Metropolitan Stock Exchange of India Limited (MSEIL) is an electronic platform for trading in capital market, futures and options; currency derivatives and debt market segments. The company’s products include equities, currency derivatives, interest rate derivatives and initial public offerings. MSEIL has also received in-principle approval from SEBI for operating SME trading platform.

MSEI Website: www.msei.in

How was MSEI formed?

- The Metropolitan Stock Exchange of India Limited (MSE) is recognized by the Securities and Exchange Board of India (SEBI) under section 4 of the Securities Contract (Regulation) Act, 1956.

- On December 21, 2012, MSEI was notified as a “Recognized Stock Exchange” under Section 2(39) of the Companies Act, 1956 by the Ministry of Corporate Affairs, Government of India.

- Initially, the clearing and settlement of trade were done on an exchange through its subsidiary clearing corporation, Metropolitan Clearing Corporation of India Ltd.

- After the implementation of the interoperability framework from June 03, 2019, the clearing and settlement of trades can be executed through any clearing corporation like Metropolitan Clearing Corporation (MCCIL), Indian Clearing Corporation (ICCL), and National Securities Clearing Corporation (NSCCL).

Several services that are offered by MSEI:

- The stock exchange offers an electronic, transparent, and hi-tech platform for trading in several segments like the capital market, futures & options, currency derivatives, and debt markets.

- The exchange also provides an SME trading platform.

- It commenced its Currency Derivatives (CD) segment operations on October 07, 2008, under the regulatory framework of the Reserve Bank of India (RBI) and SEBI.

- The exchange also launched its capital market segment, futures, and options segment, and flagship index “SX40” on February 09, 2013, and started trading on February 11, 2013.

Other derivatives and their other features:

The following are the derivatives that were launched by MSEI:

|

Name |

Commencement Date |

Features |

|

SX40 |

May 15, 2013 |

It is a free-float-based index that consists of 40 large cap stocks and other liquid stocks that will represent the diverse sectors of the economy. Here, the base value is 10,000, and the base date is March 31, 2010. |

|

Debt Market Segment |

June 10, 2013 |

This exchange started with live trading through cash settled Interest Rate Futures (IRF) through Government of India security, into its Currency Derivative Segment from January 20, 2014. It provides a better option to hedge against volatile market rates. |

Principles followed by MSEI:

metropolitan stock exchange is based on four base principles:

- Information, innovation, Education, and Research are the four basic pillars of the unique market philosophy used by MSEI.

- its mission, as conceived by the government of India, is maintained as “Financial Literacy for Financial Inclusion”.

- To fulfill this mission, MSEI conducts investor education and awareness programs that average at least one program per working day, across the length as well as the breadth of the country.

Subsidiaries of the company:

The company has two subsidiaries:

1. (MCCIL) Metropolitan Clearing Corporation of India Limited:

This subsidiary was set up with the intention of clearing and settling all the trades on the exchange.

It has also set up an agreement with the Indian Commodity Exchange Limited (ICEX) to offer clearing and settlement services to MSEI for all the trades done on their existing commodities and derivative segments.

metropolitan stock exchange holds an 86.94% stake in MCCIL.

2. MCX-SX KRA:

This is a wholly-owned subsidiary of the company to completely overtake the business of KYC Registration Agencies and allied activities, subject to registration with SEBI under the SEBI(KYC (Know Your Customer) Registration Agency) Regulations, 2011.

MSEI holds a 100% stake in MCX-SX KRA.

Shareholdings:

| Sr. NO. | Name of the Shareholder | No, of Shares | % |

| 1 | Multi Commodity Exchange of India | 33.17,77,008 | 6.90 |

| 2 | Siddharth Balachandran | 23,84,09,950 | 4.96 |

| 3 | Radhakishan S Damani | 11,74,63,496 | 2.44 |

| 4 | Trust Investment Advisors Pvt. Ltd. | 11,91,15,930 | 2.48 |

| 5 | IL&FS Financial Services Ltd. | 11,91,09,627 | 2.48 |

| 6 | Union Bank of India | 15,87,50,000 | 3.30 |

| 7 | State Bank of India | 9,74,00,000 | 2.02 |

| 8 | Nemish S Shah |

9,73,70,000

|

2.02 |

| 9 | Aadi Financial Advisors LLP | 9,73,50,000 | 2.02 |

| 10 | Bank of Baroda | 9.37,57,564 | 1.95 |

Financials:

| Particulars | FY2021 | FY2020 |

| Revenue | 10.63 Cr. | 10.29 Cr |

| Reserves | (188.77 Cr.) | (158.07 Cr.) |

| Equity Share Capital | 480.52 Cr. | 480.52 Cr. |

| Number of Shares | 480.52 Cr. | 480.52 Cr. |

| Face Value | 1/sh | 1/sh |

| Earnings Per Share | (0.06/sh) | (0.10/sh) |

| Profit/(Loss) After Tax | (31.08 Cr.) | (45.77 Cr.) |

| Profit/(Loss) Before Tax | (30.67 Cr.) | (45.01 Cr.) |

- Total Revenue increased to Rs. 1,881 Lakhs in FY 2020-21 compared to Rs. 1,575 Lakhs in FY 2019-20.

- Operating Revenue increased to Rs. 585 Lakhs in FY 2020-21 compared to Rs. 525 Lakhs in FY 2019-20.

- Transaction fees income increased to Rs. 158 Lakhs in FY 2020-21 compared to Rs. 68 Lakhs in FY 2019-20.

- Listing processing fees increased to Rs. 51 Lakhs in FY 2020-21 compared to Rs. 22 Lakhs in FY 2019-20.

- Total Expenses has decreased to Rs. 4,311 Lakhs in FY 2020-21 as Compared to Rs. 4,910 Lakhs in FY 2019-20. The operating expenses decreased to Rs. 951 Lakhs in FY 2020-21 as compared to Rs. 1,072 Lakhs in FY 2019-20

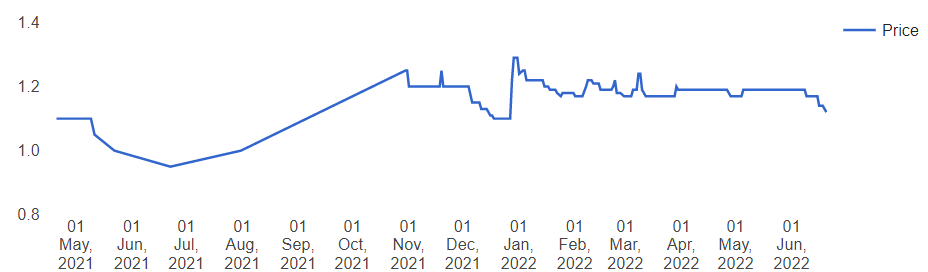

Performance In Unlisted Space:

When we first invested in the company, MSEI share price has remained stagnant hovering between 1.05 and 1.25/sh for the last couple of years. The exchange has not been able to drum up volume on its platform and thus investor has taken a hit.

Also, MSEI has done multiple fund raises in the form of rights issue, to supplement its capital base. This has led to a very bloated capital structure for the company.

MSEI V/S NSE:

MSEI v/s NSE in Rs 856-crore predatory pricing case update:

Metropolitan Stock Exchange had dragged NSE to the Competition Commission of India (CCI) citing monopolistic practices. The Rs 856-crore claim by Metropolitan Stock Exchange of India (MSEI) against National Stock Exchange (NSE) at the National Company Law Appellate Tribunal (NCLAT) was first held on 10 October 2017. The competition watchdog held NSE guilty and asked it to compensate MSEI.

The NSE is likely to have offered between ₹25 crore and ₹100 crore to settle the matter but a proposal of such a low amount is likely to face stiff resistance from MSEI shareholders, the sources said.

MSEI is on its deathbed since its net worth is fast depleting below the regulatory requirement of ₹100 crore. Market regulator SEBI has warned the exchange that it will not renew its license next year if the exchange cannot shore up its net worth.

According to the process, the exchange has filed an application for award of compensation against NSE for Rs 856 crore before COMPAT, pending the appeal. Now, as COMPAT ceased to exist, all pending matters before COMPAT stand transferred to the NCLAT.

Udai Kumar, MD & CEO of MSEI,said, “MSEI started out as a fast-growing exchange with immense potential, when it was deeply impacted by the financial burden imposed by NSE’S predatory pricing. Speedy disposal of this matter is the need of the hour. “It will encourage transparency and compliance with existing competition laws and practices across the spectrum and also dis-incentivise anti-competitive practises and misuse of dominant position.

Also Read: Tata Technologies – Foxconn of EV Engineering Services