The Genesis of Swiggy

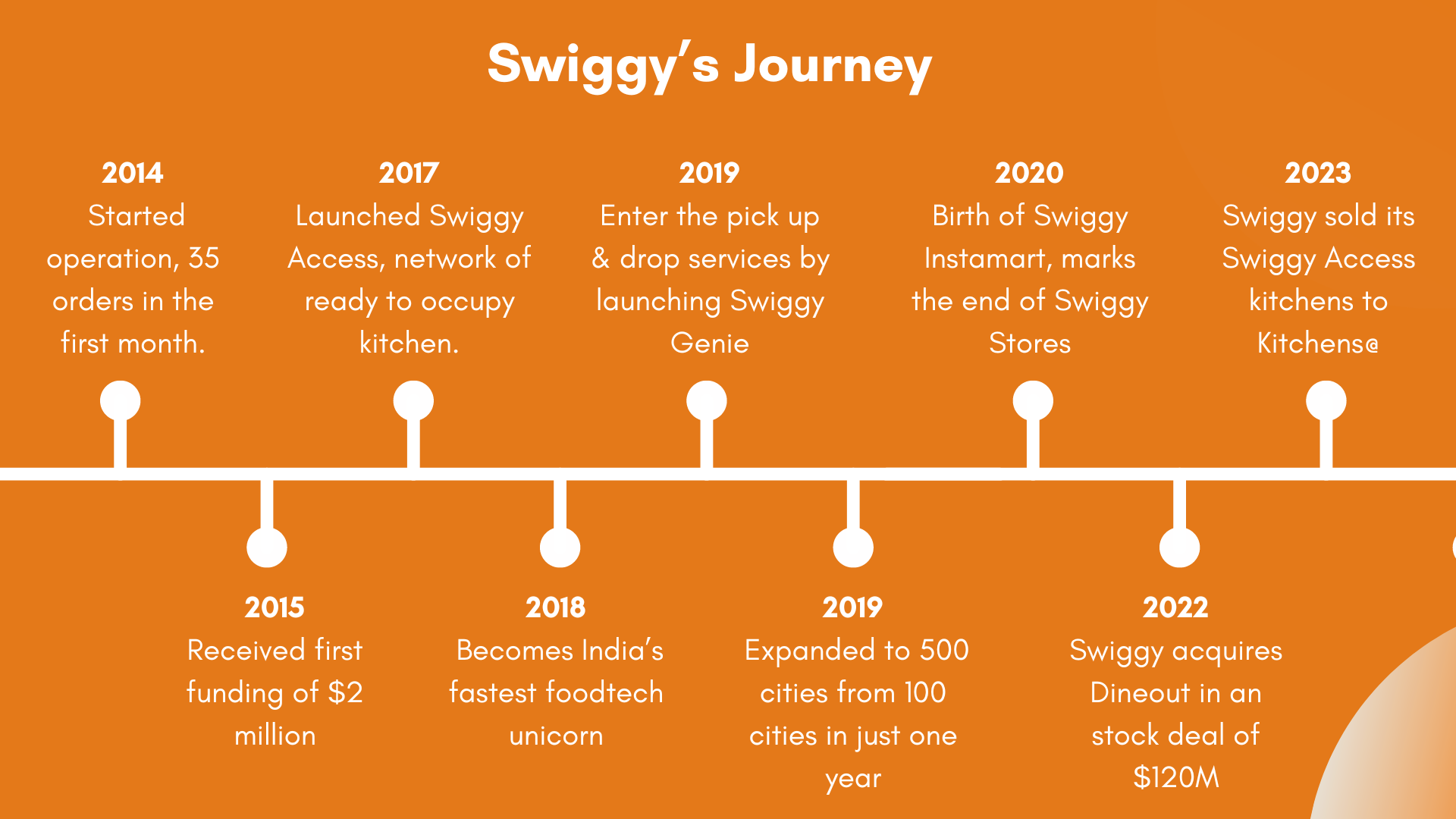

Swiggy’s origin story might surprise you—it didn’t begin as a food delivery venture. In 2013, Sriharsha embarked on a six-month cycling journey across Europe, pondering business ideas. His initial concept involved establishing a chain of backpacker hostels to assist foreign travelers exploring India. However, in the same year, Sriharsha and Nandan joined forces to launch Bundl Technologies Private Limited, aiming to revolutionize courier services nationwide. Despite their efforts, Bundl didn’t succeed, prompting a pivot. Recognizing the untapped potential in the food industry, Sriharsha pivoted towards food delivery, giving rise to Swiggy. With the assistance of Rahul Jaimini in developing the software, Swiggy officially launched in August 2014.

Upon entering the market, Swiggy encountered established players like Foodpanda, Tinyowl, and Ola Café. Despite the struggles faced by its competitors—Foodpanda and Tinyowl later acquired by Ola Cabs and Zomato respectively, and Ola Café shutting down within a year—Swiggy started modestly in 2014, with just six delivery personnel serving food from 25 restaurants. Yet, by March 2015, Swiggy had scaled impressively, processing one million orders monthly. Thus began the remarkable journey of the food tech behemoth.

Expansion of Swiggy

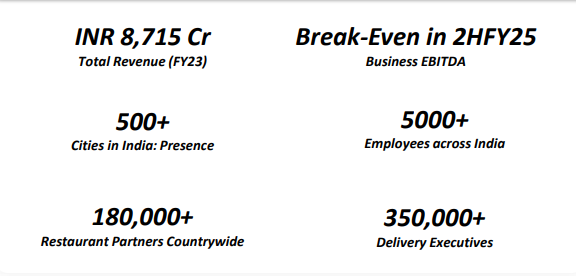

Swiggy has become a powerhouse in the Indian food delivery landscape, now serving customers in 500+ cities across the nation. This extensive reach underscores Swiggy’s commitment to providing convenient food delivery services to a vast and diverse customer base.

Diversification and Challenges Amid Pandemic

The company diversified its services in early 2019, venturing into general product deliveries with Swiggy Stores and instant pickup/dropoff services with Swiggy Go, later rebranded as Swiggy Genie in 2020. The COVID-19 pandemic brought challenges, leading to the layoffs of 1,100 employees in May 2020 and the closure of a significant portion of its cloud kitchens.

Adaptation and New Ventures

Swiggy adapted by launching Instamart, an instant grocery delivery service, in August 2020. By early 2021, Swiggy closed Swiggy Stores and expanded its grocery delivery operations under Instamart.

Swiggy’s Mission and Vision

Swiggy’s mission, as stated on the company’s website, is dedicated to enhancing the urban consumer’s quality of life by delivering unmatched convenience. Convenience is the driving force behind their actions, motivating them to rise and embrace each day with enthusiasm.

The vision for Swiggy is to emerge as India’s foremost local service provider. By offering a diverse array of service options, they aim to redefine convenience for all users, striving to become the nation’s most user-friendly and accessible platform.

Swiggy’s Services

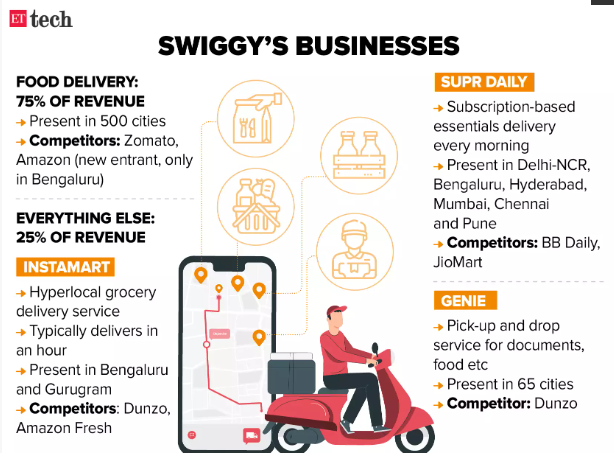

- Food Delivery– Swiggy operates as an aggregator between the customer and the restaurant and delivers the food through it’s fleet within 30-40 minutes.

- Quick Commerce – Swiggy Instamart provides quick grocery delivery service to customers’ doorsteps in under an hour.

- Hyperlocal Delivery: Swiggy offers pickup and delivery service for a wide range of products under the name Swiggy Genie.

- Restaurant tech: Swiggy Dineout allows users to discover restaurants, view menu, and reserve tables for dining out.

Swiggy’s Products and Features

Swiggy has launched many products and features. Some of the features are:

- Swiggy Photoshoot: To improve the visual attractiveness of restaurant menus, Swiggy introduces an AI-based solution on November 8, 2023

- Swiggy Introduces Learning Station: To offer customized content for restaurant partners’ growth, Swiggy Presents Learning Station on September 13, 2023

- The Swiggy Moonlighting Policy permits delivery employees to work regular jobs in addition to extracurricular activities on August 24, 2023

- Swiggy Menu Score Tool, which provides restaurant partners with data-driven recommendations to increase conversions in 2023

- Co-branded credit cards were introduced by Swiggy in collaboration with Mastercard and HDFC Bank to improve customers’ purchasing experiences on July 26, 2023

- Swiggy WhatToEat function, which allows users to browse meal options according to their appetites and moods on July 2023

- With the launch of Swiggy Mini, fee-free product sales are now possible throughout India on April 2023

- Swiggy Launchpad: Offering new restaurant partners a commission-free first month, Swiggy Launchpad is live as per the news report of March 2023

- Swiggy Dine Out Offers: Providing millions of Swiggy users in 24 cities with discounts at over 18,000 restaurants on February 2022

- Swiggy Extends Cloud Cooking Business: To open restaurants in new areas, Swiggy is extending its Cloud Kitchen program in July 2022

- Swiggy Affiliate Program: Offering a lucrative affiliate program to people that send Swiggy customers

Management of the Company

Sriharsha Majety: CEO & Co-Founder

Sriharsha Majety, an alumnus of BITS Pilani and IIM Calcutta, is the CEO who transformed Swiggy into one of India’s most valuable unicorns, with a staggering valuation of Rs 87,500 crore. Hailing from Vijayawada, Andhra Pradesh, Majety’s entrepreneurial journey began after a stint at Nomura International, where he co-founded a logistics startup called Bundle. However, it was his leadership at Swiggy, alongside co-founders, that propelled the food delivery app to the forefront of India’s tech landscape.

.

Lakshmi Nandan Reddy: Co-Founder

Lakshmi Nandan Reddy, a co-founder of Swiggy, is an alumnus of BITS Pilani, where he completed his M.Sc in 2010. Prior to Swiggy, Reddy served as the head of social media operations at SourcePilani, the pioneering BPO for rural India, for approximately two years. He also played a pivotal role as a founding partner of Zurna, a restaurant based in Hyderabad, before venturing into entrepreneurship with the founding of Bundl, which eventually evolved into the successful food delivery platform, Swiggy.

.

Rahul Bothra: CFO

Rahul Bothra, a CA and B.com graduate, is the current CFO at Swiggy. Rahul has previously worked as the Divisional CFO & VP- Finance at Olam from September 2009 to September 2017. Prior to that, they were the Regional Finance Manager at Colgate-Palmolive from January 2004 to December 2004. Rahul has also worked as the Finance & Commercial Manager-Dairy at Britannia Industries Limited from January 2005 to August 2009. Rahul’s other previous positions include Asst Manager-Internal Audit at Britannia Industries Limited from April 2002 to May 2004 and Senior Internal Auditor at Wipro from January 2000 to December.

Swiggy Business Model

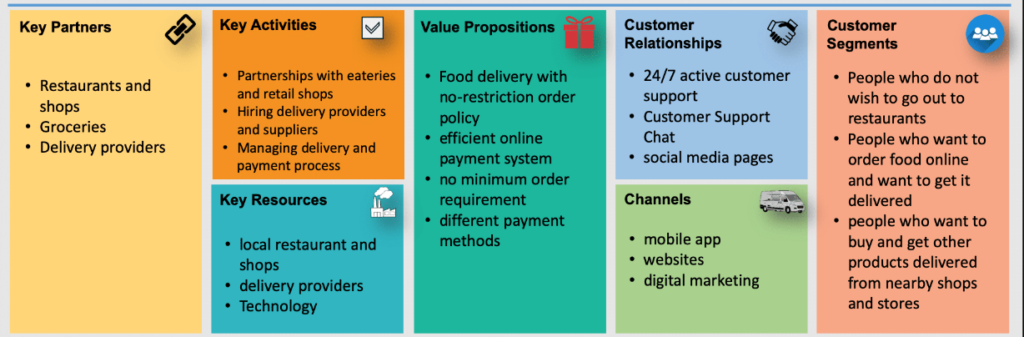

A hyperlocal on-demand food delivery service is the foundation of Swiggy’s business model. With its cutting-edge technological platform, Swiggy functions as a single point of contact, bridging the gap between patrons and restaurants.

Swiggy Revenue Model

Swiggy’s revenue model has evolved over time, incorporating various streams to drive its income. Here are the key revenue sources the company currently relies on:

1. Delivery Charges:

Customers constitute Swiggy’s primary revenue source, with the company levying delivery fees based on order value. These charges may fluctuate during peak demand or adverse weather conditions.

2. Commissions:

Swiggy earns substantial revenue through commissions paid by partner restaurants for generating sales leads and utilizing Swiggy’s delivery fleet.

3. Advertising:

Swiggy also earns some revenue with:

- Banner Promotions – Swiggy encourages restaurants to promote their brand via display ads on its app. This helps all the restaurants that are partnered with Swiggy from different regions, to receive considerable visibility against the payment they make.

- Priority listing of restaurants – Swiggy has an option for priority listing and in them, the company includes select restaurants against premium rates. A restaurant has to pay higher if it wants to be displayed ahead of its peers.

3. Platform Fees:

Swiggy introduced platform fees in April 2023 in select cities like Bangalore, Hyderabad, and Chennai, charging a flat fee of Rs. 2 per order.

4. Swiggy Access:

The company generates income by renting out fully equipped kitchen spaces to restaurant partners, facilitating their expansion into new neighborhoods.

5. Swiggy Super Memberships:

Swiggy offers subscription-based memberships to users, providing benefits such as priority issue resolution and fee-free orders during peak hours, thereby creating a recurring revenue stream.

6. Swiggy Go:

Swiggy expands its revenue streams by offering quick pick-and-drop services for packages, catering to the growing demand for logistics solutions.

7. Instamart:

Swiggy generates revenue through expedited grocery delivery, ensuring prompt service to meet customers’ urgent needs.

8. Swiggy Genie:

This service charges for on-demand pick-and-drop services for various items, offering customers convenience while monetizing the delivery process.

9. Swiggy Bazaar:

With aspirations to enter the social commerce space, Swiggy aims to generate revenue by offering fresh farm produce and FMCG goods on its platform.

10. Affiliate Income:

Swiggy collaborates with financial institutions to provide customers with discounts when using their credit and debit cards, thereby increasing sales for partner companies and earning affiliate income.

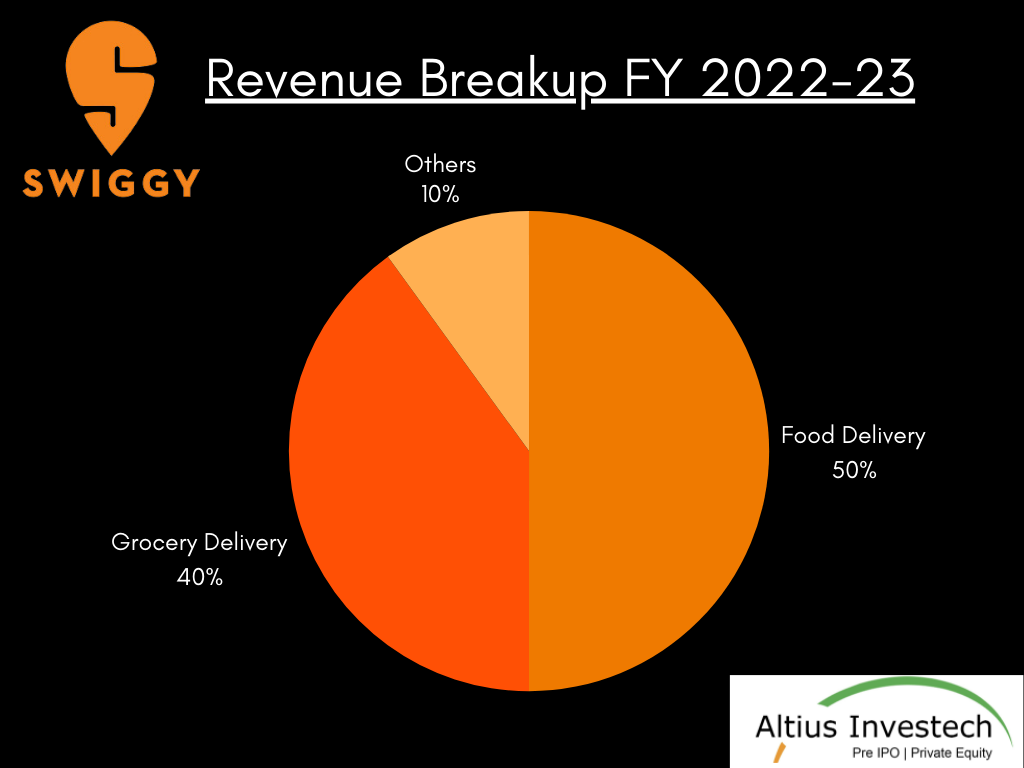

Revenue Breakup FY 2022-23

Innovations by Swiggy

- AI for Enhanced Delivery Services: Swiggy utilizes AI technology to optimize its delivery processes, ensuring accountability by preventing delivery executives from marking their status as ‘Arrived’ before reaching the restaurant, with GPS integration providing real-time location tracking.

- Swiggy One Membership: Swiggy integrates its various services, including Swiggy Super, Instamart, and Swiggy Genie, into a single platform called Swiggy One, offering users the convenience of accessing all services through one app and managing their account with a single login, along with membership plans providing discounts and free delivery across integrated services.

- Drone Delivery Trials: Swiggy explores futuristic delivery methods through drone delivery trials conducted in collaboration with Garuda Aerospace, aiming to revolutionize delivery logistics by transporting goods from dark stores to customer locations, with trials initially conducted in cities like Delhi-NCR and Bengaluru.

- Multimedia Card Insights: Swiggy introduces multimedia cards featuring informative videos to provide users with a rich product overview experience, enhancing user engagement and understanding by showcasing product features and benefits in an immersive format.

- Pocket Hero Feature: Swiggy launches the Pocket Hero feature, offering up to 60% discounts and cashback at selected partner restaurants in Delhi, aimed at providing users with enhanced value and savings on food orders while making food delivery more accessible and affordable.

Swiggy – Awards and Recognitions

Here are some of the popular awards won by Swiggy:

- Swiggy won the “Best Employer Brand Award” in 2023 from Linkedin Talent Awards.

- Swiggy won the Economic Times Start-up Award in 2017 as the Best Start-up of the Year

- Swiggy also was recognized at Star Re. Imagine Awards for its tagline ‘No order too small’

- The brand won the Outlook Social Media Award in 2016

- Furthermore, Swiggy is also known for achieving unicorn status in just 4 years since it was founded

Swiggy – Funding Details

| Year | Round | Amount | Valuation | Investors |

|---|---|---|---|---|

| 2015 | Series A | $3M | $4M | Elevation Capital, Accel, Norwest Venture Partners, DST Global |

| Series B | $16.5M | $50M | Elevation Capital, Accel, Norwest Venture Partners, DST Global | |

| 2017 | Series C | $42M | $275M | Harmony Partners, RB Investments, Norwest Venture Partners, Accel, DST Global, Elevation Capital, Bessemer Venture Partners |

| 2018 | Series D | $15M | $204M | Harmony Partners, RB Investments, Norwest Venture Partners, Accel, DST Global, Elevation Capital, Bessemer Venture Partners |

| Venture Debt | $5M | – | – | |

| 2019 | Series E | $80M | $399M | Innoven Capital, Prosus, Accel, Bessemer Venture Partners, Harmony Partners, Norwest Venture Partners, Elevation Capital |

| 2020 | Series F | $101M | $739M | Prosus, DST Global, Coatue, Hillhouse |

| Series G | $210M | $1.3B (Unicorn Status) | Prosus, DST Global, Coatue, Hillhouse | |

| Series H | $1B | $3.2B | Prosus, DST Global, Coatue, Hillhouse | |

| 2021 | Series I | $158M | $3.6B | Prosus, Samsung Venture Investment, Korea Investment Partners |

| Series J | $1.3B | $5.5B | Prosus, SoftBank, Alpha Wave, Accel, Lathe Investment, Goldman Sachs, Think Investments | |

| 2023 | Series K | $700M | $10.7B | Sumeru Ventures, Invesco, Sixteenth Street Capital, Segantii Capital, Alpha Wave, Prosus, Lathe Investment |

| 2023 | Series K (Acquisition) | $46M | – | Rajapalayam Mills, LYNK Logistics |

Swiggy Valuation Rollercoaster

- January 2022:

- Up: Swiggy’s valuation reached $10.7 billion during a fundraising round led by the US-based AMC, indicating investor confidence and a high perceived value of the company.

- April 2023:

- Downturn: Invesco reduced Swiggy’s valuation to $8 billion, down from the previous $10.7 billion, due to a downturn in global tech stocks. This downturn likely reflects broader market trends affecting investor sentiment.

- Shortly thereafter in April 2023:

- Downturn: Invesco further revised Swiggy’s valuation downward to $5.5 billion, acknowledging slower-than-anticipated growth in the food delivery market. This decline suggests a reevaluation of Swiggy’s growth prospects and market position.

- October 2023:

- Up: Invesco increased Swiggy’s valuation by 42% from the previous year to $7.85 billion, demonstrating continued interest and potential growth prospects.

Swiggy: Key Investors

Swiggy – Acquisitions

Swiggy has acquired 6 companies to date.

Here’s a glimpse at all the companies that Swiggy has acquired:

| NAME OF THE ACQUIRED COMPANY | DATE OF ANNOUNCEMENT | COST OF ACQUISITION |

|---|---|---|

| LYNK Logistics | Jul 13, 2023 | – |

| Dineout | May 13, 2022 | $200 million |

| Kint.io | February 4, 2019 | – |

| Supr Daily | September 1, 2018 | – |

| Scootsy | August 2, 2018 | $8 million |

| 48East | December 13, 2017 | – |

Swiggy: Key Business Metrics

Industry Overview

The food delivery industry in India is fiercely competitive, with several prominent players vying for market dominance alongside industry giants like Swiggy and Zomato. Regional players such as Dunzo, Uber Eats (now acquired by Zomato), and Foodpanda (acquired by Ola) have also left their mark on the market. Additionally, niche platforms like Box8, Faasos, and FreshMenu cater to specific culinary preferences and delivery niches. This intense competition has led to aggressive marketing strategies, innovative service offerings, and strategic partnerships as companies strive to capture market share and maintain relevance in this dynamic industry landscape.

- Tech-driven Disruption: The emergence of smartphone penetration and the widespread availability of high-speed internet have revolutionized the way Indians order food. Online platforms and mobile applications have made it convenient for consumers to browse menus, place orders, and track deliveries with just a few taps on their devices.

- Changing Consumer Preferences: Rapid urbanization, coupled with busy lifestyles, has led to a shift in consumer preferences towards convenience and time-saving options. As more people join the workforce and dual-income households become increasingly common, there is a growing demand for ready-to-eat meals and hassle-free dining solutions.

- Diverse Culinary Landscape: India’s rich cultural diversity is reflected in its culinary landscape, offering a wide array of cuisines ranging from traditional regional delicacies to international favorites. Food delivery platforms capitalize on this diversity by partnering with local restaurants and chains to offer a vast selection of dishes to cater to varying tastes and preferences.

- Intense Competition: The Indian food delivery market is highly competitive, with several players vying for market share. While Swiggy and Zomato dominate the industry, numerous regional players and niche platforms also compete for a slice of the market. This intense competition has led to aggressive marketing strategies, discounts, and promotions to attract and retain customers.

- Regulatory Challenges: The food delivery industry in India faces regulatory challenges related to food safety, hygiene standards, and licensing requirements. Additionally, issues such as surge pricing, commission rates charged to restaurants, and labor regulations have sparked debates and discussions within the industry and among policymakers.

- Pandemic Impact: The COVID-19 pandemic significantly accelerated the adoption of food delivery services in India as lockdowns and social distancing measures restricted dine-in options. Food delivery platforms witnessed a surge in demand, prompting them to innovate and adapt to meet evolving customer needs while ensuring safety and hygiene standards.

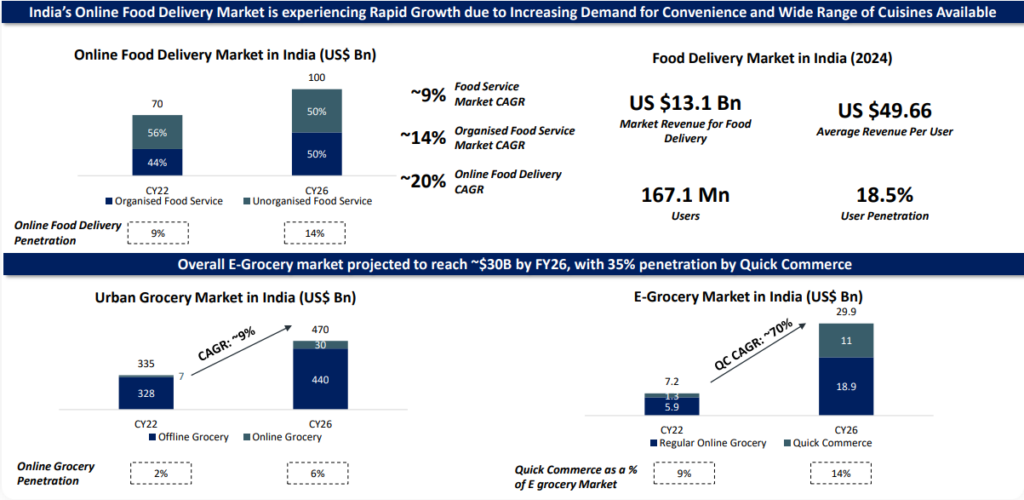

The Indian food delivery industry was valued at $5 billion in 2020, which is growing at 30% CAGR every year and is expected to reach around $21 billion by 2026. Since the growth is not steady and it fluctuates depending on various factors, it is still one of the fastest-growing industries in India.

India’s Rapidly Growing Online Food Delivery and Quick Commerce Market

The industry has shown tremendous growth over the past couple of years. The main reasons behind the growth are as follows.

Swiggy – Competitors

Though Swiggy boasts of a huge market now, it has always witnessed tough market competition from companies like:

- Zomato

- Fassos

- Box8

Peer Comparison: Zomato vs Swiggy

| PARTICULARS | ZOMATO | SWIGGY |

|---|---|---|

| Number of Restaurants | 3 Lakhs+ | 2 Lakhs+ |

| Cities Covered | 1000+ | 500+ |

| App Downloads | 100 Million+ | 100 Million+ |

| Number of Employees | 5000+ | 5000+ |

| Revenue (2022-23) | 7,760.9 | 8,714.5 |

| Profit After Tax (2022-23) | (971) | (4,180) |

| Approx daily orders (FY23) | 1.3Mn | 1.5Mn |

| Total Fundings Raised | $1.79 Billion (in 18 rounds) | $3.58 Billion (in 16 rounds) |

| Last Valuation (as per primary fund raise) | $17.0 Billion (Latest MCap) | $10.7 Billion (Jan 22) |

| Last Valuation / FY24 Sales | 11.0x | 7.4x |

| Share Price (as on 19.04.2024) | 187 | 390 |

- Expected Valuation: 9.0

- Implied Price/Sales: 6.2x

- Discount to Zomato: 44%

Recent News

Swiggy Preps for IPO with Strong Financial Performance in FY24

In March 2024, Swiggy had geared up for its IPO aiming to present a robust financial outlook. During the first nine months of FY24, Swiggy reported revenue from operations of Rs 5,476 crore, showcasing a steady 25-30% year-on-year growth. The company is also exploring a secondary market deal to offer exits to early and late-stage investors, aiming to strengthen its cap table. With a focus on profitability, Swiggy had notably improved its EBITDA margins, despite facing challenges in the past, including workforce reductions and shortlisting bankers. Swiggy is expected to file for IPO by May, targeting a valuation range of $12-15 billion. Additionally, in April 2024 had offered a 20% discount to high net-worth individuals in a pre-IPO deal, aiming to sell shares at Rs 350 each, valuing the company at around Rs 80,000 crore. Meanwhile, rival Zomato’s revenue stood at Rs 8,552 crore for the first three quarters of FY24, with a market cap of $20.7 billion.

Swiggy Introduces ‘Swiggy Pawlice’ Feature to Assist in Finding Missing Pets

(April 2024) Swiggy introduces ‘Swiggy Pawlice’, a new feature on its app allowing pet parents to report missing pets, leveraging its vast network of delivery partners for assistance. The initiative, launched in the presence of Tata Trusts representatives, enables delivery partners to notify Swiggy’s dedicated team upon spotting a missing pet, with details shared promptly with the pet parent for potential reunification. Swiggy also announces a “Swiggy Paw-ternity Policy” for employees, offering benefits like pet adoption leave and remote work options during a pet’s settling-in period, demonstrating its commitment to animal welfare and employee well-being.

Share Price of Swiggy (as of 01.05.2024)

- The buy price of Swiggy varies based on quantity, ranging from ₹399 for quantities between 1000 – 2499 shares to ₹385 for quantities between 10000 – 24999 shares, with corresponding rates per share.

Currently, the Swiggy Share Price is trading at around Rs. 380/share. CLICK HERE to Invest.

Financial Metrics for Swiggy (as of 01.05.2024)

| Particulars | Amount |

| Price to Earning Ratio (P/E) | (26.23) |

| Price to Sales Ratio (P/S) | 13.26 |

| Price to Book Value (P/B) | 12.1 |

| Industry PE | – |

| Face Value | ₹ 1 |

| Book Value per share | ₹31.82 |

| Market Cap | ₹109560 Cr |

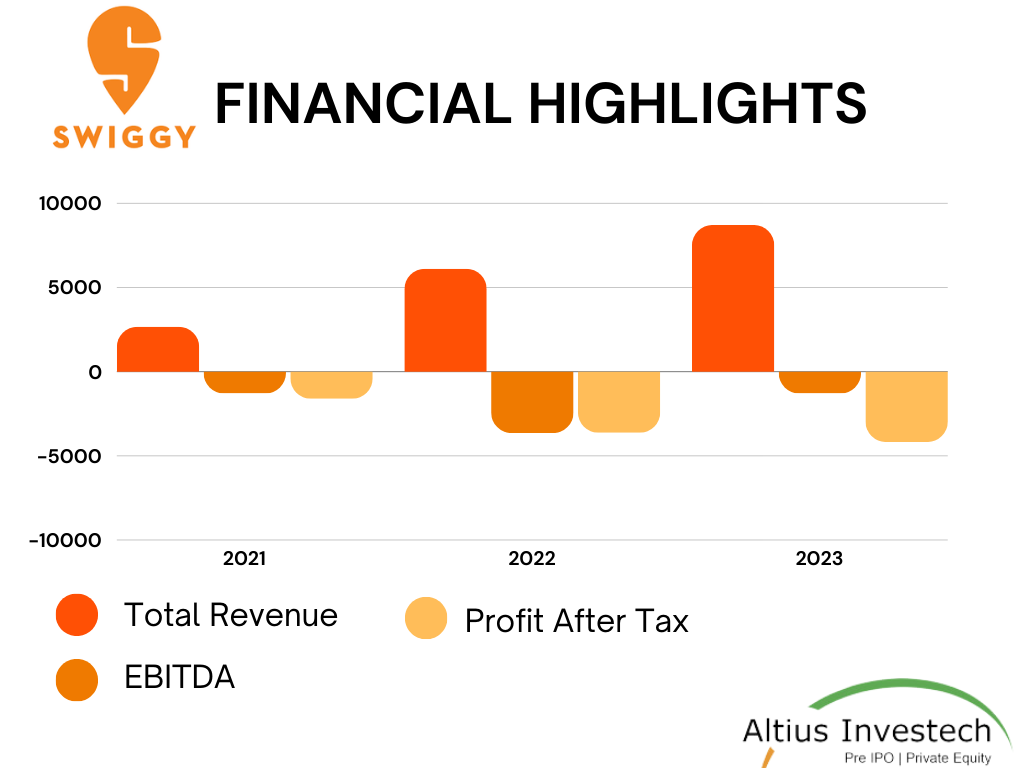

Financial Highlights

₹ in crores

| Particulars | FY 2020-21 | FY 2021-22 | FY 2022-23 |

| Total Revenue | 2675.9 | 6119.8 | 8714.5 |

| EBITDA | (1298.7) | (3651.1) | (4275.8) |

| PAT | (1616.90) | (3628) | (4180) |

| EPS | (5.65) | (12.72) | (14.67) |

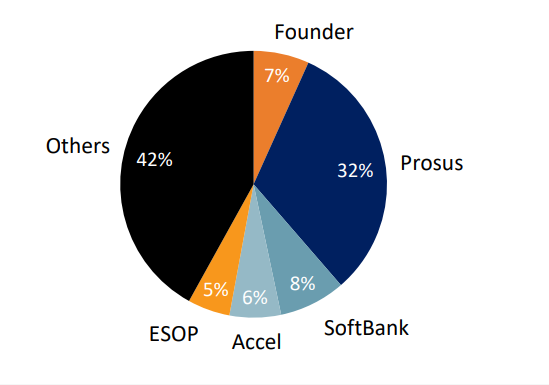

Swiggy: Shareholdings

Swiggy – ESOPs

Swiggy has been steadfast in its commitment to recognizing and rewarding its employees through its Employee Stock Ownership Plan (ESOP) liquidity program, which commenced in 2021. Starting in June 2022 with an initial value of $23 million, the first tranche of the program provided benefits to approximately 900 employees.

This initiative underscores Swiggy’s dedication to employee engagement and retention, as evidenced by its ongoing efforts to acknowledge the contributions of its workforce. With four liquidity events held since 2018, Swiggy has consistently demonstrated its commitment to rewarding its employees.

Continuing its momentum, Swiggy announced plans for the second phase of its ESOP liquidity program in July 2023, with a total investment of $50 million. This reaffirms Swiggy’s commitment to fostering a positive work environment and ensuring that its employees are recognized and rewarded for their efforts.

Challenges Faced by Swiggy

- Operational Challenges: Swiggy faces ongoing challenges in ensuring the smooth functioning of its app and managing relationships with restaurants and delivery partners.

- Labor Unrest: The platform encountered labor unrest when delivery executives in Bangalore and Mumbai went on strike, demanding improved pay and working conditions.

- Impact of COVID-19: The COVID-19 outbreak presented unprecedented challenges for Swiggy, prompting the company to implement safety precautions for its employees and endure layoffs. Additionally, operational difficulties led to the temporary halt of Swiggy Genie operations and the reduction of services like Supr Daily.

- Resilience and Adaptability: Despite these challenges, Swiggy has demonstrated resilience and adaptability, striving to overcome setbacks and thrive in the competitive food technology market.

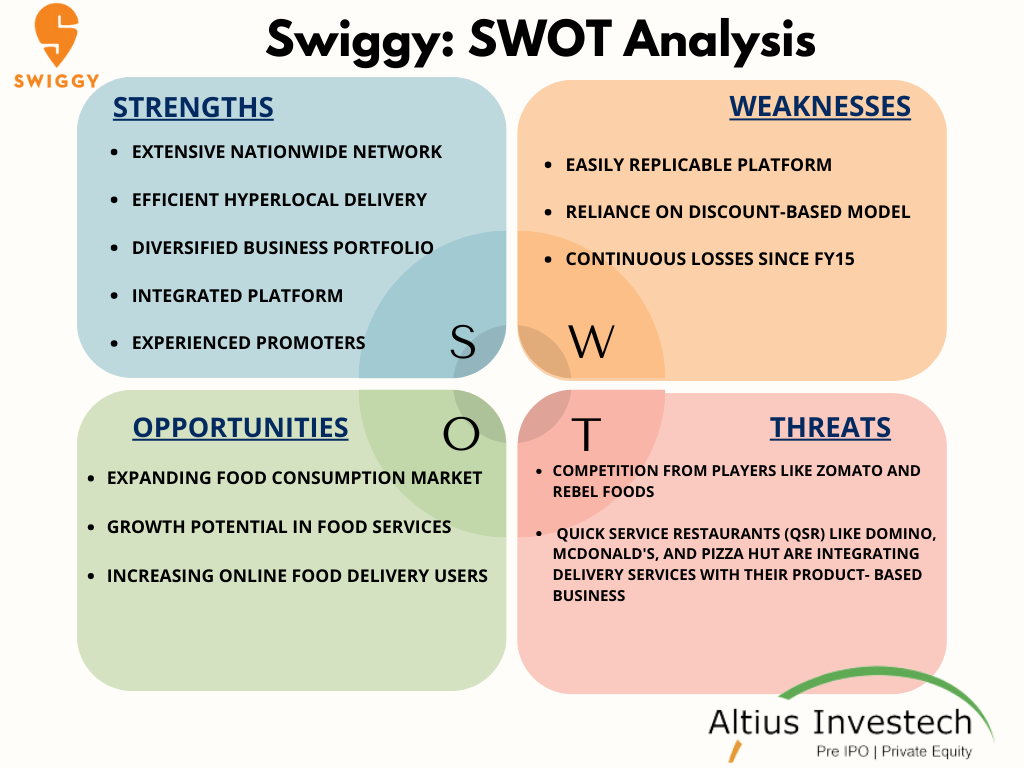

Swiggy SWOT Analysis

Conclusion

In summary, Swiggy’s evolution from a courier service to a food delivery powerhouse showcases resilience and innovation. Despite challenges, it’s expanded services, embraced tech advancements, and fostered employee engagement. With an upcoming IPO and strong financials, Swiggy is poised for continued success, reaffirming its commitment to convenience and customer satisfaction in India’s competitive food tech landscape.

ALSO READ OUR OTHER BLOGS

GET IN TOUCH WITH US:

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

To know, more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

You can also checkout the list of Best 5 Unlisted Shares to Buy in India

Click here to connect with us on WhatsApp

For Direct Trading, Visit – https://altiusinvestech.com/companymain.

To know more about How to apply for an IPO? Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/