Sterlite Power Transmission: About the Company

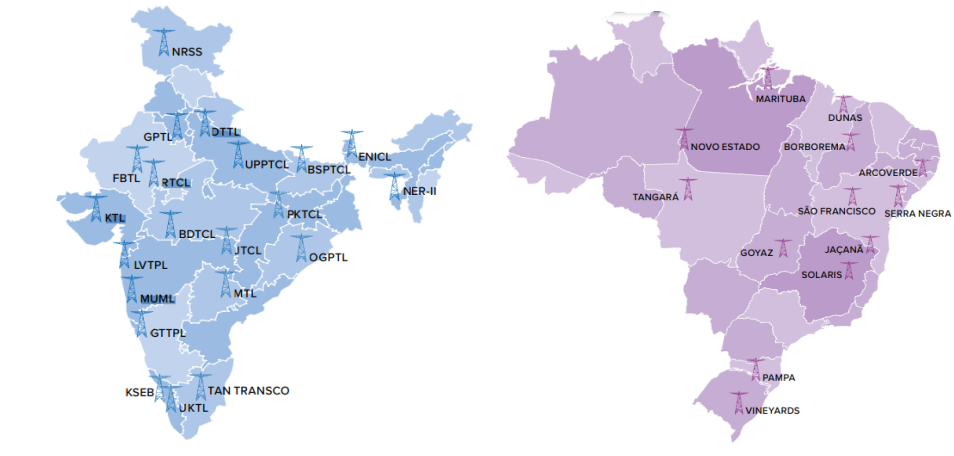

Sterlite Power is a leading power transmission infrastructure developer with a robust portfolio of 30 projects spanning approximately 14,602 circuit kilometers in India and Brazil. The company leverages innovative technologies such as helicranes and drones to enhance project efficiency, reduce human intervention, and minimize environmental impact. Sterlite Power’s deep understanding of local regulations and strong partnerships with leading Indian EPCs enable it to complete projects ahead of schedule. Through its innovative practices and strategic collaborations, Sterlite Power has established itself as a prominent player in the power transmission sector.

| Company Name | STERLITE POWER TRANSMISSION LIMITED |

| Company Type | Unlisted Public Company |

| Industry | Power Transmission |

| Incorporation Year | 2015 |

| Region | India and Brazil |

| Headquarter | Pune, Maharashtra, India |

| Total Projects (Circuit km) | 15,000 ckm |

| Total Projects (Mega-Volt Ampere) | ~28,322 MVA |

| Key Technologies Used | Helicranes, Drones |

| Benefits of Technology | Enhanced efficiency, Reduced human intervention, Minimized environmental impact |

Sterlite Power Transmission: Business Divisions

- Global Infrastructure: Sterlite Power bids, designs, constructs, owns, and operates power transmission assets across various geographies. This division focuses on expanding and managing power transmission networks globally to enhance energy delivery efficiency.

- MSI and Products Business: Specializing in upgrading, uprating, and strengthening existing power delivery networks, Sterlite Power’s MSI and Products Business division aims to optimize and modernize infrastructure to meet increasing energy demands. This includes developing and supplying advanced materials and solutions for enhanced network performance.

- Convergence: Sterlite Power’s Convergence division aims to establish a nationwide optical ground wire network across India. This innovative initiative utilizes existing power transmission lines to deliver high-speed data, supporting digital infrastructure development across the country. By integrating data and power transmission capabilities, Convergence seeks to create a more efficient and interconnected energy and communication network.

These three divisions collectively support Sterlite Power’s core purpose of empowering humanity by tackling the most challenging aspects of energy delivery through innovation and strategic infrastructure development.

Sterlite Power Transmission: Leading Power Infrastructure Developer

- Global Reach: Manages projects spanning 15,000 circuit km (ckm) and approximately 28,322 mega-volt ampere (MVA) across India and Brazil.

- Industry-Leading Portfolio: Specializes in power conductors, extra-high voltage (EHV) cables, and optical ground wire (OPGW), enhancing network capabilities.

- International Impact: Primary manufacturer of bare overhead conductors, exporting to 60+ countries globally.

- Innovation and Leadership: Sets industry benchmarks through advanced technologies and innovative financing methods.

- Investment Sponsorship: Acts as sponsor for IndiGrid, India’s pioneering Infrastructure Investment Trust (InvIT) in the power sector, listed on BSE and NSE.

- Global Recognition: Receives prestigious awards from S&P Global Platts and IPMA for excellence in power transmission infrastructure.

Asset Portfolio across India and Brazil

₹41,748.89* crores (US$ 5.08 billion)

Overview of Sterlite Power’s Journey

Sowing Seeds (2006-2009)

- Acquired the power business from Sterlite Industries Ltd.

- Entered power transmission under Sterlite Technologies Ltd. (STL).

- Expanded power conductor manufacturing capacity.

Strengthening Roots (2010-2013)

- Awarded India’s first independent Power Transmission Project under TBCB.

- Established a power cable manufacturing facility in Haridwar.

- Secured India’s first 765 kV private project, Bhopal Dhule Transmission Ltd (BDTCL).

Nurturing Growth (2014-2015)

- Received `500 crores (US$ 67.8 million) investment from Standard Chartered Private Equity.

- Commissioned the first inter-state project, ENICL.

- Won the NRSS-29 project in Jammu & Kashmir.

- Recognized for early commissioning of the Dhule substation.

Spreading Branches (2016-2017)

- Commissioned a TBCB project ahead of schedule.

- Raised India’s first AAA (SO) rated infrastructure bonds.

- Invested in UAV-based technology and deployed helicranes in J&K.

- Expanded into Brazil and listed IndiGrid on Indian stock exchanges.

Expanding with Confidence (2018-2019)

- Acquired 28.4% stake from Standard Chartered Private Equity.

- Won the largest global order from GS S Korea for High-Performance Conductor.

- Pioneered ‘Zero Shutdown’ capability in India.

- Won new transmission projects in Brazil and commissioned Arcoverde.

Continuing with Resilience (2020-2021)

- Added three ISTS projects worth ~`3,600 crores (US$ 488 million).

- Achieved 3 million safe person-hours at MSI projects.

- Pioneered Live-Line Reconductoring and robotic technology for OPGW stringing.

- Won several awards, including the IPMA Project Excellence Awards 2021.

Embracing New Frontiers (2022-2023)

- Commissioned the first Green Energy Corridor Project.

- Recognized as a Great Place to Work for the second consecutive year.

- Introduced the 96 Fibre OPGW and ACCC ULS Brahmaputra High-Performance Conductor.

- Commissioned multiple transmission lines and acquired new projects in Brazil.

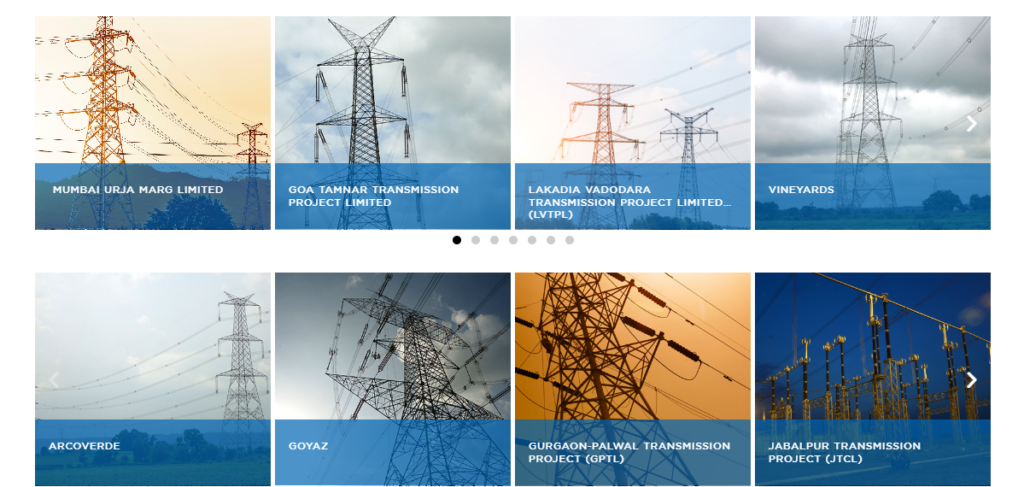

Sterlite Top Projects

Management of the Company

Pravin Agarwal: Chairman & Non-Executive Director

Pravin Agarwal serves as the Chairman and Non-executive Director of Sterlite Power. He holds a bachelor’s degree in commerce from Patna University and has been integral to the Sterlite Power group since its inception. With substantial experience in general management and commercial affairs, he previously held directorship positions at Sterlite Technologies Limited, East-North Interconnection Company Limited, and Speedon Network Limited. Over his 24-year career as a director, he has adeptly managed various companies. Agarwal has been a member of the Sterlite Power Board since May 5, 2015.

Pratik Pravin Agarwal: Managing Director

Pratik Pravin Agarwal, Managing Director of Sterlite Power, holds an MBA from London Business School and a bachelor’s in economics from the University of Pennsylvania. With extensive managerial experience, he has directed various companies including Sterlite Technologies Limited. Recognized with the Economic Times 40 Under Forty award in 2018, Agarwal is actively involved in industry committees and serves as President of the Electric Power Transmission Association of India. Joining Sterlite Power’s Board in 2016, Agarwal plays a crucial role in the company’s leadership.

Alampallam Ramakrishnan Narayanaswamy: Independent Director

Alampallam Ramakrishnan Narayanaswamy served as an Independent Director of Sterlite Power. He held a bachelor’s degree in commerce from the University of Mumbai and was a fellow member of the Institute of Chartered Accountants of India. With 26 years of experience as a director overseeing company management, he had previously held directorship positions in Hindustan Zinc Limited, Sterlite Technologies Limited, MALCO Energy Limited, and IBIS Logistics Private Limited. Narayanaswamy had been a Director on Sterlite Power’s Board since July 22, 2019.

Indian Subsidiaries

| Subsidiaries | % of Shareholding |

| Sterlite Convergence Limited | 100 |

| One Grid Limited | 100 |

| Sterlite EdIndia Foundation | 99.95 |

| Sterlite Interlinks Limited | 100 |

| Nangalbibra-Bongaigaon Transmission Limited | 100 |

| Maharashtra Transmission Communication Infrastructure Ltd | 64.98 |

| Kishtwar Transmission Limited | 100 |

Brazilian Subsidiaries

| Subsidiaries | % of Shareholding |

| Sterlite Brazil Participacoes S.A | 76.59 |

| GBS Participicoes S.A. Brazil | 76.59 |

| Borborema Participacoes S.A. | 76.59 |

| São Francisco Transmissão de Energia S.A | 76.59 |

| Marituba Transmissão de Energia S.A. | 76.59 |

| Goyas Transmissão de Energia S.A | 76.59 |

| Solaris Transmissão de Energia S.A | 76.59 |

Industry Overview

Power Sector of India

Governance and Regulation

The power sector in India is governed by Central and state regulatory agencies, with key regulators including:

- Central Electricity Regulatory Commission (CERC): Approves tariffs for central utilities and licenses.

- Central Electricity Authority (CEA): Acts as a technical advisor, focusing on planning power demand, generation, and transmission capacity, and reviewing sector performance monthly.

- State Electricity Regulatory Commissions: Oversee state-level regulations.

The Ministry of Power collaborates closely with CERC and CEA to manage the sector.

Generation-Transmission-Distribution Businesses

Generation Segment

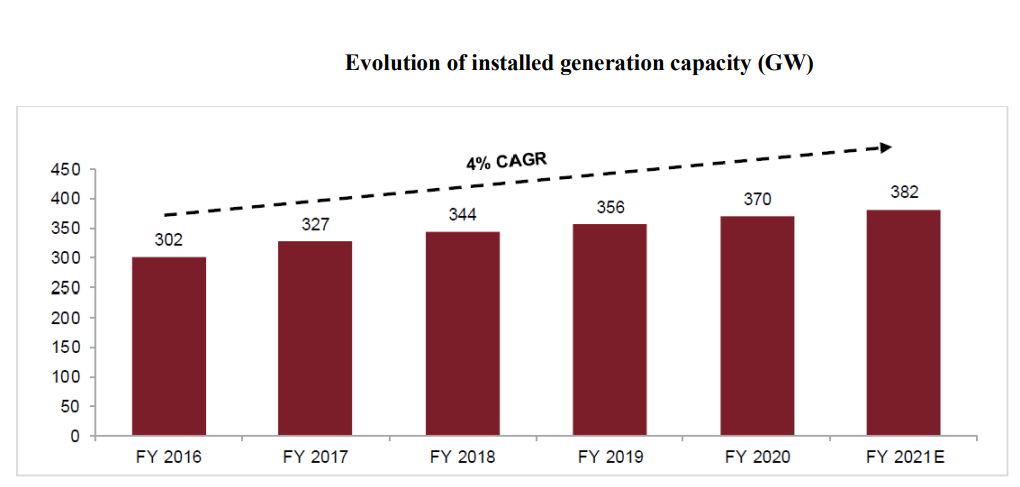

- Capacity Growth: Witnessed a 4% growth from 2016-2021, reaching a total installed capacity of 382 GW by March 2021.

- Conventional Capacity: Increased from 195,801 MW in 2013 to 287,717 MW in 2021, with coal and lignite accounting for 55% of the total.

- Private Sector Participation: Encouraged by the Electricity Act, 2003 and competitive bidding introduced in 2006, which led to significant capacity additions by private players.

- Capacity Additions: Between 2016-2021, around 42 GW of conventional power generation capacity was added, with private sector contributing approximately 26%. Major contributors include Tata Power, Adani Power, JSW Energy, and Reliance Power.

- Private Sector Share: Increased from 24% in 2014 to 32% in 2020 due to aggressive expansion plans and competitive bidding.

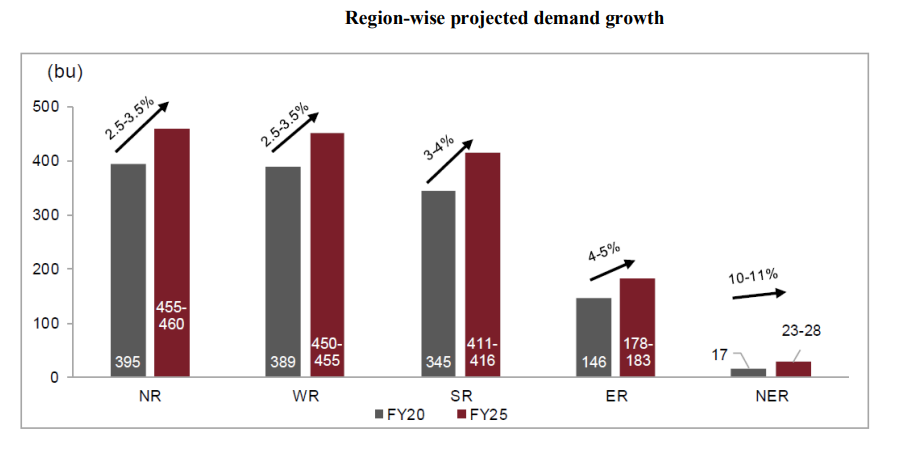

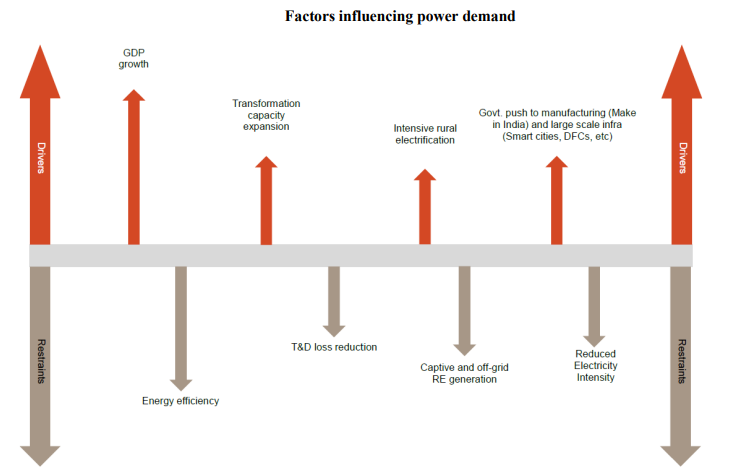

Regions and Sector That Are Expected to Drive Demand

Eastern and North-Eastern Regions

- Growth Expectation: Higher growth in power demand compared to other regions, with a 4-5% CAGR in the eastern region due to significant capacity additions.

- Challenges: Financial health of utilities in Bihar and Jharkhand remains poor due to inadequate tariff revisions and high AT&C losses. The north-eastern region had a 3.7% energy deficit in fiscal 2020, with Assam at 5.3%. Difficult terrain and weather could constrain transmission infrastructure.

Northern Region

- Growth Expectation: 2.5-3.5% CAGR, led by Uttar Pradesh, Rajasthan, and Haryana.

- Energy Deficit: 1.4% in fiscal 2020.

Southern Region

- Growth Expectation: Moderate 3-4% CAGR, driven by enhanced transmission capacities and capacity additions in Tamil Nadu and Telangana.

- Challenges: Weak financial position of key state utilities could constrain power offtake ability.

Western Region

- Growth Expectation: Tepid 2.5-3.5% CAGR, with key states like Maharashtra, Gujarat, Chhattisgarh, and Madhya Pradesh being power surplus or having zero energy deficit.

- Challenges: The pandemic is expected to slow demand growth in highly industrialized states. High industrial and commercial tariffs (Rs 8-9 per kWh) and high cross-subsidy charges restrict significant demand rise from these segments.

Recent News

Sterlite Power Secures Rs. 1373 Crore Funding from Power Finance Corporation

(May 30,2024) Sterlite Power secures a substantial Rs. 1373 crore funding for Neemrana II Kotputli transmission project from Power Finance Corporation (PFC) to bolster its transmission network expansion in India. Sterlite Power aims to build a green energy corridor. Acquired in November 2023, the project will operate on a BOOT basis for 35 years. This initiative will interconnect the Neemrana and Kotputli substations and facilitate a LILO to integrate the Neemrana II substation with Gurugram and Sohna substations. Leveraging strategic collaborations and innovative financing, Sterlite Power aims to address the growing demand for reliable electricity transmission solutions, positioning itself to achieve significant milestones and deliver enduring value to stakeholders.

Sterlite Power Receives Stakeholder Approval to Demerge into Two Entities

(May 23, 2024) Sterlite Power received approval from its stakeholders to demerge its business into two separate entities. This decision is part of the strategic move to separate the Power Transmission Infrastructure business, which includes assets in India and Brazil, into Sterlite Grid 5 Limited (SGL5). The remaining entity, Sterlite Power Transmission Limited (SPTL), will focus on the Global Products & Specialised EPC Services business and the Convergence – Fiberco business. The demerger aims to create ‘pure play’ business verticals, each with independent capital structures to attract suitable investors based on their distinct growth profiles. Existing shareholders of SPTL will receive one additional share of SGL5 for every share they hold in SPTL.

Read this blog to know more about Sterlite’s Demerger:

Share Price of Sterlite Power Transmission (as of 03.06.2024)

- The buy price of Sterlite varies based on quantity, ranging from ₹ 699 for quantities between 20-49 shares to ₹ 675 for quantities between 500-999 shares, with corresponding rates per share.

- The 52-week high is ₹695, and the 52-week low is ₹ 495, indicating the range of fluctuations in the share price.

Currently, the Sterlite is trading at around Rs.680/share CLICK HERE to Invest.

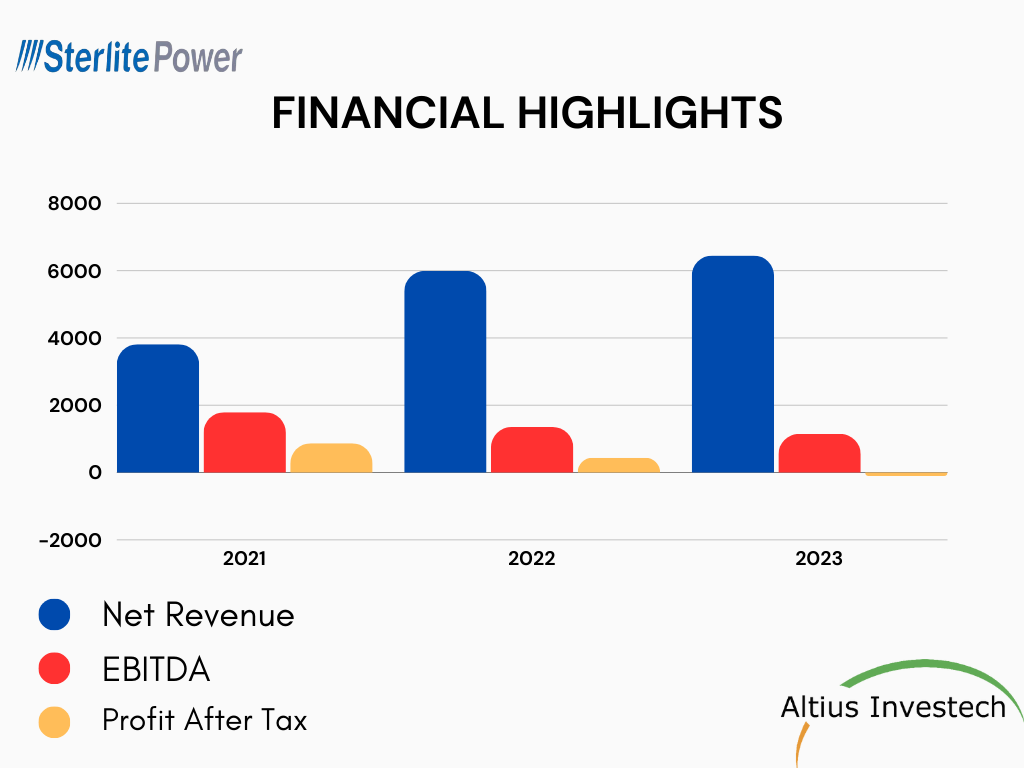

Financial Highlights

₹ in crores

| Particulars | FY 2023 | FY 2022 | FY 2021 |

| Total Revenue | 6452 | 5994 | 3816 |

| EBITDA | 1149 | 1353 | 1793 |

| Profit After Tax | (33) | 440 | 870 |

| EPS | (2.67) | 35.97 | 59.32 |

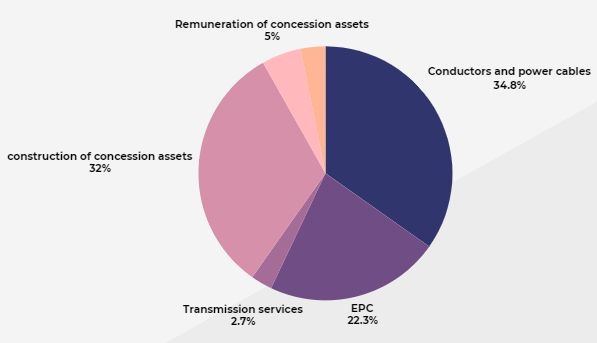

Segment wise Revenue

| Segments | Revenue |

| Conductors and power cables | 2190 |

| EPC | 1402 |

| Transmission services | 172 |

| Construction of concession assets | 2018 |

| Remuneration of concession assets | 317 |

| Others | 198 |

| Total | 6297 |

Dividend

Sterlite Power Transmission, declared an interim dividend of 50% per equity share for FY’2023, totaling approximately ₹12.23 crores. The dividend was paid to shareholders listed on the Register of Members as of April 07, 2023, except for those who had waived their right to receive it. Additionally, no final dividend was recommended for FY’2023. Thus, the Interim Dividend for FY’2023 will be considered as the final dividend.

IPO Plans

Sterlite Power Transmission Ltd considers a public listing post-demerger of its transmission business, focusing on its manufacturing arm. MD Pratik Agarwal anticipates completion by Q2 FY25, aiming to raise funds for expansion, projecting 20-30% growth in FY25. Discussions with private equity investors for transmission funds and plans for renewable energy solutions underline its strategic trajectory

Awards and Recognition

- Power Transmission Company of the Year 2023.

- Pratik Agarwal awarded CEO of the Year (non-renewables) in the ET Energy Leadership Awards 2022.

- Great Place to Work Certification of 2022.

- World Manufacturing Congress Award for “Best Innovative Product of the Year” 2022.

- Aegis Graham Bell Award in the category of “Innovation in Telecom Infra” for its game-changing innovation in building edge computing Containerized Data Centre (CDC) 2022.

Shareholdings

| Shareholder Type | Total Shares | % To Equity |

|---|---|---|

| Promoter | 8,73,40,796 | 71.38 |

| Promoter Group | 35,96,406 | 2.94 |

| Total of Promoter & Promoter Group (A) | 9,09,37,202 | 74.32 |

| Institutions | 10,24,609 | 0.83 |

| Non-Institutions | 2,70,42,131 | 22.1 |

| Body Corporates | 33,59,862 | 2.74 |

| Total – Public shareholders (B) | 3,14,26,602 | 25.68 |

| Total (A) + (B) | 12,23,63,804 | 100 |

Peer Comparison

| Particulars | Revenue | PAT | EPS | CMP | MCAP | P/E | P/B |

| Sterlite Power transmission ltd | 6452 Cr | -33 | – | ₹685 | ₹8377Cr | – | 5.5 |

| Reliance Power Ltd | 7882 Cr | -471 | – | ₹32 | ₹11953Cr | – | 0.9 |

| Tata Power Company Ltd | 56547 Cr | 3809 | 11.9 | ₹450 | ₹143864Cr | 38 | 4.2 |

| Power Grid Corporation of India Ltd | 46605 Cr | 15168 | 21.75 | ₹321 | ₹223912Cr | 14.75 | 2.7 |

Read our other blogs:

Get in touch with us

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

To know, more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

You can also checkout the list of Best 5 Unlisted Shares to Buy in India

For Direct Trading, Visit – https://trade.altiusinvestech.com/

To buy unlisted shares Visit – https://altiusinvestech.com/companymain

To know more about How to apply for an IPO? Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/