Small Finance Banks: Insights into Fino Paytech, Fincare, and Utkarsh

By primarily providing basic banking services to underserved groups such as small business units, small and marginal farmers, micro and small industries, and unorganized entities, small finance banks (a particular type of banking that the RBI established under the direction of the Government of India) are advancing financial inclusion. These banks are capable of carrying out all standard banking operations, such as lending and deposit taking, just like regular commercial banks.

Through high-tech, low-cost operations, small finance banks are designed to (1) offer savings vehicles and (2) extend credit to small firms, micro and small industries, small and marginal farmers, and other unorganized sector organizations.

Commercial banks are not restricted to any particular group of clients, which is the primary distinction between them and small finance banks. Small finance banks must serve a certain group of clients, including MSME, small enterprises, unorganized laborers, and small-scale farmers. While commercial banks are able to lend to all of their clients, small finance banks must ensure that 75% of their loans are given to their target clients.

Loans and transaction fees are two ways a commercial bank might make money. Lending services to the intended clientele are Small Finance Banks’ primary source of revenue. Another feature that distinguishes small finance banks from commercial banks is that during the initial three years of operation, a Small Finance bank has to have 25% of its branches in rural areas.

Small Finance Banks are good prospects for an IPO as once the Small Finance Bank attained the net worth of Rs. 500 crores, within three years the shares of it should list on a stock exchange. Small Finance Banks have been attractive investments for both public and private markets.

AU Small Finance Bank Ltd.

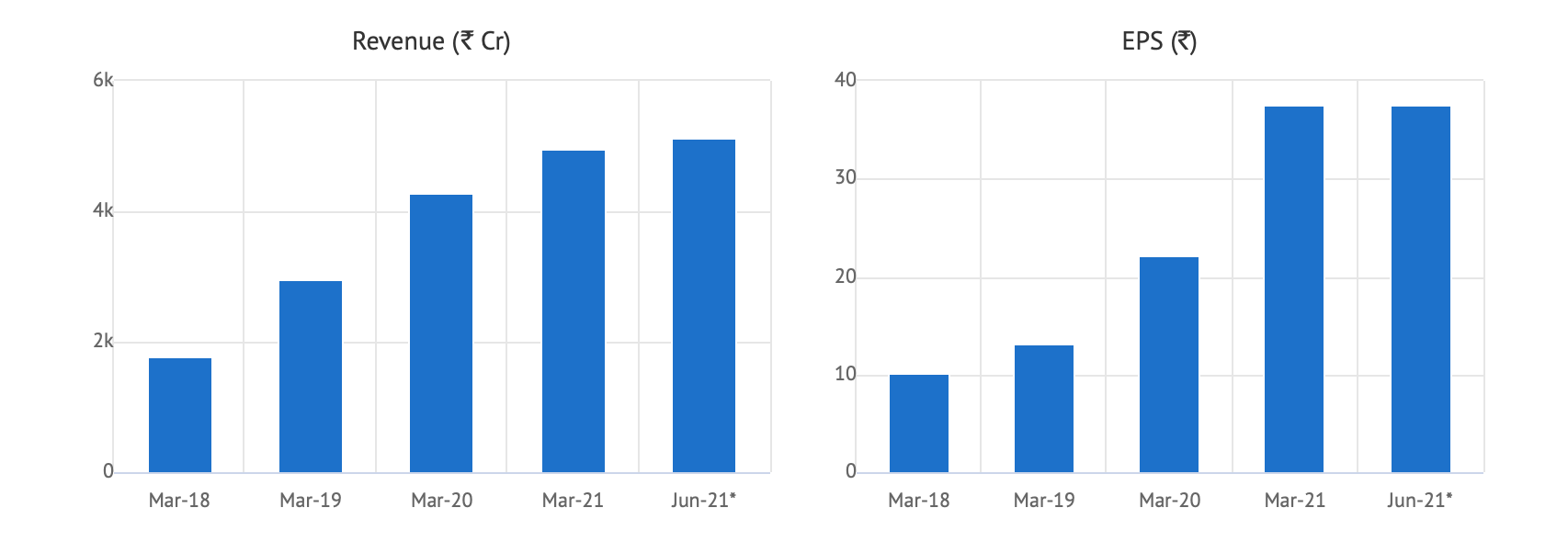

AU Small Finance Bank Ltd.’s share price has increased by 62%. The company’s revenues have been steadily increasing. With over 84% of retail loans and an average ticket size of about 5 lakh, the corporation has strengthened its asset book.

Improved spread, which led to an improved asset portfolio IRR of 14.7% (compared to 14.3% in FY 2018–19).

Fino Paytech, Fincare Small Finance Bank, and Utkarsh Small Finance Bank Limited are the three leading small finance banks in the private equity market.

Fincare Small Finance Bank Ltd.

Since the company’s founding, the digital paradigm has been the driving force behind its success, helping it to become one of the top banks in India.

While the company’s net profit climbed by more than 500% year over year, its income increased by 80%.

Fincare Small Finance Bank are those that have already submitted an IPO application and have been approved by SEBI to raise Rs. 1,330 crores through this means. Its DRHP states that a new issue of equity shares valued at Rs. 300 crores will be part of the IPO. Additionally, its promoter, Fincare Business Services Ltd., would make an OFS (Offer for Sale) of Rs. 1,000 crores. Fincare staff will also be able to reserve subscriptions as part of this offer.

Fino Payments Bank

Fino’s primary source of revenue is fee and commission-based revenue from its network of merchants and strategic business partnerships. With 0.64 million banking touchpoints as of FY20 data, Fino led the payments bank network, followed by India Post and Airtel. Additionally, FBCL owns about 55% of the micro-ATMs in use in India as of March 31, 2021.

In FY21, it claimed 17,269 active business correspondents or agents and 641,892 merchants, of which 52% “own” merchants and the remainder merchants on the open banking network via its API channel. In FY21, commissions, exchange, and brokerage fees accounted for more than 87% of company revenue (INR 675.5 Cr).

In FY19, FY20, and FY21, FBCL’s total revenue from financial goods and services was INR 351.9 Cr.

Income derived from all of FBCL’s financial products and services in the FY19, FY20, and FY21 was INR 351.9 Cr, INR 673.3 Cr, and INR 770.7 Cr, respectively, representing a CAGR of 29.9%. It reported a net profit of INR 20.5 Cr in FY21 compared to a loss of INR 32 Cr in FY20.

Click on the link to find out more information on Fino Payments Bank –

Utkarsh Small Finance Bank Limited

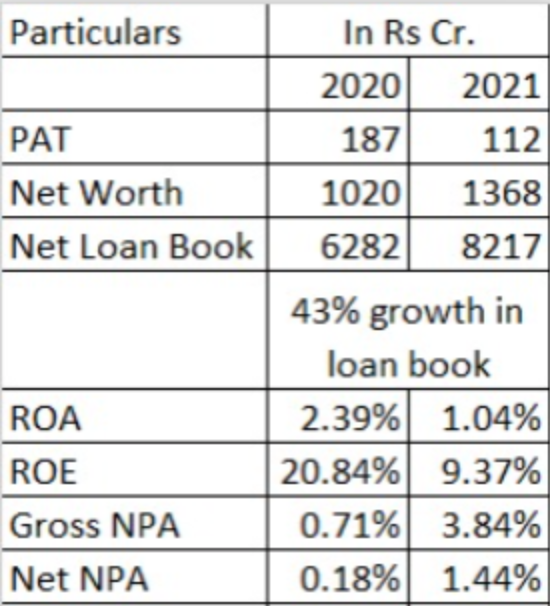

As can be observed from Utkarsh Small Finance Bank’s financials on the left, the company has performed well despite the pandemic’s disruptions. However, the Small Finance Bank’s asset quality has suffered, which has resulted in a rise in gross and net non-performing assets. Although the company has begun diversifying its product line in recent years to reduce the risks connected with microfinance, microfinance loans still account for about 87.9% of the loan book.

Geographic diversification is also being carried out, and the business has ventured into Eastern India, where there is much room for growth in the credit sector and the market is less crowded. Hence it shows that the company has identified its huge dependence on 2 states i.e. Bihar and UP for 75% of the loans granted.

To invest in Utkarsh, Click Here

Read our other related blogs:

Get in Touch with Us:

To know more about Unlisted Company. Contact Us.

For Direct Trading, Visit – https://trade.altiusinvestech.com/.

To learn more about How to apply for an IPO. Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/