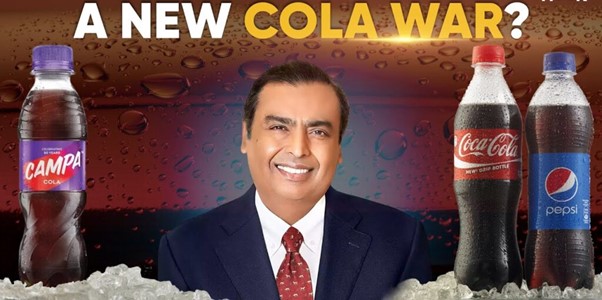

India’s Cola Titans Go Head-to-Head

Although there has been intense competition in the Indian soft drink market for many years, recent events indicate a new era, with Campa Cola emerging as a strong competitor to the industry titans, Pepsi and Coca-Cola. With Reliance Consumer Products Limited (RCPL) making significant investments in the resuscitation of Campa Cola, the once-iconic Indian brand is posing a threat to the market leaders by focusing on regional areas with strong retailer margins and reasonable prices. Let’s examine the rivalry’s development, tactics used by the competition and implications for the Indian market.

A Historical Overview of the Soft Drink Market in India

- Coca-Cola’s Early Entry (1949): In 1949, Coca-Cola joined forces with Pure Drinks Group to enter the Indian market, where it quickly became the industry leader. But Coca-Cola left the nation in 1977 over new rules, creating a void for regional competitors.

- Rise of Campa-Cola: Following Coca-Cola’s withdrawal, Campa-Cola became the new favourite, gaining traction thanks to its partnership with Pure Drinks. Before Coca-Cola and Pepsi made a comeback, Coca-Cola dominated the market for almost 15 years.

- Economic Liberalisation and the Re-entry of Foreign Brands (1991): Following India’s economic liberalization in 1991, Pepsi and Coca-Cola returned to the market, gradually displacing Campa-Cola and reducing its market share.

- The Return of Campa Cola (2025): Reliance Retail Ventures’ subsidiary RCPL purchased Campa Cola for ₹22 crore in March 2024 with the goal of reviving its history with contemporary tactics. In order to become a disruptive force in the soft drink market, Mukesh Ambani’s strategy for Campa Cola in the present day includes competitive pricing, a vast distribution network, and large trade margins for retailers.

The Indian Soft Drinks Market

With a projected market size of $8.85 billion in 2023 and an anticipated yearly growth rate of 5.4% through 2027, the soft drink industry in India is a lucrative one. Even while global behemoths like PepsiCo and Coca-Cola dominate the market, domestic companies like Coca-Cola have a big chance. In comparison to China’s 10 litres and the global average of 30 litres, India’s per capita consumption of soft drinks is comparatively low at 4-5 litres annually. This suggests a sizable unexplored market that Reliance hopes to reach with the Campa Cola relaunch.

Strategic Moves by Campa Cola and Competitive Reactions from Coca-Cola and Pepsi

Pricing Strategy: Competing with Affordability

Reliance’s Campa Cola has adopted a pricing model similar to that of Jio in the telecom industry, aiming to undercut competitors:

- Aggressive Pricing: 200 ml bottles of Campa Cola are available for ₹10, which is half the price of the 250 ml bottles of Pepsi and Coca-Cola, which retail for ₹20. Coca-Cola and Pepsi cost ₹30 and ₹40, respectively, while the 500 ml bottle costs ₹20.

- High Trade Margins: The 6-8% margin that Reliance offers wholesalers is far greater than the 3.5-5% that Coca-Cola and Pepsi provide, which has increased retailer interest in Campa Cola.

PepsiCo and Coca-Cola’s Response: Entering the Budget Segment

To counter Reliance’s aggressive pricing, both Pepsi and Coca-Cola are exploring “B-brands,” lower-cost alternatives designed to protect their premium products while targeting price-sensitive consumers:

- PepsiCo’s Plan: Varun Beverages, PepsiCo’s biggest bottling partner in India, has acknowledged Campa Cola’s “formidable competition” and stated that it is willing to fight in this market with more reasonably priced solutions.

- Coca-Cola’s Strategy: To satisfy consumer demand for more reasonably priced solutions, Coca-Cola is increasing its distribution of returnable glass bottles with a price tag of ₹10, mostly in Tier-II regions. Additionally, the business is thinking of launching regional brands that can be expanded in response to consumer demand.

Product Portfolios and Market Positioning

Coca-Cola and Pepsi’s Diversified Offerings:

With well-known brands like Thums Up, Sprite, Limca, Fanta, Maaza (fruit beverage), and Kinley (water), Coca-Cola provides a diverse portfolio that appeals to a wide range of consumer tastes.

PepsiCo has a distinct edge in terms of cross-promotional opportunities because of its products, which include 7Up, Mountain Dew, Mirinda, Tropicana (juice), and Aquafina (water). The company has also made investments in snack goods like Lays, Kurkure, and Doritos.

Coca-Cola: Known for brands like Thums Up, Sprite, Limca, Fanta, Maaza (fruit beverage), and Kinley (water), Coca-Cola’s portfolio is well-diversified and caters to various consumer preferences.

PepsiCo: With offerings including 7Up, Mountain Dew, Mirinda, Tropicana (juice), and Aquafina (water), PepsiCo has also invested in snack products such as Lays, Kurkure, and Doritos, giving it a unique advantage in terms of cross-promotional opportunities.

Campa Cola’s Narrow but Targeted Portfolio:

While Campa Cola’s product range is limited compared to its competitors, RCPL is investing ₹500-700 crore in bottling plants, which will enable a broader production capacity and potential expansion of offerings in the future.

Market Share Dynamics

Pepsi holds the position of the second-largest player in India’s carbonated soft drink (CSD) market, commanding a significant 33% market share by value and 31% by volume. However, Coca-Cola maintains a dominant presence, leading the market with a substantial 60% share by value and 57% by volume, showcasing its continued popularity and reach in the region. Additionally, Campa Cola has recently managed to capture a modest 2% market share, adding a new dynamic to the competitive landscape.

Financial Performance of Key Players in India’s Soft Drink Market

PepsiCo India reported ₹8,203.19 crore in operating revenue, ₹267.43 crore in net profit, and ₹8,302.34 crore in total income for the financial year 2023–2024. Coca-Cola India’s operating revenue during that time was ₹4,521.31 crore, a 45% increase over the prior year. Additionally, the company’s consolidated profit increased by 57.15% to ₹722.44 crore.

Reliance Consumer Products Limited (RCPL), the FMCG division of Reliance Industries, made almost ₹400 crore from Campa Cola in the current fiscal year, 2024–2025. This figure reflects the brand’s increasing popularity in the Indian soft drink industry.

Marketing Campaigns and Retail Strategy

Reliance’s Distribution Power and Marketing Team:

Campa Cola can reach customers directly and affordably thanks to Reliance’s extensive retail network, which includes Jio Mart, Reliance Fresh, and Reliance Smart. In order to create powerful ads with a nostalgic touch that appeals to older generations who are familiar with the brand’s history, Campa Cola has also hired famous ad writer Prasoon Joshi.

PepsiCo and Coca-Cola’s Established Marketing Campaigns:

With a combined yearly marketing budget of ₹2500 crore in India, Coca-Cola and PepsiCo are both well-known for their iconic advertising and high-budget campaigns. Additionally, they have collaborated with celebrities to develop youth-oriented advertisements, forging a close bond with the Gen Z and millennial populations.

- Coca-Cola’s Iconic Campaigns: Ads like “Share a Coke” and “Taste the Feeling” create a strong emotional connection with consumers and help them associate the brand with camaraderie, memories, and community.

- Pepsi’s humorous and celebrity-driven advertisements: By working with celebrities like Cardi B, Britney Spears, and Cindy Crawford, Pepsi has effectively positioned itself as a “cool” and witty brand that appeals to young people through humor and cultural relevancy.

Challenges and Future Prospects

Distribution and Market Reach:

Reliance’s vast retail and e-commerce network provides Campa Cola with a strong platform on which to grow across the country. However, it will be difficult for Campa Cola to compete with Coca-Cola and Pepsi’s well-established distribution networks and decades of brand devotion.

Health and Sustainability Trends:

Coca-Cola and Pepsi have responded to consumers’ growing health consciousness by introducing low-sugar choices and venturing into the energy drink market. If Campa Cola expands its product line to include healthier beverages, this change may present a growth potential.

Looking Forward: What Lies Ahead for the Soft Drink Market?

As Coca-Cola and PepsiCo gear up for the budget segment with B-brands and localized pricing, they’ll be walking a fine line between competing on price and preserving their premium reputation. If successful, this move could establish a multi-tiered market, much like what’s seen in FMCG segments, where both budget and premium options coexist. However, if not handled with care, it risks diluting the brand equity they’ve built over decades. In contrast, Reliance’s Campa Cola has the potential to redefine value in soft drinks. If it continues its aggressive pricing and distribution expansion, it may attract a loyal consumer base that prioritizes affordability—a trend that could influence pricing norms across the sector.

Conclusion

A new chapter in the history of the soft drink industry in India has begun with the arrival of Campa Cola. Coca-Cola and PepsiCo will launch products that appeal to both price and superior quality as they battle this new rival. It remains to be seen if these behemoths can adjust quickly enough or if Campa Cola and other local firms will outsmart them in their pursuit of market supremacy.

Get in touch with us

For any query/ personal assistance feel free to reach out atsupport@Altiusinvestech.com or call us at +91-8240614850.

Learn more about Unlisted Company.

Click on the link to buy unlisted shares.

Learn more about How to apply for an IPO?

Read More