Dive into the future of industrial innovation with the Inox India Limited IPO (Inox CVA IPO). Join us as we embark on a journey of growth, global presence, and technological prowess.

Your opportunity to be part of this strategic venture awaits – “invest in excellence, invest in Inox.”

About Inox India Limited

Established in 1976, Inox India Limited has been a stalwart in manufacturing and supplying cryogenic equipment. With a rich history spanning over four decades, the company operates through three distinctive divisions: Industrial Gas, LNG and Cryo Scientific.

The diverse product portfolio includes standard cryogenic tanks, beverage kegs, bespoke technology, equipment, and solutions. Additionally, the company undertakes large-scale turnkey projects across various industries, including industrial gases, LNG, green hydrogen, energy, steel, medical and healthcare, chemicals and fertilizers, aviation and aerospace, pharmaceuticals, and construction.

Inox CVA IPO Details

| IPO Date | December 14, 2023 to December 18, 2023 |

| Face Value | ₹2 per share |

| Price Band | ₹627 to ₹660 per share |

| Lot Size | 22 Shares |

| Total Issue Size | 22,110,955 shares (aggregating up to ₹1,459.32 Cr) |

| Offer for Sale | 22,110,955 shares of ₹2 (aggregating up to ₹1,459.32 Cr) |

| Issue Type | Book Built Issue IPO |

| Listing At | BSE, NSE |

| Shareholding pre issue | 90,763,500 |

Inox CVA IPO Lot Size

| Application | Lots | Shares | Amount (₹) |

| Retail (Min) | 1 | 22 | ₹14,520 |

| Retail (Max) | 13 | 286 | ₹188,760 |

| S-HNI (Min) | 14 | 308 | ₹203,280 |

| S-HNI (Max) | 68 | 1496 | ₹987,360 |

| B-HNI (Min) | 69 | 1518 | ₹1,001,880 |

IPO GMP

The Inox India IPO GMP aka Grey Market Premium is ₹450 as on 15th December,2023

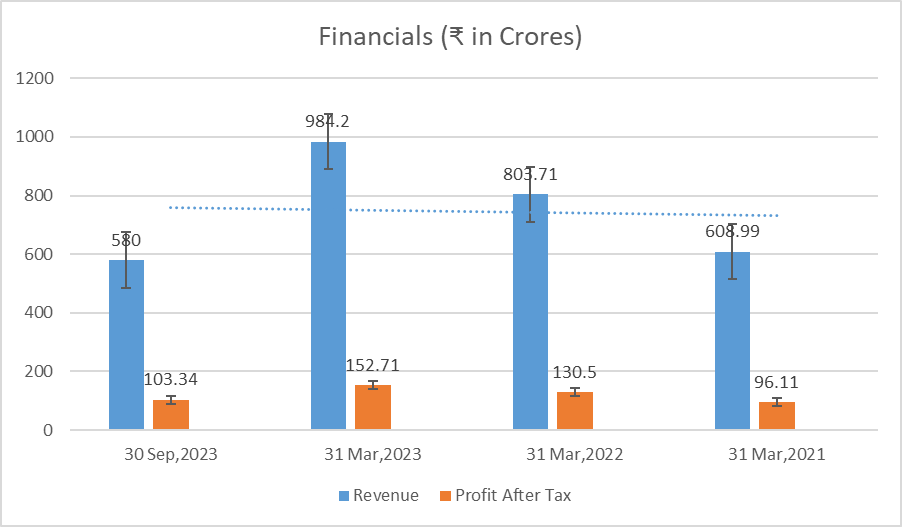

Inox India Limited Financial Information (Consolidated)

₹ in Crores

| Particulars | 30 Sep,2023 | 31 Mar,2023 | 31 Mar,2022 | 31 Mar, 2021 |

| Assets | 1,155.81 | 1,148.36 | 896.75 | 687.20 |

| Revenue | 580 | 984.20 | 803.71 | 608.99 |

| Profit After Tax | 103.34 | 152.71 | 130.50 | 96.11 |

Key Performance Indicator

| KPI | Values |

| P/E (x) | 39.22 |

| Market Cap (₹ Cr.) | 5990.39 |

| ROE | 27.79% |

| ROCE | 36.53% |

| EPS (Rs) | 16.83 |

| RONW | 27.79% |

Strengths

- Established Reputation: Inox India Limited boasts a strong and established reputation as a leading manufacturer and supplier of cryogenic equipment.

- Diverse Product Portfolio: The company’s product range spans across various industries, including industrial gases, LNG, green hydrogen, and healthcare, providing diversification and revenue stability.

- Global Reach: With exports to 66 countries, Inox has a robust global presence, tapping into markets such as the United States, Saudi Arabia, the Netherlands, Brazil, and more.

- Comprehensive Divisions: The three divisions (Industrial Gas, LNG, and Cryo Scientific) contribute to a comprehensive and versatile business model, catering to different technological and industrial needs.

Risks

- Market Dependence: Inox’s performance is subject to market conditions, and any downturn in sectors like energy, steel, or aviation could impact its financials.

- Regulatory Challenges: The company operates in a sector that may be influenced by evolving regulations, and changes in compliance requirements could pose challenges.

- Global Economic Factors: Economic fluctuations globally can impact demand for industrial equipment, affecting Inox’s export-oriented business.

- Technological Changes: Rapid technological advancements may require continual investment in research and development to stay competitive, posing a risk of obsolescence.

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

To know, more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

You can also checkout the list of Best 5 Unlisted Shares to Buy in India

For Direct Trading, Visit – https://altiusinvestech.com/companymain.

To know more about How to apply for an IPO? Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/