Zomato vs. Swiggy: A Quick Comparison

In the rapidly evolving world of food delivery, two giants have emerged as fierce competitors: Zomato and Swiggy. Both companies have transformed the way Indians order food, making it as simple as tapping a button. But with both offering similar services, which one truly reigns supreme? Let’s dive into the key differences, financials, and growth trajectories of Zomato and Swiggy.

Market Presence & Reach:

Zomato, founded in 2008, began as a restaurant discovery platform and later expanded into food delivery. It operates in over 1,000 cities in India and has a broader global presence with operations in 23 countries.

Swiggy, on the other hand, started in 2014 but has rapidly grown, covering over 500 cities across India. While its operations are more concentrated domestically, Swiggy has become synonymous with hyper-local delivery services, not just for food but also for groceries through its Instamart vertical.

Revenue Streams: Beyond Food Delivery

While food delivery is the core business for both, they are diversifying to sustain growth:

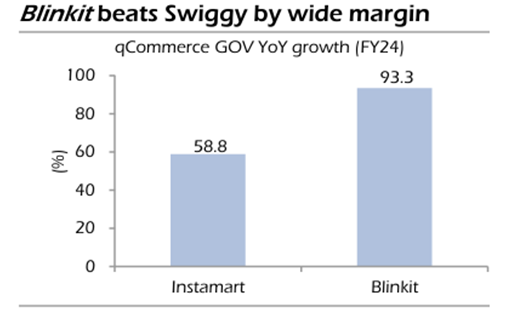

- Zomato: Acquired Blinkit (formerly Grofers) to strengthen its instant grocery delivery segment. It also has a growing dine-out and restaurant reservation vertical. In FY24 Blinkit’s gross order value surged 97% in the March quarter, with revenue more than doubling from a year earlier to ₹769 crore.

- Swiggy: Launched Instamart for grocery delivery, which has grown to become a significant revenue driver. Other verticals include Genie (on-demand task service) and Swiggy’s supply chain service. Instamart registered Rs 1,100 crore gross revenue in the last fiscal year (FY24).

For context, Blinkit had the highest market share among quick commerce players as of July, according to consulting firm UBS. Swiggy Instamart was in second position followed by Zepto and BigBasket.Blinkit leads the quick commerce segment with approximately 40 to 45 per cent market share. Instamart’s market share is 32% as of March 2024.

Customer Experience & Loyalty

Both platforms boast a vast restaurant network, but customer loyalty varies:

- Zomato has focused on customer retention through its Zomato Pro membership, offering discounts on orders and priority delivery.

- Swiggy counters with Swiggy One, a subscription service providing free deliveries on both food and grocery orders.

User Base & Market Reach

Zomato

- Cities: 1,000+ cities across India

- Partnered Restaurants: 2 lakh+

- Delivery Fleet: 3 lakh+ personnel

Swiggy

- Cities: 500+ cities across India

- Partnered Restaurants: 1.5 lakh+

- Delivery Fleet: 2.6 lakh+ personnel

Future Prospects & IPO Plans:

Swiggy’s IPO Aspirations: Swiggy has ambitious plans to go public, targeting a $15 billion valuation. The company aims to raise ₹10,400 crore ($1.28 billion) through its IPO and is expected to file an updated DRHP with SEBI by September 2024. This IPO will be a critical step in Swiggy’s journey towards profitability.

Zomato’s Stock Performance: Since its IPO in 2021, Zomato has seen fluctuating stock performance but remains a strong player in the public market. With a focus on further improving its financials and expanding its grocery delivery business, Zomato is well-positioned to continue its growth trajectory.

Investment in Unlisted Equities: Swiggy’s CCPS

For investors looking to get in on Swiggy before its IPO, Compulsorily Convertible Preference Shares (CCPS) are available. These shares are a popular investment vehicle in startups, offering a convertible feature into common equity at the time of an IPO or other triggering events.

Conversion Ratio: Each Swiggy CCPS can be converted into 1,401 Common Equity shares. This conversion typically occurs during the IPO, at the investor’s request, or within a maximum of 20 years from issuance.

Trading Discount: Swiggy’s CCPS trade at a discount compared to common equity shares, mainly due to a limited supply of common equity and the larger ticket size (1 lot = 1,401 equity shares).

Priority in Dividends and Bankruptcy: Swiggy CCPS holders have precedence over common equity shareholders in receiving dividends and capital returns in case of bankruptcy.

Financial Highlights:

| Financials | Swiggy FY24 | Zomato FY 2024 |

| Revenue | 11247 | 12114 |

| EBITDA | (2208) | 889 |

| PAT | (2350) | 351 |

| PAT Margins | (20.60)% | 2.89% |

Swiggy Vs Zomato Key Metrics:

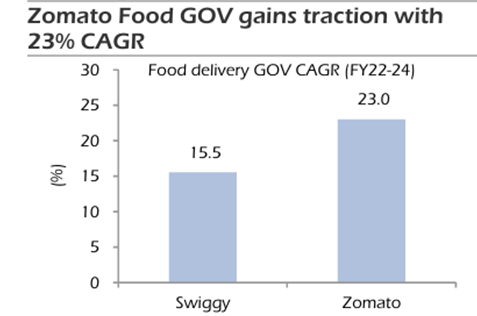

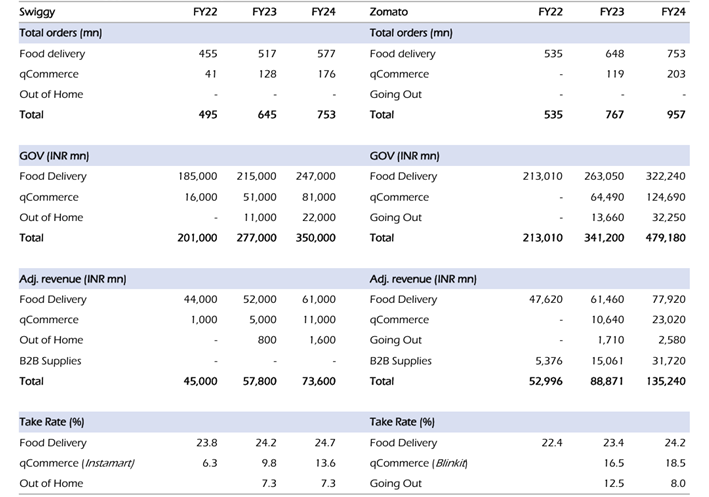

Swiggy experienced substantial growth from FY22 to FY24, with food delivery orders increasing from 455 million to an estimated 577 million, while the Gross Order Value (GOV) rose from INR 185,000 million to INR 247,000 million. Its quick commerce (qCommerce) segment saw a dramatic rise in orders, from 41 million in FY22 to 176 million in FY24, with the GOV expanding from INR 16,000 million to INR 81,000 million. Consequently, Swiggy’s total revenue grew from INR 45,000 million in FY22 to INR 73,600 million by FY24.

Zomato also reported strong growth, with food delivery orders rising from 535 million in FY22 to 753 million in FY24, alongside a GOV increase from INR 213,010 million to INR 322,240 million. The qCommerce segment surged as well, with orders jumping from 119 million in FY23 to 203 million in FY24, and its GOV growing from INR 64,490 million to INR 124,690 million. Zomato’s overall revenue expanded from INR 52,996 million in FY22 to INR 135,240 million in FY24, fueled by growth in B2B supplies and the “Going Out” segment.

Valuations:

| Share Price (Sep 2024) | 520 | 285 |

| MCAP | 102000 Cr | 251868 Cr |

| P/E Ratio | -47.66 | 418 |

| P/S Ratio | 9.07 | 20.79 |

| P/B Ratio | 14.49 | 12.13 |

| Book value | 35.2 | 23.1 |

Final Thoughts: Who Wins?

While Zomato currently holds a larger market cap and stronger financial performance, Swiggy is hot on its heels with a clear path to growth, especially with its upcoming IPO. Both companies have their strengths, and the battle for supremacy will hinge on who can diversify and innovate beyond food delivery while turning a profit.

The ultimate winner? The Indian consumer, who continues to benefit from faster deliveries, better discounts, and a wider range of services!

Buy Swiggy Unlisted Share Prices

Get in touch with us

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

To know, more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

To buy unlisted shares Visit – https://altiusinvestech.com/companymain

To know more about How to apply for an IPO? Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/

Visit our website homepage: https://altiusinvestech.com/

Read More