Blog Highlights

- Glimpse Into the Personal Life

- Veliyath Investment Strategy

- Breakdown of Veliyath’s Portfolio- Notable Investments and Holdings

- Porinju Veliyath’s Portfolio’s Top Holdings

- Porinju Veliyath’s Public Shareholdings

- Sector-wise Breakup of Holdings Chart

- Insights on Veliyath’s Net Worth

- Lessons from Veliyath’s Investment Journey

A Look Inside Porinju Veliyath Latest Portfolio & Net Worth in 2024

Porinju Veliyath is a luminary in the Indian Investment sector and his odyssey to become a celebrated maestro of stocks is nothing short of remarkable. We onlook his foray into the financial world, which started in the bustling city of Bombay as a floor trader with Kotak Securities, and progressed to Parag Parikh Securities when he developed an aptitude for market intricacies. Here, he honed his skills as a fund manager and research analyst.

Veliyath returned to his roots in 2002 in Kerala and founded Equity Intelligence India Private Ltd. The venture had been dedicated to value investing in Indian equities, a philosophy this man passionately advocates for. His capability to pick undervalued stocks to turn them into valuable investments is what brings our attention. He has also attained the title of “Small-Cao Czar” as his story speaks of sharp acumen, resilience, and a pursuit of financial wisdom, which makes him the beacon for aspiring investors.

Glimpse Into Porinju Veliyath‘s Personal Life

Despite Veliyath’s professional achievements and recognition to be widely acclaimed, his personal life paints a picture of balance and simplicity. As he resides in a serene farmhouse in Kerala, he happens to enjoy a life of tranquility with his family.

His interests include traveling to far-flung destinations, spending time with his family and pets, and playing football.

His professional and personal life intersects with harmony, and his surroundings serve as inspiration for his vital decisions of investment.

Porinju Veliyath Investment Strategy

Veliyath’s success results from his unique strategy that is deep-rooted in value investing. As he draws inspiration from Warren Buffet, Veliyath focuses on companies that remain undervalued despite sound management or robust business models. The contrarian approach lets him make bold investments in lesser-known small-cap stocks. This method surprisingly has yielded impressive returns to solidify his reputation as a maverick investor. Also read about the investment strategy of Vijay Kedia.

Breakdown of Porinju Veliyath Portfolio- Notable Investments and Holdings

Currently, Veliyath’s portfolio involves a mixture of small-cap as well as large-cap stocks. Key holdings remain in companies like Archies Ltd, Ansal Buildwell, Archies Ltd, Shalimar Paints, and Duroply industries. Veliyath’s ability to identify undervalued stocks early has been instrumental in his successes.

As per the current records, Porinju happens to hold 14 stocks having a net worth of over Rs 214.7 Crores.

In order of increasing-decreasing stock valuations, the 14 active stocks have been stated below-

- Aurum Proptech-The holding value for this stock is Rs 50.0 Crores with the March ‘24 holding percentage estimated to be 4.5%.

- RPSG Ventures- The holding value for this stock is Rs 31.1 Crores with the March ‘24 holding percentage estimated to be 1.4%.

- Centum Electronics Ltd- The holding value for this stock is Rs 21.8 Crores with the March ‘24 holding percentage estimated to be 1.0%.

- Orient Bell Ltd- The holding value for this stock is Rs 20.6 Crores with the March ‘24 holding percentage estimated to be 3.7%.

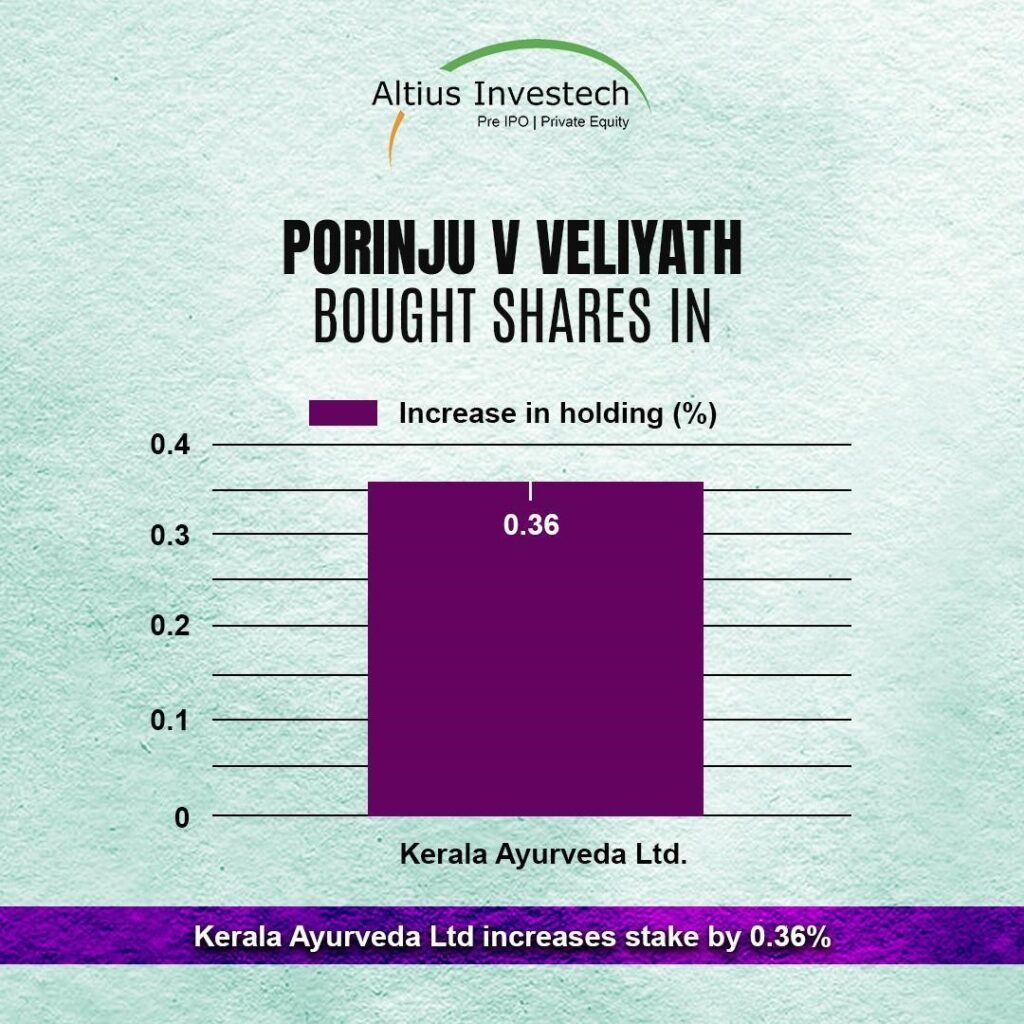

- Kerala Ayurveda Ltd- The holding value for this stock is Rs 18.2 Crores with the March ‘24 holding percentage estimated to be 5.2%.

- Kokuyo Camlin Ltd– The holding value for this stock is Rs 14.8 Crores with the March ‘24 holding percentage estimated to be 1.0%.

- Duroply Industries Ltd- The holding value for this stock is Rs 14.7 Crores with the March ‘24 holding percentage estimated to be 5.5%.

- Kaya Ltd- The holding value for this stock is Rs 12.7 Crores with the March ‘24 holding percentage estimated to be 3.0%.

- Max India Ltd- The holding value for this stock is Rs 12.3 Crores with the March ‘24 holding percentage estimated to be 1.0%.

- Taal Enterprises Ltd- The holding value for this stock is Rs 8.8 Crores with the March ‘24 holding percentage estimated to be 1.1%.

- Mitsu Chem Plast Ltd- The holding value for this stock is Rs 3.4 Crores with the March ‘24 holding percentage estimated to be 1.7%.

- P G Foils Ltd- The holding value for this stock is Rs 2.5 Crores with the March ‘24 holding percentage estimated to be 1.1 %.

- Ansal Buildwell Ltd- The holding value for this stock is Rs 2.2 Crores with the March ‘24 holding percentage estimated to be 2.0 %.

- AeonX Digital Technology Ltd- The holding value for this stock is Rs 1.4 Crores with the March ‘24 holding percentage estimated to be 3.0 %.

Porinju Veliyath’s Portfolio’s Top Holdings

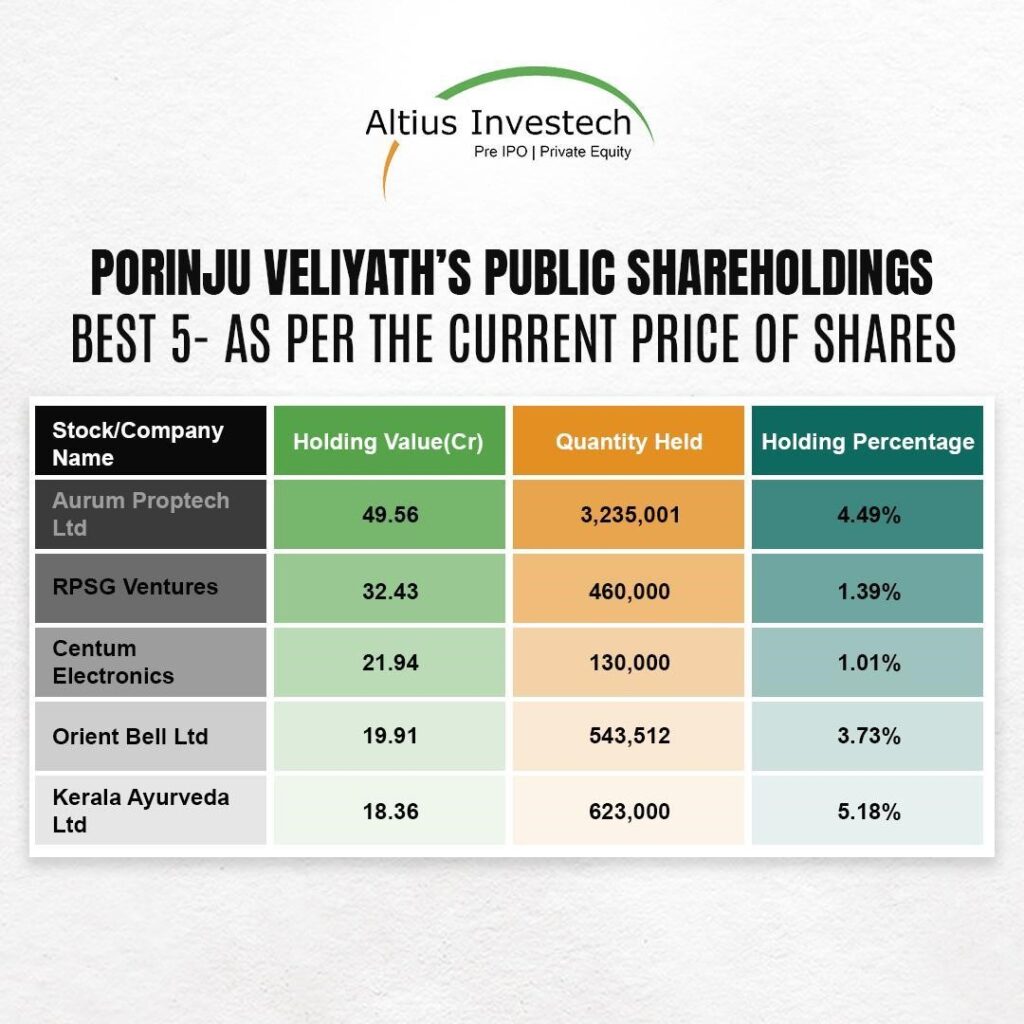

Porinju Veliyath’s Public Shareholdings

| Stock/Company Name | Holding Value(Cr) | Quantity Held | Holding Percentage |

| Aurum Proptech Ltd | 49.56 | 3,235,001 | 4.49% |

| RPSG Ventures | 32.43 | 460,000 | 1.39% |

| Centum Electronics | 21.94 | 130,000 | 1.01% |

| Orient Bell Ltd | 19.91 | 543,512 | 3.73% |

| Kerala Ayurveda Ltd | 18.36 | 623,000 | 5.18% |

As we notice, the investment portfolio is characterized by a strategic selection of stocks across different sectors. Various significant investments in consumer goods, financial services, and real estate can be acknowledged. Particular holdings in Emkay Global Financial Services and Shalimar Paints exemplify his focus in this field.

Additionally, his portfolio also includes shares in blue-chip organizations like Reliance Industries, thereby reflecting a balanced approach to growth and risk.

For instance, his investment in Geojit’s financial services, which was regarded as a poor investment initially, turned out to be highly profitable, thereby exemplifying his keen eye for potential.

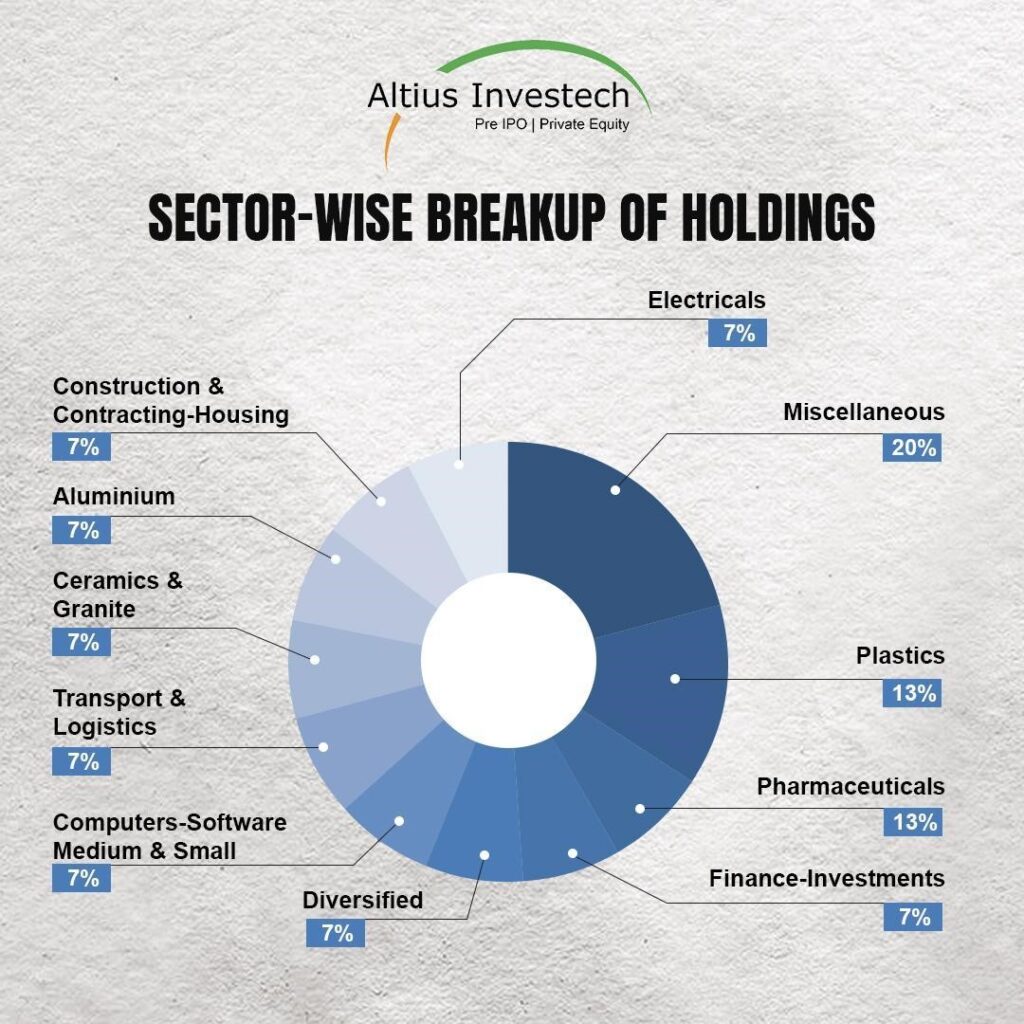

Sector-wise Breakup of Holdings Chart

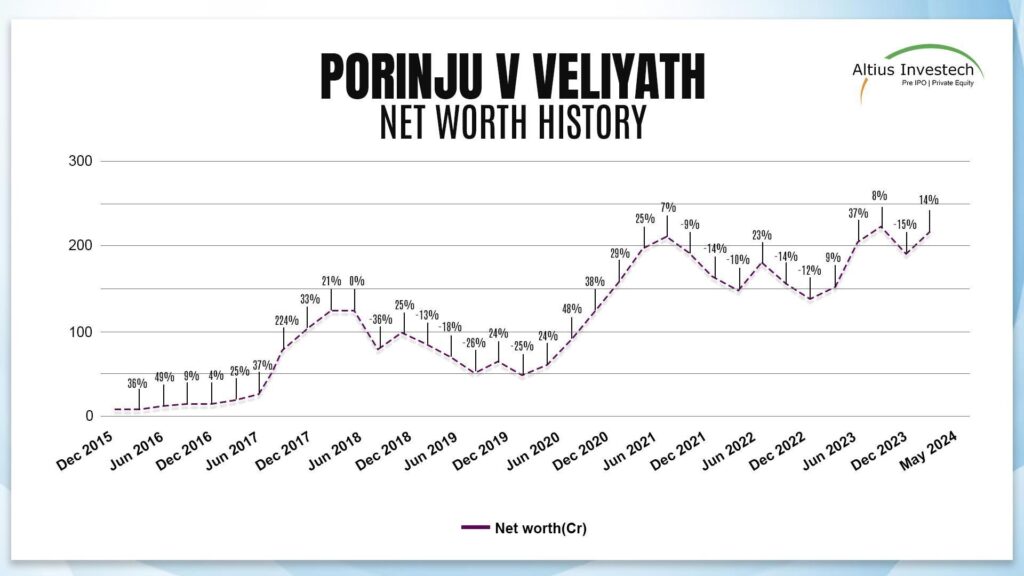

Insights on Veliyath’s Net Worth

Veliyath’s Net worth has been growing exponentially, owing to his successful strategies of investment.

His investments were valued at around Rs 213.11 Crores. Veliyath’s firm Equity Intelligence manages assets that are worth Rs 1700 Crores, which underscores his prominence in the investment community.

Current records suggestively imply his net worth to be Rs 219 Crores. Also, you can read our other blogs like Net Worth of Ashish Dhawan & Radhakishan Damani.

Lessons from Veliyath’s Investment Journey

- Value in Investing– Focusing on undervalued companies having strong fundamentals. If you are someone willing to take minimal risks for double, or even triple the returns, unlisted shares would serve as the best bet for you! Buy it from a trusted platform like Altius Investech and maximize your revenues.

- Contrarian Approach– Embracing opportunities in places that are risky to others.

- Long-term Perspective-Investing with a vision for long-term growth.

- Research– Conduction of due diligence and detailed analyses.

- Staying Grounded– Maintaining a balance between professional and personal endeavors to maintain focus and clarity.

Investors would be able to apply these strategies through careful research of potential investments, maintenance of a diverse portfolio, and patience for the investments to yield returns.

Conclusion

His investment journey shows a masterclass in strategic thinking, financial acumen, and importantly resilience. The way he identified undervalued stocks and had a disciplined approach has shaped Porinju Veliyath’s wealth significantly. Aspiring investors must take inspiration from the strategies, which would make him attain financial success.

It is a story of his testament to the power of value investing and the significance of a well-researched approach to the stock market.

FAQs

Ans:- Porinju Veliyath’s net worth is around Rs 219 Crores.

Ans:- Porinju Veliyath is a well-known small-cap investor based in Kerala.

Ans:- Porinju Veliyath is the founder of Equity Intelligence, a prominent portfolio management firm.

GET IN TOUCH WITH US:

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

To know, more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

You can also checkout the list of Best 5 Unlisted Shares to Buy in India

Click here to connect with us on WhatsApp

For Direct Trading, Visit – https://altiusinvestech.com/companymain.

To know more about How to apply for an IPO? Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/

Read More