Blog Highlights

- Overview of Spray Engineering Devices

- About Spray Engineering Ltd

- Recent Funding & Financial Highlights

- Key Financial Metrics

- Industry Outlook

- Monthly Overview of Share Prices

- SEDL’s Share Price Monthly Overview

Spray Engineering Devices Unlisted Share Price Analysis: Monthly Performance in 2024-2025

Understanding the performance of individual stocks on a granular level is crucial for investors who need to make informed decisions. The monthly performance of shares reflects the dynamic nature of market forces and also gives detailed insights into investor sentiments and underlying trends. The blog focuses on the monthly share price performance of SEDL or Spray Engineering Devices Ltd, an industry leader that is known for its innovative solutions in the sugar as well as allied industries. It also explores its financial history, key milestones and a detailed month-by-month overview of its stock price movements.

Overview of Spray Engineering Devices

Spray Engineering Devices Ltd. or SEDL is a pioneer in the fields of evaporation, heat exchange, condensation, and crystallization. Established in 2004 with a modest start in manufacturing spray nozzles, the company has grown into a globally recognized name, offering state-of-the-art solutions for sugar and allied industries. With over 500 successful implementations in India and operations in more than 40 countries, SEDL continues to innovate and lead in energy-efficient technologies.

The company offers comprehensive solutions such as process and equipment design, industrial automation, project management, and EPC or “Engineering, Procurement, and Construction” services. The modern fabrication and automation units in Baddi, Himachal Pradesh are ISO 9001 and 14001 certified, ensuring high-quality services and products.

About Spray Engineering Ltd

Spray Engineering Devices Ltd specializes in giving turnkey solutions for the sugar industry, especially focusing on evaporation, crystallization, cooling, refining, and condensing systems. The portfolio of the products includes Spray Continuous Pans, Mechanical Circulators, Jet Ejectors, Vacuum Batch Pans, Falling Film Evaporators, and Direct Contact Heaters. In addition to this, SEDL has formed innovative boiler-free jaggery production units, enabling 100% bagasse savings and offering technological solutions. The company holds more than 90 design and innovation patents globally, highlighting a commitment to research and development.

You Can Buy Spray Engineering Devices Share Prices @ Rs 510 By Altius Investech.

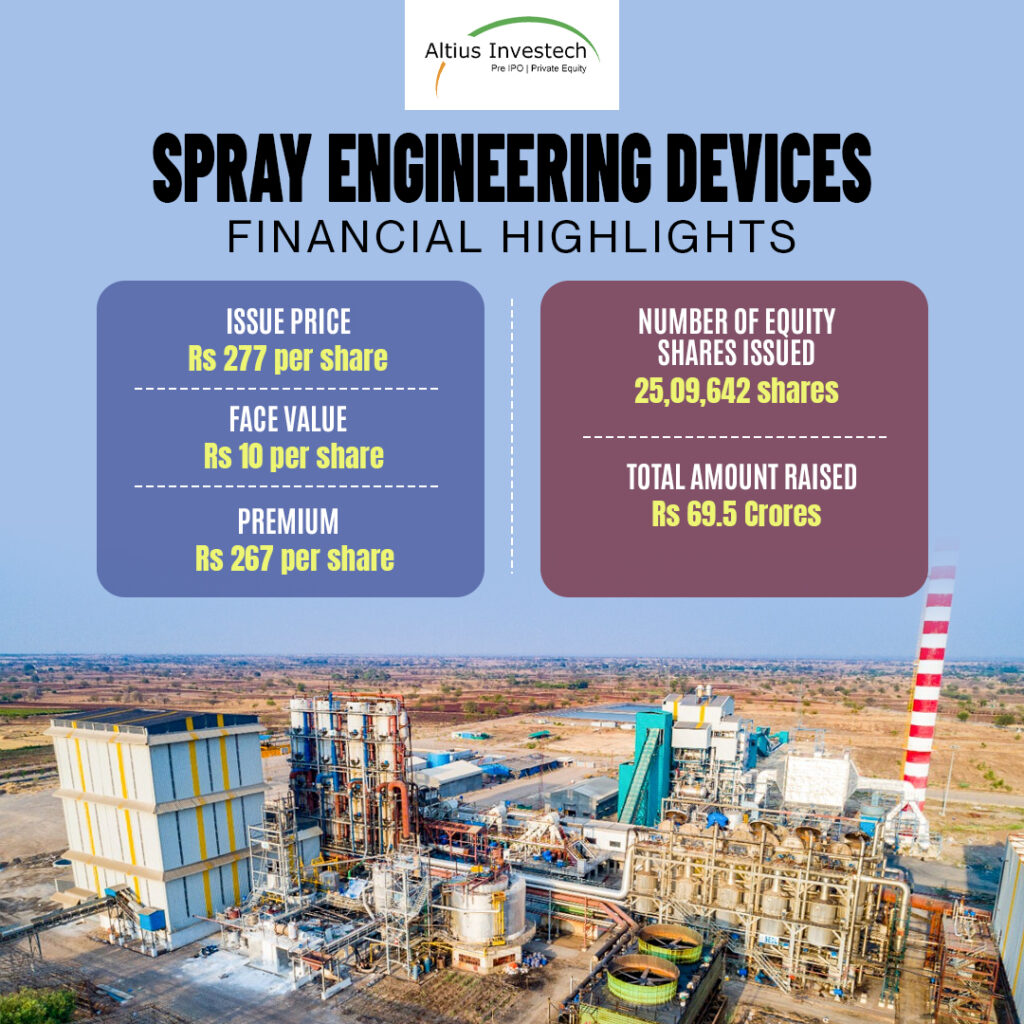

Recent Funding & Financial Highlights

In May 2024, Spray Engineering Devices raised Rs 72 Crores through a private placement of equity shares.

In May 2024, Spray Engineering Devices raised INR 72 crores through a private placement of equity shares. Key details of the private placement include:

- Issue Price: Rs 277 per share

- Face Value: Rs 10 per share

- Premium: Rs 267 per share

- Number of Equity Shares Issued: 25,09,642 shares

- Total Amount Raised: Rs 69.5 Crores

| Parameter | Details | Description |

|---|---|---|

| Issue Price | Rs 277 per share | The equity shares were issued at Rs 277 per share, reflecting a premium over the face value. |

| Face Value | Rs 10 per share | Each share has a nominal face value of Rs 10, with the premium accounting for the remaining INR 267. |

| Premium | Rs 267 per share | The premium of INR 267 per share underscores the high valuation investors placed on the company’s future potential. |

| Number of Equity Shares Issued | 25,09,642 shares | A total of 25,09,642 equity shares were issued, significantly bolstering the company’s equity base. |

| Total Amount Raised | Rs 69.5 crores | While the intended capital raise was Rs 72 crores, the actual amount secured stood at INR 69.5 crores due to minor variations in the final allotment process. |

The recent funding round valued the company at approximately Rs 720 crores, reflecting strong investor confidence.

Key Financial Metrics

- Operational Revenue: Increased by 39.55%, highlighting significant growth in the company’s primary revenue streams.

- EBITDA: Improved by 59.65%, reflecting enhanced operational efficiency and cost management.

- PAT (Profit After Tax): Rose by 59.13%, showcasing a healthy bottom line and efficient tax management.

- EPS (Earnings Per Share): Jumped by 52.50%, signaling increased earnings available to shareholders.

- Reserves: Surged by 108.24%, significantly boosting the company’s retained earnings and financial resilience.

- Book Value: Increased by 73.89%, demonstrating a substantial rise in the net worth per share, enhancing shareholder equity.

Industry Outlook

The Indian engineering sector, which includes companies like SEDL, is a major contributor to the economy. In 2023, the sector was valued at approximately USD 100 billion and has been growing at a CAGR of around 10% over the past few years.

Engineering exports from India were valued at USD 76 billion in the year 2023, showing a growth of 8% from the previous year. With increasing demand for innovative and energy-efficient solutions, companies like SEDL are well-positioned to capitalize on this growing market.

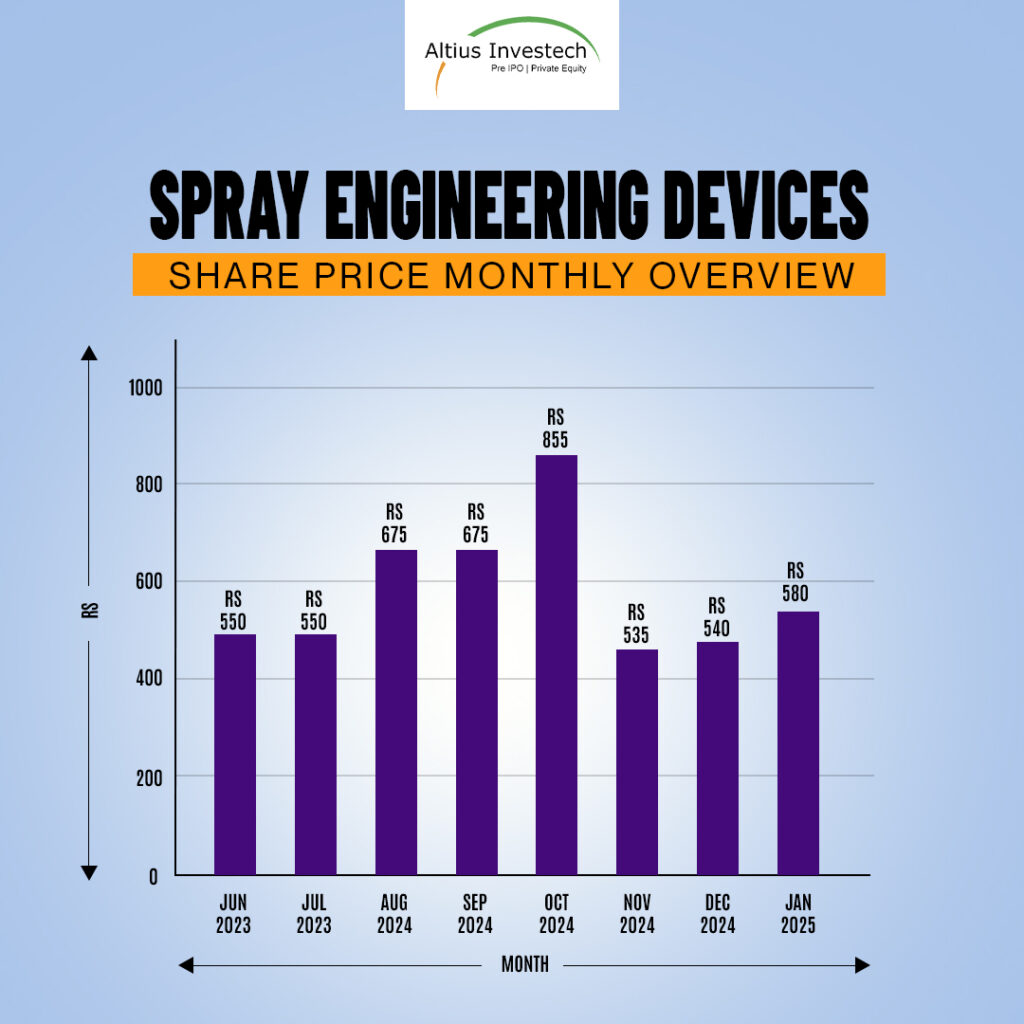

Monthly Overview of Share Prices

June 2024

In June 2023, SEDL’s share price remained stable at Rs 550, reflecting a balanced market sentiment. The company reported strong quarterly earnings, which helped maintain investor confidence. Additionally, investor sentiment was buoyed by positive announcements regarding ongoing projects in core markets.

July 2024

The share price in July mirrored the stability of the previous month. Market analysts attributed this to sustained demand for the company’s products and steady revenue growth. The absence of significant external market shocks contributed to the consistency in share price.

August 2024

August saw a significant uptick in the share price, climbing to Rs 675. The sharp increase was driven by the announcement of a major contract win in the energy sector, which bolstered investor optimism. This contract was perceived as a game-changer for the company, leading to heightened expectations of future revenue growth.

September 2024

In September, the share price maintained its position at Rs 675. The company’s continued focus on expanding its product line and entering new markets helped sustain the positive momentum. Investor confidence remained high, supported by the anticipation of new product launches and strategic partnerships.

October 2024

October was a standout month for SEDL, with the share price surging to Rs 855, on an average. This remarkable increase was attributed to exceptional quarterly earnings and optimistic forward guidance provided by the management. Analysts noted that the company’s robust financial performance and expansion into emerging markets played a pivotal role in this surge.

November 2024

The share price took a steep dip in November, closing at Rs 535. Market volatility, coupled with broader economic concerns, led to a temporary decline in investor confidence. Factors such as fluctuations in commodity prices and fears of a potential slowdown in the global economy contributed to the downturn.

December 2024

December saw a minor recovery, with the share price rising slightly to Rs 540. Analysts noted that the stabilization was driven by renewed interest from institutional investors. The company’s strategic moves to diversify its product offerings and improve operational efficiency also played a role in restoring investor confidence.

January 2025

In January, the share price rose to Rs 580, signaling a positive start to the new year. The company’s strategic initiatives aimed at expanding its footprint in international markets played a pivotal role in driving this upward movement. Improved macroeconomic conditions and increased investor appetite for industrial stocks further supported the price gain.

SEDL‘s Share Price Monthly Overview

| Month & Year | Price (₹) |

|---|---|

| June 2023 | ₹550 |

| July 2023 | ₹550 |

| August 2024 | ₹675 |

| September 2024 | ₹675 |

| October 2024 | ₹855 |

| November 2024 | ₹535 |

| December 2024 | ₹540 |

| January 2025 | ₹580 |

Reasons Why Investing in Unlisted Shares is a Wise Decision

Unlisted companies operate in emerging sectors while being on the brim of rapid expansion. Early investment in these companies can yield substantial returns once they scale up. Including unlisted shares in a portfolio also allows diversification beyond traditional markets, mitigating risks and enhancing portfolio performance.

Unlisted investments give access to unique business ventures that are not available through public markets. In some cases, investing in these shares allows investors to have a significant influence on the company’s strategy and direction, allowing a chance to drive value creation actively.

This aligns with Altius Investech’s principles. If you’re interested in investing in unlisted shares, be sure to read our blogs for valuable insights and guidance.

- 5 Advantages of Buying Unlisted Shares in 2024

- Demystifying Unlisted Shares: How They Work

- Mitigating the Risks of Buying Unlisted Shares

- Income Tax on Capital Gains in Unlisted Shares

- Listed Vs. Unlisted Shares: Assessing Risk and Reward

- Top 5 Unlisted Shares You Should Consider Buying in India in 2024

Final Thoughts

Spray Engineering Devices Ltd has experienced notable fluctuations in its share price over the past several months, reflecting the dynamic nature of market forces and investor sentiments. The stock has shown periods of stability, considerable price movements in certain monetary

GET IN TOUCH WITH US

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91 8240614850.

Click here to connect with us on WhatsApp

For Direct Trading, Visit – https://altiusinvestech.com/companymain