Blog Highlights

- Journey of Leadership

- Educational Background

- Entrepreneurial Ventures

- Career Achievements

- Role on Shark Tank India

- Radhika Gupta Net Worth is INR 41 Crores.

- Investment Strategies and Philosophy

Edelweiss Asset Management CEO Radhika Gupta Net Worth in 2024 is 41 Crores.

“If everything is going wrong, our determination shows who we are”- the prominence of Radhika Gupta’s financial successes is a testament to how she has carved herself a niche as a stalwart in the Indian financial landscape.

As the CEO of Edelweiss Asset Management, she rises through the ranks with strategic foresight and acute financial acumen. She establishes herself as a trailblazer in her industry, where she leads one of the most innovative investment firms in the country, reflecting her skill and dedication.

Her effective leadership has transformatively guided the firm through phases of expansive growth while diversifying investment strategies to include both alternative and traditional assets.

Radhika Gupta Early Life & Education

Radhika is rooted in a strong economic background, anchoring her journey in excellence and knowledge. As a kid from a middle-class family, earning a place in an Ivy League school could only serve as a dream. The Penn and M&T programs aided generous financial support, and she was grateful to be identified as a distinguished alumnus by her school. She studied CSE and Mathematics at the University of Pennsylvania. She earned a degree in Economics from the renowned Wharton School.

At 24 years of age in the USA, there happened to be a financial crisis, where her unique decision to come to India and start an entrepreneurial venture came to fruition. She built the organization ForeFront Capital, after slogging in Bombay for 4-5 years. Overseeing an opportunity she sold that company to the Edelweiss Group.

Fortune happened to play an exciting role for her.

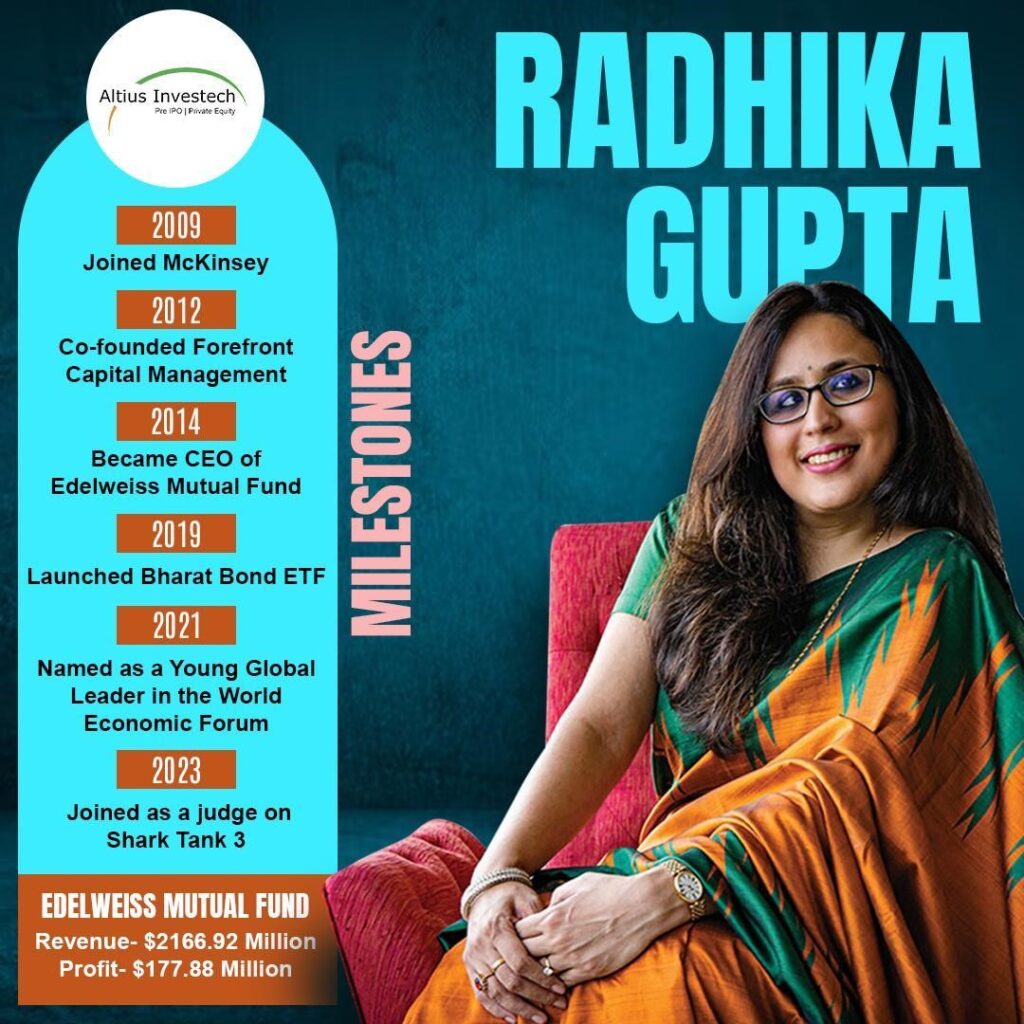

Radhika Gupta Career Milestones

Gupta’s journey is nothing short of an amalgamation of achievements, which reflects her adeptness to navigate the intricate, financial world.

Her early days in investment banking from her current role as a meticulous investor, calls out for Gupta’s career to be at the pinnacle of extraordinary.

She has co-founded Forefront Capital Management, one of India’s first alternative investment boutiques, that offer differentiated strategies on Alternative Investment Funds and PMS platforms. It was the first fund to receive a Category III AIF license, as well as a pioneer in liquid alternatives. Currently, investors in our country frequently talk about new business initiatives where they believe that their ROI would be the new-age disruption!

Forefront had been attained by Edelweiss Financial Services, in 2014. It is presently referred to as Edelweiss Multi-Strategy funds.

Post 2014, as the Business Head of Edelweiss Multi-Strategy funds, she grew the business from Rs 150 Crores at acquisition to Rs 2000 Crores in a little above 2 years. It has become the country’s most dominant player in the listed alternatives space. She led the acquisition of Ambit Alpha Fund in 2016 and integrated JPMorgan into Edelweiss AMC through 2016.

From 2017 to the present, she has been the CEO of one of the fastest-booming companies of asset management, across public market alternatives or traditional mutual funds. They handle more than 1 lakh Crores in AUM or $12 Billion, becoming one of the innovative asset managers in the country.

For overseeing sales and marketing, investments, operations, and technology, which would create a high-quality business and team. By 2023, the company’s money grew from Rs 6700 Crore to 104896 Crore, showing her unrivaled dedication.

Radhika has deservedly bagged a place in lists containing powerful entrepreneurs- for instance, the “Forbes Women Power- Self-made Women, India 2022”, and “Economic Times’ 40 Under 40 Business Leaders Award”.

Radhika Gupta’s Leadership Philosophy & Advocacy

Radhika advocates for inclusive growth and proactive problem solving, for the dynamicity in her leadership style. She supports gender equality, which is visible through her actions of mentoring young women and encouraging their ascent, within the industry. She creates an equitable financial landscape, where her efforts happen to go beyond corporate policies.

Gupta oversees assets worth billions, which steers her company Edelweiss to unprecedented heights. Her leadership and strategic vision get her accolades from industry experts and peers alike, which firmly cements her position as a reputed, visionary leader.

With a few easy steps, you can reap benefits from her analyses, through investment in pre IPOs companies , P2P Lending & Frac Real Estate. high-Yield NCDs.

Shark Tank India- A Platform for Influence

Shark Tank India has given a suitable platform where Radhika could utilize her expertise to have an impact on a broader audience. The demonstration of her keen insight into market potential and business models shows ways in which she could guide aspiring entrepreneurs on financial structuring and business scaling. Her decisions highlight an understanding of the risks and potential returns, undoubtedly shaped by her extensive asset management background.

Radhika had pre-hinted that her investments on the show would be calculated decisions and limited in nature, as compared to investments made by other sharks.

Her strategic decisions and astute investments make her amass a considerable fortune, which solidifies her position as a formidable force. She has invested in startups such as Deeva, JewelBox, CanvaLoop Fibre, Dil Foods, Cool The Globe, and Tohands, to name a few.

The show typically highlights the importance of investment strategies and financial planning. Don’t fall back and invest to earn remarkable returns with Altius Investech. Invest with confidence and make some money!

Radhika Gupta Net Worth in 2024 and Investment Strategy

Radhika Gupta net worth is reflective of her smart investment choices alongside her successful career. She remains known for her bold and prudent investment strategies, which mix a solid base of long-term, stable investments for high-growth ventures.

Her approaches are showcased on Shark Tank as well, where she invests in startups promising sustainability and scalability. Beyond her television persona, her portfolio includes real estate holdings and a collection of high-end automobiles, showcasing her appreciation for valuable assets.

As the CEO and MD of Edelweiss Mutual Fund, she boasts a net worth of around INR 41 Crores. Gupta shares insightful tips that are likely to hold investors in proper stead.

She signifies how it’s necessary to save a part of the income and incur wise investments. She advises how after the deduction of expenses and taxes from an individual’s earnings, one should try saving at least 20-50% of the remaining amount.

Radhika Gupta Net Worth Growth Over The Years.

Radhika Gupta Investment Strategy

One can also make SIPs or systematic investment plans to cultivate an investment habit. Although this might seem challenging for beginners, she emphasizes how investing and saving are crucial for long-term financial security. SIPs give disciplined approaches to saving while enabling individuals to invest systematically for their goals, allowing compounding returns with time. Read More.

Altius Investech allows you to take the first step toward a prosperous future. Do not fret if you are a beginner as we have your back, find our guide to start investing seamlessly.

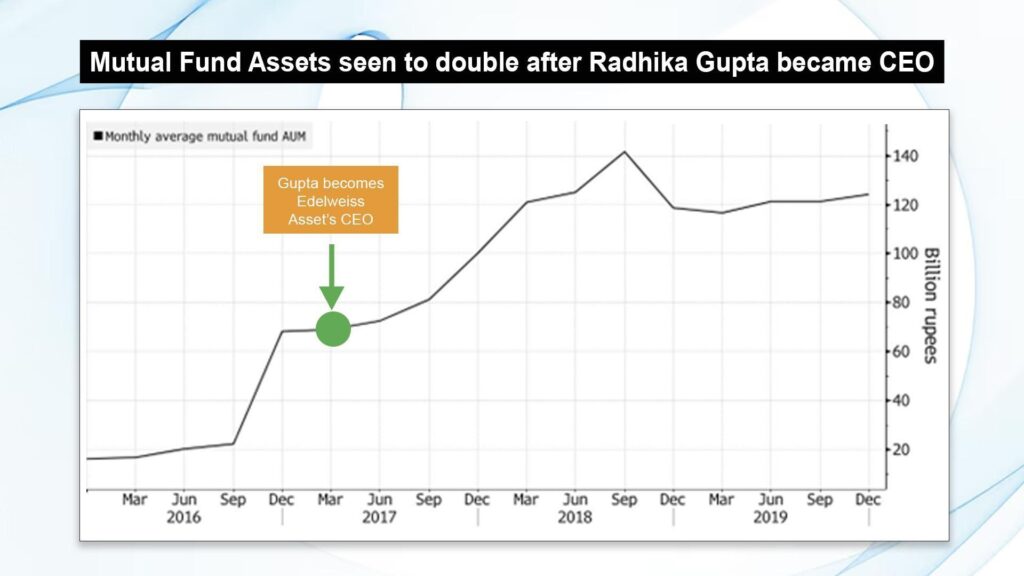

Edelweiss Mutual fund assets doubled after Radhika became the CEO

Mutual funds tend to pool money from different investors for investing in a diverse portfolio of bonds, stocks, and assets. The diversification decreases risk as investments are spread across various securities and sectors, making it easy for people to access professionally managed portfolios. Certain fund schemes like ELSS or Equity Linked Savings Schemes, also offer tax advantages according to the Income Tax Act’s Section 80C.

Conclusion

Radhika Gupta’s journey from an entrepreneur to the CEO of Edelweiss Asset Management amplifies her profound impact on the finance sector and contributes to the growth of her net worth. Her strategic advocacy and acumen for gender equality have not just advanced her company but also inspired an inclusive financial landscape.

Her commitment to unique investment opportunities paves a way for savvy strategies that can be accessed by all. As Radhika influences the industry through her Shark Tank India role, she offers guidance to entrepreneurs aiming for success. Follow her insights and start the journey with Altius to navigate through financial markets with confidence.

FAQs

Her net worth has been estimated to be 41 Crores INR, showing her success in asset management as well as strategic investments.

Radhika Gupta utilizes her financial acumen to choose startups with strong, scalable business models and potential for long-term success, emphasizing innovative and sustainable solutions.

Entrepreneurs can learn the importance of due diligence, diversification, and focusing on scalable, innovative business models from Radhika Gupta’s investment strategies.

Radhika empowers women by advocating gender equality in finance, supporting women-led startups, and providing mentorship to assist women ascend in their entrepreneurial journeys.

GET IN TOUCH WITH US

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

Click here to connect with us on WhatsApp

For Direct Trading, Visit – https://trade.altiusinvestech.com/.

ALSO READ OUR OTHER BLOGS