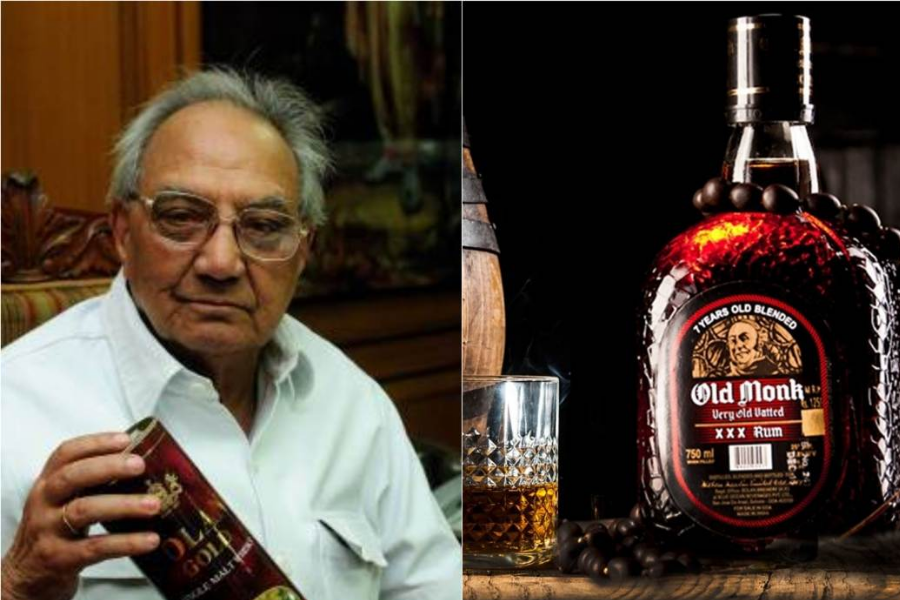

India’s consumer landscape is evolving rapidly, but some brands continue to thrive on legacy, trust, and consistent quality. One such timeless giant is Mohan Meakin Ltd, the maker of the iconic Old Monk rum. With roots stretching back to the 1850s, this company is a blend of history, innovation, and financial resilience. And today, its unlisted shares are quietly drawing attention from smart investors looking for long-term value.

From Kasauli to Nationwide Fame – A Rich History

The story of Mohan Meakin begins in 1855, when Edward Dyer established Asia’s first brewery in Kasauli. This was no small feat—it marked the beginning of India’s modern alcohol industry. Later, H.G. Meakin brought his British brewing expertise and expanded the company’s footprint. By the 20th century, the two pioneers had merged their operations to form Dyer Meakin & Co. Ltd, which eventually evolved into Mohan Meakin Ltd in 1966 under the leadership of Padamshree N.N. Mohan.

But the company didn’t stop at brewing. It strategically diversified into distilleries, fruit juices, mineral water, glass containers, engineering units, and breakfast foods—making it a robust consumer goods conglomerate.

Business Divisions – A Portfolio That Pours Value

Brewery & Distillery

At the heart of Mohan Meakin’s empire lies its liquor division—famous for producing Old Monk Rum, Golden Eagle beer, Solan No.1 whisky, and more. These legacy brands enjoy strong loyalty, especially in Northern India and among defense personnel.

Food & Beverages

Not just spirits—the company manufactures fruit juices, cereals, vinegar, and packaged food items, making it a multi-segment FMCG player.

Mineral Water & Glass Factory

Mohan Meakin also produces mineral water and operates its own glass container factory, giving it end-to-end control and backward integration for bottling.

Engineering & Cold Storage

Its Mohan Nagar industrial hub houses units for ice, malt houses, cold storage, and mechanical operations—diversifying both risk and revenue.

Financial Snapshot – Cheers to Growth

Here’s where things get even more interesting. Mohan Meakin’s FY25 performance continues its upward trajectory:

| Particulars | FY2025 (₹ Cr) | FY2024 (₹ Cr) | YoY Growth (%) |

| Revenue from Operations | 2,151 | 1,923 | 11.8% ↑ |

| EBITDA (Operating Profit) | 149 | 123 | 21.1% ↑ |

| Profit Before Tax (PBT) | 138 | 114 | 21% ↑ |

| Profit After Tax (PAT) | 102 | 85 | 20% ↑ |

| Dividend per Share | ₹120.62 | ₹99.55 | – |

Segment-wise Revenue (₹ in crores)

| Financial Year | Alcoholic | Non-Alcoholic | Total Revenue |

| FY25 | ₹2,136 | ₹15.71 | ₹2,151.71 |

| FY24 | ₹1,912 | ₹18.24 | ₹1,930.24 |

What Makes Mohan Meakin Unique?

Brand Recall: Old Monk isn’t just a rum—it’s a cultural icon. Despite no celebrity endorsements or flashy ads, it commands a loyal fan base.

Diversification: From liquor to food to glass to water, the company isn’t overly reliant on a single vertical.

Export Potential: Its products are exported to the UK, US, Africa, Russia, and the Middle East, opening future opportunities in global spirits markets.

Operational Efficiency: Operating out of key Indian states (U.P., H.P., Haryana, Punjab), the company maintains control across the value chain.

Mohan Meakin Unlisted Shares – A Vintage Investment Opportunity?

| Metric | Mohan Meakin Ltd | Tilaknagar Industries | United Breweries |

| Price (₹) | 2,199 | 367 | 1,983 |

| Market Cap (₹ Cr) | 1,893 | 7,114 | 52,431 |

| P/E | 22.25 | 31 | 114 |

| P/B | 5.17 | 8.1 | 12 |

| P/S | 0.98 | 5 | 5.9 |

Strong Legacy, Stronger Fundamentals: With iconic brands like Old Monk and attractive valuations (P/E of 22.25, P/S of 0.98), Mohan Meakin blends heritage with healthy financials.

Unlisted Edge: Limited availability and lower valuations offer investors a rare chance to tap into a timeless brand before any potential listing.

Why Investors Are Interested:

- Consistent Profitability

- Debt-Free Business

- Strong Free Cash Flow

- Legacy Consumer Brand

- Reasonable Valuation

Risks to Watch

- Brand Aging: Old Monk needs premiumization or repositioning to stay relevant with Gen Z.

- Marketing Gaps: Competitors invest heavily in branding, where Mohan Meakin remains conservative.

- Regulatory Risks: As a liquor company, it operates in a highly regulated space.

- Unlisted Status: Less liquidity and financial transparency compared to listed stocks.

Buy Mohan Meakin unlisted shares - Get in touch with us

- For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

- To know, more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

- Visit our website homepage: https://altiusinvestech.com/

- Join our Whatsapp Channel: The Market Buzz by Altius

Read More

Mohan Meakin Reports Strong Q3 FY25 Performance with Robust Revenue Growth