Blog Highlights

- Chennai Super Kings

- Streams of Revenue

- Strategic Expansions

- Considerations for Investment

- Market Valuation & Share Performance

- CSK Unlisted Shares & Price

- IPL Media Rights Auction

- Global Comparison

CSK Unlisted Shares: A Pre-IPL 2025 Investment Masterstroke?

Investing in unlisted shares of the ‘Chennai Super Kings’ franchise ahead of the Indian Premier League 2025 season presents a compelling opportunity for investors seeking to capitalize on the robust growth trajectory of one of cricket’s most successful teams.

CSK is a brand powerhouse, a fan-favourite franchise that combines iconic leadership and on-field dominance. With a sharply growing brand valuation, CSK is not just winning on the field, it is also winning in the boardroom. As Dhoni once said, “You don’t play for the crowd, you play for the country.” That same ethos of purpose, discipline, and vision has guided CSK’s growth.

This comprehensive analysis delves into CSK’s financial performance, revenue streams, strategic expansions, and the potential benefits and risks of investing in its unlisted shares.

Chennai Super Kings

Established in 2008, CSK has cemented its status as a dominant force in the IPL, boasting five championship titles and consistent playoff appearances. The franchise’s on-field success has translated into substantial brand value and financial growth, making it an attractive prospect for investors.

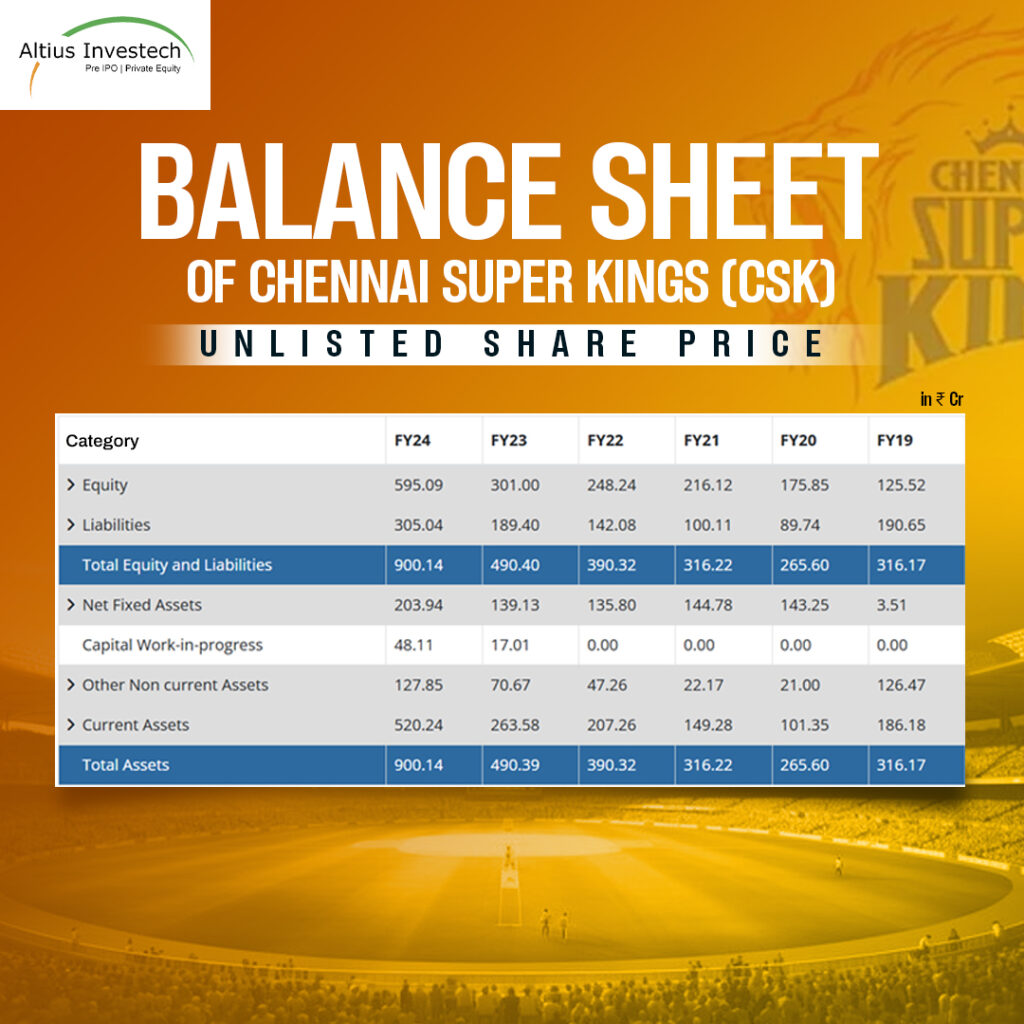

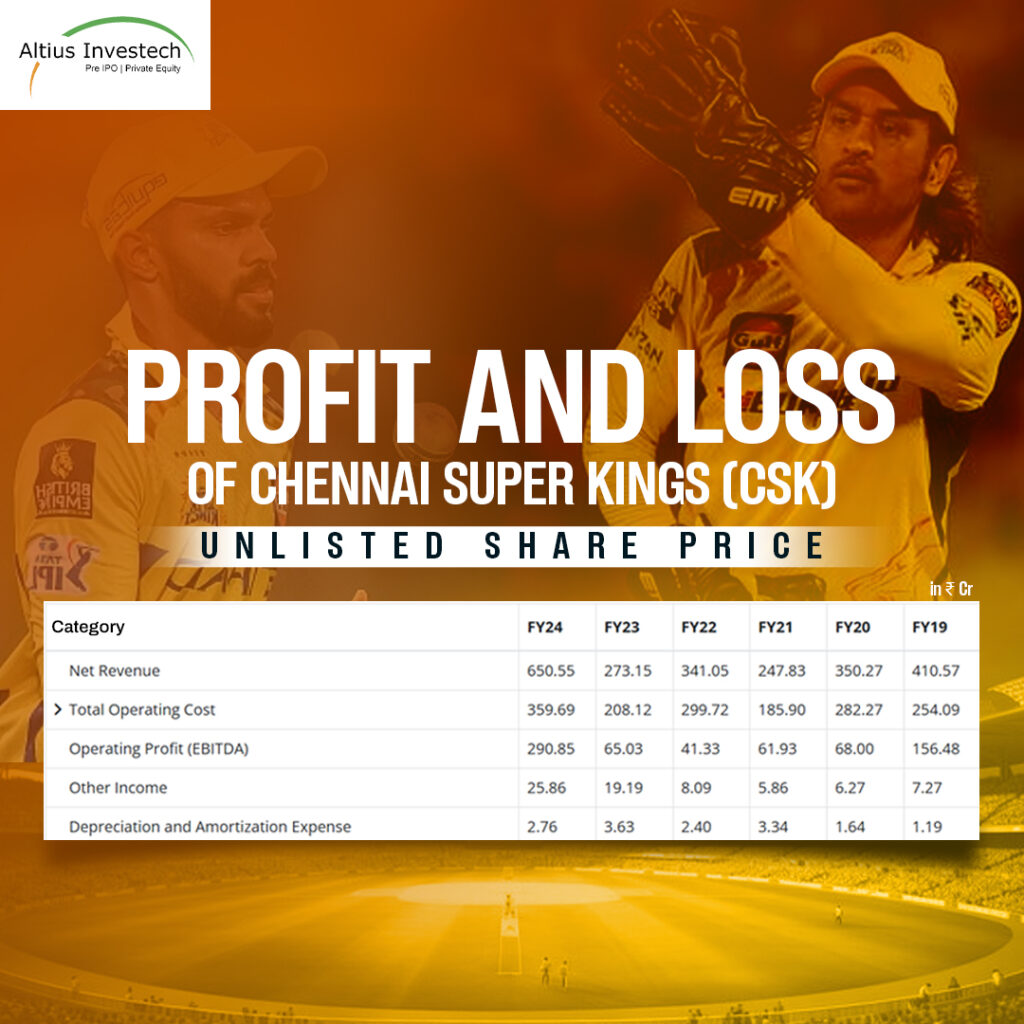

- Finances – CSK’s financial metrics have shown remarkable improvement in recent years.

- Revenue Growth – In the fiscal year ending March 31, 2024, CSK reported total revenues of Rs 676.40 Crores, a significant increase from Rs 292.34 Crores in the previous fiscal year.

- Profit Surge – The net profit for 2024 soared to Rs 229.20 Crores, marking a 340% increase from Rs 52 Crores in 2023.

- Earnings Per Share – The EPS for 2024 stood at Rs 6.14, reflecting the company’s enhanced profitability.

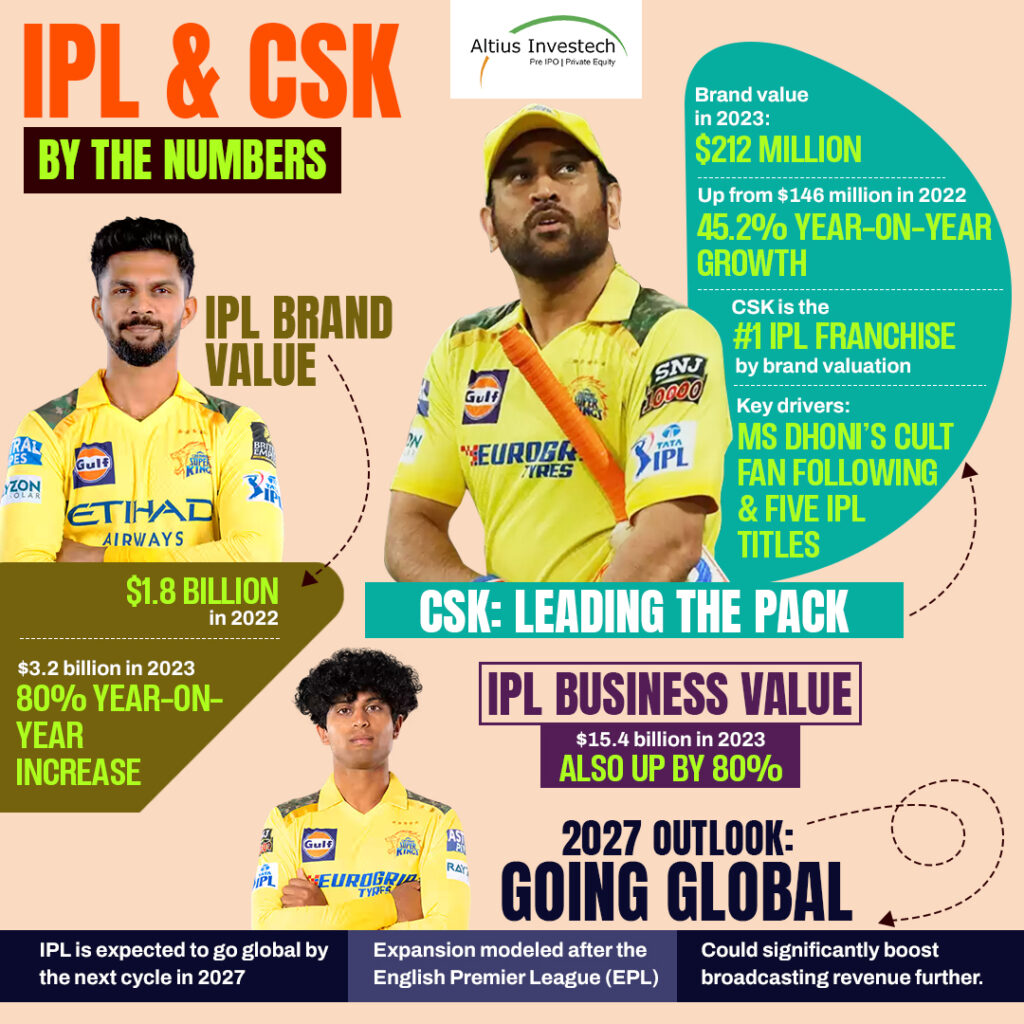

Key data points and growth drivers around the IPL and CSK:

- Brand Value Growth: IPL surged from $1.8B in 2022 to $3.2B in 2023 — an 80% increase.

- Business Value: Touched $15.4B in 2023, also up by 80%.

- Media Rights: 3x the 2017 deal, with an 18% CAGR since 2008.

- 2027 Outlook: Global expansion like the EPL could further spike media revenues.

- CSK Highlights: Brand value jumped 45.2% to $212M, powered by MS Dhoni’s legacy and five IPL titles.

You Can Also Read the Blog of Ms Dhoni’s Net Worth!

Streams of Revenue

CSK’s revenue is diversified across several key channels.

A substantial portion of CSK’s revenue is derived from the Board of Control for Cricket in India (BCCI) central rights, which contributed Rs 479.21 crore in 2024, up from Rs 191.52 crore in 2023.

Sponsorship income increased to Rs 95.47 crore in FY24 from Rs 77.75 Crores in the previous year, underscoring the franchise’s strong brand appeal.

Ticket sales and other matchday-related incomes surged to Rs 75.85 Crores in 2024, a significant rise from Rs 3.87 Crores in 2023, indicating a robust return of fan engagement post-pandemic.

Strategic Expansions

CSK has strategically expanded its footprint beyond the IPL:

- International Ventures: The franchise owns the Joburg Super Kings in South Africa’s SA20 league and has invested in the Texas Super Kings in the United States Major League Cricket. These ventures aim to diversify revenue streams and enhance global brand recognition.

- Cricket Academies: Through Superking Ventures Pvt Ltd, CSK operates multiple cricket academies, including nine centers in Tamil Nadu and two overseas, catering to over 1,100 students. This initiative not only nurtures talent but also strengthens community engagement and brand loyalty.

Market Valuation & Share Performance

The valuation and performance of CSK’s unlisted shares have been noteworthy:

- Market Capitalization: As of March 2023, CSK’s market capitalization was approximately Rs 5,701 Crores, with unlisted shares trading at Rs 185 per share.

- Share Price Appreciation: The unlisted share price has experienced significant growth, reflecting investor confidence and the franchise’s strong financial performance.

Considerations for Investment

Investing in CSK’s unlisted shares offers several potential advantages including strong brand equity, diversified revenue streams, as well as great growth potential.

CSK’s consistent on-field success and loyal fan base contribute to its robust brand value, enhancing revenue-generating opportunities. The franchise’s expansion into international leagues and cricket academies provides additional income sources and mitigates reliance on IPL revenues. With the IPL’s increasing global popularity and lucrative broadcasting deals, CSK is well-positioned for sustained financial growth.

CSK Unlisted Shares & Price

As of March 2025, CSK unlisted shares are trading at around Rs 195 per share. It has a 52 week range of Rs 166- Rs 220 and a market cap of about RS 7361 Crores. CSK has reported a total income of 723 Crores and a profit of Rs 201 Crores for 2023-2024. The rising valuation is fueled by consistency in on-field success, Dhoni’s brand value and expanding international presence. The media rights revenue are booming too.

CSK unlisted shares remain a compelling pre-IPO opportunity of investment.

Buy Csk Unlisted Shares from Altius Investech!

IPL Media Rights Auction – What it Means for CSK and Investors

In June 2022, the IPL made headlines when the BCCI( Board of Control for Cricket in India) sold the media rights for the 2023-2027 season for Rs 48,075 Crores. This deal was historic, in both scale of the numbers and also what it means for franchises like CSK.

TV rights for the Indian subcontinent were picked up by Star India(owned by the Walt Disney company India) for Rs 22,575 Crores.Digital streaming rights were snapped by Viacom for Rs 21,500 Crores. This in total covers 410 IPL matches over five seasons. Also add a title sponsorship deal with TATA worth Rs 670 Crores. You should begin to understand the sheer commercial muscle behind the league.

Based on revenue-sharing arrangements, CSK is expected to earn more than Rs 2400 Crores from central media rights alone over the five-year period starting from 2023. This central revenue includes a portion of media rights income shared among all franchises after deducting the costs of production.

Consider the previous cycle of 2018-2022. Star Sports held the combined TV and digital rights for Rs 16, 347 Crores, during that period. It is almost a third of the current deal’s value. The title sponsor at that time was VIVO. They committed Rs 2199 Crores over a period of 5 years. Even then, franchises like CSK gained over Rs 1000 Crores from central revenue sharing across media rights and sponsorships. Franchises are, however, required to share 20% of their income with the BCCI as a part of the league structure.

The current deal has marked a big leap. IPL is evolving rapidly into one of the most valuable sports leagues globally, with its media rights comparable to those of major international leagues.

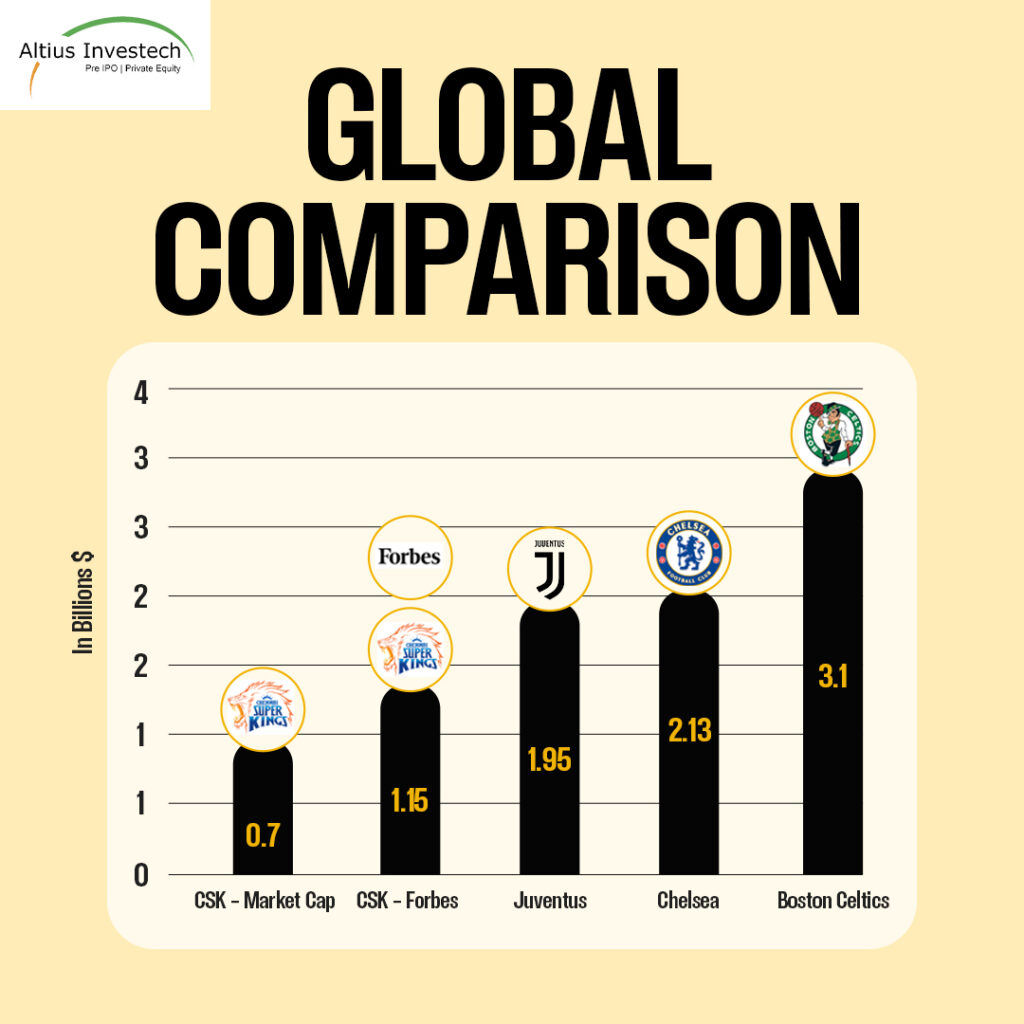

Global Comparison

The Chennai Super Kings were valued at $231 million as of 2024, maintaining their position as the most valuable franchise in the Indian Premier League. In March 2025, the Celtics were sold for a record of $6.1 billion. As of May 2024, Forbes valued Juventus at about $2.3 billion, showing a modest 5.1% increase from the previous year. In May 2022, Chelsea had been acquired for $5.25 billion. This includes $3.1 billion for the club and a commitment of $2.15 billion for various future investments.

Challenges

Prospective investors should also consider potential risks:

1) Market Liquidity

As an unlisted entity, CSK’s shares may have limited liquidity, making it challenging to buy or sell shares promptly.

2) Performance Dependency

The franchise’s financial success is closely tied to its on-field performance; a decline could impact revenues and brand value.

3) Regulatory Changes

Alterations in BCCI policies or IPL structures could affect revenue distributions and franchise operations.

Reasons Why Investing in Unlisted Shares is a Wise Decision

Unlisted companies operate in emerging sectors while being on the brim of rapid expansion. Early investment in these companies can yield substantial returns once they scale up. Including unlisted shares in a portfolio also allows diversification beyond traditional markets, mitigating risks and enhancing portfolio performance.

Unlisted investments give access to unique business ventures that are not available through public markets. In some cases, investing in these shares allows investors to have a significant influence on the company’s strategy and direction, allowing a chance to drive value creation actively.

This aligns with Altius Investech’s principles. If you’re interested in investing in unlisted shares, be sure to read our blogs for valuable insights and guidance.

- 5 Advantages of Buying Unlisted Shares in 2024

- Demystifying Unlisted Shares: How They Work

- Mitigating the Risks of Buying Unlisted Shares

- Income Tax on Capital Gains in Unlisted Shares

- Listed Vs. Unlisted Shares: Assessing Risk and Reward

- Top 5 Unlisted Shares You Should Consider Buying in India in 2024

Final Thoughts

Investing in CSK’s unlisted shares before IPL 2025 could be a strategic move for investors seeking exposure to the burgeoning sports entertainment sector. The franchise’s impressive financial performance, diversified revenue streams, and strategic expansions underscore its potential for sustained growth. However, investors must conduct thorough due diligence, considering both the opportunities and inherent risks associated with unlisted securities, to make informed investment decisions.

GET IN TOUCH WITH US

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91 8240614850.

Click here to connect with us on WhatsApp

For Direct Trading, Visit – https://altiusinvestech.com/companymain