About:

NCL Buildtek is engaged in manufacturing and selling Spray Plasters, Paints, Skim Coat, Steel Profiles, Doors, Windows (Steel, ABS & uPVC) and Fly Ash Bricks.

The Company is organized into three divisions namely:

- Coatings: They started manufacturing operations of Spray Plasters in 1992 with technology from M/s.ICP Sweden. Being the first to start manufacturing Acrylic based Putties (Spray Plasters) in India and today it is the largest manufacturer of Spray Plasters in India. They also manufactures Emulsion Paints including Textured Paints, White Cement based Putty and other Cement based products like Tile Adhesives, Mortars and Plasters.

- Windoors: The Company has started manufactures Prepainted Steel Doors, Windows, Partitions, Glazing etc., in 1988 with technology from M/s.Industrie Secco S.P.A. of Italy and marketing the products under the brand name of Seccolor. The Company is also into the fabricating uPVC Doors, Windows & ABS Doors etc.

- Walls: The Fly Ash Bricks manufacturing has started from 2016 in Kavuluru, Krishna District, Andhra Pradesh. Second Project at Nellore, Andhra Pradesh, with an installed capacity of 5.00 lakh Cu Mtrs has commenced commercial operations from March 21, 2020.

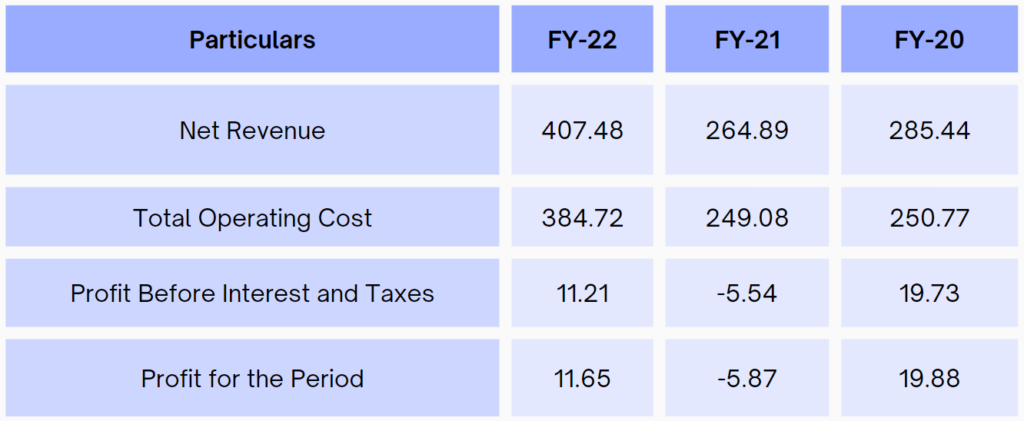

Financials:

Key Highlights from previous year :

1800 Crore Order: NCL Industries and NCL Buildtek are part of a consortium that has secured a significant order worth approximately Rs. 1800 Crores to supply steel windows and door frames to the AP State Housing Corporation.

The order is part of the “Navaratnalu Pedalandariki Illu” scheme of the AP Government.

The consortium has executed orders worth about Rs. 10 Crores in the latter part of Q3 and Q4 of FY 2021-22. Rest is expected to be executed in the next 2 FYs

The order is a significant win for NCL Industries and NCL Buildtek and is likely to have a highly positive impact on their financial performance in the coming years.

TATA Pravesh: NCL has been supplying 1000+ doors to TATA Pravesh and this is expected to scale in the coming years

What seems to be working for NCL Buildtek:

- Government push for Affordable Housing: NCL Buildtek could be one of the key suppliers of doors and windows in Andhra Pradesh and Telangana – 1800 Crores project has already been sanctioned which will ensure clear revenue streams for the next 2-4 years

- Promoter Pedigree: NCL Buildtek is part of the NCL Industries group. NCL industries is a listed company with market capitalization of more than 800 crores. NCL Industries was founded in 1979

- Share Price rationalized: From a peak of 275/sh to now 215/sh

- Diversified stream of revenues: All three verticals coatings, AAC blocks and uPVC windows have each crossed 100 crores in revenue. This reduces dependency on any one sector

Valuation Analysis:

Market Cap (CMP@220/sh): 255 Crores

FY22 Revenues : 408 Crores

FY22 Profits : 11.70 Crores

Multiples Analysis:

Market Cap to Sales: 0.61x

Market Cap to Profits: 21x

Peer comparision to listed companies shows that NCL buildtek share price might experience a runup

++

Runup in Revenues and Profits expected:

Revenue Boost : 1800 crore AP gov order provides visiblilty of revenues in the next 2-3 years – Revenues are expected to cross 500 Crores in FY23

Profit Margins Improvement: In FY 20 NCL had generated a PAT of 17 crores, on revenue base of 285 Cr. FY21 and 22 were impacted on account of COVID. FY23 onwards profits margins may revert to previous levels. Mgmt expects margin profile to improve going forward

Key points from the virtual AGM (36th) of NCL Buildtek Ltd

- Company has launched aluminium window-as a new product, continued partnership with Tata Pravesh a positive step in that direction

- In Window segment company has increased capacity in Eastern India, good sales in Bhubaneshwar. Tata Pravesh has approached the company to provide window products to their customers in the Eastern markets

- Augmenting existing manufacturing capacity to cater to growing needs of the market

- Company achieved highest sales of Rs 464cr in FY22, on target to reach sales of Rs 500cr in FY23

- AP housing Corporation order, this order was received by JV with NCL Ind. and was intended to be a Rs 1800cr order. There has been a significant delay in the execution of the project from the Govt side in addition to the less offtake by beneficiary in getting the homes. As of Aug 2022, Govt has raised purchased orders worth Rs 52cr, company has supplied material worth Rs 26cr. Of the Rs 26cr company has collected Rs 21cr and Rs 5cr is under process. Expect payments to be released by AP Govt. There has been price increase in raw material, especially steel. Since Aug 2022 company has maintained EBIDTA Margin-15% and Net Profit margin-12%-13% on this order. Expect another Rs 70-75cr worth of his order in FY23 from AP housing order.

- In FY23 for the first 5 months’ company has achieved sales of Rs 221cr (vs Rs 164 cr YoY) and now crossed Rs 250cr as on date. Margins are improving now with some stabilisation of commodity prices. Current EBIDTA margin is ~9%

- Not right time to do IPO due to volatile market condition.

- Company is exploring option of SME listing to increase liquidity to the shareholders

- De-merger of NCL holding was done in 2018

- In Q4FY20 Nellore plant was started which is having an impact of ~Rs 25cr in depreciation and interest since March 2020

- Company has order book of ~Rs 133cr in window business, projects take 2-3 years for execution and margins gets impacted if commodity price increase over this time

- In FY20 blocks and coating business, B2B-55% & Retail and consumer-45%. In FY23 block business share of retail business is now ~75%. In Coating business ~82% in trade and ~18% in institutional sales

- In last 3 years, Rajasthan plant has increased sales to ~1100 MT/month from 600 MT/month, have taken a land in Nimrana a few year ago for expansion

- Company has paid dividend in FY22, after skipping last year

Click Here to invest in NCL Buildtek Ltd.

In case you need any assistance you can reach out to us at +91 8240614850

also Read: Reliance Retail Valuation update