In the ever-changing world of finance, investors are always looking for more intelligent and adaptable strategies to increase their wealth while controlling risk. A potent remedy that offers a tailored combination of conventional investment tools with cutting-edge features is structured products. One such characteristic is the Twin-Win strategy, which is a desirable choice during uncertain times since it gives investors the chance to profit from both rising and falling markets.

A balanced approach to investing is offered by structured products, which are made to match particular financial objectives and risk tolerance. We will examine how the Twin-Win idea and structured products can safeguard and improve your investing journey in this blog.

What are Structured Products?

Pre-packaged investment instruments known as “structured products” combine derivatives with conventional financial assets, such as bonds, to produce a unique investment solution. They are made to address particular investor requirements that traditional financial products are unable to satisfy.

For instance, a structured product may provide a non-traditional return depending on the performance of an underlying asset, index, or market condition rather than monthly interest payments like a standard bond would. Principal protection is a feature of specific structured securities that guarantees the initial investment amount will be reimbursed at maturity, irrespective of market performance.

Why there is a need of a Structured Products?

- Low Interest Rates and the Pursuit of Real Returns:

Conventional fixed-income assets, such as government bonds or fixed deposits, frequently fall short of providing real returns after taking inflation into consideration in the current low-interest rate environment. Because structured products are meant to manage associated risks and potentially produce higher returns, they provide a more effective solution.

- Inflation-Efficient Investment Option:

By tying returns to market indexes, stocks, or other dynamic financial instruments, structured products, as opposed to conventional fixed-return investments, can be made to beat inflation.

- Investment Solutions:

Since structured products are highly adaptable, they can be made to match the demands of confident investors according to their financial objectives, risk tolerance, and market outlook.

- Capital Allocation and Diversification:

Structured products fuse the benefits of debt and equity instruments to give investors a clear foundation for planned asset allocation, distributing risk and achieving greater balance.

- Diligence-Backed Investments:

The Securities and Exchange Board of India (SEBI) and Reserve Bank of India (RBI) laws govern this trustee’s operations, guaranteeing investor protection, compliance, and transparency.

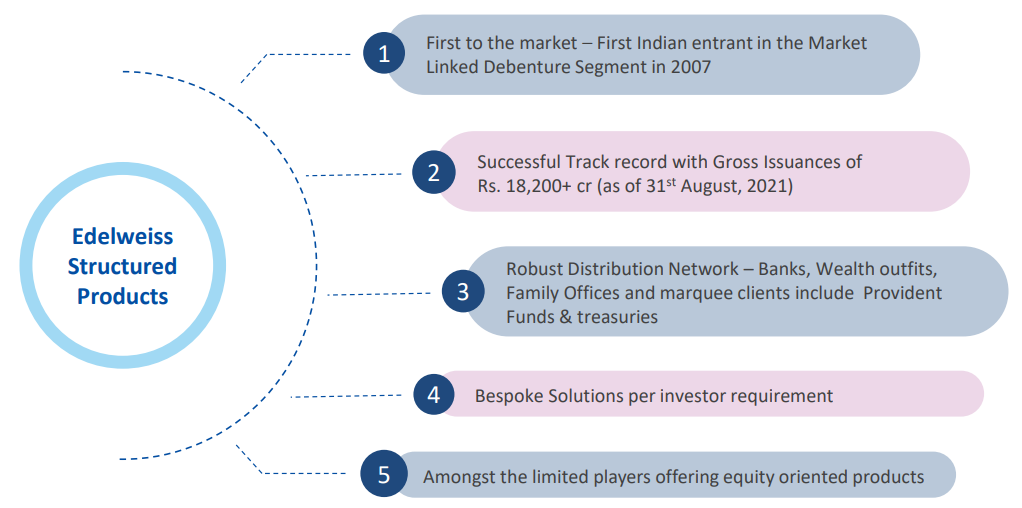

Edelweiss – One of India’s leading structured solution architects

One of India’s leading pioneers in the field of structured investment products is Edelweiss. Edelweiss has established a solid reputation for creating customized, goal-oriented products that strike a balance between risk and growth due to its in-depth knowledge of financial markets and investor demands. These solutions are perfect for modern investors looking for intelligent diversification and returns that beat inflation since they blend traditional fixed-income instruments with sophisticated derivatives to create flexible and effective products.\

To ensure openness, credibility, and investor safety, Edelweiss adheres to a strict due diligence procedure that is overseen by SEBI and RBI laws and supported by independent trustees. In India’s changing financial landscape, Edelweiss is at the forefront of structured investment architecture by fusing innovation with in-depth market knowledge.

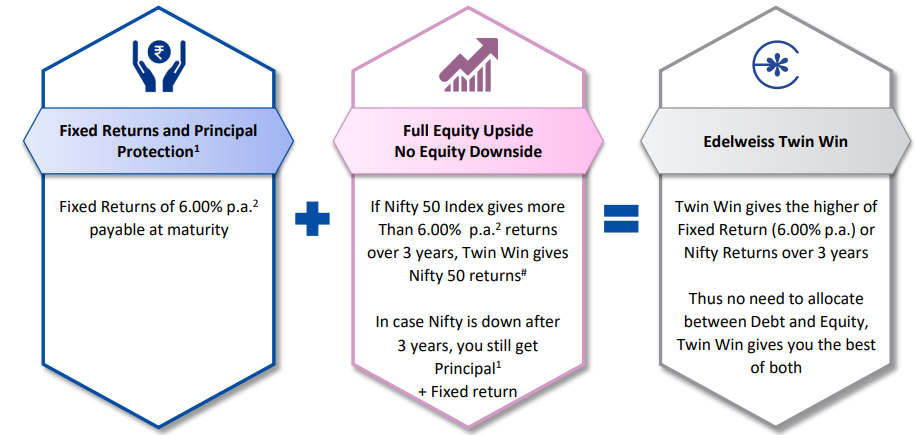

What is Edelweiss Twin Win?

The Edelweiss Twin Win is an organized investment opportunity with the objective of providing the finest features of the equity and fixed-income markets. Over the years, it has offered buyers the choice between a fixed return and the Nifty 50 index’s performance. Investors earn the entire Nifty return if, during the investment period, the Nifty 50 index beats the specified fixed return.

Investors continue to receive the set return and capital protection in the event that the index underperforms or yields negative returns. For individuals looking for development potential without sacrificing capital protection, Twin Win is a compelling option.

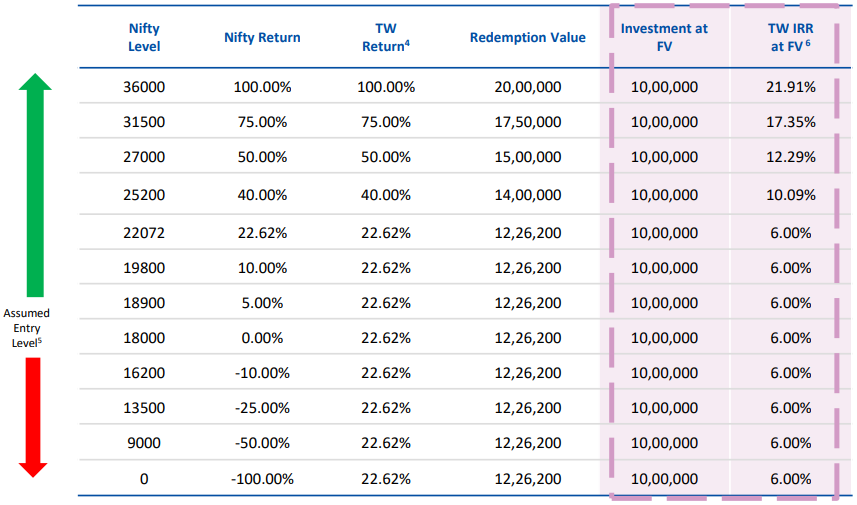

Twin Win – Return Scenarios

Twin Win Idea – Details

| Details | Twin Win |

| Issuer | ECAP Equities Ltd. |

| Credit Rating | Minimum of PP-MLD-(A+) |

| Secured | Yes, secured by 1x cover on Principal & Coupon against balance sheet assets |

| Minimum Investment Amount ( Per Client) | ₹ 10,00,000/- |

| Listing | Unlisted. |

| Principal Protection | Principal Amount is protected at maturity, to the extent of Face Value |

| Tenor in Months | 36/42 Months |

| Entry Level | Average of Official Closing Level of Nifty 50 as on primary trade date & F&O expiry of next 5 months |

| Exit Level | Average of Official Closing Level of Nifty 50 as on NSE F&O Expiry of 31st to 36th month from primary trade date |

| Return Profile | Maximum of 6.00% IRR or Nifty Underlying Performance |

General Risk Factors

1. Interest Rate Risk

If interest rates rise, the value of existing Market Linked Debentures (MLDs) may decline, potentially resulting in a mark-to-market loss during the investment period—even if the bond is held until maturity.

2. Liquidity Risk

MLDs have a fixed maturity and typically do not offer early exit options. Although they may be listed on stock exchanges, there is no guarantee of active trading. This means investors may face difficulty selling their MLDs before maturity due to the lack of buyers or sellers in the market.

3. Repayment Risk

The principal amount and any other amounts that may be due in respect of the debentures are subject to the credit risk of the Issuer. In the event of bankruptcy or similar proceedings, the investor may stand to lose the entire invested Principal or the due amount may not be made, may be substantially reduced, or may be delayed.

Final Thoughts

Structured products, especially innovative options like Edelweiss Twin-Win, offer a good balance between risk and reward. They provide strategic investment solutions that evolve and match various market situations, allowing investors to protect their wealth while taking advantage of rising and falling markets. As part of a well-diversified portfolio that matches their risk tolerance and financial goals, structured products help investors more efficiently build wealth.

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

Learn more about Unlisted Company.

You can also checkout the list of Best 5 Unlisted Shares to Buy in India

Learn more about How to apply for an IPO?