Altius Investech Pvt Ltd is being featured In India Top 100 Startup To watch for 2023.

Declare as they arrived, A brand-new India is taking off, speeding toward uncharted territory and a brighter future. Using tomorrow’s innovations to address current issues, the country’s innovators and entrepreneurs are setting the standard. Leap To Unicorn, a startup mentorship and funding program developed by IDFC FIRST Bank in partnership with Moneycontrol and CNBC-TV18, has given the talented entrepreneurs the platform they truly deserve. It contributed to bringing attention to India’s top 100 companies.

Union Budget 2022: HNIs can’t evade taxes through ‘bonus stripping’ from April 2023

Union Budget 2022: Section 94(8) of the Income Tax Act prohibits bonus stripping by tax payers by taxing bonus units of mutual funds. The restriction did not, however, apply to company bonus equity shares. That changes with the Budget.

Report from Hella India for 2022–2023

According to Hella India’s report, income increased by a healthy 42%, from 61 crores in 2022 to 87 crores in 2023.From 16 crore in 2022 to 26 crore in 2023, the pat has climbed by 62%. As well, the eps has increased from 53 to 86.

Unlisted companies may face tough disclosure rules

Markets regulator Sebi plans to change its rules to force unlisted companies to make more disclosures, including on related-party and financial transactions at the group or conglomerate level.Private companies in India are not required to make rigorous disclosures related to their financials or other material changes in the same way public companies are. This also applies to conglomerates that may have both listed and unlisted units.

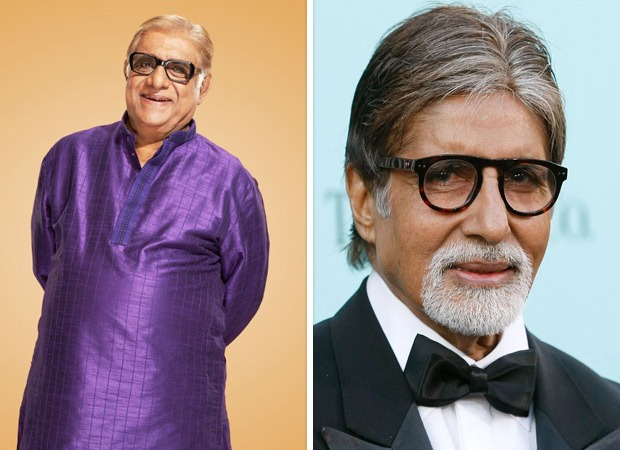

Aanjjan Srivastava recalls the financial crisis of ABCL; says, “Amitabh Bachchan folded hands and said ‘I will return your money as soon as possible’”

ABCL shares available at 15/sh ( Demat)

Aanjjan Srivastava, who has been a popular television and film personality, recently opened up about his bond with Bollywood’s megastar Amitabh Bachchan. Srivastava, who has completed several decades in the industry, has seen the many phases of the superstar, including his rise, fall, and later the road to superstardom. In a recent interview, he recalled the 80s and the 90s when Amitabh Bachchan was going through a low phase in his life.

Sebi reduces IPO listing period to 3 days

The Securities and Exchange Board of India (Sebi), the market regulator, announced on June 28 that it would shorten the current T+6 listing schedule following an initial public offering (IPO) to three days after the issue’s closure. The issue ends for the subscription on day ‘T’. The amended T+3 day deadline will be implemented in two stages, starting with optional application for all public issues opening on or after September 1, 2023, and moving to mandatory application on or after December 1, 2023, according to Sebi.

India has the potential to become gaming nation of the world: Nitish Mittersain, Nazara Technologies

According to Nitish Mittersain of Nazara Technologies, “We are also considering attractive acquisitions that we will make this year in both of these segments to scale our business and possibly increase our margins.”What are the prospects, then? Let’s talk briefly about your overall margins as you’ve stated that you’re considering growing aggressively. Is anything currently planned, and how would that affect your margin situation as a whole? Yes, the company has grown significantly in the first nine months, and we are currently on track to exceed our margin targets for this year as we had earlier guided. Nazara’s revenue has increased by 80%, therefore we are pleased with the company’s overall revenue balance and speedy revenue. growth

The Pro Football Network acquisition by Nazara’s Sportskeeda is now complete.

NFL news outlet Pro Football Network Inc. in the US has been acquired by sports media source Sportskeeda, a fully owned subsidiary of Nasdaq gaming firm Nazara Technologies. On March 22, Sportskeeda acquired 73.27% of Pro Football Network in an all-cash acquisition for $1.82 million through Absolute Sports, another wholly-owned subsidiary of Nazara.

Syngenta Share Holder Rewarded Compensation by Court order On Buy Back

The Mumbai bench of the National Company Law Tribunal vide order dated

October 27, 2020 had allowed the petition filed u/s 66 of the Companies Act, 2013 read with National Company Law Tribunal (Reduction of Share Capital of the Company) Rules, 2016 by Syngenta India Private Limited (formerly known as Syngenta India Limited’) [hereinafter referred to as the Company’] to reduce the issued, subscribed and paid-up equity share capital of the Company by cancelling and extinguishing the equity shares to the extent of 3.59% (Three point Five Nine per cent.) of the total issued, subscribed and paid-up equity share capital, comprising 11,81,036 (Eleven Lakh Eighty One Thousand and Thirty Six) equity shares of INR 5/- (Indian Rupees Five only) each held by the non-promoter shareholders of the Company and by discharging consideration of INR 2,445/- (Indian Rupees Two Thousand Four Hundred and Forty Five only) per equity share to the non-promoter shareholders whose names were registered with the Company as on November 11, 2020 (‘the Record Date‘),

Two Nazara Tech subsidiaries own a Rs 64 billion cash position in the bankrupt lender as a result of SVB.

Digital gaming and sports platform Nazara Technologies reported on March 12 that two of its step-down companies, Kiddopia Inc. and Mediawrkz Inc., have cash balances there amid the shocking collapse of US-based Silicon Valley Bank (SVB), the main supplier in the startup scene. The aggregate balances held by the subsidiaries with SVB are $7.75 million (approximately Rs 64 crore). Mediawrkz Inc. is a subsidiary of Datawrkz Business Solutions Private Limited, while Kiddopia Inc. is a subsidiary of Paper Boat Apps Private Limited, which is owned 51.5 percent by Nazara (owned 33 percent by Nazara).

MC Exclusive: Sebi proposes mutual funds ‘own their broking’ or foot broking expenses

In what could be a big blow to the broking industry, and a painful affair for mutual fund companies, the Securities and Exchange Board of India has proposed that mutual funds get membership on stock exchanges, and do trades through their own trading terminals, two senior MF officials with knowledge of the matter told Moneycontrol.

How Malavika Hegde brought back Café Coffee Day after her business husband’s terrible death

The meteoric rise of the Café Coffee Day brand is still hailed as one of the greatest success stories of home-grown businesses in India. However, not many knew about the huge debts the coffee giant has amassed until its owner VG Siddhartha died by suicide. After his death, many thought that the company wouldn’t survive. But, Malavika Hegde, Siddhartha’s wife, took over the reins of the company at a crucial juncture and scripted an amazing saga of resurrection.

Asscher Enterprise ltd Formerly Indian Seamless Enterprises ltd offer of buy back

Cash offer of buyback of upto 10,62,000 fully paid-up equity shares of face value of rs. 10/- each, representing approximately 9.50% of the total number of equity shares in the issued, subscribed and fully paid-up equity share capital of the company, from the existing shareholders / beneficial owners of equity shares of the company as on the record date i.e. february 24, 2023, on a proportionate basis, through the “tender offer” route at a price of rs. 283/- (rupees two hundred and eighty- three only) per equity share for an aggregate amount not exceeding rs. 30,05,46,000/- (rupees thirty crore five lakhs and forty-six thousand only)

Nitish Mittersain: The Game Theorist

The CEO, founder and joint MD of gaming unicorn takes us through his journey from being a gamer to building a large diversified gaming company. He is on Entrepreneur India’s Digital Cover for February 2023.They say blessed are those who can follow their passion and turn that into their profession. Nitish Mittersain, CEO, founder and joint MD, Nazara Technologies is one of those few lucky people who not only converted his love for gaming into his career, but built a large business around it. That too, when smartphones had not arrived and nobody else was thinking of gaming as a business in India.

Within eight weeks from now, all stockholders are expected to get 20.5% of ₹2445 each share in their individual bank accounts

These appeals are directed against the judgment And order dated 5th March, 2021 of the National Company Law Appellate Tribunal, New Delhi (hereinafter referred To as “NCLAT”). The NCLAT had reversed the approval Granted by the National Company Law Tribunal, Mumbai (hereinafter referred to as “NCLT”) on 27.10.2020 to the Proposal initiated by the appellant (hereinafter referred Proposal initiated by the appellant (hereinafter referred To as “Syngenta”) The proposal was to reduce its issued, Subscribed and paid-up share capital of the appellant Syngenta by canceling and extinguishing in aggregate 3.59% Of such total shares issued by it and held by the public Shareholders. These shares had been earlier de-listed in The stock exchange. The NCLT by its order took note of The proposal as well as the valuation reports submittedin support of it by the Price Waterhouse & Co. LLP, Chartered Accountants (“PWC”) and Haribhakti & Co. LLP (“Haribhakti”) dated 25.10.2017 and 26.10.2017 Share accepted by Syngenta’s Board of Directors and Approved by majority of its shareholders, was in order

Web3 company Kratos, run by the former CEO of Nazara, raises Rs 160 Cr in a seed round.

Kratos Studios, a Web3 game startup, has raised Rs 160 crore ($20 million) in a seed round that was co-led by Accel and included investors such as Prosus Ventures, Courtside Ventures, Nexus Venture Partners, Nazara, and others. According to a press statement from the company, the cash will aid in developing distribution channels for international Web 3 games in developing countries. In addition, the Decentralised Autonomous Organization (DAO) will invest in the most promising Web 3 games worldwide.

Holding power is the most underrated aspect of investing and life

Markets are collapsing, and it appears like a recession is about to start. The good news is that “markets always rise” and this is just another economic cycle if you are a long-term passive investor like us who invests in a number of capitalist economies throughout the world. After all, you’ll have more serious issues to worry about if major world indexes don’t recover.

World’s play store: India scripts a local toy story, turns a net exporter

Although India’s share in the world toy trade has marginally improved, it still lags behind China’s. Toys are not China’s main item of export, but about two-thirds of the toys sold globally are from china.

The world exported toys worth $73.2 billion in 2021: China accounted for 66.2 per cent, or $48.5 billion of that, out of which mainland China made up $46.1 billion and Hong- kung $2.4 billion. By comparison, India’s toy exports were a minuscule 0.23 per cent of the world’s toy exports

First depository in India, NSDL, launches 2023 IPO plans; IDBI Bank, NSE may sell stake

According to numerous industry sources with knowledge of the situation and as reported by Moneycontrol, National Securities Depository Limited (NSDL), the oldest depository services company in the nation that transformed the Indian securities market by enabling the holding and transfer of securities in dematerialized form, has begun preparations to launch an initial public offering (IPO) in 2023.

SEBI mulling stake for public shareholders in firms, post CIRP

Millions of public shareholders of listed businesses that go through the Corporate Insolvency Resolution Process are protected by a system created by market regulator SEBI (CIRP). Until now, the CIRP catered primarily to the interests of banks and other significant creditors, but shareholders lost their rights over a company the moment it got entered into the debt restructuring process, and the new owner, post-restructuring, assumed 100 per cent control of the entity. In a consultation paper published on Thursday, SEBI has now suggested that the current public shareholders of a company operating under CIRP should also become shareholders in the company following its restructuring and should have the right to participate in the process proportionate to their shareholding.

IDBI Bank and NSE-backed NSDL may pick 7 i-banks for 2023 IPO

NSDL (National Securities Depository Limited), the country’s first depository services firm, which is backed by key investors like IDBI Bank & NSE is likely to shortlist 7 investment banks as advisors as its prepares to launch an initial public offer in 2023, multiple industry sources with knowledge of the matter told Moneycontrol.

If the listing plans fructify, NSDL would become the second depository services company to be listed on the domestic bourses, post the bumper market debut of peer CDSL ( Central Depository Services Limited) in 2017.

Around 15 companies, including Rakesh Jhunjhunwala-backed Nazara Technologies are jostling to acquire Smaaash Entertainment, The Economic Times reported. The sports-focused digital firm is under insolvency proceedings, it added. Sources said that prominent among the parties that submitted Expressions of Interest (EoIs) are Nazara Tech (Rare Enterprises), Adlabs Entertainment (Malpani Group), Manikchand Group, FZE, Tech Connect Services, Capri Global, Jindal Enterprises and iLabs India Special Situation Fund, it added.

APL Metal Ltd unaudited financial results for the quarter ended.

The board has approved unaudited Standalone Quarterly financial results for the quarter Ended 30th june , 2022 in details format along with Auditors limited review report.

Creditors to Smaaash optimistic about recovery of dues

Lenders are expecting almost full recovery of their dues in Smaaash, a sports-centric digital entertainment company backed by cricketer Sachin Tendulkar, as its revenues have improved over the last few months, said people with knowledge of the matter.

Smaaash Entertainment Pvt Ltd (SEPL) was admitted by the Mumbai National Company Law Tribunal (NCLT) following a default of ₹292.4 crore to Edelweiss Asset Reconstruction Company. The company suffered losses since it was shut for 18 months during the Covid-19 pandemic, but revenues improved after the Covid-related restrictions were lifted.

“Several entertainment companies have shown interest in acquiring Smaaash due to change in the outlook post-Covid. After two years of lockdown, people are more inclined to spend for entertainment,” said one of the persons cited above. The resolution professional Bhrugesh Amin has set August 8 as the deadline to submit expressions of interest.The company has generated ₹34.5 crore in revenue in the first quarter of this financial year against ₹46 crore for FY22. Operating profit or Ebitda (earnings before interest, taxes and amortisation) for the first quarter ending June 2022 stood at ₹11.3 crore against ₹14 crore in the last financial year,

Magic Of Equity Investment

For all our Investment Tigers : Terrific Data

Sensex at 53000 or at 80000 or much much higher!

Just see for the first time ever amazing data about Indian Equity Markets.

1. BSE completed 40 years.

2. There were around 10,000 trading days in last 40 years.

3. Observations on regular basis and positive and negative returns occurrences.

| Frequency | Positive | Negative |

| Daily | 53% Time | 47% Time |

| Weekly | 56% Time | 44% Time |

| Monthly | 61% Time | 39% Time |

| Quartely | 64% Time | 36% Time |

| Yearly | 72% Time | 28% Time |

| 3 Year | 89% Time | 11% Time |

| 5 Year | 96% Time | 4% Time |

| 10 year | 100% Time |

4. Bse Sensex delivered 15.5% CAGR returns over last 40 years.

5. Decadal returns dispersion

| Period | CAGR |

| 1980-1990 | 21.60% |

| 1990-2000 | 14.30% |

| 2000-2010 | 17.80% |

| 2010-2020 | 8.80% |

6. BSE Sensex returns 15.5%. Add 1.4% average dividend yield of 1.4% of last 40 years. At 16.9% compounding the value of BSE is actually around 80,000 level.

7. Longest period without returns was from 1994 till 2003. 9 years in total.

8. Since 2002 in last 18 years NO single 7 years rolling returns were without returns. This means since 2002 if you ever invested and kept money for minimum period of 7 years then you would have never lost money.

9. But what is most surprising and rewarding has been the performance of actively managed equity funds. Here are the data:

| Category | 20 Year CAGR | 25 Year CAGR |

| Hybrid | 15.17% | 15.96% |

| Hybrid-ex* | 16.37% | 16.74% |

| Diversified | 18.11% | 16.25% |

| Diversified -ex* | 19.89% | 18.10% |

| ElSS | 18.45% | 18.20% |

| ElSS-ex* | 19.66% | 21.47% |

| All Funds | 17.52% | 16.41% |

| All Funds -ex* | 18.73% | 18% |

excluding LIC/JM/Taurus/Quant MF schemes. This mean schemes of HDFC/ Nippon (earlier Reliance)/ Birla/ ICICI Pru/ SBI/ Principal/ Canara Rebecco/ Franklin etc.)

10. BSE Sensex was at 3800 in June 1996 (25 years back). In last 25 years average-ex* MF delivered 18% CAGR. Had BSE Sensex delivered as much as average MF schemes then the value of BSE Sensex should have been:

At 16.4% CAGR, BSE Sensex should be around 1,70,000 levels

At 18% CAGR, BSE Sensex should be around 2,38,000 levels.

How Brokers Sidestep SEBI Rules To Rip-off Investors: Now Targeting Super Senior Citizens

The pandemic has been a flourishing time for the brokerage business. India’s investor population nearly doubled, as people from the age of 9 years to 90 years turned into traders after a quick online class. Brokers used this boom during the lock-down to lure and loot people with well-laid traps backed by the façade of technical compliance with the rules. The two stories I will narrate, to caution investors, are chilling enough to jolt even a cynic like me who has reported a variety of scams for over 30 years.

MCA bats for shareholders’ privacy, restricts access to personal information on register of members

Move expected to prevent misuse of data by third parties, say expert. In a significant decision, the Corporate Affairs Ministry (MCA) has said that companies need not make available certain personal information of shareholders to those who inspect their register of members. The information barred from sharing include e-mail ID, unique identification number, PAN, and address or registered address (in case of a body corporate) of shareholders.

Get in Touch with us:

To know more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

For Direct Trading, Visit – https://altiusinvestech.com/companymain.

To learn more about How to apply for an IPO. Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/

Pingback: General News | altiusinvestech | Scoop.it