Orbis Financial Corporation Limited: About the Company

Established in 2009, Orbis Financial Corporation Limited is a trusted financial custodian known for its tailored services that help investors manage their money securely. With a focus on providing custodial services to various investor segments, including brokers, managers, and funds, Orbis stands out for its advanced technology solutions and customized reporting. Their state-of-the-art systems ensure flexibility and efficiency, while their personalized reports empower investors to make informed decisions. Orbis’s commitment to safety is demonstrated through its prestigious certifications, reassuring clients of the reliability and security of their investments. Overall, Orbis Financial Corporation Limited serves as a dependable partner in the financial industry, offering innovative solutions and peace of mind to investors.

| Company Name | Orbis Financial Corporation Limited |

| Company Type | Unlisted Public Company |

| Industry | Finance |

| Founded | 2005 |

| Headquarters | Haryana, India |

| Website | https://www.orbisfinancial.in/ |

Products and Services of Orbis Financial Corporation Limited

1. Custody Services:

- Designated Depository Services

- Custody & Depository Services

- Derivative Clearing Services

- Fund Accounting & Customer Reporting Service

- FX Execution

2. Registrar to an Issue (RTA) and Share Transfer Agent (STA) Services:

- Support for initial public offerings

- Maintenance of Securities Registry

- Shareholder-relationship consulting

- Securities administration consulting

3. Seamless Integration of Technology and Industry Knowledge:

- Online Solution: OrbisConnect

- Easy-to-use platform for upgradation and adaptive technology

- Secured system with 24-hour access

- Allows clients to view, organize, export, and analyze data

4. Trusteeship Services:

- Offered to a wide variety of clients including Equity Funds, Alternative Investment Funds, NBFC’s, Corporates, Insurance, Banking Institutions, and Non-Profit Organizations

- Covers financial products such as debentures, bonds, and term loans

- Directed towards corporate formation, market entry services, due diligence, and enforcement services for both domestic and foreign entities

Management of the Company

ATUL GUPTA: Founder & Executive Chairman

Mr. Atul Gupta is a qualified Chartered Accountant and a first-generation entrepreneur with 40+ years of rich multi-faceted experience including Management Consulting, Manufacturing sector, Banking and Financial Services in India & Australia. He had authored a professional reference book titled “Guide to Project Financing” that was a best seller in its year of publication. During his years in Melbourne, he had conceived the need for Custody services beyond the institutional segment leading to the conception of Orbis Financial Corporation Limited.

SHYAMSUNDER AGARWAL:Managing Director & CEO

Shyamsunder Agarwal is a Chartered Financial Analyst and a Chartered Accountant with more than 2 decades of rich, rare, and diverse experience in Banking, Custody and Capital Markets. He brings rich domain expertise and thorough understanding of the specialized segments of the Capital Market. In his previous role as the Business Head at ICICI Ltd, he had been responsible for business and product development, delivering superior client satisfaction with enhanced financial results through proactive engagement with Foreign & Domestic Institutional Clients, Broker Dealers & Investors.

MANASI GUPTA:Non-Executive Director

Ms. Manasi is a graduate in Law and Commerce from the University of Melbourne. She has rich litigation experience in the Delhi High Court and Supreme Court through her employments at Karanjawala & Co and Trilegal.

Subsidiary Companies

| Name | State | Incorporation Year | Paid Up Capital |

| Orbis Trusteeship Services Private Limited | Haryana | 2020 | 10.11 Cr |

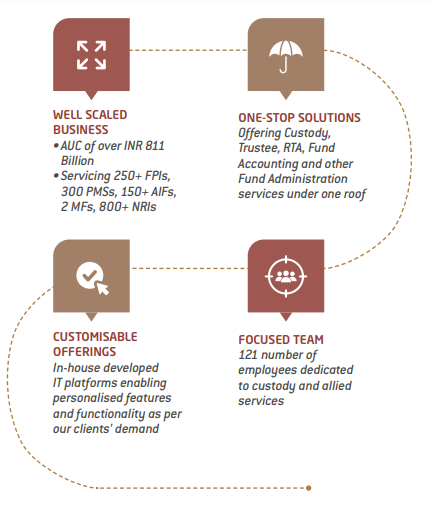

Strategic Advantage

Orbis Financial Corporation Limited: Awards and Recognition

2020

- Maiden Dividend in FY20

- Assets under Custody increased to Rs. 10,000 crores in March 2020

2021

- Additional capital raising in FY21@ Rs. 27 per share.

- Branch office in Gift City operationalized to provide Trusteeship services as per regulatory guidelines.

2022

- Additional capital raising in FY22 @ Rs. 40.50 per share.

- Net worth increases to Rs. 220 crores as at March 31, 2022.

- Crossed 2,000 mark of onboarded custody clients.

- Assets under custody increased to Rs. 67,369 crores in March 31, 2022.

2023

- Another round of capital raising of Rs. 112 crores in January 2023 from marquee investors.

- Crossed 2,700 mark of onboarded custody clients with Assets under Custody increasing to INR 81,160 crores as on March 31, 2023.

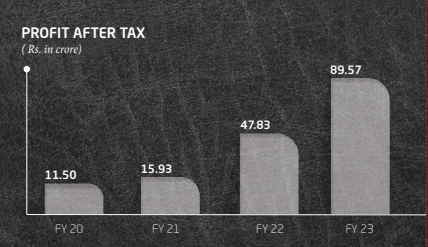

- Record PAT of INR 89 crores for FY23.

- Average volume across cash and derivative markets increases to INR 13,000 crores on daily basis.

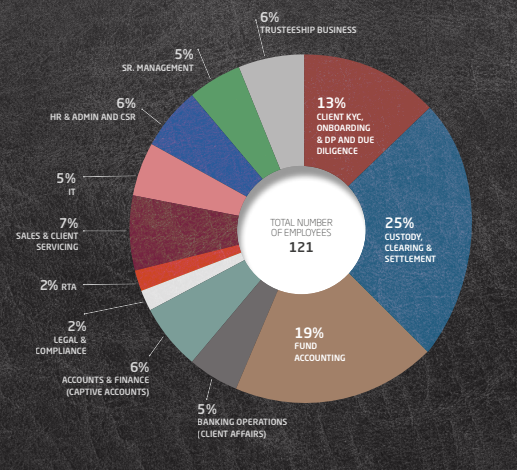

Orbis Financial Corporation Limited: Department wise employee allocation

Corporate Action of Orbis Financial Unlisted Share

| Financial Year | Particulars | Record Date | Ratio/Rates/Amount | Remarks |

| 2022-23 | RIGHTS | 18-Nov-2022 | 1:06 | Orbis financial corporation ltd has offered RIGHTS share in the ratio of 01 Equity Share for every 6 Equity Shares (1:6) of face value Rs 10 per share at premium of Rs 59.00/- per share for cash. |

| 2020-21 | RIGHTS | 28-Jan-2022 | 1:16 | Orbis financial corporation ltd has offered RIGHTS share in the ratio of 01 Equity Share for every 16 Equity Shares (1:16) of face value Rs 10 per share at premium of Rs 30.50/- per share for cash. |

| 2021-22 | DIVIDEND | 30-Sep-2022 | 0.5 | Orbis financial corporation ltd has declared a dividend of Rs.0 .50 per equity share of Rs. 10 each fully paid-up. |

Orbis Financial Corporation Limited Raises Rs 102 Crore in Funding Round Led by Investor Ashish Kacholia

Orbis Financial Corporation Limited has secured Rs 102 crore in its latest funding round led by investor Ashish Kacholia. This marks the second round of investment by Kacholia, following a previous funding of Rs 111 crore. Derivative Saint served as the exclusive advisor in both funding rounds. The newly raised funds will be utilized to bolster Orbis Financial’s position in the financial securities market. Orbis Financial Corporation Limited offers professional services and solutions to various investor segments, including Foreign Portfolio Investors (FPIs), insurance companies, and high-net-worth individuals (According to the news-December 2023).

You can check https://altiusinvestech.com/blog/ashish-kacholia-invests-in-orbis-financial/ to know more about this news.

Competitors of Orbis Financial Corporation Limited

| Legal Name | Revenue (Rs. Crore) | City |

| IKM INVESTORS PRIVATE LIMITED | 68.14 | NEW DELHI |

| RJ CORP LIMITED | 67.66 | NEW DELHI |

| VIJIT GLOBAL SECURITIES PRIVATE LIMITED | 63.64 | INDORE |

| SUSHIL FINANCIAL SERVICES PRIVATE LIMITED | 63.60 | MUMBAI |

Financials

₹(in crores)

| Particulars | FY 2020 | FY 2021 | FY 2022 | FY 2023 |

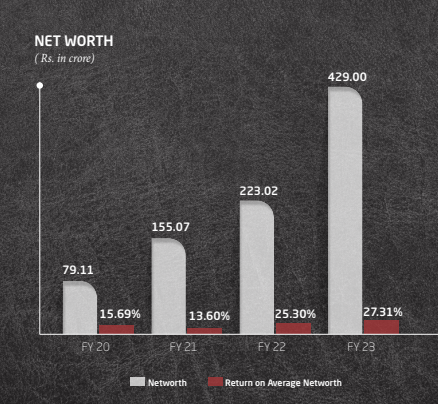

| Net Worth | 79.11 | 155.07 | 223.02 | 429.00 |

| Return on Average Net worth | 15.69% | 13.06% | 25.30% | 27.31% |

| Profit After Tax | 11.50 | 15.93 | 47.83 | 89.57 |

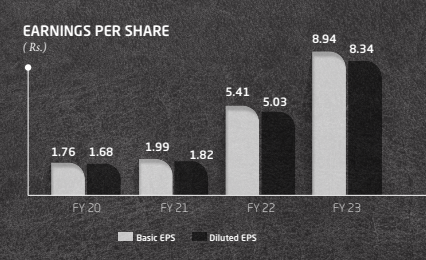

| Earning Per Share | 1.76 | 1.99 | 5.41 | 8.94 |

Financial Overview of Orbis Financial Corporation Limited for the fiscal years (FY) 2020 to FY 2023:

- Net Worth: Orbis Financial Corporation Limited’s net worth has shown consistent growth over the years, more than doubling from FY 2020 to FY 2021, and continuing to increase significantly in FY 2022 and FY 2023. This indicates a healthy expansion of the company’s asset base and overall financial strength.

- Return on Average Net Worth: Orbis Financial Corporation Limited’s Return on Average Net Worth has fluctuated but generally remained at healthy levels throughout the period. There was a significant increase in Return on Average Net Worth from FY 2021 to FY 2022 and further growth in FY 2023, suggesting improved efficiency in generating profits relative to its net worth.

- Profit After Tax (PAT): The company’s Profit After Tax has shown remarkable growth year over year, with substantial increases from FY 2020 to FY 2021, FY 2021 to FY 2022, and FY 2022 to FY 2023. This indicates strong profitability and successful business operations.

- Earnings Per Share (EPS): Orbis Financial Corporation Limited’s Earnings Per Share has also experienced significant growth over the years, reflecting the company’s ability to generate more profits on a per-share basis. The EPS has more than doubled from FY 2020 to FY 2023, indicating increased earnings available to shareholders.

Orbis Financial Corporation Limited Share Price (as on 04.03.2024)

- The buy price of Orbis Financial Corporation Limited varies based on quantity, ranging from 257 for quantities between 500 – 999 shares to 253 for quantities between 2500 – 4999 shares, with corresponding rates per share.

- The 52-week high is 259, and the 52-week low is 77 indicating the range of fluctuations in the share price. Additionally, the sell price of Orbis Financial Corporation Limited is fixed at 235.

Currently Orbis Financial Corporation Limited Share Price is trading at around Rs. 259/share. CLICK HERE to Invest by Altius Investech.

Financial Metrics for Orbis Financial Corporation Limited (as on 04.03.2024)

| Particulars | Amount |

| Price to Earning Ratio (P/E) | 32.15 |

| Price to Sales Ratio (P/S) | 9.43 |

| Price to Book Value (P/B) | 10.77 |

| Industry PE | 0 |

| Face Value | ₹ 10 |

| Book Value | ₹ 23.49 |

| Market Cap | ₹ 2796.38 Cr |

| Dividend | 0.5 |

| Dividend Yield | 0.2 % |

Orbis Financial Corporation Limited Raises FY23 Dividend to Rs. 0.80

Orbis Financial Corporation Limited increases FY23 dividend to Rs. 0.80 per share, up from Rs. 0.50 in the previous year, reflecting strong performance and commitment to shareholder value

Shareholdings of Orbis Financial Corporation Limited

| Shareholding Above 5% | Holding % |

| Atul Gupta | 28.12 |

| Atul Gupta Trustee of Orbis Foundation | 7.18 |

| Manasi Gupta | 1.21 |

Orbis Financial Corporation Limited: A Leader in IPO Services for Clients, No Immediate Plans for Own IPO

Orbis Financial Corporation Limited stands as a distinguished provider of IPO services, adept at guiding clients through the complexities of going public. Despite this expertise, the company currently harbors no plans for its own initial public offering (IPO). Orbis Financial Corporation Limited’s decision underscores its commitment to maintaining autonomy and flexibility in its growth strategies, prioritizing client needs, innovation, and long-term value creation. While acknowledging the potential benefits of going public in the future, the company remains focused on delivering exceptional services to its clients and charting its own path of sustainable growth as a privately held entity.

Conclusion

- Financial Performance: Orbis Financial Corporation Limited has demonstrated robust financial performance over the fiscal years 2020 to 2023, with consistent growth in net worth, return on average net worth, profit after tax, and earnings per share. This indicates the company’s strong position and successful business operations.

- IPO Plan: Despite not having immediate plans for its own IPO, Orbis Financial Corporation Limited excels in providing IPO services to its clients. The company is recognized for its tailored solutions, advanced technology, and commitment to client satisfaction in navigating the complexities of going public.

- Strategic Decision: Orbis Financial Corporation Limited’s decision to remain private underscores its focus on autonomy, flexibility, and long-term value creation. By staying privately held, the company can prioritize client needs, innovation, and strategic growth initiatives without immediate pressures from public markets.

- Client-Centric Approach: Orbis Financial Corporation Limited’s commitment to serving its clients remains paramount. The company’s dedication to delivering exceptional services, fostering innovation, and maintaining industry-leading standards reinforces its position as a trusted partner in the financial services sector.

- Future Outlook: While Orbis Financial Corporation Limited does not have immediate plans for an IPO, the company continues to explore opportunities for growth and expansion. With a strong foundation, innovative solutions, and a client-centric approach, Orbis Financial is well-positioned to navigate future challenges and capitalize on emerging opportunities in the dynamic financial landscape.

Get in Touch with us

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

To know more about Orbis Financial Corporation Limited Share Price, Click Here- https://altiusinvestech.com/company/orbis-financial-corporation

To know more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

To know more about How to apply for an IPO? Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/

Read our other blogs: