Prabhudas Lilladher Advisory Services Private Limited (PLASPL) : Company Overview

Prabhudas Lilladher Advisory Services (PLASPL), a subsidiary of Prabhudas Lilladher Pvt Ltd, was incorporated in 1991 and is engaged in providing corporate and financial fund advisory services. A SEBI-registered entity under PL Capital, PLASPL offers personalized wealth management solutions, delivering curated investment strategies tailored to individual client needs.

The firm specializes in investment, trading, and mutual fund strategies, providing clients with comprehensive financial guidance. Known for its fee-based, customized advisory services, PLASPL leverages decades of expertise to help clients navigate complex financial markets with confidence.

| Company Name | Prabhudas Lilladher Advisory Services Private Limited (PLASPL) |

| Company Type | Unlisted Public Company (Buy unlisted shares) |

| Industry | Financial Advisory |

| Founded | 1991 |

| Registered Address | MUMBAI, Maharashtra, India – 400018 |

Industry Overview

India’s financial advisory market, currently valued at around $3 billion, is projected to grow at a CAGR of 13-15% over the next five years. Key growth drivers include rising disposable incomes, growing financial product complexity, increased financial literacy, and technological advancements. The market is segmented into wealth management, retail financial planning, corporate advisory, and robo-advisory services.

Financial advisory firms primarily target young professionals, middle-aged individuals planning for retirement, retirees, SMEs, and large corporations. Emerging trends include digital transformation, hybrid advisory models combining human expertise with automation, a focus on holistic financial wellness, and the growing importance of ESG factors.

The industry’s future will be shaped by innovation, increased digitalization, and a client-centric approach, offering significant growth opportunities for firms able to adapt to these evolving dynamics.

Business Segments

Wealth Management

Includes broking, depository services, and third-party financial product distribution like mutual funds, insurance, and bonds. They also provide securities finance solutions to enhance liquidity management.

Asset Management

Offers tailored Portfolio Management Services (PMS) and Alternative Investment Funds (AIF) for high-net-worth individuals and institutional investors, along with mutual fund services for retail investors.

Capital Markets

Serves institutional clients with equity research, brokerage, and investment banking services, focusing on mergers, acquisitions, and capital raising.

Products & Services

Cash Segment – InvestActive

is an equity research product offering continuous investment advice through disciplined, balanced portfolios with three variants: Fundamental Model Portfolios, a mix of Fundamental and Alpha (Short-Term Trades), and Alpha-only portfolios.

Derivatives – Traders Edge

provides algorithm-driven positional and market-neutral trading strategies, offering long and short trades on indices and stock pairs with built-in stop-loss measures for optimized risk management.

Mutual Funds – InvestActive MF

is a mutual fund research product that uses the SPARK methodology to match recommendations with your risk profile, from conservative to aggressive investors.

Management

Amisha Vora | Chairperson & MD |

Amisha, a Chartered Accountant and equity expert, is a prominent opinion maker in the market. She began her career with JM Financial and is now a key shareholder and Group Joint Managing Director at Prabhudas Lilladher (PL). With over 28 years in finance, she has significantly expanded PL’s Institutional business and led the formation of PL Advisory Services and NBFC Business. Since taking charge of PL’s Retail broking in 2012, she has driven a 23.5% CAGR in toplines through technology and innovative advisory services. Amisha is also a member of the CII Capital Markets Committee and has received numerous accolades.

..

Mr. Rajeev Dalal | Non-Executive Director |

Rajeev brings over 35 years of experience in corporate finance, including more than 100 M&A and Private Equity transactions, both domestic and cross-border. He spent over 15 years as a Corporate Finance Partner at EY, from 2002 to 2018. Rajeev co-founded Ind Global Finance Trust (IGFT) in 1990, which was acquired by Arthur Andersen in 2000. Before IGFT, he worked in investment banking with HSBC and JM Financial. He holds a degree in Law & Commerce from Bombay University.

..

..

Shareholding Pattern

| Shareholding Above 5% | Holding % |

| AMISHA NIRAJ VORA | 48 |

| CONVICTION CAPITAL PRIVATE LIMITED | 48 |

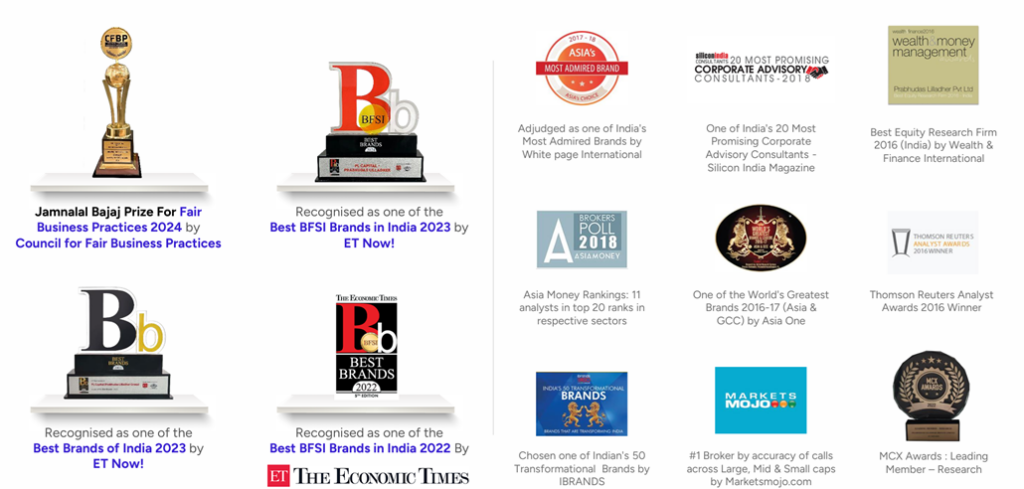

Awards & Achievements

..

..

..

..

..

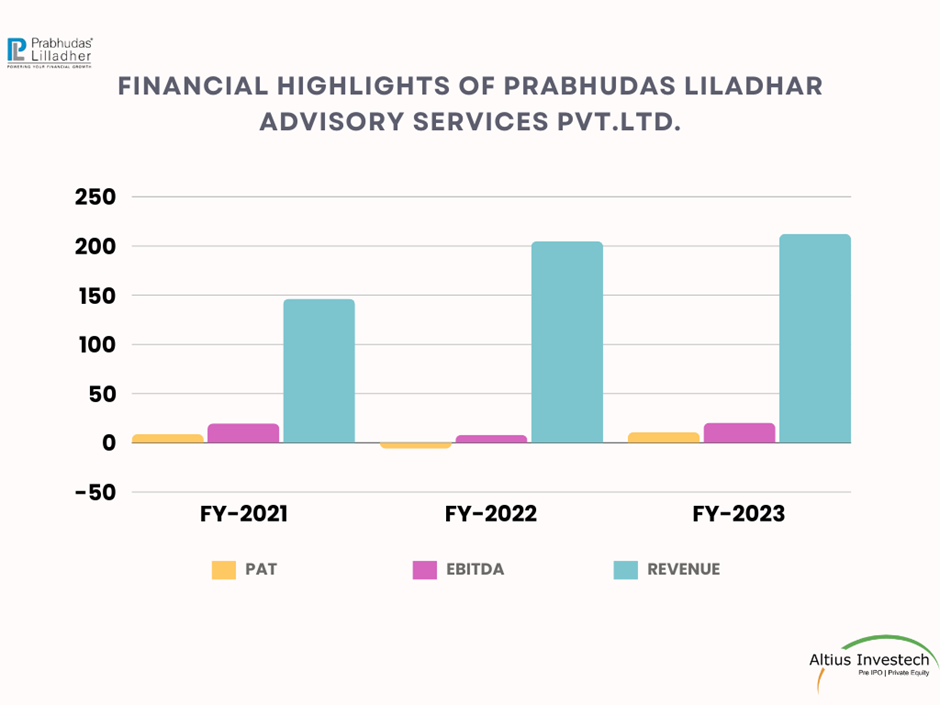

Financial Highlights

| Financials (in crores) | 31st March,2023 | 31st March,2022 | Increase % |

| Revenue | 212.3 | 204.85 | 4% |

| EBITDA | 20.29 | 8.06 | 152% |

| PAT | 10.85 | -5.88 | 285% |

| EPS | 1.75 | 48.61 | -96% |

| PAT Margins | 5% | -3% |

Key Takeaways:

- The company has undergone an increase in earnings over FY22-23, indicating a positive outlook.

- EBITDA has gone back to normal levels post a downfall in FY22.

- The company has recovered its losses and is profit-making in FY23 with a PAT margin of 5%.

Valuation

| Valuations | 31st March, 2023 |

| Share Price (06/09/2024) | 275 |

| Outstanding shares | 6,18,23,113 |

| MCAP (in Crs) | 1700.14 |

| P/E Ratio | 4.57 |

| P/S Ratio | 8.01 |

| P/B Ratio | 8.52 |

| Book value per share | 32.26 |

Peer Comparison

| Particulars | PL Advisory | Motilal Oswal Financial Services |

| Revenue | 212.3 | 2692.71 |

| PAT | 10.85 | 568.91 |

| PAT Margin | 5% | 21.10% |

| Current Market Price (06/09/2024) | 275 | 764 |

| MCAP | 1700 | 45,621 |

| P/E | 156.64 | 15.86 |

| P/S | 8.01 | 8.13 |

| P/B | 8.52 | 5.23 |

Key Takeaways:

The peer company is proportionately larger, which is considered in the ratio analysis.

- Valuation Analysis: The company is slightly undervalued based on the Price-to-Sales (P/S) ratio and overvalued according to the Price-to-Book (P/B) ratio. The Price-to-Earnings (P/E) ratio indicates that the company is slightly undervalued which can be explained by the negative PAT in FY22.

- Growth Prospects: These valuation metrics suggest that the company has significant growth potential for attracting investor interest and confidence.

Recent News

18 June, 2024

Prabhudas Lilladher Advisory Services is raising funds through a preferential placement of equity shares, priced at ₹253 per share with a minimum investment of ₹1 crore. The company plans to use the funds to expand its margin funding book, asset, and wealth management operations, contribute to the promoter’s share in AIF, and meet AMC guidelines. An IPO is planned within the next two years to offer investor exits. Prabhudas Lilladher manages over ₹26,000 crore across 160,000 clients, including 4,000 HNIs and 100 institutional clients.

(Source: Money Control)

SWOT Analysis

Strengths:

- Established Reputation: With over 75 years in the financial services industry, Prabhudas Lilladher has built a strong brand and is known for trustworthiness and reliability.

- Comprehensive Product Portfolio: The firm offers a wide range of financial products and services, including wealth management, asset management, and institutional equities, catering to a diverse clientele.

- Experienced Leadership: The management team has extensive experience in corporate finance, wealth management, and investment banking, providing strong strategic direction.

- Research-Driven: A large team of analysts offers thorough equity research and personalized investment strategies, ensuring clients receive informed advice.

- Technological Integration: Investment in algorithmic platforms and automated advisory services enhances the efficiency and reach of its products.

Weaknesses:

- Dependence on Market Volatility: The firm’s success, especially in trading and equity services, is closely tied to market performance, making it vulnerable during market downturns.

- Niche Client Base: Although it has institutional and HNI clients, the firm’s focus on high-net-worth individuals may limit growth opportunities in mass retail markets.

- Limited Global Presence: Despite strong domestic performance, the company has relatively limited international exposure compared to global competitors.

Opportunities:

- Growing Financial Services Market: India’s financial sector is expanding rapidly, offering opportunities for increased market share in wealth management, AIFs, and mutual fund advisory.

- Robo-Advisory and Digital Platforms: With increasing demand for digital financial solutions, the firm can expand its algorithm-driven advisory products to attract tech-savvy clients.

- Expansion of AIF and PMS Products: The rising demand for alternative investments in India offers growth potential in the AIF and PMS sectors.

- Strategic Partnerships: Collaborations with fintech companies or international financial institutions can enhance service offerings and expand clientele.

Threats:

- Regulatory Changes: The financial services industry in India is subject to stringent regulatory changes that could affect profitability and operations.

- High Competition: The sector is highly competitive, with established players and new entrants offering similar services, potentially leading to margin pressures.

- Economic Slowdown: Any economic downturn or market instability may negatively impact investment flows, advisory revenue, and client portfolios.

- Technological Disruption: The rapid evolution of financial technology could pose a threat if the firm does not continue to innovate and adapt to new platforms and trends.

..

..

Prabhudas Liladhar Advisory services unlisted shares are currently trading, CLICK HERE to Invest.

Get in touch with us

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

To know, more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

To buy unlisted shares Visit – https://altiusinvestech.com/companymain

To know more about How to apply for an IPO? Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/

Visit our website homepage: https://altiusinvestech.com/