Rydak Syndicate: Company Overview

Rydak Syndicate Limited, the brand name tea experts swear by, is one of the last proud torch-bearers of the rich legacy, regal art and life philosophies that defined the tea landscape of India in the 19th and 20th century.

Tea lovers ourselves, our teas represent the haven of tea-drinking erudition. Sold in select packets in teasingly small lots, we bring the freshness and fragrance of the parent bush to your tables.

Founded in 1898 during India’s independence struggle, Rydak has evolved over three-quarters of a century through mergers with estates like Baradighi, Mangaldai, Central Cachar, and others. In 1948, Rydak joined the Jardine Henderson group, becoming a centerpiece of their diverse businesses.

Their team consists of erudite tea experts, experienced industry veterans, and dynamic youth driving innovation. Rydak is a universe of its own, home to thousands, with a rich colonial history, unique tastes, and a distinct corporate culture.

| Company Name | RYDAK SYNDICATE LIMITED |

| Company Type | Unlisted Public Company (Buy unlisted shares) |

| Industry | Tea Production |

| Founded | 1898 |

| Registered Address | Kolkata, West Bengal |

Key Clients

Rydak Syndicate Limited serves key clients, including luxury hotels and resorts, gourmet retailers, tea auctions, export markets in the UK, Europe, and Japan, as well as the local Indian market.

Industry Overview

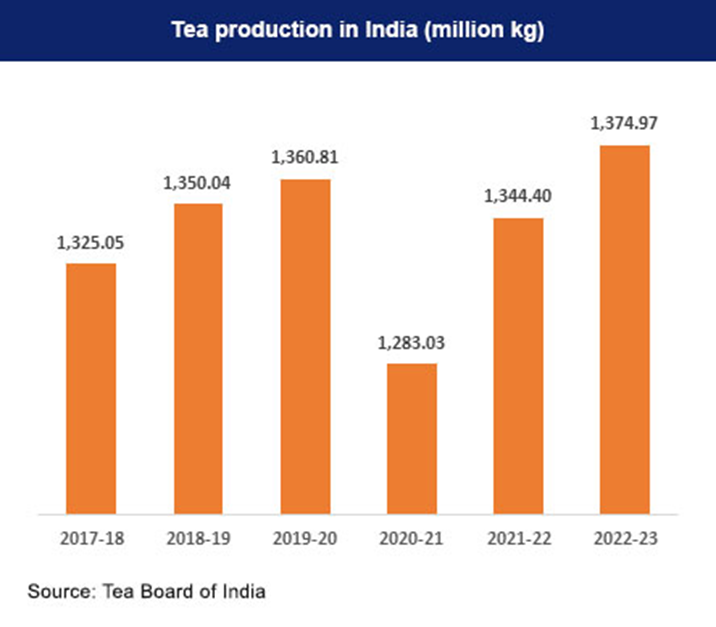

India is the second-largest tea producer globally, known for its high-quality tea due to strong geographical indications, significant investment in processing units, continuous innovation, an expanded product mix, and strategic market expansion. As of 2022, tea was cultivated on 6.19 lakh hectares, with 80% of production consumed domestically. In 2022-23, India’s tea production increased to 1,374.97 million kgs from 1,344.40 million kgs in 2021-22. Key tea-producing regions include Assam (Assam Valley and Cachar), West Bengal (Dooars, Terai, and Darjeeling), and Southern India (Tamil Nadu, Kerala, and Karnataka), which together contribute about 17% of the country’s total production.

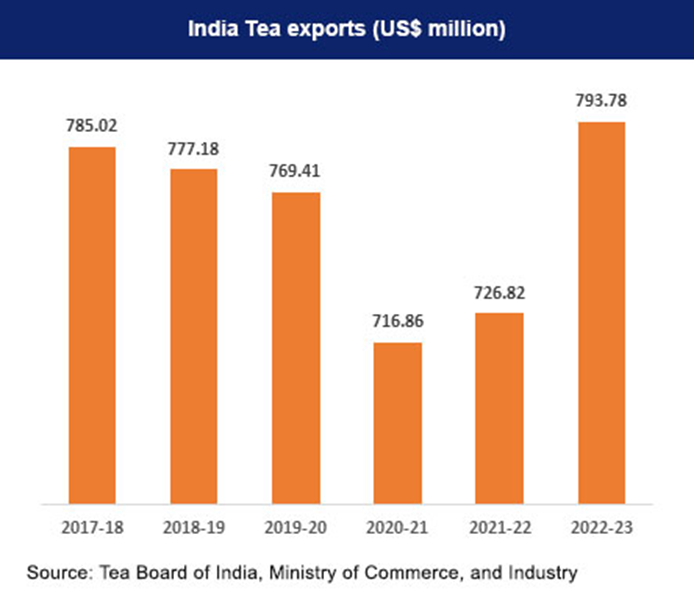

India ranks among the top five tea exporters globally, accounting for about 10% of total exports. From April to February 2024, the total value of tea exports from India was USD 752.85 million, with Assam, Darjeeling, and Nilgiri teas being highly regarded worldwide. The export composition is dominated by black tea, which makes up about 96% of total exports, including black tea (~80%), regular tea (~16%), and green tea (~3.5%). In the 2022-23 period, India exported 228.40 million kg of tea valued at USD 793.78 million, with a unit price of USD 3.48 per kg. In comparison, the 2021-22 exports totaled 200.79 million kg valued at USD 726.82 million, while from April 2023 to January 2024, exports were 199.84 million kg.

..

Business Segments

Tea Production and Estates:

Rydak Syndicate Limited operates six tea estates across Assam and West Bengal’s Dooars region. The estates include Kartick, Baradighi, Duklingia, Kopati, Serispore, Dhelakhat, and Mohunbaree. These estates are renowned for producing high-quality teas that have consistently dominated auction markets. Rydak’s teas are highly sought after globally.

Tourism and Hospitality:

Rydak diversified into tourism with the launch of “Baradighi the Bungalow” in 2019. The retreat is located at Baradighi Tea Estate. It offers a luxurious experience combining tea plantation life, colonial architecture, and tribal culture.

Research and Development:

Rydak Syndicate Limited is actively involved in tea research and development.

The company is a member of the:

- Indian Tea Association

- National Tea Research Foundation

- Tea Research Association

Product Portfolio

Rydak Premium Tea:

Rydak Premium Tea is crafted by passionate tea lovers who carefully assort teas. The tea is sourced from the renowned Duklingia Tea Estate in Assam, a haven of tea-drinking erudition. Sold in select packs and teasingly small lots, maintaining exclusivity.

..

..

..

Kopati Tea:

A small portion of the yearly yield is reserved for creating fine, unblended teas. These teas carry the undiluted pedigree of the Kopati Tea Estate. Sourced from Kopati’s 700 acres of premium green tea bushes.

..

..

..

Serispore Tea:

Sourced from the prestigious Serispore Tea Estate in the Cachar region. Meticulously chosen by experienced tea tasters for exceptional quality. A premium, single estate tea packet known for its superior standards. Highly regarded and a favorite in the auction markets of Cachar.

..

..

..

Management

RAJVINDER SINGH – Managing Director

PRABIR KUMAR BHATTACHARJEE – Additional Director

GYAN DUTT GAUTAMA – Director

SUPARNA CHAKRABORTTI -Director

SUBIR DAS – Director

..

Major Shareholders

| Shareholding Above 5% | Holding % |

| Jardine Henderson Limited | 49.88 |

| Kant and Co Ltd | 10.35 |

| Sripadam Investments Ltd | 8.33 |

| Monet Securities Private Limited | 6.06 |

Financial Highlights

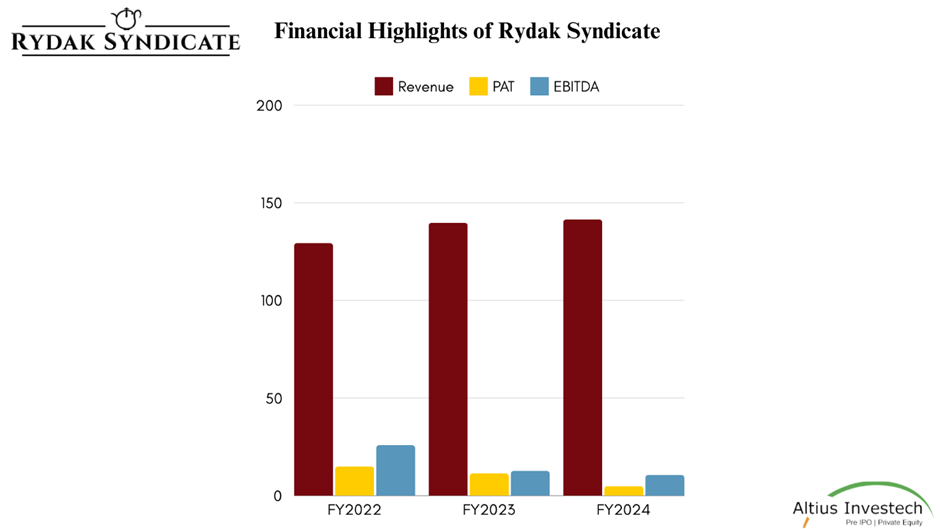

₹ in Cr.

| Financials | 31st March, 2024 | 31st March, 2023 | % increase |

| Revenue | 141.49 | 139.79 | 2% |

| PAT | 4.91 | 11.47 | -57% |

| EPS | 50.43 | 117.61 | -57% |

| EBITDA | 10.68 | 12.73 | -16% |

| PAT Margins | 3.51% | 8.37% | -58% |

Valuation

| Valuation | 31st March, 2024 |

| Share Price | 555 |

| Outstanding shares | 9,73,128 |

| MCAP | 54 Cr. (Approx) |

| P/E Ratio | 11 |

| P/S Ratio | 0.39 |

| P/B Ratio | 0.76 |

| Book value per share | 731 |

Peer Comparison

| Particulars | Rydak Syndicate | Indong Tea Company Ltd | Diana Tea Co (Only Standalone Data Available) | Warren Tea |

| Revenue | 141.49 | 23.56 | 75.61 | 3.37 |

| PAT | 4.91 | 1.35 | 0.01 | -0.86 |

| EPS | 50.43 | -0.91 | 0.00 | 0.24 |

| EBITDA | 10.68 | -0.53 | 2.98 | 3.66 |

| Share Price | 555 | 27.50 | 30.50 | 56.60 |

| MCAP | 54.00 | 41.30 | 48.00 | 67.60 |

| P/E Ratio | 11.01 | -30.22 | 8.24 | 235.83 |

| P/S Ratio | 0.39 | 1.75 | 0.63 | 20.07 |

| P/B Ratio | 0.76 | 0.84 | 0.66 | 0.72 |

| Book value per share | 731.3 | 32.60 | 45.90 | 79.10 |

SWOT Analysis

Strengths:

- Established in 1898, strong heritage and legacy in the tea industry.

- Renowned for high-quality tea production from estates like Kartick and Baradighi.

- Diversified product portfolio with black, green, and specialty teas.

- Strong presence in tea auctions and markets.

- Tourism venture “Baradighi the Bungalow” adds income streams.

- Active in tea research and development.

Weaknesses:

- Heavy reliance on tea production for revenue.

- Limited global brand recognition outside specialized markets.

- High operational costs due to estate maintenance and manual processing.

Opportunities:

- Expand into new geographical markets.

- Growth potential in specialty and organic teas.

- Leverage e-commerce for broader reach.

- Emphasize sustainability and ethical branding.

- Further develop tea tourism and experiences.

Threats:

- Vulnerability to climate change and environmental impacts.

- Intense competition in the tea industry.

- Regulatory changes in key markets.

- Economic fluctuations affecting premium tea demand.

- Potential supply chain disruptions.

..

Rydak Syndicate unlisted shares are currently trading at ₹ 490, CLICK HERE to Invest.

Read our other blogs

Get in touch with us

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

To know, more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

To buy unlisted shares Visit – https://altiusinvestech.com/companymain

To know more about How to apply for an IPO? Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/

Visit our website homepage: https://altiusinvestech.com/