Vivriti Capital: Company Overview

Vivriti Capital Limited (VCL), is an NBFC-ND-SI registered with the Reserve Bank of India. The company commenced lending operations in fiscal 2019. VCL offers institutional loans, supply chain financing, retail loans via co-lending, and has recently forayed into the leasing and factoring business. Of this, 52% comprised institutional lending to both financial sector and non-financial sector entities. The balance portfolio was deployed as retail lending through co-lending partnerships with NBFCs and supply chain financing.

Key Focus Areas:

The company primarily caters to:

- Small and Medium Enterprises (SMEs)

- Microfinance Institutions (MFIs)

- Non-Banking Financial Institutions (NBFCs)

- Affordable Housing Finance Companies

| Company Name | Vivriti Capital Limited |

| Company Type | Unlisted Public Limited Company(Buy Vivriti Capital Unlisted Shares) |

| Industry | Financial Services (Specializes in debt market, financial solutions, and providing credit to businesses) |

| Founded | 2017 |

| Registered Address | Prestige Zackria Metropolitan, No.200/1-8, 2nd Floor, Block 1, Anna Salai, Chennai 600002 |

Vivriti’s Journey:

Achievements:

- Client Base: As of March 2024, Vivriti Capital has a portfolio of loans to over 1.5 million SMEs and retail borrowers, and 300 companies across India.

- Workforce: The company employs over 400 professionals across Chennai, Mumbai, Bangalore, and Delhi-NCR.

- Rating: Strong credit ratings A (Stable) by ICRA; A+ (Stable) by CARE & A+ (Stable) by CRISIL) further solidify the Company’s financial position.

- Portfolio Diversification: Utilizes a co-lending model to create a diversified retail book with low credit risks.

- Pioneers in deepening the under-penetrated market and building appetite toward mid-market enterprises, Vivriti manages a portfolio of Rs 8800+ Cr across 300 enterprises and 45+ sectors.

Product Portfolio:

1. Term Loan: Provides upfront lending for funding short-term and long-term growth initiatives of businesses.

2. Working Capital Demand Loan: Offers loans to businesses for funding their day-to-day operational needs.

3. Supply Chain Finance: Extends short-term credit solutions to ensure liquidity within a company’s supply chain.

4. Co-Lending: Facilitates joint disbursal of loans to borrowers, particularly in the priority sector, by partnering with other financial institutions.

5. Securitization: Converts illiquid assets into tradable securities, allowing businesses to unlock capital.

6. Non-Convertible Debentures (NCDs): Instruments used by businesses to raise long-term funds through a public issue, providing an alternative to traditional borrowing methods.

Group Companies:

- Vivriti Group, through its entities Vivriti Capital and Vivriti Asset Management (VAM), is focused on transforming the mid-market lending landscape in India.

- Vivriti Capital (VCL): NBFC provides critical debt capital to mid-market enterprises.

- Vivriti Asset Management (VAM): Manages Category II Alternate Investment Funds (AIFs)and tailored debt solutions

Services Offered through Group Companies:

- Debt Financing: Providing term loans, working capital loans, and other forms of debt to mid-sized corporates.

- Structured Products: Offering tailored financial solutions that meet the specific needs of businesses.

- Investment Banking: Assisting in raising capital and providing strategic financial advice.

- Financial Advisory: Offering expert advice to optimize financial performance and growth strategies.

Subsidiary:

- Yubi (Fintech Brand) | CredAvenue Private Ltd.: Offering fintech solutions across financial services like credit evaluation, asset building, and monitoring/collections.

- Yubi achieved rapid growth, becoming a unicorn in February 2022 with significant backing from venture capital firms.

Management Details:

Vineet Sukumar (Founder & MD)

Vineet Sukumar is the founder and Managing Director of Vivriti Capital Limited. With vast experience in the financial services sector, he has a deep understanding of structured finance, debt capital markets, and credit underwriting. Vineet has previously held leadership positions in large financial institutions, focusing on corporate and institutional lending. Under his leadership, Vivriti Capital has grown into a significant player in providing innovative credit solutions to underserved markets, helping the company build a strong reputation in debt financing and securitization.

.

Anita Belani ( Independent Director)

Anita Belani brings extensive experience in human resources and leadership advisory to Vivriti Capital’s board. With over three decades of experience, she has worked with leading multinational companies across industries. Anita specializes in organizational transformation, executive coaching, and HR strategy, and has held key leadership roles at companies like Watson Wyatt, Right Management, and Altair Advisory Partners. Her expertise in governance, talent management, and leadership development strengthens Vivriti’s corporate governance.

,

Namrata Kaul (Independent Director)

Namrata Kaul is an experienced professional in the financial services sector, serving as an Independent Director at Vivriti Capital. With a career spanning over two decades, she has worked with Deutsche Bank and Standard Chartered Bank in various leadership roles, focusing on corporate banking, infrastructure financing, and risk management. Namrata’s extensive experience in managing large corporate relationships, along with her strong governance expertise, adds value to Vivriti’s growth strategy and risk management framework.

,

,

Santanu Paul (Independent Director)

Santanu Paul is a seasoned entrepreneur and technologist who serves as an Independent Director at Vivriti Capital. He is the co-founder and CEO of TalentSprint, a technology-driven professional learning platform. Santanu’s deep expertise in technology, innovation, and entrepreneurship brings a unique perspective to Vivriti Capital, especially as the company looks to leverage technology for its growth. With a background in computer science and experience in leading tech-based initiatives, Santanu provides strategic guidance on Vivriti’s digital transformation and tech-driven lending models.

,

Shareholding:

| Shareholding Above 5% | Holding % |

| Creation Investments India III, LLC | 57% |

| Lightrock Growth Fund | 10.38% |

| Financial Investments SPC | 9% |

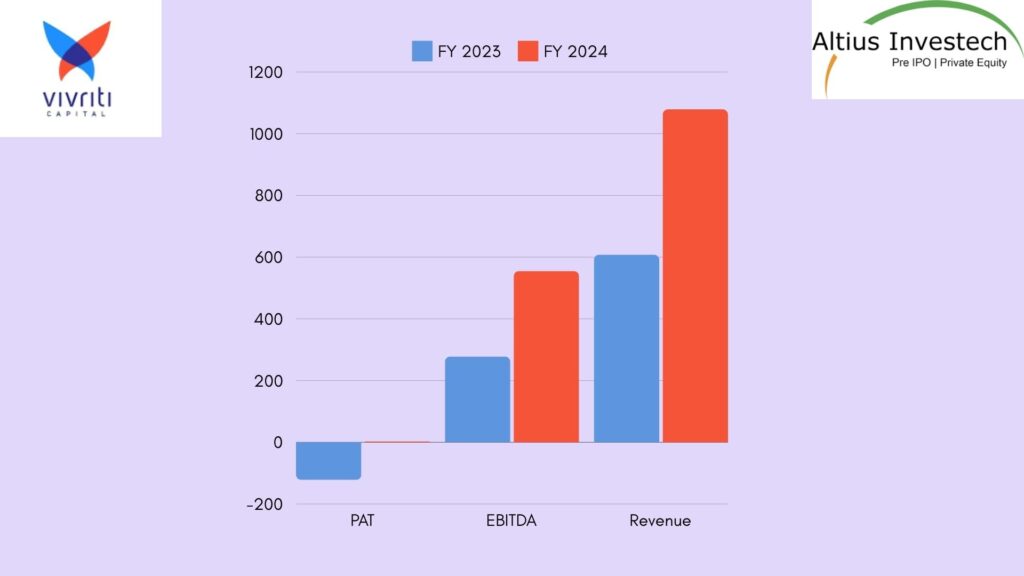

Financial Highlights:

| Financials (Consolidated) | FY24 | FY 2023 | % Increase |

| Revenue | 1079.31 | 608.45 | 55.02% |

| EBITDA | 555.36 | 277.78 | 99.93% |

| PAT | 3.19 | -121.69 | -102.62% |

| PAT Margins | 0.3% | -20% | – |

| EPS | 0.34 | -13.08 | – |

Valuations:

| Share Price ( as Sep 2024) | 1049 |

| Outstanding Shares | 10.68 Cr |

| MCAP | 12213.46 Cr |

| P/E Ratio | 3085.29 |

| P/S Ratio | 11.32 |

| P/B Ratio | 4.07 |

| Book value per share | 257.73 |

Key Investors:

Swot analysis:

Strengths:

- Innovative Financial Solutions: Vivriti Capital offers a diverse range of financial products such as term loans, working capital loans, and supply chain finance, catering to the varied needs of businesses across sectors.

- Focus on the Priority Sector: Through co-lending initiatives, the company is committed to providing credit in priority sectors, boosting its reputation in areas that have strong government backing.

- Securitization Expertise: Vivriti’s ability to transform illiquid assets into tradable securities provides a competitive edge in structured finance and increases liquidity for its clients.

- Strong Market Growth: Since its inception in 2017, Vivriti Capital has shown significant growth, leveraging technology and financial innovation to rapidly scale its business operations.

Weaknesses:

- Limited Market Presence: Compared to older, well-established financial institutions, Vivriti is a relatively new player, which might limit its ability to attract large corporate clients.

- Concentration Risk: Vivriti may face risks due to concentrated exposure to specific sectors or regions, especially since the Indian financial services market can be volatile.

Opportunities:

- Rising Demand for Credit: With increasing demand for business finance, especially in sectors like MSMEs, Vivriti is well-positioned to grow its loan book and expand into new markets.

- Digital Transformation: Adoption of financial technology and digital lending can help Vivriti improve efficiency, reduce costs, and expand customer reach.

- Expanding Product Portfolio: With the potential to introduce new financial products like green bonds or more innovative structured finance offerings, Vivriti can diversify and enhance its services.

Threats:

- Regulatory Risks: The financial sector is heavily regulated, and any changes in government policies or banking regulations could impact Vivriti’s operations and profitability.

- Competition: Vivriti faces competition from established banks, NBFCs, and fintech companies, which may have greater resources and a larger customer base.

- Credit Risk: As with all financial institutions, Vivriti is exposed to credit risk, especially in challenging economic conditions where borrowers may default on loans, impacting its financial performance.

.

Get in touch with us

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

To know, more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

To buy unlisted shares Visit – https://altiusinvestech.com/companymain

To know more about How to apply for an IPO? Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/

Visit our website homepage: https://altiusinvestech.com/

Read More