Ashish Kacholia Invests in Orbis Financial: A Strategic Move in the Financial Sector

Orbis Financial, a securities services provider, announced on Tuesday that it had raised Rs 111 crore from existing and new investors, including investor Ashish Kacholia.

Orbis Financial’s sole adviser for the latest transaction was Mumbai-based boutique investment banking firm DerivativeSaint.

According to a press release, Orbis Financial intends to use the raised capital to capitalise on the growth momentum and further strengthen its position as the market leader in the securities services business in India.

The Gurugram and Mumbai-based company provides securities services to institutional investors, particularly mutual fund houses, foreign portfolio investors, institutional investors, family offices, and high-net-worth individuals (HNIs) across segments.

Custodial banking services entail the settlement, safekeeping, and reporting of investors’ securities and cash.

Shyam Agarwal, the company’s managing director (MD) and chief operating officer, currently leads Orbis Financial (CEO). Agarwal was the head of the custody business at ICICI Bank before joining Orbis in 2017.

The firm is registered with the market regulator Securities and Exchange Board of India (Sebi) as a designated depository participant for foreign portfolio investors and a clearing member on multiple exchanges, including the NSE, BSE, MSEI, and MCX, in a variety of segments. It also participates as a depositary with the securities depositories NSDL (National Securities Depository Limited) and CDSL (Central Depository Services).

The company also provides trustee services through its subsidiary Orbis Trusteeship Services Private Limited, which is registered with SEBI as ‘Trustees’ and undertakes the activities of a “Debenture Trustee”.

According to the company, it has seen stellar growth in assets under custody (AUC), clearing services, trustee, and fund accounting services, among other areas. It also claimed that the growth was highly capital-efficient, owing to a strong emphasis on unit-level economics.

It competes with several Indian banks, including Axis Bank, State Bank of India, HDFC Bank, ICICI Bank, and Kotak Mahindra Bank, as well as international investment banks, including BNP Paribas. IL&FS Securities Services, DBS Bank, Edelweiss Custodial Services, Hong Kong and Shanghai Banking Corporation, IL&FS Securities Services, and JPMorgan Chase Bank are among the other Sebi-registered securities custodians.

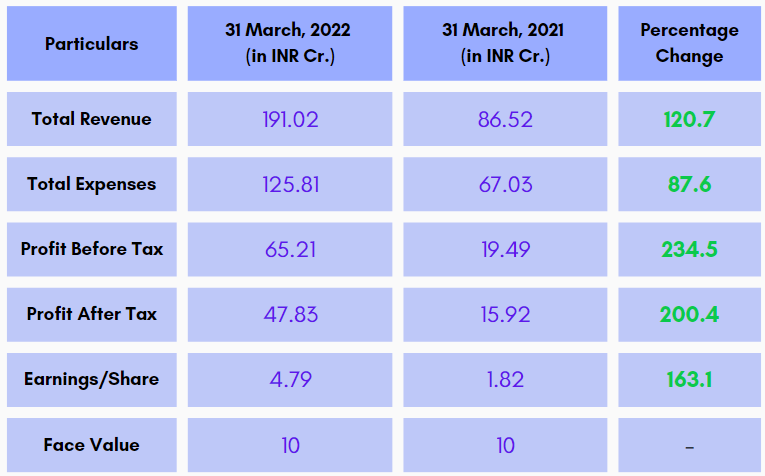

Financial Highlights

Current Market Price: Rs.88/Share (as of Feb’2023)

Current Market Cap: Rs.811.11 Cr (as of Feb’2023)

Invest in Orbis Financial unlisted shares via Altius Investech.

Get in Touch with us

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

To know more about Orbis Financial Corporation Limited Share Price, Click Here- https://altiusinvestech.com/company/orbis-financial-corporation

To know more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

To know more about How to apply for an IPO? Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/

Also Read our other blogs: