About The Company

Established in January 1991, Jyoti CNC Automation Limited is a leading manufacturer and supplier of CNC machines based in India. Specializing in CNC turning centres, turning-milling centres, vertical and horizontal machining centres, 3-axis, and 5-axis machining centres, as well as multi-tasking machines, the company boasts an extensive product range.

With a customer base that includes prestigious entities such as the Indian Space Applications Center (ISRO), BrahMos Aerospace Thiruvananthapuram, Turkish Aerospace, and Tata Sikorsky Aerospace, Jyoti CNC has earned a reputation for delivering high-quality CNC machines. Other notable clients encompass diverse industries, including aerospace, defence, engineering, and manufacturing.

Key Highlights of Jyoti CNC’s Global Reach and Operational Strengths (as of June 30, 2023)

Jyoti CNC offers a comprehensive portfolio of CNC machines, comprising 200 types across 44 series. Over the past three financial years, the company has successfully supplied more than 7,200 machines to over 3,000 customers globally, reaching markets in India, Europe, North America, and parts of Asia. Since April 1, 2004, the company has achieved a significant milestone by delivering over 30,000 CNC machines worldwide.

The company’s global reach is facilitated by its distribution network through Huron’s established dealers and a network of 29 sales and service centers in key locations, including Romania, France, Poland, Belgium, Italy, and the UK.

Jyoti CNC operates three manufacturing facilities, with two located in Rajkot, Gujarat, and another in Strasbourg, France. The Strasbourg facility is equipped with the capabilities to design, develop, and manufacture the entire product line.

As of June 30, 2023, the company’s production capacity in India stood at 4,400 machines per year, supplemented by an additional 121 machines per year from the facility in France.

Highlighting its robust financial standing, the company reported an order backlog of ₹31,430.56 million as of June 30, 2023, which includes a significant ₹2,602.50 million order from an electronic manufacturing services (EMS) company.

With a dedicated workforce, as of June 30, 2023, Jyoti CNC employs a total of 2,573 professionals, contributing to the company’s continued success and growth in the CNC machine manufacturing industry.

Jyoti CNC Automation IPO Details

| IPO Date | January 9, 2024 to January 11, 2024 |

| Face Value | ₹2 per share |

| Total Issue Size | [.] shares (aggregating up to ₹1,000.00 Cr) |

| Fresh Issue | [.] shares (aggregating up to ₹1,000.00 Cr) |

| Issue Type | Book Built Issue IPO |

| Listing At | BSE, NSE |

| Shareholding pre issue | 195,757,090 |

Jyoti CNC Automation IPO GMP

Jyoti CNC Automation IPO GMP is ₹60 as on 3rd January,2024.

Jyoti CNC Automation IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not less than 75% of the Net Issue |

| Retail Shares Offered | Not more than 10% of the Net Issue |

| NII (HNI) Shares Offered | Not more than 15% of the Net Issue |

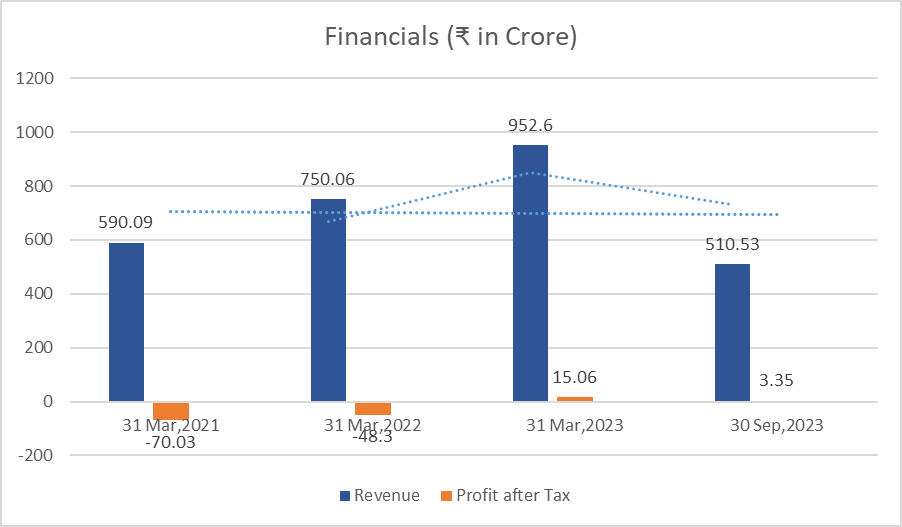

Jyoti CNC Automation Limited Financial Information (Restated Consolidated)

₹ in Crore

| Period Ended | 30 Sep, 2023 | 31 Mar,2023 | 31 Mar,2022 | 31 Mar,2021 |

| Assets | 1,706.07 | 1,515.38 | 1,286.24 | 1,388.19 |

| Revenue | 510.53 | 952.60 | 750.06 | 590.09 |

| Profit After Tax | 3.35 | 15.06 | (48.30) | (70.03) |

| Net Worth | 205.63 | 36.23 | (29.68) | 18.67 |

| Reserves and Surplus | 213.33 | 49.14 | 11.67 | 83.11 |

| Total Borrowing | 821.40 | 834.97 | 792.16 | 725.12 |

Key Performance Indicator

| KPI | Values |

| ROE | 18.35% |

| ROCE | 9.50% |

| Debt/Equity | 10.17 |

| EPS(Rs) | 1.02 |

| RONW | 18.35% |

Strengths of Jyoti CNC Automation Limited IPO:

- Industry Reputation: Established in 1991, Jyoti CNC has a long-standing reputation as a leading manufacturer and supplier of CNC machines, showcasing expertise and reliability.

- Diverse Product Portfolio: A comprehensive range of CNC machines, with 200 types across 44 series, catering to various industries, indicating versatility and market adaptability.

- Global Presence and Distribution Network: A strong global reach facilitated by distribution through Huron’s dealers and a network of 29 sales and service centers in key international locations, contributing to market penetration.

Weaknesses of Jyoti CNC Automation Limited IPO:

- Dependency on Global Economic Conditions: Sensitivity to global economic fluctuations, as the demand for CNC machines is often linked to the overall health of manufacturing and industrial sectors.

- Concentration of Manufacturing Facilities: The concentration of manufacturing facilities in India and France may pose operational risks, such as supply chain disruptions, geopolitical issues, or regulatory challenges specific to these regions.

- Order Backlog Dependency: While a substantial order backlog is reported, the dependence on a few large orders, like the ₹2,602.50 million from an electronic manufacturing services (EMS) company, may expose the company to potential risks if these orders are delayed or cancelled.

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

To know, more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

You can also checkout the list of Best 5 Unlisted Shares to Buy in India

For Direct Trading, Visit – https://trade.altiusinvestech.com/.

To know more about How to apply for an IPO? Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/