Off-market transfers of unlisted shares with consideration will attract a 0.015% stamp duty.

Say if you are transferring securities worth 100,000 INR, stamp duty @ 0.015% will be 15Rs.

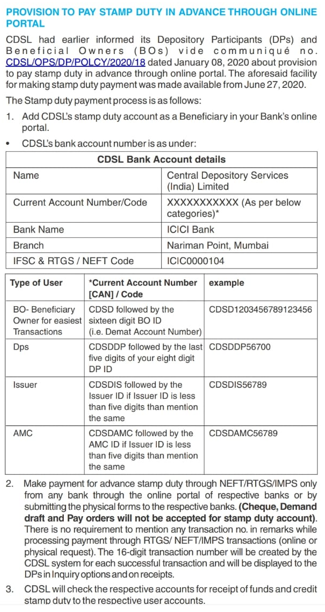

Method of paying stamp duty varies as per the depository you are having an account with CDSL or NSDL. Links to payment for stamp duty

NSDL- To calculate and pay stamp duty in NSDL (Click Here)

CDSL- To calculate stamp duty in CDSL (Click Here) . Make payment for advance stamp duty through NEFT/RTGS/IMPS only from any bank through the online portal of respective banks or by submitting the physical forms to the respective banks.

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

To know, more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

You can also checkout the list of Best 5 Unlisted Shares to Buy in India

For Direct Trading, Visit – https://altiusinvestech.com/companymain.

To know more about How to apply for an IPO? Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/

Having read this I thought it was extremely informative.

I appreciate you finding the time and effort to put this information together.

I once again find myself spending way too much time both reading and leaving comments.

But so what, it was still worthwhile!

Paid share transfer fee online at nsdl.

Pl advise how to generate payment challan.

Thanks