Overview of Alternative Investment Funds (AIFs)

Alternative Investment Funds (AIFs) are made up of investment funds that have been pooled together and are then utilised to invest in private equity, hedge funds, and so on.

AIFs are defined in Regulation 2(1)(b) of the Securities and Exchange Board of India’s (SEBI) Regulation Act, 2012. A business or a Limited Liability Partnership (LLP) can be formed to establish an Alternative Investment Fund.

AIF does not include funds that are subject to SEBI laws that govern fund management activities. Family trusts, employee welfare trusts, and gratuity trusts are also exempt.

Types of Alternative Investment Funds

AIFS are classified into three types by the Securities and Exchange Board of India. These are their names:

1. AIFS Category 1

These funds are invested in start-ups, small and medium-sized firms, and businesses with the potential to grow financially. The government encourages investment in these businesses because they benefit the economy by increasing output and creating jobs.

The following are some examples of this category:

- Infrastructure Investment Trusts

- Angel Investments

- Funds for Venture Capital

- Funds for Social Entrepreneurship

2. AIFS Category 2

This category includes funds that are invested in both equities and debt instruments. Those funds that are not currently classified as Category 1 or 3 are also included. The government makes no concessions for any investment made for Category 2 AIFS.

The following are some examples of this category:

- The Fund of Funds

- Debt Funding

3. Category 3 AIFS

AIFs in Category 3 are those that provide returns in a short period of time. To achieve their objectives, these funds employ a wide range of complex and diverse trading strategies. The government has made no known concessions or incentives in relation to these funds.

The following are some examples of this category:

- Private Investment in Public Equity Funds

- by Hedge Funds

Advantages of Alternative Investments

Alternative investments do not normally correspond with the stock market, therefore they can be utilised to diversify a portfolio and help avoid volatility. Some may also provide tax advantages not available in regular investing.

The rate of return on alternatives, like any other investment, is not guaranteed, but it has the potential to be higher than that of traditional investments.

Individual investors, according to proponents of alternatives in their portfolios, now have access to sophisticated investments and potentially greater returns that were previously only available to institutions such as pension funds and foundations.

Alternative Investment Risks

Alternative investments are more difficult to understand than traditional investment vehicles. They frequently have greater fees attached to them.

As with any investment, the possibility of a bigger return implies a higher risk.

Overcoming the Drawbacks

Alternative investments, particularly those that are more liquid, have grown since the 2008 financial crisis.

Alternative investments, in their broadest sense, can include some exchange-traded funds (ETFs) and mutual funds that use risk-mitigation tactics akin to hedge funds. In other words, because their portfolios are so broad, their overall returns are unrelated to the stock or bond markets.

Alternative assets, such as private equity stakes, are now being included in 401(k) portfolios. Private equity funds’ underlying assets are usually illiquid and difficult to appraise, which makes them challenging to provide in defined contribution plans. Defined contribution plans give liquidity and prices on investment options to plan participants on a daily basis. Private equity firms are looking to offer private equity exposure through target-date funds and collective investment trusts to solve liquidity and pricing problems.

Advocates for private equity as a 401(k) plan option argue that the average investor will now have access to the potentially higher returns that this type of non-traditional investment yields when compared to the typical plain-vanilla options—such as mutual funds, stock and bonds—from which they have to choose.

In conclusion

Non-traditional investing proponents argue that the typical investor now has access to assets that are not associated with the stock market, providing diversity and perhaps superior returns when compared to mutual funds, stocks, and bonds.

They are also riskier than traditional assets like equities, bonds, and mutual funds. Most are illiquid, which means they are difficult to sell fast.

The majority of these alternatives are sophisticated, with larger risks than standard investments. A prudent investor may regard alternative investors as a means of diversification rather than the primary approach of a long-term strategy.

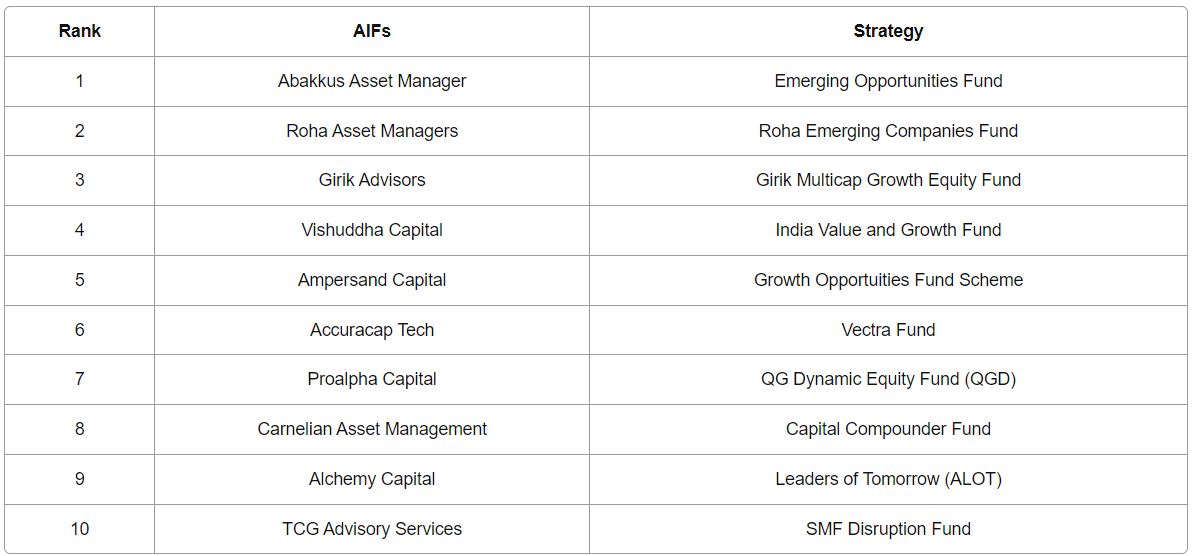

Top 10 AIfs in India

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

To know, more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

You can also checkout the list of Best 5 Unlisted Shares to Buy in India

For Direct Trading, Visit – https://altiusinvestech.com/companymain.

To know more about How to apply for an IPO? Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/