Arch Pharmalabs Ltd: Expanding Horizons in API Manufacturing and CRAMS

The pharmaceutical company is aligned across two business verticals: Products and Services. The Products business comprises the manufacture and sale of APIs and Intermediates to both innovator and generic pharmaceutical players in domestic and international markets, including regulated markets. Over the years, the company has evolved its business, extending from manufacturing APIs and Intermediates to adding CRAMS (Contract Research and Manufacturing Services) to its offerings, which holds significant potential for business growth.

| Name | Arch Pharmalabs ltd |

| Type of Entity | Public Limited Indian Non-Government Company |

| Listing status | Unlisted |

| Date of Incorporation | 2 Apr, 1993 |

| Industry | Pharma |

| Segments | API Manufacturers,Contract Research |

| RegisteredAddress | Andheri (E) , Mumbai- 400072, Maharashtra |

Management

Ajit Kamath, 51, serves as the Executive Chairman and Managing Director of the company, with nearly 19 years of experience in the pharmaceutical industry. Holding a Bachelor’s Degree in Commerce from the University of Mumbai, he was appointed as an Additional Director on January 1, 2001. Before joining the company, he worked with CEAT Financial Services Limited and promoted Arch Commerz Private Limited, which later reverse-merged into the company. Ajit has played a pivotal role in the company’s acquisitions, including the Gurgaon Unit in December 2004, and has been instrumental in shaping the overall business strategy and fostering business relations.

Rajendra Kaimal, 48, is the Executive Director of the company, appointed as an Additional Director on November 1, 2003. He holds a Bachelor’s Degree in Commerce from the University of Mumbai, a Master’s in Management Studies from Narsee Monjee Institute of Management Studies, and is a Cost Accountant from the Institute of Cost and Works Accountants of India. With over 18 years of experience in the pharmaceutical industry, he was one of the promoters of Arch Commerz Private Limited, which reverse-merged into the company. Rajendra oversees the company’s commercial operations, including purchase and export functions, and manages day-to-day coordination between all manufacturing facilities

Product Portfolio

API Manufacturing

Therapeutic Categories and Products

- Antigout/Primary Biliary Cirrhosis

- Product: Ursodeoxycholic Acid (UDCA)

- Lipid Lowering Agent

- Products: Atorvastatin Calcium (Amorphous), Atorvastatin Calcium (Crystalline)

- Antiplatelet Agent

- Products: Clopidogrel Bisulphate (Form I), Clopidogrel Bisulphate (Form II)

- Antihistamine

- Product: Cetirizine Dihydrochloride

- Anti-Cancer

- Products: Docetaxel Anhydrous, Docetaxel Trihydrate, Gemcitabine Hydrochloride, Irinotecan Hydrochloride, Paclitaxel Hydrochloride

- Expectorant

- Product: Bromhexine Hydrochloride

- Antidepressant

- Product: Milnacipran

- Anticonvulsant

- Product: Felbamate

- Antiparkinsonian

- Products: Entacapone, Benztropine Mesylate

- Antibacterial

- Product: Nitrofurantoin

- Anesthetic

- Product: Prilocaine

- Analgesic

- Products: Flupirtine Maleate, Diclofenac Sodium, Mefenamic Acid, Meloxicam, Piroxicam, S (+) Ibuprofen, Nabumetone

· Intermediate Manufacturing

Pharma Intermediates and Their End Use

Antiviral Agents:

- Boc CK

- End Use: Darunavir, Atazanavir

- Boc CA

- End Use: Darunavir

- S,S-Epoxide

- End Use: Darunavir

- Boc Amine

- End Use: Darunavir

- Boc Nitro

- End Use: Darunavir

- Amino Sulphonamide Compound

- End Use: Darunavir

- Boc-R,S-Alcohol

- End Use: Atazanavir

- R,S-Epoxide

- End Use: Atazanavir

- MOC-L-tert-Leucine

- End Use: Atazanavir

Cholesterol/Acid Derivatives:

- CDCA (Chenodeoxycholic acid)

- End Use: Ursodeoxycholic Acid

- 7-KLCA (7-Ketolithocholic acid)

- End Use: Ursodeoxycholic Acid, Obeticholic Acid

Statins (Cholesterol-Lowering Agents):

- ATS-5 (HN-2)

- End Use: Atorvastatin Calcium

- ATS-8 (TBIN)

- End Use: Atorvastatin Calcium

- ATS-9

- End Use: Atorvastatin Calcium

- ATV-1

- End Use: Atorvastatin Calcium

- DKT3

- End Use: Atorvastatin Calcium

- D-5/BHA-4

- End Use: Rosuvastatin

Antibiotics:

- CMIC Chloride

- End Use: Cloxacillin

- DCIMC Chloride

- End Use: Dicloxacillin

- FCIMC Chloride

- End Use: Flucloxacillin

- PMIC Chloride

- End Use: Oxacillin

- ENC

- End Use: Nafcillin

- NFHDA

- End Use: Mecillinam, Pivmecillinam

Others:

- Lithium Carbonate (Li2CO3)

- End Use: Technical Grade/Battery Grade

- (SABAM HCl)

- End Use: Levetiracetam

Overview of Indian pharmaceutical industry

India’s Pharma Powerhouse: Poised for Global Growth”

The Indian pharmaceutical industry, valued at around ₹4.15 lakh crore in 2024, is growing rapidly at 11-12% CAGR, projected to reach ₹6.64-7.47 lakh crore by 2028. As a global leader in APIs, CRAMS, and low-cost generics, it continues to expand internationally, especially in emerging markets. Backed by technological advancements like AI and biotechnology, along with government initiatives like the PLI scheme, the sector is pushing boundaries in innovation, R&D, and sustainability. However, it faces challenges such as regulatory compliance, cost pressures, and intellectual property concerns.

Dr. Ajit Kamath Honored with Honorary Doctorate for Transformative Contributions to Global Pharma Industry

Dr. Ajit Kamath, the visionary founder of Arch Pharma Labs Limited, was honored with an “Honorary Doctorate in Health Administration” by Sunrise University for his outstanding contributions to the pharmaceutical industry. With over 25 years of experience, Dr. Kamath has led Arch Pharma Labs to global recognition, building a world-class pharmaceutical enterprise known for innovation, quality, and compassionate healthcare. His leadership and philanthropy have left a lasting impact on the industry, and he continues to drive advancements in healthcare, including emerging herbal innovations. Dr. Kamath’s achievements include multiple prestigious awards, underscoring his influence and commitment to excellence.

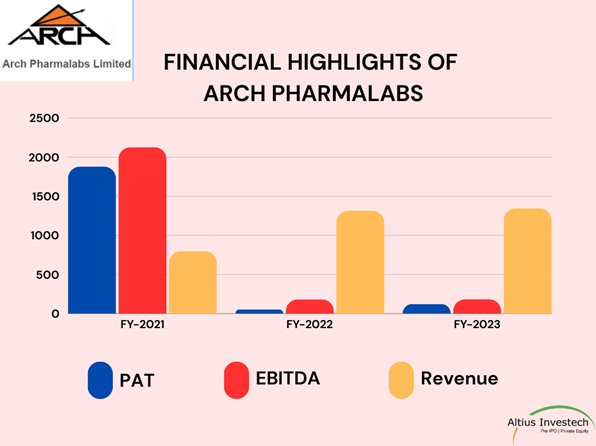

Financial Highlights

₹ in crores

| Particulars | FY 2023 | FY 2022 |

| Revenue | 1,344 | 1,314 |

| EBITDA | 183 | 182 |

| Profit after tax | 122 | 52 |

| EPS | 8.02 | 3.41 |

| PAT Margin | 9% | 4% |

VALUATION

| Valuation | 31st March, 2023 |

| Share Price ( Septeember ,2024) | 129 |

| Outstanding shares | 16 |

| MCAP | 2019 cr. |

| P/E Ratio | 16.08 |

| P/S Ratio | 0.10 |

| P/B Ratio | 8.43 |

| Book value per share | 15.31 |

Peer Comparison

| Particulars | Arch Pharmalabs ltd.. | Gujarat Themis Biosyn Ltd | Hikal ltd | Aarti Drugs Ltd |

| Revenue | 1,344.16 | 155 | 2028 | 2718 |

| EBITDA | 182.85 | 80 | 263 | 308 |

| Profit after tax | 122.12 | 58 | 78 | 166 |

| EPS | 8.02 | 40 | 6 | 18 |

| Book value per share | 15.31 | 18.50 | 96.30 | 128 |

| Share Price ( Septeember ,2024) | 129 | 335 | 347 | 554 |

| MCAP | 1975 | 3653 | 4,262 | 5094 |

| P/E Ratio | 16 | 67 | 63 | 39 |

| P/S Ratio | 0.10 | 2.16 | 0.17 | 0.20 |

| P/B Ratio | 8.43 | 18.10 | 3.60 | 4.32 |

Shareholding Patterns (%)

| Name | Shareholding % |

| Arch Impex Private Limited | 35.41 |

| Arch Pharmachem Ltd | 13.54 |

| JM Financial Asset R | 25.24 |

SWOT Analysis

Strengths:

- Global Recognition: Approved by major regulatory agencies like USFDA, EMA, and WHO.

- Diverse Product Portfolio: Offers a wide range of APIs, including high-demand products like Atorvastatin.

- Innovative Leadership: Led by Dr. Ajit Kamath, a leader with over 25 years in the pharmaceutical industry.

- Strong Partnerships: Recognized as a strategic partner by global pharmaceutical companies.

Weaknesses:

- Regulatory Compliance: High costs associated with maintaining global compliance.

- Dependence on External Markets: Vulnerability to global trade policy changes.

- High Operational Costs: Maintaining state-of-the-art facilities impacts profitability.

Opportunities:

- Expansion into Emerging Markets: Growing demand for affordable healthcare.

- Herbal Innovations: Potential in the market for natural and alternative medicines.

- Increased Demand for APIs: Opportunity to capitalize on the global push for self-reliance.

- Government Initiatives: Support from policies like the Production Linked Incentive (PLI) scheme.

Threats:

- Intense Competition: High competition may impact pricing and margins.

- Regulatory Risks: Potential delays and challenges due to changing regulations.

- Patent Expirations: Risk of increased competition from generics.

- Economic Instability: Vulnerability to global economic fluctuations

Arch Pharmalabs ltd unlisted shares are currently trading at ₹ 129, CLICK HERE to Invest.

Read Our Other Blogs

Get in touch with us

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

To know, more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

To buy unlisted shares Visit – https://altiusinvestech.com/companymain

To know more about How to apply for an IPO? Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/

Visit our website homepage: https://altiusinvestech.com/