About the Company

Established in January 2005, Innova Captab Limited is a pharmaceutical enterprise operating across three key sectors. Firstly, it specializes in providing contract development and manufacturing services to various Indian pharmaceutical companies. Secondly, the company actively engages in the domestic market by offering a range of branded generics. Lastly, it maintains an international presence, dealing in branded generics on a global scale.

Product Portfolio

The diverse product portfolio of Innova Captab Limited encompasses tablets, capsules, dry syrups, dry powder injections, ointments, and liquid medicines. In the fiscal year 2023, and for the three months concluding on June 30, 2023, the company successfully produced and sold over 600 different types of generics.

These products are strategically distributed under the company’s own brands within the Indian market. This is achieved through an extensive network comprising approximately 5,000 distributors and stockists, along with an impressive reach of over 150,000 retail pharmacies. Moreover, the company extends its global footprint by exporting branded generic products to 20 countries in the full fiscal year 2023 and 16 countries in the three months ended June 30, 2023.

As of October 31, 2023, the company boasts a dedicated team of 29 scientists and engineers operating in its state-of-the-art research and development laboratory. The manufacturing facility is strategically located in Buddi, Haryana, ensuring efficient production processes.

Innova Captab Limited takes pride in its esteemed customer base, which includes industry giants such as Cipla, Glenmark Pharmaceuticals, Wockhardt, Corona Remedies, Emcure Pharmaceuticals, Lupin, Medley Pharmaceuticals, Eris Healthcare, Zuventus Healthcare, Ajanta Pharma, Mankind Pharma, and various others.

As of October 31,2023, the company has secured 200 active product registrations, with an additional 20 registrations pending renewal with international authorities. Furthermore, the company is actively processing 218 new registration applications with these international authorities, reflecting its commitment to expanding its global presence.

Innova Captab IPO Details

| IPO Date | December 21, 2023 to December 26, 2023 |

| Face Value | ₹10 per share |

| Price Band | ₹426 to ₹448 per share |

| Lot Size | 33 Shares |

| Total Issue Size | 12,723,214 shares (aggregating up to ₹570.00 Cr) |

| Fresh Issue | 7,142,857 shares (aggregating up to ₹320.00 Cr) |

| Offer for Sale | 5,580,357 shares of ₹10 (aggregating up to ₹250.00 Cr) |

| Issue Type | Book Built Issue IPO |

| Listing At | BSE, NSE |

| Shareholding pre issue | 50,082,072 |

| Shareholding post issue | 57,224,929 |

Innova Captab IPO Lot Size

| Application | Lots | Shares | Amount (₹) |

| Retail (Min) | 1 | 33 | ₹14,784 |

| Retail (Max) | 13 | 429 | ₹192,192 |

| S-HNI (Min) | 14 | 462 | ₹206,976 |

| S-HNI (Max) | 67 | 2,211 | ₹990,528 |

| B-HNI (Min) | 68 | 2,244 | ₹1,005,312 |

Innova Captab IPO GMP

Innova Captab IPO GMP as on 20th Dec,2023 is ₹210.

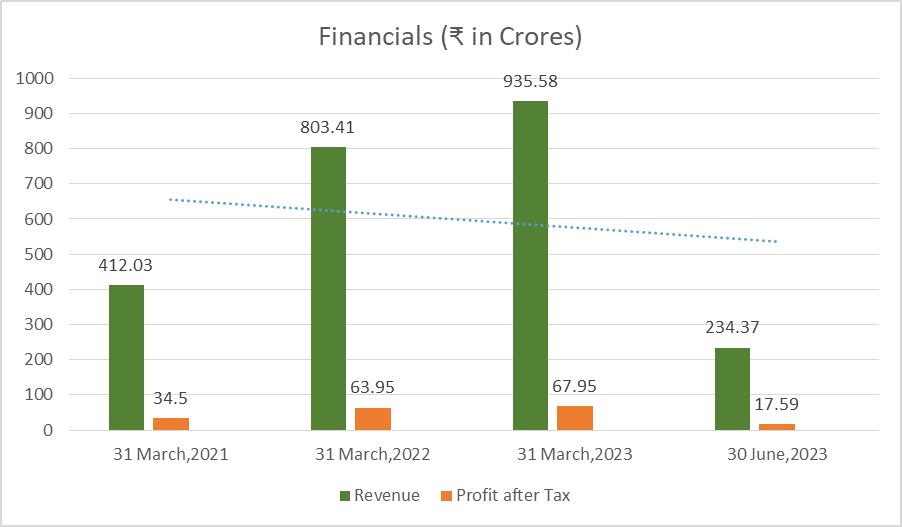

Innova Captab Limited Financial Information

₹ in Crores

| Particulars | 30 June,2023 | 31 March,2023 | 31 March.2022 | 31 March,2021 |

| Assets | 1,086.16 | 704.41 | 575.48 | 369.62 |

| Revenue | 234.37 | 935.58 | 803.41 | 412.03 |

| Profit after Tax | 17.59 | 67.95 | 63.95 | 34.50 |

Key Performance Indicator

| KPI | Values |

| P/E (x) | 31.64 |

| Post P/E (x) | 36.42 |

| Market Cap (₹ Cr.) | 2563.7 |

| ROE | 24.58% |

| ROCE | 22.61% |

| Debt/Equity | 0.85 |

| EPS (Rs) | 14.16 |

| RONW | 24.58% |

Strengths of Innova Captab Limited:

- Diverse Product Portfolio: Innova Captab Limited boasts a comprehensive product portfolio, including tablets, capsules, dry syrups, injections, ointments, and liquid medicines. This diversity allows the company to cater to various market segments and respond to changing consumer needs.

- Established Customer Base: The company has secured partnerships with leading pharmaceutical companies such as Cipla, Glenmark Pharmaceuticals, Wockhardt, and others. This established customer base provides a stable revenue stream and enhances the company’s credibility in the industry.

- Global Presence: Innova Captab Limited has successfully expanded its reach internationally, exporting branded generic products to multiple countries. This global presence not only diversifies revenue sources but also positions the company in emerging markets, fostering long-term growth opportunities.

Risks for Innova Captab Limited:

- Regulatory Challenges: The pharmaceutical industry is subject to stringent regulations. Innova Captab Limited faces the risk of regulatory challenges, including compliance issues and delays in obtaining approvals, which could impact product launches and international expansion.

- Dependency on Key Customers: The company’s reliance on a select group of major customers, such as Cipla and Glenmark Pharmaceuticals, poses a risk. Any adverse developments or changes in business relationships with these key customers could have a significant impact on revenue and profitability.

- Market Competition: Intense competition within the pharmaceutical sector poses a risk to Innova Captab Limited. The emergence of new competitors, pricing pressures, and changes in market dynamics could affect the company’s market share and profitability. Continuous innovation and strategic positioning are essential to mitigate this risk.

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

To know, more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

You can also checkout the list of Best 5 Unlisted Shares to Buy in India

For Direct Trading, Visit – https://trade.altiusinvestech.com/.

To know more about How to apply for an IPO? Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/