Blog Highlights

- Background, Education & Career

- Raamseo Agrewal Notable Investment

- Raamdeo Agrawal Portfolio

- Raamdeo Agrawal Stock Holding List

- Raamdeo Agrawal Investment Strategy

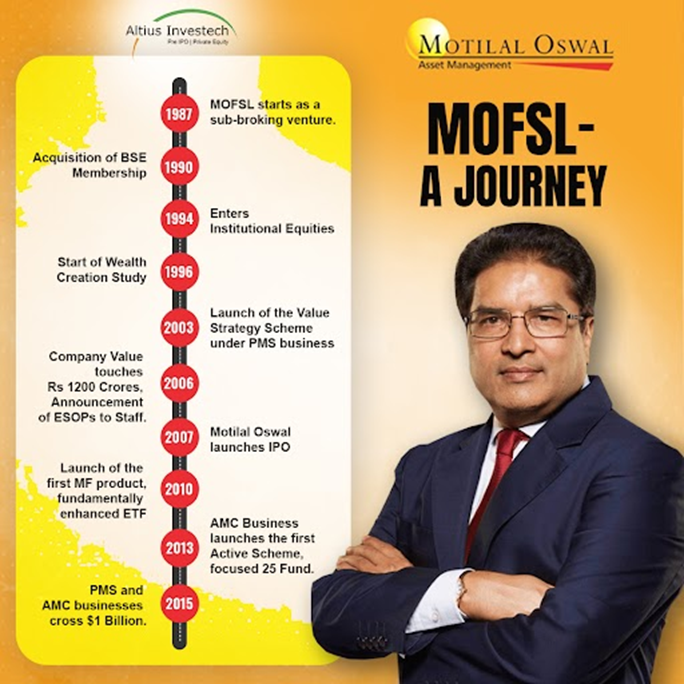

- Charting out Raamdeo Agrawal’s Journey

- Raamdeo Agrawal Net Worth

- Note from the Chairman Himself

Exploring Raamdeo Agarwal’s Investment Portfolio and Latest Net Worth in 2024

Unfolding the domain of the stock market could be difficult for new entrants. However, not everyone requires a finance degree or tons of experience to be successful in investments. With knowledge and tools at one’s disposal, one could create wealth in the bustling stock trading market of our country.

Raamdeo Agrawal Background, Education & Career

Agrawal was born and raised in a middle-class family in Raipur, Chhattisgarh, with ancestors hailing from Rajasthan. Being a Chartered accountant from the reputed ICAI , he moved to Bombay for his studies. He wrote the book “Corporate Number Games” along with MR Ram K.P Mriparia. He has also been the author of the book called “Art of Wealth Creation”.

Raamdeo began his career in 1987 as a sub-broker. Co-founding the popularly acclaimed Motilal Oswal Financial Services, his family currently has ownership of 36% of this organization. This incredible personality has received the award of Rashtriya Samman Patra from the CBDT or Central Board of Direct Taxes, pertaining to his consistent record and integrity for tax payments over 5 years from ‘95-’99. He claims Warren Buffet to be his mentor and inspiration in his endeavors.

Raamdeo Agrawal is married, being a husband to Mrs Sunita Agrawal, and a father to Vaibhav Agrawal. He continuously seeks knowledge of markets and is an avid reader. He credits his success to hard work, and constant, consistent learning. Outside of work, Agrawal enjoys spending time with family as well as engaging in activities that promote well-being and personal growth.

Raamseo Agrewal Notable Investment

By the time he was a sub-broker, Raamdeo could build a portfolio of about Rs 10 lakhs. It grew to Rs 30 crores during the Harshad Mehta scam period but again fell to Rs 10 Crores on its exposure. He traveled to the States to meet Mr. Warren Buffet and studied all the letters addressed to his company Berkshire Hathaway. During this time, he already held 225 stocks in his portfolio, which later became 15 stocks alone. By 2000, his portfolio rose to Rs 100 Crores.

Raamdeo has always believed in research when it came to investments. It helped him start Motilal Oswal Financial Services Ltd or MOFSL with his friend Motilal Oswal in 1987 as a sub-broker, to eventually grow it into a conglomerate having interests in private equity, PMS or Portfolio Management Services, home loans, and currently mutual funds. As a Chairman, he has only kickstarted the prolific start, to initiate a billion-dollar empire from zero.

Raamdeo starts with growth and then stares at value. There are times when he would not mind paying more for a stock when he is convinced about the business. He was highly inspired by the deep-rooted concept of the Cigar Butt investing strategy of Warren Buffet, as cigar butts might look unappealing and worthless, there always remains the scope of a few puffs being left.

Agrawal’s bet on Hero Moto Corp, formerly known as Hero Honda has been a market legend. In the year 1995, he had invested around 10 lakhs in the shares of this two-wheeler manufacturer, as 30 Rs per piece. He held them for 20 years till the share price rose to about 2600 Rs per piece. Also read about Vijay Kedia’s portfolio and top holdings.

To have your hands-on gains that we can vouch for, buy hero fincorp unlisted shares from Altius Investech starting from just ₹ 1065.

Addtionally, Raamdeo also invested in Waaree Renewable Technologies.

As per current records, Waaree Renewables have been trading at 4.98% higher than at Rs 2512.20 in comparison with its last closing price.

The highest share price for 3rd June, 2024 is Rs 2512.50 (+4.99%) as per Live Mint.

Waaree Renewables have given 476.70% this year and 27.62 in the last 5 days. The organization attained a net profit of 54.21 Cr as of the last quarter.

For promising returns on your investment, consider buying waaree energies unlisted shares from Altius Investech, starting at just Rs 625.

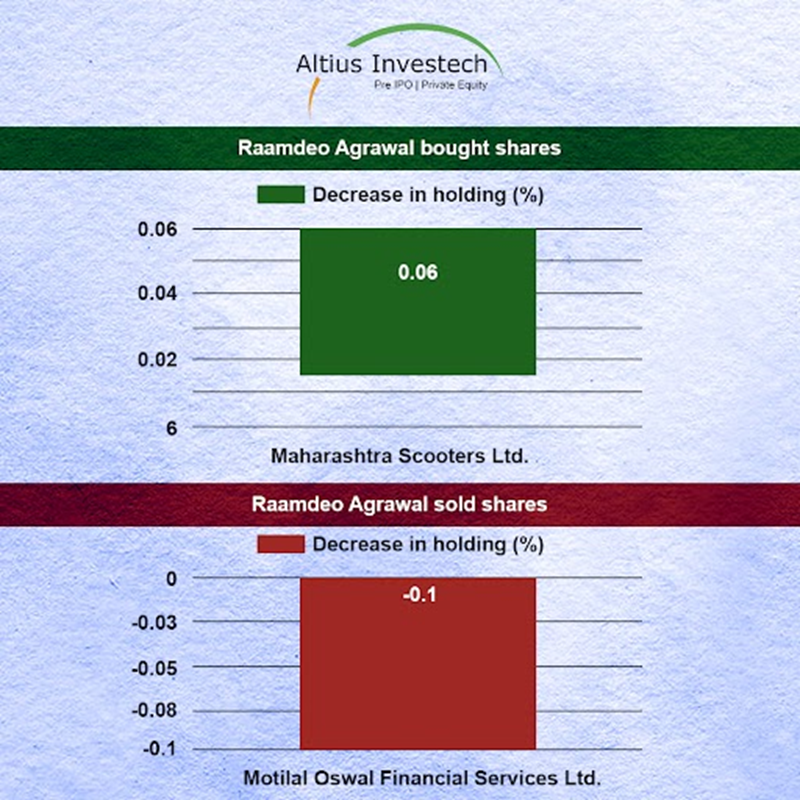

Raamdeo Agrawal Portfolio

Active Stocks in his Portfolio Include

- Maharashtra Scooters Ltd- The current price of this stock is Rs 7672, with a holding value of Rs 140.3 Crores. The Quantity Held for this stock is 182, 909.

As per the records of corporate shareholdings filed for March 31, 2024, Raamdeo Agrawal holds 2 stocks with a net worth of more than Rs 9340.8 Crores.

- Motilal Oswal Financial Services Ltd- The current price of this stock is Rs 2295.40, with a holding value of Rs 9200.4 Crores. The Quantity Held for this stock is 40,082,015.

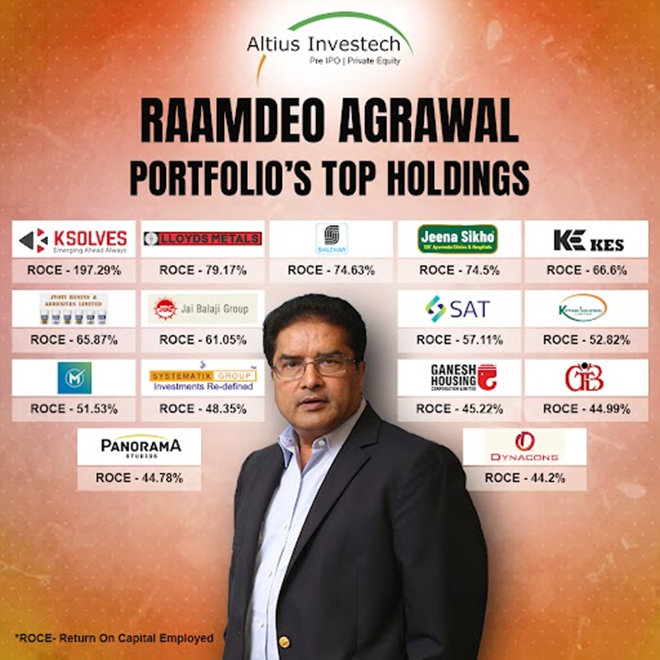

Raamdeo Agrawal Stock Holding List

It has been presented from increasing to decreasing order in terms of the Price of Stock.

| Stock Name | Current Price In Rs- Cr | Net Profit (Latest Quarter) In Rs-Cr | Sales (Latest Quarter) In Rs- Cr | Return on Capital Employed In % |

| Benares Hotels | 8792.00 | 11.59 | 35.58 | 40.56 |

| Apar Inds | 7830.50 | 236.22 | 4455.11 | 42.86 |

| Shilchar Tech. | 4921.00 | 25.02 | 105.43 | 74.63 |

| Sharda Motor | 1585.00 | 85.72 | 703.39 | 42.77 |

| Share India Sec. | 1544.40 | 115.75 | 465.37 | 38.34 |

| RPG Life Science | 1451.20 | 13.24 | 126.99 | 34.67 |

| Jyoti Resins | 1360.10 | 18.77 | 71.24 | 65.87 |

| Dynacons Sys. | 1249.50 | 13.06 | 226.74 | 36.51 |

| Beta Drugs Ltd | 1239.95 | 16.56 | 154.45 | 36.02 |

| Nucleus Soft. | 1180.00 | 52.14 | 210.26 | 36.71 |

| Jeena Sikho | 1106.05 | 37.38 | 167.05 | 74.50 |

| Ksolves India | 1074.60 | 9.58 | 30.36 | 197.29 |

Raamdeo Agrawal Investment Strategy

Raamdeo Agrawal believes in focusing on investments in high-growth companies having strong fundamentals. It requires these companies to have a strong, long-term potential in terms of growth. We find the investment philosophy to be based on the concept of QGLP or “Quality, Growth, Longevity, and Price”. Companies following these characteristics can potentially give high returns in the long run.

- Quality– It includes Quality of Business and Management. It allows huge business opportunities, and sustainable competitive advantages, along with a competent management team. It involves healthy financials and ratios.

- Growth– Growth is determined in earnings in terms of volume growth and price growth. It also includes mix change, operating, and financial leverages.

- Longevity– It needs to be observed both in terms of growth and quality. It should encompass long-term business relevance, extension of the competitive advantage period, and initiatives that can sustain growth for about 10-15 years.

- Price– Reasonable Valuation and relative growth prospects, with a high margin of safety, preferring stocks with PEG (price/earnings to growth) of around 1x.

While noticing the background to his incredible success, Raamdeo and his ace team at MOFSL have also laid out the theoretical factors in identifying multi-bagger stocks in the 20th Wealth Creation Study. It serves as reading material for investors who aspire to snare at multi-bagger stocks.

Charting out Raamdeo Agrawal’s Investment Journey

(From Zero- 1 Billion USD)

- Utilizing the power of compounding- He mentions how 26% CAGR would create a 1026x Portfolio in 30 years.

- Building a focused portfolio of 15-20 Stocks.

- Importance of Position Sizing- A neglected area in the design of the portfolio. Using Kelly’s formula would decide on the allocation.

- Selection of Stocks based on QGLP Strategy, as mentioned above.

- Clarity in the determination of portfolio objectives.

Kelly’s Formula for Equities

Kelly’s formula as utilized by Raamdeo widely, determines the optimal percentage of capital that can be invested in a single trade, where Kelly% is W- (1-W)/R

W= Historical winning percentage in a winning system.

R= Historical average win/loss ratio.

In order to find the optimal percentage, one needs to start with the winning percentage or W, showing historically successful trades, and then substract it from the ratio of losing percentage or (1-W) to the average win/loss ratio or R.

Raamdeo Agrawal Net Worth

Raamdeo Agrawal’s Net Worth has been estimated to be Rs 2700 Crores, with the revelation of Motilal Oswal’s Net Worth to be around Rs 2800 Crores. Also, you can read our other blogs like Net Worth of Ashish Dhawan & Radhakishan Damani.

The duo has a collective fortune of Rs 5500 Crores. The market capitalization of Motilal Oswal Financial Services Ltd is itself around Rs 6800 Crores. Promoters constituting their family members control 72% equity of this organization.

In the last 8 years, Raamdeo Agrawal’s net worth has compounded at a 22.5% rate.

Note from the Chairman Himself

Raamdeo Agrawal, the chairman of MOFSL has commented on how his organization is deemed as digital as any other competitors, where they do not happen to be left behind in this digital era. He comments on how the company still continues to experience growth, which will continue to increase in the next 5-10-year span. He suggestively implies how the growth is not seldom due to the market performance, but also MOFSL’s growing net worth, which will only be on the rise. The opportunities are immense for the capital market, inclusive of savings, wealth, broking, asset management, private equity, and seed opportunities.

Conclusion

Raamdeo Agrawal’s story, spanning from being a sub-broker to an exemplary stock market titan, shows the power of dedication, research, and exceptional investment strategy. His journey of success coupled with his emphasis on QLGP, is inspiring for aspiring investors.

Through his notable investments and strategic insights, Agrawal has not only amassed wealth but also shared invaluable knowledge through books and studies. As he continues to steer Motilal Oswal Financial Services to greater heights, Agrawal’s legacy brilliantly testifies to the potential within the country’s stock market for those who are willing to learn and invest wisely.

FAQs

Ans:- Motilal Oswal is founded by Mr Raamdeo Agrawal and Mr Motilal Oswal.

Ans:- Raamdeo Agrawal is originally from Raipur in Chhattisgarh, Rajasthan.

Ans:- Raamdeo Agrawal’s Net Worth has been estimated to be Rs 2700 Crores.

Ans:- To contact Raamdeo Agrawal send an email to raamdeo.agrawal@motilaloswal.com.

Raamdeo Agrawal was born on February 2, 1957, making him 67 years old as of 2024.

Raamdeo Agrawal’s investment strategy focuses on long-term value investing, identifying quality companies with strong growth potential and holding them for extended periods.

Raamdeo Agrawal is a Chartered Accountant by profession.

Some of Raamdeo Agrawal’s top stock picks include Benares Hotels , Apar Inds, and Shilchar Tech..

Raamdeo Agrawal resides in Mumbai, India.

GET IN TOUCH WITH US

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

Click here to connect with us on WhatsApp

For Direct Trading, Visit – https://trade.altiusinvestech.com/.