Ola Cab: Company Overview

Ola was founded in Dec 2010 by Bhavish Aggarwal and Ankit Bhati with a mission to build mobility for a billion people.

Ola is India’s largest mobility platform and one of the world’s largest ride-hailing companies, serving 250+ cities across India, Australia, New Zealand, and the UK.

The Ola app offers mobility solutions by connecting customers to drivers and a wide range of vehicles across bikes, auto-rickshaws, metered taxis, and cabs, enabling convenience and transparency for hundreds of millions of consumers and over 1.5 million driver-partners.

Core Mobility Offering:

- Supplemented by Ola Electric (electric vehicles)

- Ola Fleet Technologies (India’s largest fleet management)

- Ola Skilling (livelihood opportunities for India’s youth)

Strategic Moves:

- Acquired Ridlr (public transportation app)

- Invested in Vogo (dockless scooter sharing)

Key clients

Ola Cabs serves a diverse range of clients, including individual passengers seeking convenient transportation options, corporate clients requiring reliable mobility solutions, and driver-partners who benefit from the platform’s vast network. Additionally, Ola caters to event organizers needing large-scale transportation arrangements and partners with travel and hospitality businesses to enhance the overall customer experience.

Achievements

The company has achieved significant milestones, covering over 250 cities across India, Australia, New Zealand, and the UK. The company facilitates more than 55 crore rides annually and its Ola S1 scooters have covered over 12 crore kilometers within a year of their launch.

Industry Overview

The Indian taxi market is fragmented, with key players including Ola Cabs, Uber, Meru Cabs, Mega Cabs, Spice Cabs, Carzonrent, Blu-Smart Mobility, and others. Intense competition drives these companies to adopt various technologies and strategies to capture market share. Notably, BluSmart Mobility, an Indian startup, is challenging Uber and Ola by focusing on an all-electric taxi fleet, leveraging government clean energy initiatives. Additionally, in April 2022, Swiggy led a USD 180 million investment in Rapido, a bike and auto-taxi aggregator, highlighting the dynamic and competitive nature of the Indian taxi market.

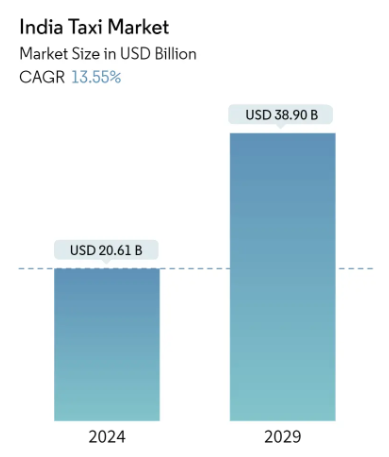

India Taxi Market Analysis:

The India Taxi Market is projected to grow from USD 20.61 billion in 2024 to USD 38.90 billion by 2029, with a compound annual growth rate (CAGR) of 13.55% during this period. The COVID-19 pandemic impacted shared mobility, but medium to long-term growth in the taxi market remains likely. The increasing adoption of electric vehicles is driving market growth, supported by the government’s target of 30% EV sales by 2030 and expanding partnerships, such as Uber with Tata Motors, Ola Electric with StoreDot, and BluSmart with Tata Motors.

Leading companies like Uber, Ola, and Meru are expanding services to meet growing consumer demand for eco-friendly and convenient options. Long-term growth is driven by rising demand for ride-hailing and ride-sharing, growth in online taxi bookings, increasing traffic congestion, and low taxi fares. The continued adoption of EVs, along with strategic partnerships and technological advancements, will further positively influence the market.

Business Segments

Ride-Hailing:

Offers various categories such as Ola Micro, Mini, Prime, and Lux, catering to different customer needs and budgets.

..

Ola Fleet:

Ola’s vehicle leasing and fleet management arm focuses on providing vehicles to drivers on a lease or rental basis, enabling those without cars to work for the company and expanding Ola’s driver network. This division also manages the acquisition, maintenance, and leasing of vehicles to ensure operational efficiency

..

Ola Financial Services:

OlaMoney, operated by Ola Financial Services, is a mobile payments and wallet product that offers a range of financial services, including buy now, pay later options, insurance, co-branded credit cards, and vehicle loans in partnership with financial institutions.

………

……………

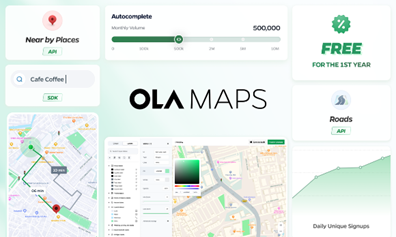

Ola Maps:

Ola’s in-house mapping and navigation system enhances ride efficiency and user experience by providing real-time traffic updates, optimal route suggestions, and accurate ETAs for both drivers and passengers.

…………..

….

Electric Vehicles (EVs):

Ola Electric is a subsidiary focusing on electric mobility solutions.

………

…………….

..

Management

Bhavish Aggarwal | Co-Founder and CEO |

Bhavish Aggarwal, co-founder of Ola alongside Ankit Bhati in 2010, aimed to build mobility solutions for a billion people. An alumnus of IIT Mumbai, Aggarwal previously worked at Microsoft Research, where he filed two patents and published three papers in international journals. A strong advocate for on-demand transportation, he has vowed never to own a car.

………

…..

G. R. Arun Kumar | Group CFO at Ola |

With over two decades of experience in finance and strategy, G. R. Arun Kumar has worked at Vedanta Resources, GE, and Hindustan Unilever. His expertise includes business growth, large-scale capital transactions, governance, and managing supply chains and manufacturing projects. He joined Ola as Ola Electric was constructing the world’s largest two-wheeler factory.

…..

…..

Ola Foundation

Ola Foundation, the social welfare arm of Ola is an outcome of a belief based on real interactions, research, and extensive study on the far-reaching impact of enabling and equipping women with the right skills.

- 1 Lakh+ Families impacted in FY 2020-21

- 93 Lakh+ Meals enabled across India in FY 2020-21

…..

Share Holding Pattern

| Name | Shareholding (%) |

| ANKIT BHATI | 24.03 |

| BHAVISH AGGARWAL | 51.84 |

| VANGUARD WORLD FUND | 5.08 |

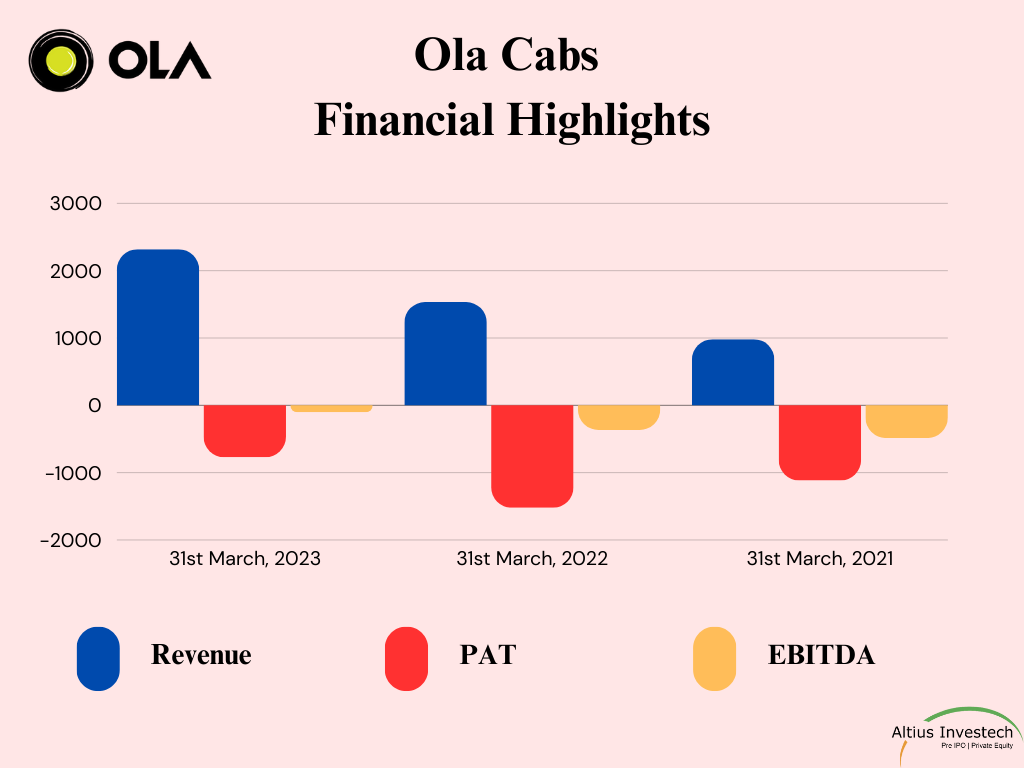

Financial Highlights

₹ in crores

| Financials | 31st March, 2023 | 31st March, 2022 | 31st March, 2021 |

| Revenue | 2,318.44 | 1,533.68 | 983.15 |

| PAT | -772.25 | -1,522.33 | -1,116.61 |

| EPS | -334 | -683 | -502 |

| EBITDA | -102.8 | -395.47 | -485.81 |

| PAT Margins | -33% | -99% | -114% |

Valuation

| Share Price | ₹19666 |

| Outstanding shares | 2 Crs. (Approx.) |

| MCAP | 43795 Crs. |

| P/S Ratio | 19 |

| P/B Ratio | 15.15 |

| Book value per share | 1,297.51 |

Recent News

(16 May, 2024)

Kartik Gupta, the Chief Financial Officer (CFO) of ANI Technologies, the parent company of ride-hailing service Ola Cabs, has stepped down, according to sources. Gupta’s resignation comes two weeks after Ola Cabs’ Chief Executive Officer Hemant Bakshi quit.

(Source : Business Standard )

IPO Plans

Ola Cabs plans to file draft IPO papers with SEBI in the next three months, aiming to raise $500 million and achieve a valuation of around $5 billion. This move follows Ola Electric’s successful IPO from August 2-6, 2024, which raised Rs 6,154 crore and was oversubscribed 4.45 times. The stock debuted on August 9, 2024, at Rs 91.2 and is now trading at Rs 133.08, with a market cap of Rs 58,699 crore. The IPO preparations for Ola Cabs are led by SoftBank-backed Ola, with talks involving Bank of America, Goldman Sachs, Citi, Kotak, and Axis.

SWOT Analysis

Strengths:

- One of India’s largest ride-hailing platforms with a strong brand presence.

- Offers a wide range of transportation options, including cabs, auto-rickshaws, and bike taxis.

- Advanced in-house tech solutions like Ola Maps and OlaMoney enhance customer experience.

- Extensive network of driver-partners across urban and rural areas.

Weaknesses:

- Issues related to driver satisfaction, vehicle availability, and customer service can impact service quality.

- Compliance with varying state and local regulations can be complex and costly.

- Significant expenses related to driver incentives, vehicle leasing, and maintenance.

Opportunities:

- Growth in the EV market offers potential for Ola Electric to lead in sustainable transportation.

- Opportunities to expand into underserved rural markets and international regions.

- Expanding financial services and integrating more mobility solutions could attract a broader customer base.

Threats:

- Competes with other ride-hailing giants like Uber and local startups.

- Changing government regulations on ride-sharing and transportation can impact operations.

- Economic downturns or fuel price hikes can affect demand and operational costs.

- Ensuring driver loyalty in a competitive market is a continual challenge.

OLA Cabs unlisted shares are currently trading at ₹ 19666, CLICK HERE to Invest.

Also read our blog on OLA Electric:

Get in touch with us

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

To know, more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

To buy unlisted shares Visit – https://altiusinvestech.com/companymain

To know more about How to apply for an IPO? Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/

Visit our website homepage: https://altiusinvestech.com/