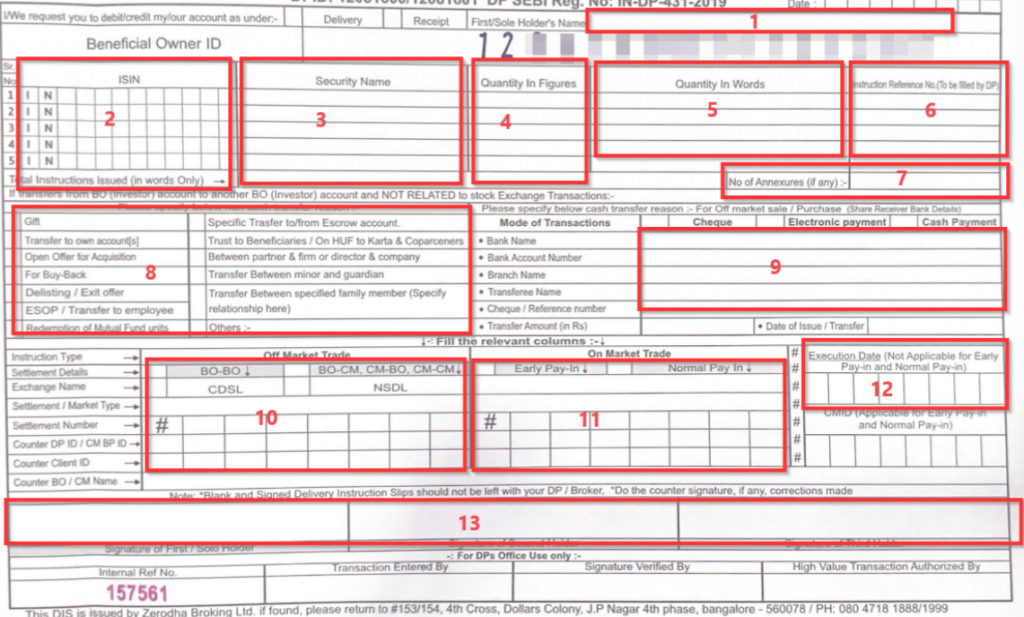

To fill out the Delivery Instruction Slip, follow these instructions:

- First/Sole Holder’s Name: Enter the account holder’s name as mentioned in the demat account.

- ISIN: Enter the ISIN of securities to be transferred as per the transaction statement.

*A maximum of 5 securities (ISINs) can be transferred per DIS.

*To transfer securities to multiple accounts, use separate DIS for each account. - Security Name: Name of security to be transferred.

- Quantity in Figures: Enter the quantity in numbers.

- Quantity in Words: Enter the quantity in words.

- To be left blank.

- No of Annexures (if any): Enter the number of DIS Annexures attached to the slip if more than 5 securities are transferred.

- Select the transfer reason.

- Bank details if it is an off-market sale of a security. The field can be left blank if it is not an off-market sale.

- Off-Market Trade: While making an off-market transfer, enter the counter DP details, i.e., the DP details to whom the securities are being transferred.

*Tick the depository option, CDSL or NSDL.

*Counter DP ID, Client ID details, and BO name (account holder’s name).

*Tick the settlement details as BO-BO. - If the securities that are being transferred are not listed or do not trade on the exchanges, leave the field blank.

- To be left blank. DP will fill in the date after the DIS is executed.

- Signature box: The account holder’s signature must be as per the signature recorded in your DP. Add a counter signature if there are any corrections or an overwritten signature.

Charges

Transfer charges of 0.03% of turnover or ₹25 per ISIN, whichever is higher, plus 18% GST is applicable.

Off-market sale

To make an off-market sale, follow these steps:

- Submit the filled DIS slip. Fill in the details of the transferee’s payment bank (the person receiving the shares) in the slip. If the DIS booklet was issued before Feb 2021, fill in the payment bank details in the Annexure for the DIS slip and submit it with DIS.

- Stamp duty is applicable per the slab mentioned in this document.