DSE Estates Limited: Company Overview

DSE Estates Limited, formerly known as Delhi Stock Exchange Limited (DSE), is located in Delhi, surrounded by the economically vibrant states of Northern India, which significantly contribute to the nation’s growth and have a large number of Small and Medium Enterprises (SMEs). Established in 1947, DSE is one of India’s oldest stock exchanges, coinciding with the country’s independence.

Over the years, DSE has played a crucial role in fostering economic development by promoting investments and encouraging an equity culture in northern India. It has supported companies in capital and net-worth creation since its inception, while also contributing to spreading financial literacy across a broader population. In 2007-08, the exchange successfully demutualized, achieving a minimum public holding of 51%.

Looking to the future, DSE Estates plans to revive its trading operations, incorporating global technology and expertise to reclaim its position as a leading stock exchange in India. The company aims to play a significant role in the growth of India’s capital market.

| Company Name | DSE Estates ltd. |

| Company Type | Unlisted Public Company (Buy unlisted shares) |

| Industry | Stock Exchange |

| Founded | 1947 |

| Registered Address | New Delhi, Delhi, 110002 |

Industry Overview

The Indian stock market, known for BSE and NSE, offers investment opportunities with brokers earning a 2-5% commission. Gold remains an attractive investment, and stock trading has shifted to an online process, influenced by inflation and economic factors like GDP, exports, and imports.

Blue-chip companies, recognized for financial stability and profitability, thrive even in adverse conditions, offering reliable growth. Tesla is now a blue-chip stock, joining the S&P 500. Company growth depends on efficient operations and strategic management, with profitable firms delivering strong returns to shareholders. Investors should analyze business models and consider macroeconomic factors like government policies and interest rates.

On January 22, 2024, India’s stock market capitalization reached $4.33 trillion, surpassing Hong Kong’s $4.29 trillion. India has two primary stock exchanges: the Bombay Stock Exchange (BSE), established in 1875 and the country’s oldest, and the National Stock Exchange (NSE), founded in 1992 and the largest by trading volume.

Both exchanges are regulated by the Securities Exchange Board of India (SEBI). The key market indexes are the Sensex for BSE and Nifty for NSE. As of January 30, 2024, the BSE had 5,315 listed firms, while the NSE had 2,266 as of December 31, 2023. Most major Indian companies are listed on both exchanges.

Services

The Delhi Stock Exchange (DSE) offers a range of services to its stakeholders, focusing on trading, investor protection, and market infrastructure. Key services provided by DSE include:

Securities Trading Platform:

- Equity Trading: Facilitating the buying and selling of equity shares.

- Debt Instruments: Providing a platform for trading government and corporate bonds.

- Mutual Funds: Allowing investors to trade mutual fund units.

- Derivatives Trading: Offering derivatives such as futures and options on various securities.

Listing Services:

- Company Listings: Helping companies raise capital by listing their securities on the exchange.

- Initial Public Offerings (IPOs): Assisting in the process of IPOs and offering a marketplace for new issues.

Investor Services:

- Investor Protection Fund: Safeguarding the interests of investors in case of defaults or disputes.

- Investor Education: Offering educational programs and resources to help investors make informed decisions.

Membership Services:

- Trading Membership: Providing membership to brokers and other participants, allowing them to trade on the DSE platform.

- Deposit-based Trading Membership (DTM): A flexible membership system for brokers based on deposit requirements.

Clearing and Settlement:

- Clearing and Settlement of Trades: Ensuring smooth, secure, and transparent clearing and settlement processes for trades executed on the exchange.

Market Data and Analytics:

- Real-Time Market Data: Providing investors and brokers with real-time data on stock prices, indices, and other market information.

- Market Analysis Reports: Offering analysis and insights on market trends and company performances.

Regulatory and Compliance Services:

- Regulatory Oversight: Enforcing market regulations to ensure transparency and fair trading practices.

- Compliance Support: Helping listed companies and brokers maintain compliance with regulatory norms.

These services aim to enhance market transparency, protect investor interests, and provide efficient trading infrastructure for participants.

Timeline

- Delhi Stock Exchange (DSE) was incorporated on June 25, 1947.

- In June 1956, DSE began recording transactions in Chopri.

- In December 1957, DSE received recognition under the Securities Contracts (Regulation) Act (SCRA) of 1956.

- DSE obtained permanent recognition under SCRA in March 1982.

- Computerized trading at DSE commenced in February 1987.

- The DSE Index was launched in February 1988.

- In March 1989, the Investor Protection Fund was constituted by DSE.

- The DSE Index crossed 1,000 points in April 1992.

- In June 1996, DSE formed its subsidiary company, DSE Financial Services Limited (DFSL).

- In March 1997, DSE listed its highest number of companies, totaling 3,895.

- Online trading was launched by DSE in August 1997.

- The DSE House was inaugurated in December 1997.

- On February 28, 2000, DSE achieved its highest trading volume of Rs. 1,070 crores.

- In August 2007, DSE successfully completed its demutualization process.

- The Deposit-based Trading Membership (DTM) was launched by DSE in June 2009.

- The discontinuation of the DSE Estates in January 2017.

Objectives, Vision & Mission

Objectives:

DSE is soon launching its Nationwide Trading Platform with several key objectives. These include providing an online trading platform for securities accessible across the country. DSE aims to offer trading access to all investors through the most appropriate and cost-effective trading network. Additionally, it seeks to focus on investor education, helping to create a nation of informed investors.

Vision:

DSE is dedicated to becoming a globally recognized stock exchange, striving to create a nation of well-informed investors.

Mission:

DSE’s mission is to provide a cost-effective, transparent, and single-window service to various stakeholders.

Management

Mr. Vijay Bhushan – Chairman

Mr. Mahender Kumar Gupta – Director

Mr. Hans Raj Kapoor – Director

Mr. Vinod Kumar Goel – Director

Financial Highlights

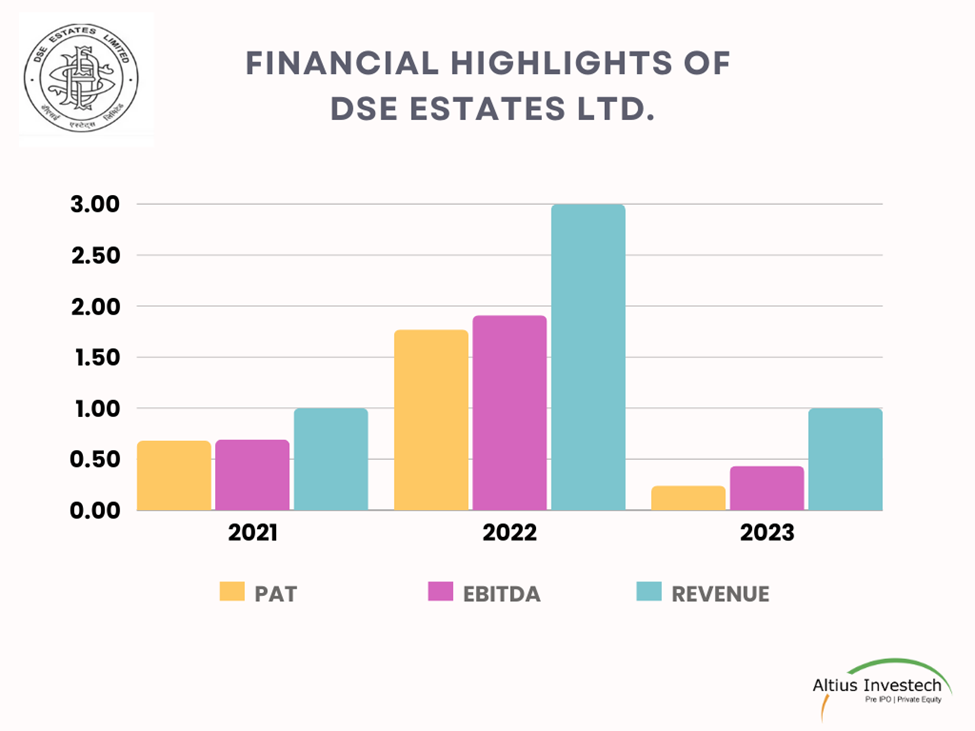

₹ in Cr.

| Financials | 31st March, 2023 | 31st March, 2022 | % decrease |

| Revenue | 1.08 | 2.8 | 60% |

| EBITDA | 0.43 | 1.91 | 77% |

| PAT | 0.24 | 1.7 | 86% |

| EPS | 40.02 | 295.23 | 86% |

| PAT Margins | 22% | 64% |

Valuation

| Share Price | 12 |

| Outstanding shares | 6 (Cr. Approx) |

| MCAP | 72 (Cr. Approx) |

| P/E Ratio | 0.3 |

| P/S Ratio | 66.21 |

| P/B Ratio | 24 |

| Book value per share | 0.50 |

SWOT Analysis

Strengths:

- DSE had strong brand recognition and trust among regional investors.

- Provided localized trading services and capital access for Delhi-NCR SMEs.

- Offered lower listing costs compared to BSE and NSE, appealing to smaller companies.

- Had a robust physical presence and infrastructure, with a network of brokers and traders.

Weaknesses:

- Low trading volumes and liquidity made DSE less attractive compared to larger exchanges.

- NSE’s rise and BSE’s dominance led to DSE’s decline in market share and relevance.

- Slow adoption of advanced trading technologies hindered DSE’s competitiveness.

- SEBI’s suspension exposed governance and compliance issues, damaging DSE’s credibility.

Opportunities:

- Target SMEs and startups with tailored listing and trading services.

- Leverage Delhi-NCR’s economic growth to attract regional businesses.

- Form alliances with fintech firms and regional exchanges to boost technology and services.

- Revive and rebrand to focus on emerging sectors and innovative financial products.

Threats:

- BSE and NSE offer more liquidity, better technology, and wider investor participation.

- Reviving DSE would require meeting stringent SEBI regulations, demanding substantial investment and restructuring.

- Restoring confidence after inactivity and suspension would need significant efforts in governance and transparency.

- Rapid tech advancements could further marginalize DSE if it doesn’t keep up with trends like algorithmic trading and blockchain.

DSE Estates Ltd. unlisted shares are currently trading at ₹12, CLICK HERE to Invest.

Read Our Other Blogs

Get in touch with us

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

To know, more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

To buy unlisted shares Visit – https://altiusinvestech.com/companymain

To know more about How to apply for an IPO? Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/

Visit our website homepage: https://altiusinvestech.com/