Aricent Technologies is a step-down subsidiary of Aricent (formerly known as the “Aricent Group”) Aricent is a leading global engineering services and software company, with specialized expertise in the communications, semiconductors and software market segments. Aricent Share price is trading at around Rs.605/share in the unlisted space.

Industry Overview

Software and Services Sector

In the last decade, the industry has grown many fold in revenue terms, and relative share to India’s GDP is around 8% in FY2020-21.

India is the topmost off-shoring destination for IT companies across the world. Having proven its capabilities in delivering both on-shore and off-shore services to global clients, emerging technologies now offer an entire new gamut of opportunities for top IT firms in India.

- The country’s cost competitiveness in providing IT services, which is approximately 3-4 times cheaper than the US, continues to be its

– Indian IT-ITeS industry offers:

- Cost-effectiveness

- Great quality

- High reliability

- Speedy deliveries and, above all,

- The use of state-of-the-art technologies globally

Expected Growth:

- India’s IT-BPM industry (excluding e-commerce) is expected to grew by 2.3% to reach at USD 194 billion, including exports of 150 USD billion in FY2020-21 (E)

- The IT-ITeS Industry has also created large employment opportunities and is estimated to employ 4.47 million professionals, an addition of 1,38,000 people over FY 2019-2020

- Women employees account for 36% (1.4 million) share in total industry employee base.

About the company

Aricent is a multinational engineering services and software firm with specialised expertise in the communications, semiconductors, and software markets.

Outsourced product development, product maintenance, and licensable software frameworks and solutions are all services provided by the company. Aricent’s service solutions provides comprehensive product lifecycle, including communications networks, linked devices, apps, and mobile services.

This software is in areas that include: 4G Long Term Evolution, Multimedia, Software Defined Networks, Mobile Edge Computing, Switching Routing solutions, Network Functions Virtualization, Self Organizing Networks, Machine-to-Machine, WiFi, Cloud, SmartGrid and Internet of Things.

Aricent focuses on the following five service lines:

- Communications

- Semiconductors and Industrial

- Enterprise Software and Consumers

- Product Service and Support

- Innovation

website: Aricent Technologies

Aricent Technologies provides communication software for the communications industry. The Company offers middleware, consumer and enterprise applications, network management, service provisioning, and billing mediation.

Capgemini SE acquired Altran Technologies SAS (formerly known as Altran Technologies SA) (the former Ultimate Parent company of Aricent) at a global level in the first half of the calendar year 2020. Pursuant to the acquisition, all the Altran group companies, including Aricent Technologies (Holdings) Ltd., became a part of the Capgemini group.

The company was founded in 1991 and with Altran’s acquisition by Capgemini, the successors of Aricent are incorporated into Capgemini Engineering. The company heads its operations from its office in Gurugram, Harayana in India.

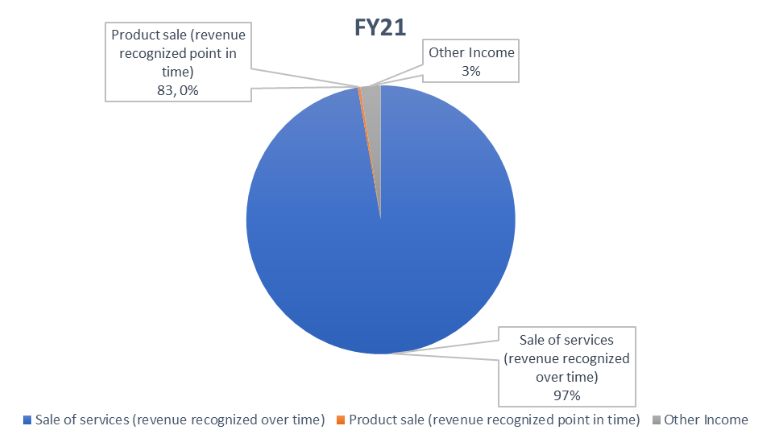

Revenue Split

| Particulars | 31 March 2021(in million Rs.) |

|---|---|

| Sale of services (revenue recognized over time) | 25,383 |

| Product sale (revenue recognized point in time) | 83 |

| Other Income | 634 |

| Total | 26,100 |

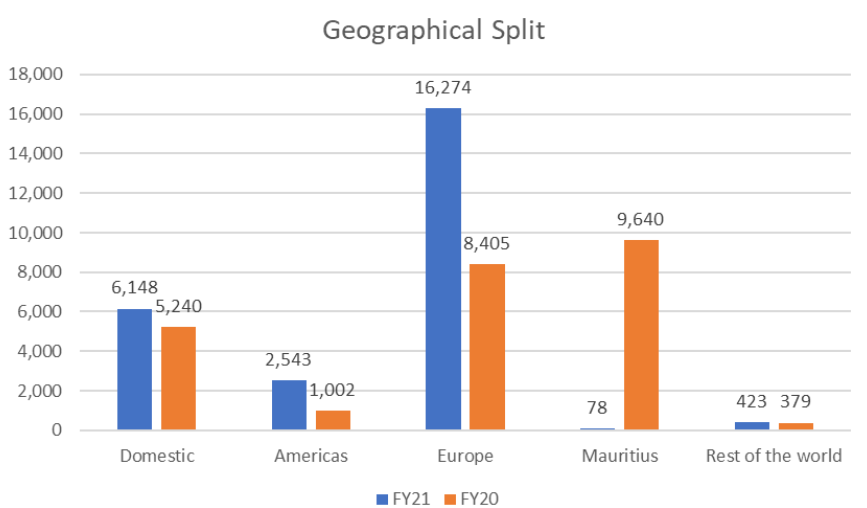

Geographical Revenue Split

Acquisition

Capgemini has been working with major players in many sectors like Automotive, Aeronautics, Space, Defence & Naval, Communications, Semiconductor & Electronics, Software & Internet, etc. and utilizes its global network of world-class experts, a cost-cutting industrial supply chain, and its customized tools to deliver clients’ business goals in an ever more challenging environment.

The acquisition of Aricent in 2018 by the Altran group and the subsequent acquisition of Altran group, including the Company, enabled Capgemini-

- To strengthen its competencies and solutions in digital, based on intellectual property developed by Aricent, extended over time

- Benefiting from a strategic positioning on emerging technologies such as artificial intelligence, cognitive systems and the Internet of Things (IoT).

- The Company offers end-to-end capabilities right from design to software and hardware product development and testing to product support services offering Deployment and TAC services.

- Following the acquisition of Altran group, Capgemini now ranks as the undisputed world leader in Engineering and R&D services (“ER&D”), with a portfolio of high-profile clients, extensive sector expertise and in-depth understanding of industrial business processes and operational technologies.

Financial Performance

| Particulars (in million rupees) | FY18 | FY19 | FY20 | FY21 |

|---|---|---|---|---|

| Revenue from operations | ₹ 21,885.00 | ₹ 22,764.00 | ₹ 24,544.00 | ₹ 25,466.00 |

| %growth | – | 4.02% | 7.82% | 3.76% |

| Other Income | ₹ 567.00 | ₹ 609.00 | ₹ 865.00 | ₹ 634.00 |

| %growth | – | 7.41% | 42.04% | -26.71% |

| Total income (I) | ₹ 22,452.00 | ₹ 23,373.00 | ₹ 25,409.00 | ₹ 26,100.00 |

| %growth | – | 4.10% | 8.71% | 2.72% |

| Total expense (II) | ₹ 19,185.00 | ₹ 19,903.00 | ₹ 21,922.00 | ₹ 23,231.00 |

| %growth | – | 3.74% | 10.14% | 5.97% |

| Profit / (loss) before tax (I) – (II) | ₹ 3,267.00 | ₹ 3,470.00 | ₹ 3,487.00 | ₹ 2,869.00 |

| %growth | – | 6.21% | 0.49% | -17.72% |

| Profit after tax | ₹ 2,043.00 | ₹ 2,046.00 | ₹ 7,027.00 | ₹ 1,960.00 |

| %growth | – | 0.15% | 243.45% | -72.11% |

| Earnings per equity share | ₹ 16.00 | ₹ 16 | ₹ 54 | ₹ 15 |

| %growth | – | 0.00% | 237.50% | -72.22% |

Analysis

- The revenue of the company has increased by 3.76% from ₹ 25,409 (in million rupees) in FY’20 to ₹ 26,100(in million rupees) in FY’21. This has a huge impact on Aricent share price.

- The increase in total expense from ₹ 21,922 (in million rupees) in FY 20 to ₹ 23,231 (in million rupees) IN FY21, is due to increase in Salaries, bonus and incentives under Employee benefit expenses.

- The company’s PAT has had a steep decline in current year from ₹ 7,027 (in million rupees) in FY’20 to ₹ 1,960 (in million rupees) in FY’21 showing a decline of 72.11%. This is primarily because the company received a tax refund of INR 354 Cr in FY’20 due to which the profit of the company had increased.

- The company has generated 150 Crores of positive cash flows from operation in FY19-20.

- The company is debt-free.

Performance of Aricent Share Price in Unlisted Space

We had first invested in Aricent Technologies when aricent share price was at around Rs 1000/sh in October 2013, since then this is how the price graph has moved of Aricent share price:

March 2014 – Rs 900/sh

June 2017 – Rs 175/sh

October 2020 – Rs250 /sh

December 2021 – Rs 710/sh

June 2022 – Rs 600/sh

This translate to a CAGR of roughly around -7.04%

Capgemini Technology Services India Ltd and Aricent Technologies Ltd Merger

The companies have proposed the amalgamation of Aricent Technologies with Capgemini Technology Service India. After shareholders’ approval on 28th June 2022, a meeting will be held on 29th July 2022 for the rest of the process. The shareholder of Aricent Shares will receive 1 share of CTSIL against 17 shares of ATHL.

Aricent Share Price is around Rs 605/share- Click Here to invest in it.