About the Company

Indian Potash Limited (IPL), founded in 1955 as the Indian Potash Supply Agency, remains a prominent player in India’s fertilizer industry under the leadership of Chairman Shri Pankaj Kumar Bansal. The business underwent a name change to Indian Potash Limited (IPL) in 1970. Ever since, it has emerged as a significant force in the fertilizer market, bringing in fertilizers such as sulfate of potash, monoammonium phosphate, Indian Potash Ltd. super phosphate, and muriate of potash.

The cooperative sector holds more than 70% of Indian Potash Limited Share., with Indian Farmers Fertiliser Cooperative being the largest shareholder. The company is also involved in the production and marketing of cattle feed, dairy products, sugar, and trading of precious metals.

| COMPANY NAME | INDIAN POTASH LIMITED |

| NATURE OF BUSINESS | POTASH DISTRIBUTION ALL OVER INDIA |

| ISIN NO. | INE363S01015 |

| FACE VALUE | RS.10/- |

| YEAR OF ESTABLISHMENT | 1955 |

| COMPANY WEBSITE | WWW.INDIANPOTASH.ORG |

| REGISTERED ADDRESS | FLOOR 1,SEETHAKATI BUSINESS CENTRE, 684-690,ANNA SALAI,CHENNAI-600 006 |

Table of Contents

TogglePlants

Indian Potash Ltd has expanded its operations to include the production and distribution of cattle feed from plants in Uttar Pradesh and Andhra Pradesh. Additionally, it has ventured into the dairy industry with plants in Haryana and Uttar Pradesh. Furthermore, Indian Potash Ltd has acquired sugar units in Uttar Pradesh and is working on joint ventures for a Green Field Port Facility in Gujarat and an Integrated Sugar Complex with Co-generation and Distillery in Bihar.

Indian Potash Limited Share Price (as on 11.02.2024)

- The buy price varies based on quantity, ranging from 1425 for quantities between 5 and 50 shares to 1399 for quantities between 601 and 634 shares, with corresponding rates per share.

- The 52-week high is 1825, and the 52-week low is 1385, indicating the range of fluctuations in the Indian Potash Limited share price. Additionally, the sell price is fixed at 1300.

Management of the Company

SHRI. PANKAJ KUMAR BANSAL, Chairman

Pankaj Bansal, an IAS officer, based in Chennai, Tamil Nadu, serves as a director at Indian Potash Limited. He currently holds positions in two companies: The Fertiliser Association Of India (as a Director) and Indian Potash Limited (as a Nominee Director). Previously, he was associated with 27 companies, including Southern Petrochemical Industries Corporation.

Dr. U.S. AWASTHI, Managing Director

A chemical engineer from Banaras Hindu University, Dr. Awasthi is a world-renowned professional and a authority in the global chemical fertilizer sector. With nearly 5 decades of experience, Dr. Awasthi has been instrumental in making IFFCO a global leader in fertilizer production. Dr. Awasthi has helmed the growth of IFFCO, blending modern technology with traditional known-how. Under his tenure IFFCO’s production capacity increased by 292%.

Shri. Rakesh Kapur, Joint Managing Director

Mr. Rakesh Kapur holds the position of Joint Managing Director & Chief Financial Officer of IFFCO. An ex-IRS Officer and a Mechanical Engineer from IIT Delhi, Mr. Kapur joined IFFCO at Jt. MD and CFO of IFFCO in 2005. Prior to joining IFFCO, Mr. Kapur served in senior positions in the Income Tax Department of the Govt. Of India and several Public Sector Undertaking.

Products of Indian Potash

Fertilizer

Indian Potash Limited’s history started in the early 1950s with the vision and hard work of a few dedicated people. Potash use was almost nonexistent, irregular, and limited to a few southern states in terms of population before to 1950. Before they were shown the advantages of potash through diligent fieldwork, Indian farmers knew very little about it. One of the most amazing stories in the fertilizer industry’s history in India is the potash success story.

Given this, Indian Potash Limited was started with a goal is to encourage the sensible use of potash. Indian Potash Limited has endured over time, even after phosphoric and potassic fertilizers were taken out of government hands in 1992.

Feeds

Indian Potash Ltd. provides fertilizers to all states throughout the year, guaranteeing their accessibility across the country. To develop ties with farmers and connectivity in rural areas, Indian Potash Ltd. started producing and marketing cow feed in the country’s northern and southern regions. This method was started by making and distributing feeds from two plants: one in Renugunta, Andhra Pradesh, and another in Sikandrabad, Uttar Pradesh, to meet the needs of states in northern and southern India.

Dairy

Indian Potash Ltd can obtain and process up to 700,000 liters of milk each day, generating a range of dairy products, thanks to its state-of-the-art processing facilities. This state-of-the-art facility guarantees effective milk handling and upholds premium standards, underscoring Indian Potash Ltd. commitment to providing consumers with wholesome and secure dairy products.

Sugar

Indian Potash Ltd. (IPL) paid around 9700 tonnes of cane crushed per day (TCD) for five incredibly old sugar plants that it purchased from the Uttar Pradesh government in 2010. Since then, Indian Potash Ltd. has ensured that all of the facilities run as efficiently as possible by upgrading any antiquated technology or equipment. Since then, the Indian Potash Ltd. has acquired Titawi Sugar Complex, a unit in the state of Uttar Pradesh, as a slump sale and going concern. In addition to a higher replacement cost for starting a green field sugar project on the side and depending on a market referral, Indian Potash Ltd. envisions a bright future for the sugar industry.

Precious Metals

In an effort to capitalize on the growing semi-urban and rural market, the Indian Potash Ltd. and the state-owned trade company MMTC opened the “Indian Potash Ltd Swarnalaya” jewelry boutique in New Delhi. The jewelry, medallions, and silver jewelry brand “Sanchi” from MMTC would be sold in the showroom.

Flagship product of the Indian Potash Ltd.: Fertilizer

Muriate of Potash (MOP):

- A key component of the Indian Potash Ltd.’s product line, MOP was essential in boosting revenue.

- In FY22, MOP sales alone made up about 65% of the Indian Potash Ltd.’s total revenue.

- This significant contribution bolsters Indian Potash Ltd’s market leadership in the fertiliser industry.

Diammonium Phosphate (DAP):

1. Sales of DAP, another important part of the Indian Potash Ltd.’s revenue stream, made a substantial financial contribution to the business.

2.DAP obtained the second-largest market share for Indian Potash Ltd. in FY22, despite MOP’s dominance.

3. The firm presence and competitiveness of Indian Potash Ltd. in the fertilizer market is highlighted by the good performance of DAP sales.

Key Strength

- Leading position in the fertilizer industry, particularly in MOP: As one of India’s biggest distributors of fertilizers, Indian Potash Ltd. (Indian Potash Ltd.) has a strong market presence in the fertiliser industry and commands a 65% Indian Potash Limited share of Muriate of Potash (MOP) sales in FY22. In addition, Indian Potash Ltdplays a significant role in the sales of complex fertilizers such as diammonium phosphate (DAP). Acknowledged for its operational effectiveness, the Indian Potash Ltdis strategically significant to the Government of India as it guarantees timely fertilizer availability nationwide. Indian Potash Ltdwas tasked with acting as a canalizing agent for imports of urea in FY22. Even with the diversification into the production of sugar, cow feed, and milk and milk products, these segments revenue during the last three years has accounted for a lesser portion, ranging from 7 to 10%.

- Enduring connections with suppliers:Through its long-standing ties, Indian Potash Ltd. (Indian Potash Ltd.) is able to secure considerable shipments of fertiliser from reliable outside suppliers. This gives the Indian Potash Ltdaccess to cheap fertiliser prices and advantageous loan conditions.

- Robust network of distribution: With over six lakh Indian villages nationally, Indian Potash Ltd. has one of the largest distribution networks, including individual dealers, cooperatives, and other fertilizer units. Indian Potash Ltd is in charge of about 5,000 main distributors that are directly supervised by district officials and regional offices, with 15 regional offices spanning all states. In order to guarantee sufficient stock availability, Indian Potash Ltd also keeps up its warehouse facilities at over 300 inland godowns that are thoughtfully placed throughout the nation and at 14 major ports. Indian Potash Ltd effectively distributes allotted supplies to states depending on proximity by utilizing rail and road transportation. This strong network of marketing and distribution helps the business shift inventory quickly.

- Improvement in financial performance during FY22 and 9MFY23: Indian Potash Ltd.’s consolidated revenue increased by 12.5% year over year in FY22 to ₹18,521 crore, mostly due to a notable spike in fertilizer prices. Nonetheless, throughout this time, overall sales volumes decreased. Indian Potash Ltd.’s overall revenue for the first nine months of FY23 was ₹29,568 crore, up from ₹14,737 crore during the same period in FY22. The government’s decision to raise subsidy rates in line with the rising cost of fertilizer contributed to an additional increase in the average realization of MOP and DAP during 9MFY23. CARE Ratings projects that demand would mostly stay constant over the medium term, despite the fact that fertiliser prices have started to stabilize during H1FY23.

- Investing in non-core assets to diversify: Indian Potash Ltd. (Indian Potash Ltd.) has been growing its business into manufacturing sectors centered around agriculture, such as dairy, sugar, and cow feed. At the moment, Indian Potash Ltd has six sugar mills that can crush 21,000 tons of cane per day altogether. The company also operates one milk processing plant with a daily capacity of 7 lakh litres, and two cattle feed plants. Indian Potash Ltd is investing ₹250 crore, mostly through borrowed financing, in a distillery project to improve its sugar sector.

Key weaknesses

- Profitability at risk from foreign exchange and commodity price fluctuations: Commodity price swings have an impact on the profitability of the Indian Potash Ltd., which will impact PBILDT margins in FY22. Because of the nature of its activities and its high inventory levels, the company is exposed to hazards associated to inventory. The Indian Potash Ltd lacks natural hedges against imports, therefore changes in currency rates also affect profitability. But with internal FX staff and solid supplier relationships, Indian Potash Ltd expertly controls these risks, frequently turning a profit.

- Executing capital-intensive processes: Significant working capital is needed for Indian Potash Ltd operations, and this money is provided by buyers’ credit and working capital limitations. Nonetheless, working capital intensity has decreased as a result of recent improvements in government subsidy disbursement. Importing fertilisers at competitive rates with significant bank limitations enhances the financial flexibility of the Indian Potash Ltd.. Although average interest rates decreased, which resulted in higher debt levels, Indian Potash Ltd.’s gross interest coverage grew to 6.97x as of March 31, 2022 (from 569x in 9FY21).

- Exposure to agroclimatic hazards and the heavily regulated fertilizer industry: Since the government sets pricing and offers subsidies, regulations governing fertilizers have a substantial impact on the profitability of fertilizer companies. Depending on the type of fertilizer, the time and size of subsidy payments have an impact on industry liquidity. The government first budgeted ₹1.05 lakh crore for fertiliser subsidies in FY23; however, as the cost of raw materials and natural gas increased, this amount was later increased to ₹2.15 lakh crore. Although there may be financial burden on the government and execution issues, plans to implement the second phase of Direct Benefit Transfer (DBT) could prove advantageous for companies. Agro-climatic hazards may also have an impact on fertiliser companies’ earnings and the timing of their subsidy receipts.

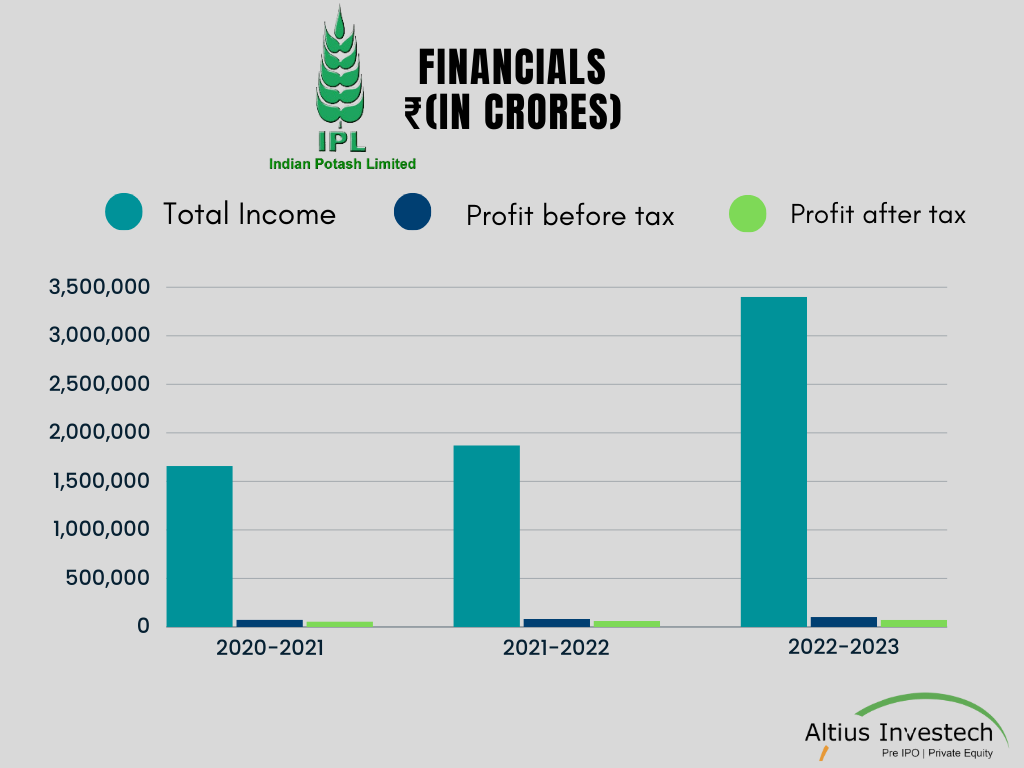

Financials

₹(in crores)

| Particulars | FY 2022-2023 | FY 2021-2022 | 2020-2021 | Growth Percentage |

| Total Income | 34010.75 | 18715.48 | 16581.09 | 27.06% |

| Profit Before Tax | 1022.97 | 821.85 | 759.94 | 10.41% |

| Profit After Tax | 751.50 | 615.06 | 570.07 | 9.65% |

| Earning Per Share | 262.79 | 215.08 | 199.35 | 9.65% |

| Overall Gearing(times) | – | 2.17 | 1.01 | – |

| Interest Coverage (times) | – | 6.97 | 5.69 | – |

Indian Potash Ltd. had a great year financially in 2022–2023, with its total income jumping by 82% compared to the previous year, reaching Rs. 34,010.75 crores. Despite facing challenges like subsidy reductions and high demand, the company managed to meet import obligations and follow regulations. They’re also trying to get reimbursed for higher import costs. The Profit Before Tax increased by 24% to Rs. 1,022.97 crores, and the Profit After Tax increased by 22% to Rs. 751.50 crores. While total income saw a massive 105% surge from 2020-2021, profit after tax only rose by about 32%, indicating a need for the company to improve operational efficiency to match profit growth with revenue growth. Indian Potash Limited share price vary, ranging from 1425 INR for quantities between 5 and 50 shares to 1399 INR for quantities between 601 and 634 shares, reflecting its market performance.

The annual report of Indian Potash Ltd is available in the annual report section (Click on link).

Dividend History

Indian Potash Ltd. during the year 2022–23 and the challenges ahead for 2023–24, a Dividend of Rs. 7/- per fully paid-up Equity Share of Rs. 10/-

Financial Metrics for Indian Potash Ltd.

| Particulars | Amount |

| Price to Earning Ratio (P/E) | 2.47 |

| Price to Sales Ratio (P/S) | 0.22 |

| Price to Book Value (P/B) | 0.65 |

| Industry PE | 11.19 |

| Face Value | ₹ 10 |

| Book Value | ₹ 2142.26 |

| Market Cap | ₹ 4000.75 Cr |

| Dividend | ₹ 7 |

| Dividend Yield | 0.5% |

Indian Potash Ltd.: Shareholdings

| Shareholding Above 5% | Holding % |

| Indian Farmers Fertilisers Cooperative Limited | 33.99 |

| Gujarat State Co-operative Marketing Federation Limited | 10.45 |

| Gujarat State Fertilisers and Chemicals Limited | 7.87 |

| Andhra Pradesh State Cooperative Marketing Federation Limited | 6.23 |

| Madras Fertilisers Limited | 5.54 |

Subsidiary and Associate Companies

| Name | Place | Incorporation Year | Paid up capital | % of shares held | Subsidiary/Associate |

| Indian Potash Ltd. SUGARS AND BIOFUELS LIMITED | Delhi, India | 2011 | 1.00 cr | 100% | Subsidiary |

| JORDAN PHOSPHATE MINES COMPANY | Amman, Jordan | 1949 | 1.50 cr | 27.38% | Associate |

Indian Potash Ltd.: IPO Plans

Indian Potash Limited (IPL) has not yet made any official announcements or public declarations regarding the start of an Initial Public Offering (IPO). In spite of Indian Potash Ltd.’s prominence in the Indian fertiliser distribution industry, no evidence is currently accessible indicating that the firm is actively contemplating or intends to carry out an IPO in the near future. A number of variables, including the company’s financial situation, market conditions, and internal strategy concerns, may have contributed to the decision to forego an IPO.

Conclusion

- Indian Potash Limited share price vary, ranging from 1425 INR for quantities between 5 and 50 shares to 1399 INR for quantities between 601 and 634 shares, reflecting its market performance.

- Indian Potash Ltd.’s revenue is bolstered by its flagship products: Muriate of Potash (MOP) and Diammonium Phosphate (DAP), contributing approximately 65% and securing the second-largest market share, respectively, in FY22.

- The company has diversified its business into sectors such as sugar, dairy, and cattle feed, with six sugar mills and a milk processing plant in operation.

- Indian Potash Ltd.’s financial performance has been robust, with total income increasing by 82% in FY22-23 compared to the previous year, reaching ₹34,010.75 crores.

- While Indian Potash Ltd. has not announced any IPO plans, its strategic positioning and diversified operations suggest promising growth prospects in the fertiliser industry and beyond.

- Key challenges include profitability risks from foreign exchange and commodity price fluctuations, as well as exposure to agroclimatic hazards and heavily regulated fertilizer industry dynamics.

- Indian Potash Ltd.’s strong distribution network, spanning over 5,000 main distributors and 15 regional offices, ensures efficient stock availability and quick inventory turnover.

- Despite facing challenges, Indian Potash Ltd. remains focused on capitalizing on opportunities in the agricultural sector and sustaining its growth trajectory in the years to come.

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

To know, more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

For Direct Trading, Visit – https://altiusinvestech.com/.

To know more about How to apply for an IPO? Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/