Blog Highlights

- What are Unlisted Shares & Benefits of Investing in Them

- Current Market Landscape

- Top Unlisted Shares to Buy in 2025

- Reasons Why Investing in Unlisted Shares is a Wise Decision

Top 10 Unlisted Shares to Watch in 2025: Unlock Early-Stage Growth

Investments in unlisted shares offer a unique opportunity for participation in the growth of companies before they can go public. On approaching 2025, several unlisted companies put forth promising prospects of investment.

We need to explore top unlisted shares that can be considered, and the benefits of investing in them, alongside the current market landscape.

What are Unlisted Shares & Benefits of Investing in Them

Unlisted shares are stocks of companies that are not traded on public exchanges like the NSE or BSE. These shares are typically offered by privately owned companies or startups and are bought and sold through private transactions. Unlisted shares are a key component of alternative investments, which include non-traditional assets like private equity, venture capital, and real estate.

There are several advantages associated with investments in unlisted shares-

- Early Access to High-Growth Organizations – Investors would be able to participate in the growth journey of companies before going public, potentially reaping significant returns.

- Potential for High Returns – Because of their illiquid nature as well as the growth phase of the companies, unlisted shares are able to offer substantial returns in case the company succeeds.

- Portfolio Diversification – Unlisted shares have a different range of risk dynamics in comparison to listed equities, giving an avenue for diversifying investment portfolios.

- Stable Pricing – They are less susceptible to market volatility, offering more stable pricing compared to the listed counterparts.

Current Market Landscape

The Indian Unlisted market has been able to witness significant activity, with several companies preparing for IPOs or Initial Public Offerings. For instance, Hyundai Motor India has sought regulatory approval for its IPO, making it one of the largest in the country. Likewise, Bajaj Finance listed its housing finance arm, Bajaj Housing Finance, in a $782 million IPO, allowing it to be the largest IPO in the country in 2024. The developments showcase a robust pipeline of companies transitioning from unlisted to listed status, giving investors chances to capitalize on the growth trajectories.

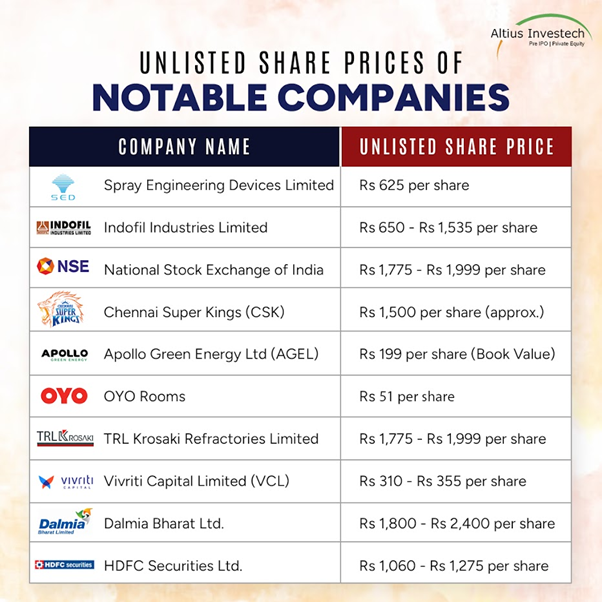

Top Unlisted Shares to Buy in 2025

1) Spray Engineering Devices Limited

Established in 2004, it specializes in energy-efficient, innovative solutions for industries like sugar, bio-refinery, jaggery, water, biofuel, distillery, and bio-based green chemicals. The company operates in over 40 countries, offering expertise in processes such as crystallization, evaporation, and refining. Their three state-of-the-art manufacturing facilities are set in over 500 sugar factories. The product portfolio involves low-temperature evaporators, heat exchangers, crystallizers, as well as condensers, all of which aim to enhance operational sustainability and efficiency. The technology utilized by SED significantly reduces resource consumption in sugar processing, which cuts steam usage to 25% on cane and power consumption from 40 kW/Ton to 22-24 kW/Ton.

| Metric | 2021 | 2024 |

| Unlisted Share Price | N/A | Rs 625 |

| Revenue | Rs 111 Crores | Rs 547 Crores |

| Net Profit | Rs 5 Crores | Rs 53 Crores |

| Earnings Per Share (EPS) | Rs 2.23 | Rs 23.56 |

The current financials demonstrate SED’s unlisted shares to have a 52-week high of Rs 2025, and a low of Rs 550, which indicates strong market interest. Having over 90 innovative design patents granted globally, SED stays at the forefront of technological advancements in the industry. The investments in SED unlisted shares offer the chance to be a part of an organization that champions efficiency and sustainability in industrial processing, making it quite an appealing choice! Buy Shares Now!

2) Indofil Industries Limited

Established in 1993, Indofil Industries Limited is a leading agrochemicals and specialty chemicals company within the KK Modi Group. Indofil works in two major divisions- Agricultural Chemicals and Indofil Innovative Solutions. The first focuses on high-impact products such as Mancozeb, a top-selling fungicide in the world, alongside other insecticides, herbicides, and bactericides. The latter caters to industries like plastics, textiles, coatings, construction, and leather with special chemical solutions.

Its manufacturing facilities include three plants in Dahej, Gujarat, equipped with advanced DCS and PLC systems, ensuring quality control and efficiency through its production lines.

In 2022, the company invested Rs 120 Crores to improve its manufacturing capacity and thereby expand its market share. In the next five years, Indofil aims to transition from a product-based company to a solution-based company. The company declared a dividend of Rs 4 per equity share for the year 2022.

Financially, Indofil boasts a 52-week high share price of Rs 1,535 and a low of Rs 650.

Consider Indofil’s impressive growth trajectory as well as expansive portfolio, for a compelling addition to your investment strategy. Buy Now!

| Metric | Value |

| 52-Week High Share Price | Rs 1,535 |

| 52-Week Low Share Price | Rs 650 |

| Revenue (FY 2023-24) | Rs 3,118 crore (+1% YoY) |

| Revenue (FY 2022-23) | Rs 3,095 crore |

| Net PAT (FY 2023-24) | Rs 363.68 crore (+45% YoY) |

| Net PAT (FY 2022-23) | ₹294.78 crore |

3) National Stock Exchange of India or NSE

It is the country’s largest stock exchange and also ranks among the top exchanges in the world by trading volume. As of November 7, 2024, NSE’s unlisted shares are valued at Rs 1,850 per share, with a face value of Rs 1.

Investing in unlisted shares of NSE can offer early-stage investment opportunities and diversification benefits. However, potential investors need to be aware of risks like valuation challenges, illiquidity, and limited regulatory oversight.

In August 2024, NSE reapplied to the Securities and Exchange Board of India for a “no objection” certificate for proceeding with its long-pending initial IPO, aiming to offer 10% of its shares. This potentially raised around $3.2 billion.

As NSE moves forward with plans of public offering and continues its leadership in equities and derivatives, its unlisted shares present an attractive opportunity, as a highly influential market player. Buy Now!

4) Chennai Super Kings (CSK)

As a franchise cricket team in the IPL or Indian Premier League, CSK has established a strong brand presence. The team’s consistent performance and dedicated fan base translate into substantial revenues, thereby making it an attractive investment prospect.

The Chennai Super Kings or CSK unlisted share currently reflects a Price-to-Earnings (P/E) ratio of 32.41, suggesting that investors are willing to pay a premium for each rupee of earnings CSK generates. It reflects confidence in the future earnings potential and confidence in the brand.

With a P/S or Price-to-Sales ratio of 10.86, the stock price is valued highly relative to the company’s revenue, indicative of the brand strength and revenue-generating ability in the cricket industry.

As of now, CSK’s market capitalization is Rs 7550.56 Crores. Highlighting its position and valuation within the unlisted market. While CSK does not currently pay a dividend, showing a reinvestment-focused growth strategy, it could be appealing to long-term investors expecting share appreciation instead of an immediate return on dividends. Buy Now!

5) Apollo Green Energy Ltd (AGEL)

Apollo Green Energy focuses on solutions for renewable energy, aligning with our country’s push towards sustainable energy. The organization’s innovative projects and strategic partnerships position it well in the growing green energy sector.

The company has a book value of Rs 199 per share and a face value of Rs 10. It does not offer a dividend.

AGEL’s green energy division has ongoing projects such as the installation of solar street lights in Bihar (Rs 392 Cr) and large-scale solar installations in collaboration with Adani Green and NHPC. Major awarded projects include a 200 MW solar project with NHPC in Gujarat Rs 966 Cr) and an EPC contract for NTPC’s solar park project in Gujarat (Rs 500 Cr).

Its focus on high-growth sectors like solar and waste-to-energy plants, combined with its extensive international and domestic footprint, places it as an attractive investment in the transition of the country to sustainable infrastructure. With strong expertise and a project pipeline in green technology, investing in AGEL’s unlisted shares could offer a great chance to support a green future, and also gain exposure to a dynamic market. Explore Now!

6) OYO Rooms

A leading hospitality chain that has been able to expand its footprint globally. Irrespective of facing challenges during the pandemic. OYO has been able to show adaptability and resilience. The focus of the company remains on asset-light business models and technology-driven solutions.

Founded in 2013, the company has expanded to over 80 countries, managing a vast inventory of rooms. OYO has successfully transitioned from an aggregator to a property management model, earning a consistent revenue stream through its 22% commission on partner hotels. With notable recent achievements, including turning PAT positive in 2024 and securing significant private funding, OYO’s valuation currently stands around Rs 29,050 Crores. The trading price for OYO’s unlisted shares is Rs 51 per share, with tiered pricing for bulk purchases.

The main growth strategy includes recent acquisitions like the Motel 6 chain in the USA, positioning it for further global expansion. Are you not interested in a brand that can redefine affordable hospitality? Explore Opportunities Now!

7) TRL Krosaki Refractories Limited

TRL Krosaki Refractories Limited (TRLKRL), formerly known as Tata Refractories Limited, is a prominent Indian manufacturer of high-quality refractory products, catering to sectors such as steel, cement, copper, aluminum, and petrochemicals.

| Financial Metric | Value |

| Market Capitalization | Rs 3,887.4 Crore |

| Dividend Yield | 2.74% |

| Dividend (Sep 2024) | Rs 28.50 |

| Dividend (Oct 2024) | Rs 22.50 |

Formed in 1958, TRLKRL is our nation’s only company that produces all types of refractories under one roof, with a consolidated production capacity of 400,000 MT annually. The dedicated plants in Belpahar in Orissa, Salem in Tamil Nadu, and Jamshedpur in Jharkhand, remain equipped with a certified NABL lab, and cutting-edge technology, ensuring world-class reliability and quality.

TRLKRL’s product line is quite extensive, encompassing high-quality refractories like dolomite, alumina, basic, monolithic, flow control, and taphole clay products. The TRLKRL is known for maintaining high quality and environmental standards, letting it be a robust player

Presently, TRL Krosaki’s unlisted shares trade between Rs 1775 and Rs 1999. The company’s consistent financial performance and strong market position allow it to be a noteworthy candidate for investment. Buy Now!

8) Vivriti Capital Limited (VCL)

It is a registered NBFC-ND-SI with the Reserve Bank of India, with its operations having commenced in 2019. The company levies its focus on supply chain financing, institutional loans, and retail loans via co-lending, and has expanded recently into factoring and leasing. As per its latest portfolio, approximately 52% of Vivitri’s lending goes to institutional borrowers, which covers both non-financial and financial sectors. The remaining supports retail lending through significant partnerships with NBFCs, improving supply chain finance access across different sectors.

With rural markets receiving just 8% of total banking credit despite accounting for 47% of India’s GDP, there’s substantial potential for expansion.

The positioning of the company aligns well with the fast-growing NBFC sector in our country, which is expected to maintain an 18.5% CAGR through 2026, largely fueled by the demand for MSME as well as rural financing. As rural markets receive just 8% of total banking credit despite accounting for 47% of the Indian GDP, there is a potential for expansion substantially. Investment in Vivriti Capital’s unlisted shares acts as an opportunity to engage with a promising NBFC since it scales in underpenetrated markets while driving financial inclusion. Buy Now!

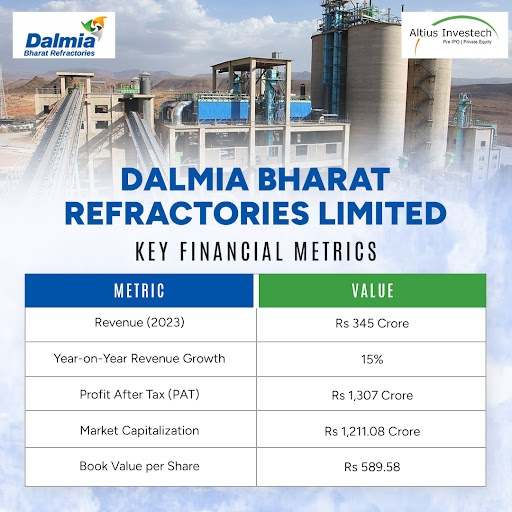

9) Dalmia Bharat Refractories Limited

They specialize in manufacturing refractory products for various industries. The company’s focus on quality and innovation has established it as a major player in the market. Levying investments in Dalmia Bharat Refractories allows exposure to the industrial manufacturing sector.

With three manufacturing units in Tamil Nadu, Gujarat, and Madhya Pradesh, DBRL has a combined production capacity of 94,800 metric tonnes per annum for refractory products.

The current market cap stands at Rs 1,211.08 Crores, while the book value per share is Rs 589.58, suggesting a significant growth potential.

Due to a promising asset base, strategic investments in high-growth sectors, and liquidity, DBRL is positioned well for future growth! You should capitalize on its evolving business model as well as untapped market potential. Secure Your Stake!

10) HDFC Securities

HDFC Securities, which is a subsidiary of HDFC Bank, is a leading brokerage firm in the country. The company’s robust digital platform and extensive customer base would have contributed to its strong financial performance. As of November 2024, HDFC Securities’ unlisted shares would be trading at Rs 11750 per share.

Recent corporate actions emphasize a commitment to shareholder returns, including an interim dividend of Rs 144 per share in June 2024 and a right issue at a premium price of Rs 5,899 in March 2024, reinforcing HDFC Securities’ robust value proposition.

As the company continues to thrive in a competitive industry, investing in HDFC Securities Unlisted shares would be able to provide a unique opportunity for being on a journey toward value creation. Secure your position in one of India’s most reliable financial intermediaries. Act Now!

Reasons Why Investing in Unlisted Shares is a Wise Decision

Unlisted companies operate in emerging sectors while being on the brim of rapid expansion. Early investment in these companies can yield substantial returns once they scale up. Including unlisted shares in a portfolio also allows diversification beyond traditional markets, mitigating risks and enhancing portfolio performance.

Unlisted investments give access to unique business ventures that are not available through public markets. In some cases, investing in these shares allows investors to have a significant influence on the company’s strategy and direction, allowing a chance to drive value creation actively.

This aligns with Altius Investech’s principles. If you’re interested in investing in unlisted shares, be sure to read our blogs for valuable insights and guidance.

- 5 Advantages of Buying Unlisted Shares in 2024

- Demystifying Unlisted Shares: How They Work

- Mitigating the Risks of Buying Unlisted Shares

- Income Tax on Capital Gains in Unlisted Shares

- Listed Vs. Unlisted Shares: Assessing Risk and Reward

- Top 5 Unlisted Shares You Should Consider Buying in India in 2024

Final Thoughts

Investments in unlisted shares carry inherent risks, including valuation challenges and liquidity constraints. It is advisable to consult with financial advisors and then conduct comprehensive research before making investment decisions. Having said that, the companies highlighted above represent some of the most promising unlisted opportunities in the country, as we approach 2025. Understanding the benefits and staying informed regarding market developments, would help investors make informed decisions in enhancing their portfolios.

GET IN TOUCH WITH US

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91 8240614850.

Click here to connect with us on WhatsApp

For Direct Trading, Visit – https://altiusinvestech.com/companymain