” it’s never about the idea but always about the people behind the idea”

Overview of the Company

Five Star provides Small business loans to meet borrower requirements for commencing new businesses, expansion of his/ her existing businesses and to settle any unorganised dues he/ she has taken to further their businesses. The loans are given based on the company’s evaluation of the borrower household cashflow coupled against the security of the borrower’s house collateral.

The typical loan ticket ranges between Rs 1 lakh to Rs 10 lakhs for a tenure between 24 and 84 months. The repayments are to be made on a monthly equated basis.

Key Features on the loans provided by “Five Star Business Finance”

- Longer Tenure Loan : Upto 7 years for business loans and 15 for housing loans

- Attractive interest rates

- Faster response and speedy disbursals

- Simple documentation

- Ease of transactions: payments can be made through PDC/ECs/NACH/Cash

- Cashflow based appraisal methodology

Origin of the Unicorn

Five Star was started in 1984 by V.K. Ranganathan ( current chairman’s Father in Law). Back then, they were lending in the consumer durables and two wheelers space, which was very tough in the early 2000s because big banks and NBFCs entered this space and smaller players like Five Star were squeezed. This forced them look for other opportunities and change direction from a high purchase lender to a mortgage lender. Their Chennai branch was very successful, and they expanded in Tamil Nadu which was even more successful and they moved away from Tamil Nadu to have 262 branches in 8 states.

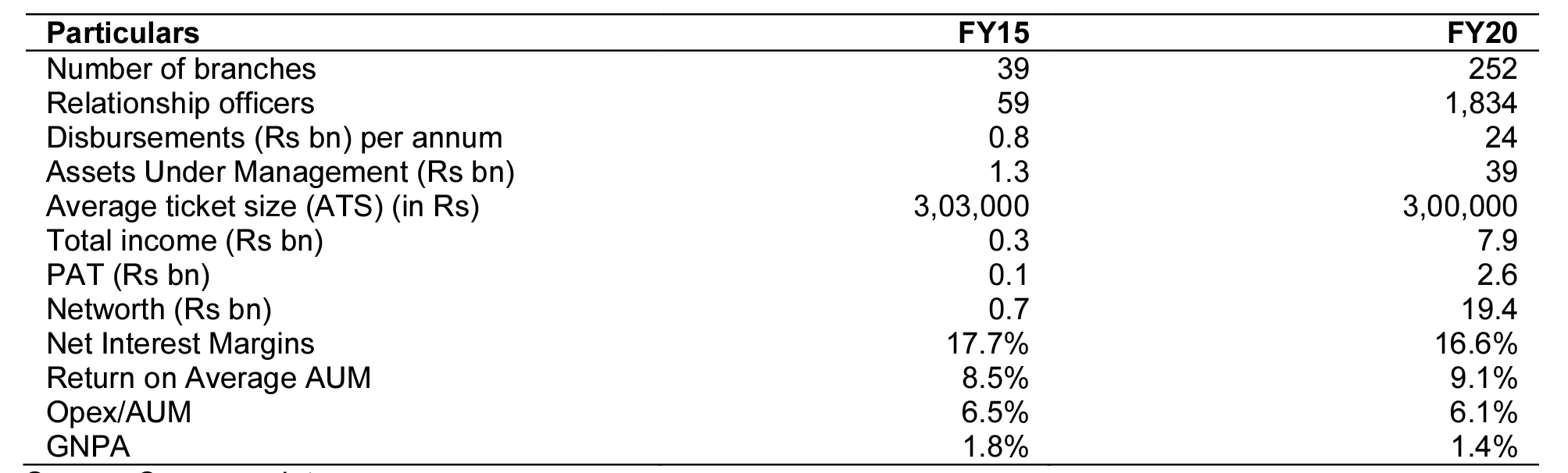

Five Star is an NBFC with AUM of Rs45 bn catering to a business community of 177k customers with an average outstanding ticket size of Rs 250k. It has created a niche in lending to ‘underserved’ business owners and self-employed segment in tiers 3-6 cities, thereby commanding IRRs of ~24% and spreads of ~12%. The execution excellence helps it manage opex/AUM at 6-7% and contain credit cost, thereby generating RoAUM of 8-9% and RoE of 16-18%. The scale-up all through past couple of decades was led purely by customer addition (not increased average ticket size).

What makes Five-Star different from Others?

Growth Strategy: They didn’t grow until they knew that the business model was perfect. If we look at 17 years down the line since inception, they just grew 10-20% for the first five years. They observed the cycles very closely. During both ups and downs how does the customer behave? What kind of effect is it having on the collection strength? If a collection turned bad what is the end recovery process? They learnt these parameters over a period of time keeping their growth very subdued but kept learning things. So, after 10 years when they were sure that they have perfected a very good business model with good profitability and excellent asset quality i.e, low NPAs, they decided to scale it up. So, they took around 27 years till 2012 or so when they started to build up their team, bring their equity and start growing rapidly.

Collection Strategy: They don’t actually have a separate collections team itself. So, the guy who sources the file is also responsible for collections. That brings a strong sense of ownership right from the beginning. They are one of the very few NBFCs of their scale which doesn’t have a dedicated collection person at all. Surprisingly, they have not repossessed a single property so far . Most of their practices are making sure that they are educating the customers, making sure that they are staying with them, through those delays, and making sure that they are working with them to discipline them.

Strong Fundamentals

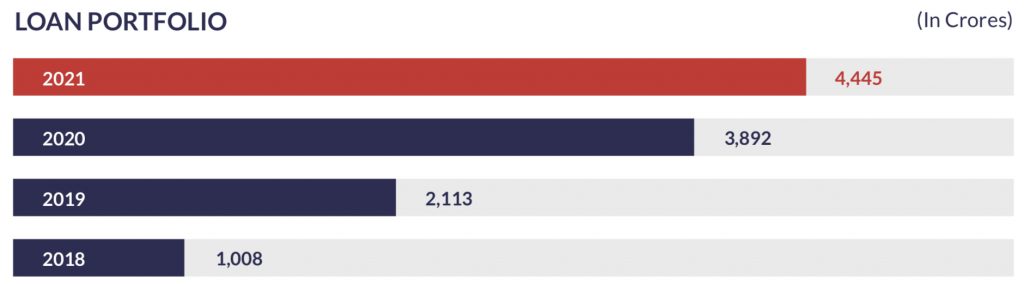

- Loan Portfolio: Their loan portfolio has increased remarkably from INR 1008 Crores in 2018 to INR 4,445 Crores in 2021 with a CAGR of 45% approx. This shows a very high effective management and strong hold & potential to acquire new clients even in adverse environment.

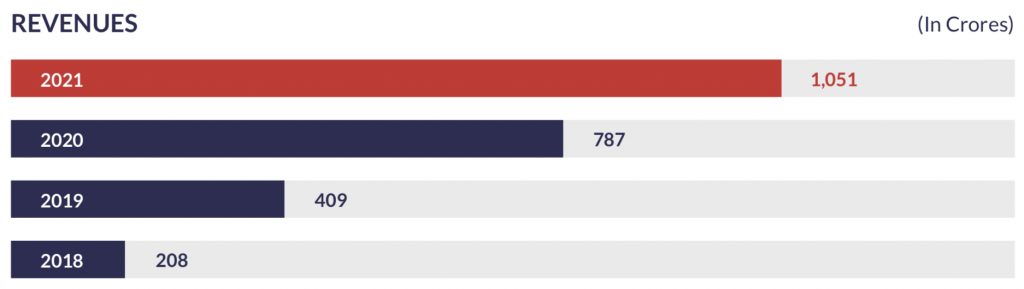

- Revenue: Management has been able to maintain 50% CAGR approx for the last 4 years from INR 208 Crores in 2018 to INR 1051 Crores in 2021. Similar kind of performance has also been observed for last decade & they are also very confident for the coming years.

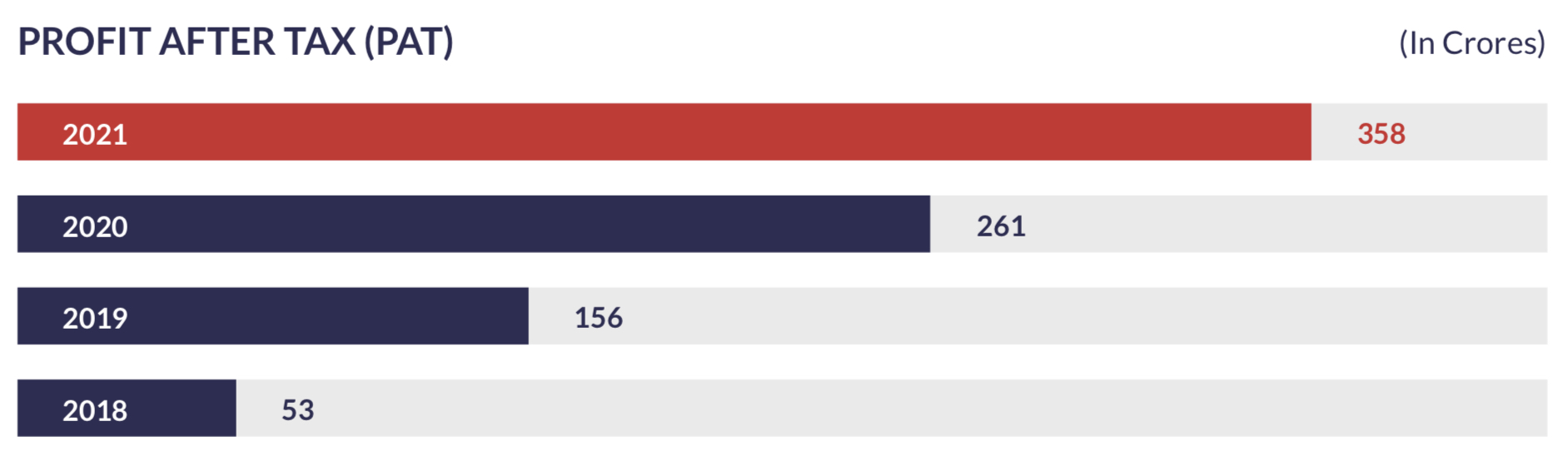

- Profit After Tax: We have seen companies that are huge in terms of Revenues but not been able be show Profitability but “Five Star” brings a very different picture. they show a very strong CAGR of 61.21% in terms of profits of last 4 years from INR 53 Crores in 2018 to INR 358 Crores in 2021.

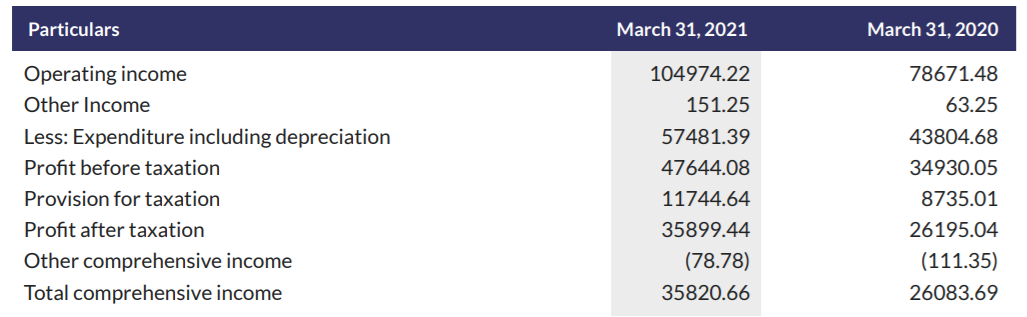

Financial Highlights

(in Lakhs)

The Company generated an Operating Income of INR 1049 Crores in 2021 which is 133.43% of the last year figure. The PAT for the Current year stands at INR 358.99 Crores which is 137.08% of the last year. This shows a strong hold on operations & expenditures. The Company’s net worth stood at Rs 2318.17 crores as on March 31,2021 (Rs 1944.58 crores in the previous financial year).

Despite the really difficult times during the financial year, This Company closed the year with a Gross Stage 3 Assets (90+ Assets) of 1.02%, which is one of the best amongst companies operating in this customer segment.

Capital Adequacy Ratio of the Company stood at 58.86% as on March 31, 2021, as against the minimum requirement of 15% stipulated by Reserve Bank of India.

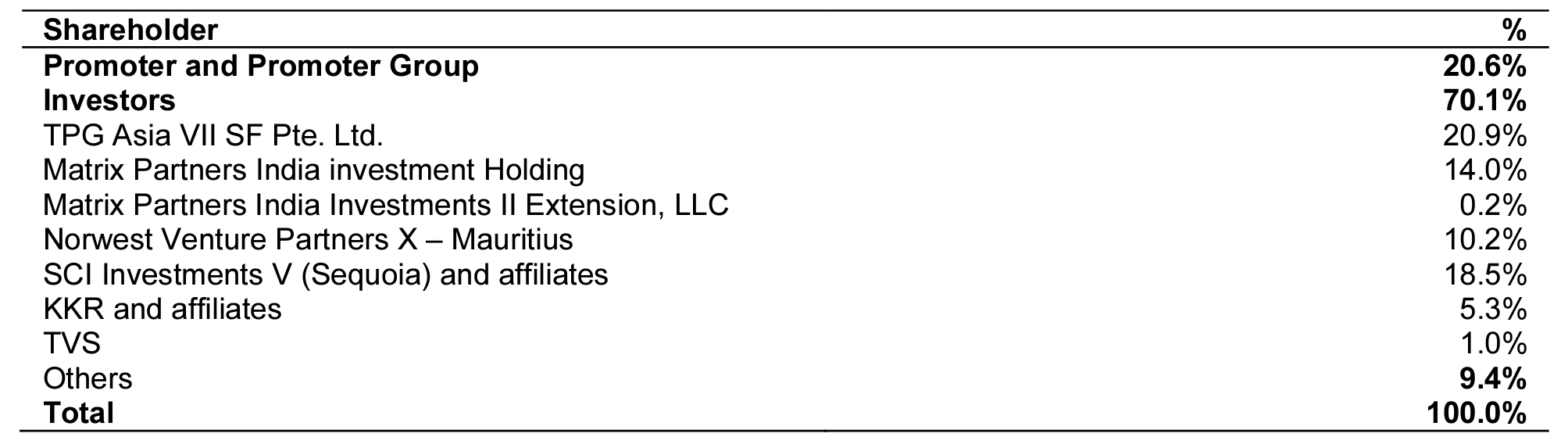

Shareholding Pattern

Growth Potential

Despite working with considerable intensity, Five Star has not fallen short on growth (AUM doubled every year for the last three years prior to COVID). It has grown its branch presence almost 6x over the past six years to 262 branches and has increased the sourcing capacity of relationship officers almost 30x during the same period to 2k RMs currently. While the peak annual disbursements have been Rs24bn, covid disruption had an adverse effect on FY21 disbursements at Rs13bn with average ticket size of Rs275k. Company is present across eight states (though dominant in the southern states of Tamil Nadu, Andhra Pradesh, Telangana, etc.) with strong focus in tiers 3-6 cities. New branches generally breakeven in 8-10 months.

Credibility

Five Star has been serving the same target segment for decades having seen customer repayment behaviour across cycles. It has developed a unique process flow from experience of underwriting >400,000 files. Rigorous credit underwriting leads to low credit costs and pristine asset quality with consistently low NPAs of <1.5-2.0%. Given the typical customer profile transitioning from money lenders to organised lending, they are not disciplined on EMI payments (1+ dpd ranges between 20-25% though it comes off to 10% on 30+ dpd basis and finally at the end of 90 days to almost less than 2%). Despite this behaviour, the company has incurred almost negligible credit loss all through its history (not exceeding 0.25% p.a. credit loss till date). The loss given default for NPA customers would be mere 200-300bps lower than the contracted IRR – it not only recovers the principal but interest as well and the loss is in terms of only some time value of money.

Due to covid second wave disruption, collection efficiency in business-owner segment is down to 91% in April (from 100% in March). However, Five Star is continuously engaging with customers virtually (as branches are partially open).

As of March 31, 2021 Five Star enjoys the following ratings from CARE, ICRA and CRISIL.

CARE

- Long term Bank Facilities : CARE A- Stable

- Short term Bank facilities : CARE A1

- Non-Convertible Debentures : CARE A- Stable

- Commercial Paper : CARE A1

ICRA

- Long term Bank Facilities ICRA : A- Stable

- Non-Convertible Debentures ICRA: A- Stable

- Securitization ICRA : AAA(SO)/ AA+(SO) /AA(SO) / AA-(SO)

CRISIL

- DA under PCG Scheme of GoI CRISIL: AA (SO) / AA-(SO)

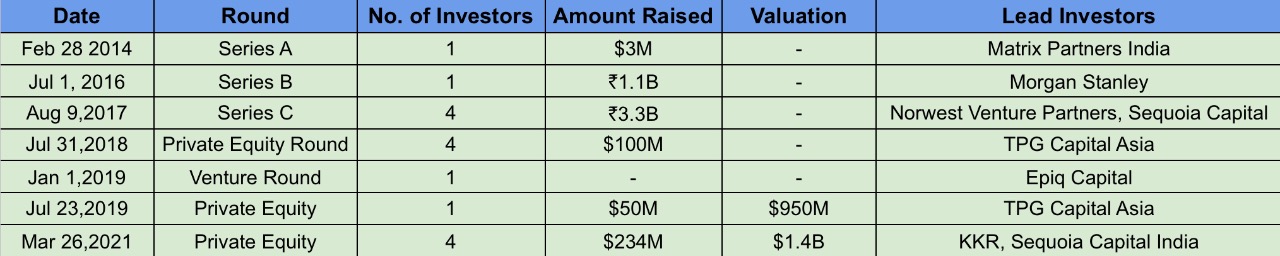

Past Funding Rounds & Valuations

Five Star has raised over Rs19bn (US$260mn) in equity till date and is backed by marquee private equities including TPG, Matrix, Norwest, Sequoia, KKR and TVS Capital. Also, it is run by a professional team (15 department heads with banking background) and stands up to high governance standards.

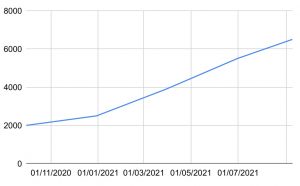

Performance in Unlisted/Pre-IPO Markets!

As far as the unlisted & Pre-IPO markets are concerned, Five-Star has performed exceptionally well during the last few months following the news of an upcoming IPO. The stock was available in the unlisted markets @INR 2000/share approx at the end of Aug’20 & you could easily see a spike of 25% in just next 3 months to INR 2500/share. The stock then rallied to INR 3900/share in Mar’21 & then to INR 5500/share in June’21. The Stock is currently trading at approx INR 6500/share. Looking at the past performances, We can expect a similar performance in the coming months.

As far as the unlisted & Pre-IPO markets are concerned, Five-Star has performed exceptionally well during the last few months following the news of an upcoming IPO. The stock was available in the unlisted markets @INR 2000/share approx at the end of Aug’20 & you could easily see a spike of 25% in just next 3 months to INR 2500/share. The stock then rallied to INR 3900/share in Mar’21 & then to INR 5500/share in June’21. The Stock is currently trading at approx INR 6500/share. Looking at the past performances, We can expect a similar performance in the coming months.

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

To know, more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

You can also checkout the list of Best 5 Unlisted Shares to Buy in India

For Direct Trading, Visit – https://altiusinvestech.com/companymain.

To know more about How to apply for an IPO? Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/