Polymatech Electronics Limited: Company Overview

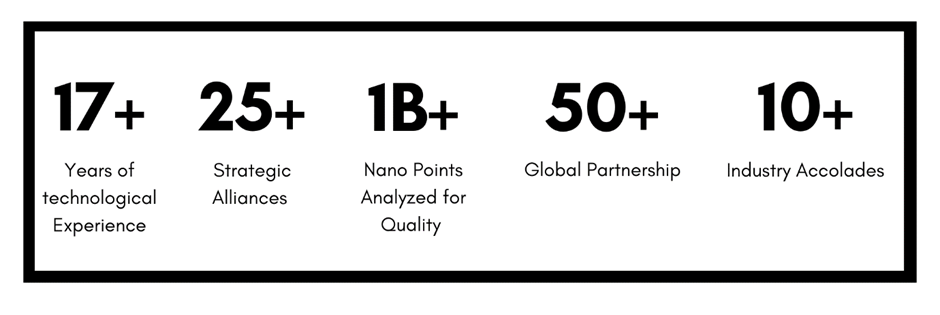

Polymatech Electronics Limited is a leading technology company focused on delivering innovative electronic solutions. The company is dedicated to pushing the boundaries of technology and creating impactful products that cater to the evolving needs of its clients. With a passion for excellence, Polymatech provides cutting-edge semiconductor solutions, positioning itself as a key player in the global technology landscape.

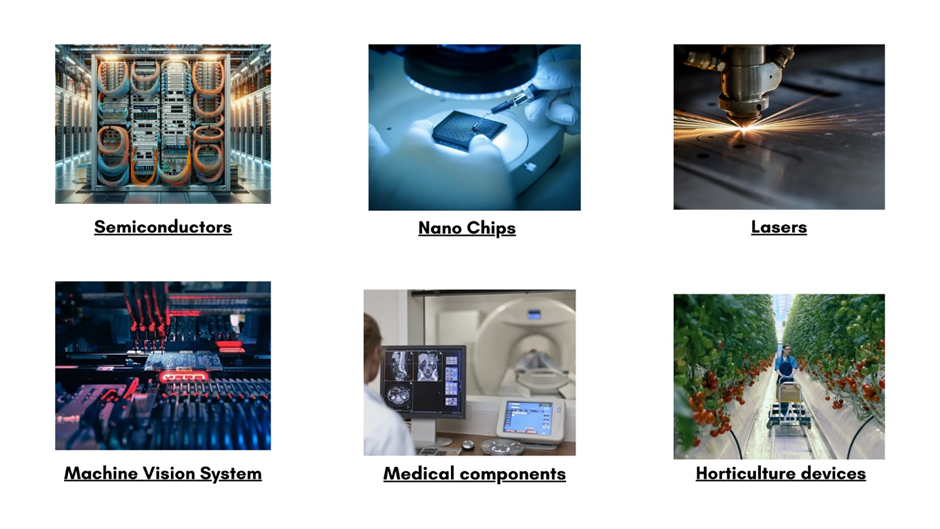

As of March 31, 2023, Polymatech’s operations are concentrated within a single business segment: the manufacturing and sale of semiconductors and LED devices. Accordingly, the segment’s revenue, results, asset and liability figures, acquisition costs for segment assets, and depreciation charges for the year are detailed in its Restated Financial Information.

Polymatech Electronics Private Limited (PEPL), according to its credit rating, is engaged in the manufacturing of LED semiconductor chips at its facility located within the SIPCOT Hi-Tech SEZ (Special Economic Zone) in Kancheepuram, Tamil Nadu. The company produces a range of products, including microcontrollers, wireless chips, logic chips, memory chips, and LED chips. Established in 2007, Polymatech has its registered office in Oragadam, Tamil Nadu.

| Company Name | Polymatech Electronics |

| Company Type | Unlisted Public Company (Buy unlisted shares) |

| Industry | Semiconductors |

| Founded | 29 May 2007 |

| Registered Address | Oragadam, Kancheepuram, Tamil Nadu 602105 |

Industry Overview

India is rapidly emerging as a global semiconductor manufacturing hub, driven by government initiatives and international collaborations. A report by the India Electronics and Semiconductor Association projects semiconductor consumption to grow from $22 billion in 2019 to $64 billion by 2026, with further growth to $110 billion by 2030, making up 10% of global demand. India already contributes 20% of global semiconductor design talent, with over 35,000 engineers engaged in chip design, and is forging strategic partnerships with countries like the US, Japan, and Taiwan.

Although India accounted for only 4% of global semiconductor sales in 2022, it represents 10% of actual consumption, as many chips sold in other regions are used in products manufactured in India. By 2030, major market segments driving demand will include wireless communications, consumer goods, and automotives. Currently, only 9% of semiconductors are locally sourced, but this is expected to increase to 17% by 2026, marking a significant shift toward domestic production.

Key Clients

Product Portfolio

Management

Mr. Eswara Rao Nandam | CEO and Managing Director |

Mr. Eswara Rao Nandam, is the promoter and Managing Director of the company, with over 30 years of experience in electronic and automobile components manufacturing, assembly, and automation with AI. He has held technical and managerial roles at prominent organizations like Rane Group, Hero Group, Pricol, Nokia, Suzlon, and GMR. An M. Tech in Manufacturing Engineering from BITS Pilani and a Six Sigma practitioner, he also holds certifications in Lean Manufacturing, System Integration, and Condition Monitoring. Mr. Nandam is a life member of the Indian Institute of Plant Engineers.

Shareholding Pattern

| Shareholding Above 5% | Holding % |

| Mr. Eswara Rao Nandam | 41.56% |

| Ms. Uma Nandam | 38.07% |

| Others | 20.37% |

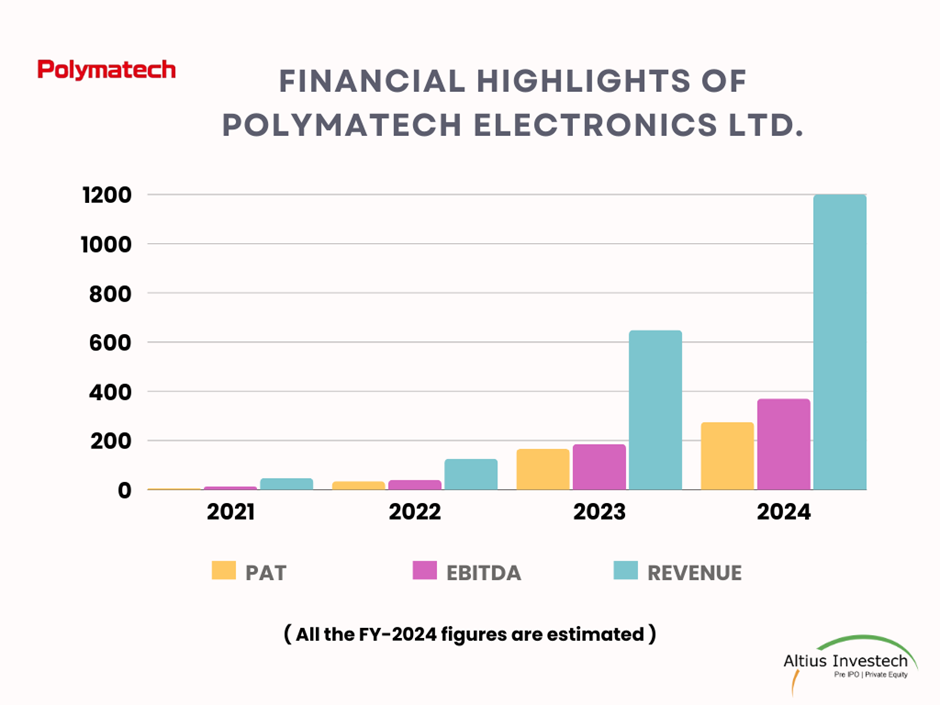

Financial Highlights

| Particulars (₹ in Cr.) | 31st March, 2024 | 31st March, 2023 | % increase |

| Revenue | 1200 | 649 | 85% |

| EBITDA | 370 | 185.41 | 100% |

| PAT | 275 | 166 | 66% |

| EPS | 38.26 | 23.8 | |

| PAT Margins | 23% | 25% |

Valuation

| Valuations (₹ in Cr.) | 31st March, 2024 |

| Share Price ( as on 23 Sep, 2024) | 740 |

| Outstanding shares | 7,18,76,216 |

| MCAP (in Crs) | 5318.84 |

| P/E Ratio | 19.34 |

| P/S Ratio | 4.43 |

| P/B Ratio | 16.46 |

| Book value per share | 44.95 |

Peer Comparison

(As on Sept, 2024)

| Financials (in crores) | Polymatech Electronics | Moschip Technologies Ltd |

| Revenue | 1200 | 297 |

| EBITDA | 370 | 34 |

| PAT | 275 | 10 |

| EPS (diluted) | 38.26 | 0.52 |

| PAT Margins | 23% | 3% |

| Share Price | 740 | 245 |

| Outstanding shares | 7,18,76,216 | 18,81,35,799 |

| MCAP (in Crs) | 5318.84 | 4,636 |

| P/E Ratio | 19.34 | 434 |

| P/S Ratio | 4.43 | 16 |

| P/B Ratio | 16.46 | 17 |

| Book value per share | 44.95 | 14.3 |

IPO Plans

Polymatech initially aimed to raise Rs. 750 crores through an IPO by filing its Draft Red Herring Prospectus (DRHP) in October 2023. However, the IPO did not proceed. The company now plans to refile the DRHP with the Securities and Exchange Board of India (SEBI) using its financials from either March or June.

Recent News

(31st July, 2024)

Polymatech acquired Nisene Technology Group Inc., a U.S.-based semiconductor company, through its Singapore subsidiary. The $100 million acquisition strengthens Polymatech’s multi-wafer capabilities, making it one of the few companies globally working with Silicon, Silicon Carbide, and Sapphire semiconductors. For Q1 FY24, Polymatech reported over Rs 800 crore in revenue and is working with financial partners to expedite its stock exchange listing.

(11th May, 2024)

Polymatech aims to achieve $2.5 billion (Rs 20,000 crore) in revenue by FY26, driven by increased production capacity. With a Rs 7,000 crore export order book and plans to manufacture 10 billion chips this year, the company saw its FY24 revenue grow by 85% to Rs 1,200 crore, supported by demand for energy-efficient lighting and semiconductor solutions.

(15th Sep, 2024)

Polymatech Electronics is investing $16 million to establish its first international semiconductor facility, “Atri,” in Bahrain’s Hidd Industrial Area. The facility will focus on producing critical 5G and 6G components, supporting Bahrain’s vision of a digital-first economy and fostering advanced technologies. This strategic move is expected to enhance Bahrain’s economic diversification.

(1st Oct, 2024)

Polymatech’s MD, Eswara Rao Nandam, addressed shareholders and investors to clarify recent rumors circulating on social media. The company remains committed to its IPO but will proceed when the timing is right to achieve its revenue goal of $12 billion by 2030. Agencies have advised launching the IPO at a reasonable value as the company expands globally. The financial results for 2023-24 are currently under review and will be released soon, with a genuine reason for the delay.

SWOT Analysis

Strengths:

- Diverse Product Portfolio: Expertise in manufacturing electronic components, mobile phones, laptops, robotics, and AI-based automation systems.

- Experienced Leadership: Led by Mr. Eswara Rao Nandam, with over three decades of industry experience and deep technical knowledge.

- Technological Expertise: Strong capabilities in electronics assembly, embedded systems, and integration of self-developed software.

- Strategic Industry Relationships: Collaborations and work experience with renowned organizations like Nokia, Hero Group, and Suzlon.

Weaknesses:

- Dependence on Key Leadership: Heavy reliance on the expertise of a few key leaders, which could affect operations in case of transition challenges.

- Limited Global Presence: While having experience in international taxation, the company’s global footprint may be limited compared to larger multinational electronics manufacturers.

Opportunities:

- Growing Demand for Automation: Increasing demand for AI-driven automation and smart electronics presents significant growth opportunities.

- Expansion in Emerging Markets: Potential for expanding into new international markets, particularly in high-growth regions for electronics and automation.

- Government Initiatives: Indian government policies favoring local manufacturing and initiatives like “Make in India” can provide incentives for growth.

Threats:

- Intense Competition: High competition from both domestic and international electronics manufacturers could pressure pricing and margins.

- Rapid Technological Advancements: The fast pace of technological changes in the electronics industry may require continuous investment in R&D to stay competitive.

- Regulatory Changes: Changes in domestic or international regulations, especially concerning electronic manufacturing and SEZ policies, could impact operations.

..

..

Polymatech Electronics unlisted shares are currently trading ₹740, CLICK HERE to Invest.

Get in touch with us

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

To know, more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

To buy unlisted shares Visit – https://altiusinvestech.com/companymain

To know more about How to apply for an IPO? Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/

Visit our website homepage: https://altiusinvestech.com/

Read More