Philips India Limited: About the Company

Philips India Limited (PIL) is a prominent manufacturer of consumer electronics, serving the Indian market with a diverse range of products including fluorescent and halogen lamps, television sets, compact disc players, digital radio systems, personal care items, household appliances, lighting solutions, loudspeakers, audio communication systems, car lights, and accessories. Philips India Limited plays a crucial role in meeting the global technological requirements of its parent company, Philips, through its innovation center, which focuses on developing cutting-edge technologies and products.

Alongside consumer electronics, PIL operates in the personal care and medical equipment sectors, offering a wide array of products to meet diverse consumer and healthcare needs. Previous strategic demergers of domestic appliances and lighting businesses in fiscal years 2022 and 2016 respectively, align with Philips’ global strategy, allowing PIL to sharpen its focus on core competencies while contributing to the broader objectives of the parent company.

| Company Name | PHILIPS INDIA LIMITED |

| Company Type | Unlisted Public Company |

| Industry | Manufacturing (Consumer Electronics) |

| Incorporation Year | 1930 |

| Registered Address | Kolkata, West Bengal, India |

Product Portfolio

.

……………………………………………………….

a. Health Systems:

- Medical Electronics Equipment: Includes advanced medical imaging systems such as MRI machines, CT scanners, X-ray machines, ultrasound machines, patient monitoring systems, and medical informatics solutions.

- Customer Services: Comprehensive support services including maintenance, repair, training, and consulting to ensure the optimal performance and uptime of medical equipment.

b. Innovation Services:

- Development of Embedded Software: This involves the creation of software solutions embedded within various electronic devices and systems. Examples include software for healthcare devices, consumer electronics, automotive systems, industrial machinery, and more.

c. Personal Health:

- Health and Wellness Products: Includes a wide range of consumer health monitoring devices such as blood pressure monitors, thermometers, activity trackers, and smart scales. Also, may encompass products like air purifiers and humidifiers designed to enhance indoor air quality and overall well-being.

- Personal Care Products: Encompasses grooming and personal hygiene products such as electric shavers, hair trimmers, hair dryers, hair straighteners, epilators, and oral care products like electric toothbrushes and water flossers.

This diverse product portfolio enables the company to cater to the needs of both healthcare professionals and consumers, offering innovative solutions for medical diagnostics and treatment as well as enhancing personal health and everyday living experiences.

Board of Directors

Susim Mukul Datta: Chairman and Non-Executive Independent Director

Susim Mukul Datta is a distinguished business leader known for his extensive roles in various companies and organizations. With over 21 chairmanships and memberships on numerous boards, including IL&FS Investment Managers Ltd. and Philips India Ltd., Mr. Datta’s influence spans industries like finance, manufacturing, and education. He has also held key positions in prestigious institutions like the Administrative Staff College of India and Bombay First. Mr. Datta’s career highlights his commitment to excellence and leadership across diverse sectors.

Daniel Mazon: Vice – Chairman and Managing Director

Mr. Daniel Mazon serves as Vice Chairman & Managing Director of Philips India Subcontinent, where he leads overall strategy and operations. With a strong background in engineering and an Executive MBA from the University of Miami Herbert Business School, he is recognized for driving growth and profitability through customer-centric approaches and team building. Mr. Daniel’s international leadership experience and educational achievements make him a valuable asset to Philips India Subcontinent.

Sudeep Agrawal: Whole – Time Director and Chief Financial Officer

Sudeep Agrawal serves as the Whole-Time Director and Chief Financial Officer at Philips, bringing over 25 years of extensive financial leadership experience across diverse global regions. His tenure includes pivotal roles in financial strategy, operations, and compliance, with notable contributions to Philips Healthcare India. Sudeep holds an MBA from the University of Wollongong, UAE, underscoring his commitment to continuous professional growth and excellence in financial management.

Overview of the Indian Medical Electronics Industry

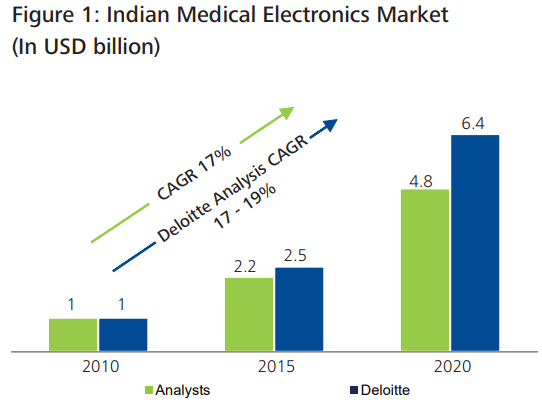

The Indian Medical Electronics industry, valued at around USD 1 billion and growing steadily at an average rate of 17% in recent years, is poised for substantial expansion, with forecasts predicting a surge to nearly USD 6.5 billion by 2020. This growth trajectory is propelled by various factors, including demographic shifts, rising disposable income, and favorable regulatory environments. Medical Electronics encompass a wide range of healthcare products requiring external energy sources, such as personal medical devices, monitoring systems, and implants. While challenges such as infrastructure development and regulatory advancements persist, market drivers like growing population, increased awareness, and government initiatives are expected to fuel continued growth. Projections indicate a market size of approximately USD 5 billion by 2020, with potential for even greater expansion beyond current estimates.

Source: Deloitte Report

Philips Unveils New Innovation Campus in Bengaluru, India, to Accommodate 5,000 Engineers

(November 2023) CEO Roy Jakobs inaugurated a new innovation campus in Bengaluru, India, capable of accommodating 5,000 engineers. He emphasized the potential of Generative AI in addressing customer needs, particularly in healthcare, where the focus lies on serving more patients efficiently.

With over 9,000 employees in India, 5,000 of whom will be based in Bengaluru working on innovative health technologies, Philips aims to accelerate access to care and develop solutions locally for global markets. The company’s investment in Pune’s healthcare innovation center and plans for further expansions underscore its commitment to innovation in India. Philips views India as a significant hub for innovation, reflecting its longstanding presence in the country dating back 92 years.

Powering Wellness with Star Ambassadors

.

…………………………………………………………………………………………………………

Philips shines with a star-studded cast of brand ambassadors, including Alia Bhatt, Varun Dhawan, Virat Kohli and Arjun Kapoor. Each embodies the brand’s values of excellence, innovation, and holistic well-being. With their influence and resonance, they amplify Philips’ mission to empower individuals to lead healthier, happier lives through cutting-edge technology and lifestyle solutions.

Philips India Limited Share Price (as of 15.05.2024)

- The buy price of Philips varies based on quantity, ranging from 950 for quantities between 10-30 shares to 925 for quantities between 305-609 shares, with corresponding rates per share.

- The 52-week high is 999, and the 52-week low is 890 indicating the range of fluctuations in the share price.

Currently, the Philips India Limited Share Price is trading at around Rs. 930/share. CLICK HERE to Invest.

Financial Metrics for Philips India (as of 15.05.2024)

| Particulars | Amount |

| Price to Earning Ratio (P/E) | 20.46 |

| Price to Sales Ratio (P/S) | 0.93 |

| Price to Book Value (P/B) | 4.32 |

| Industry PE | 50.98 |

| Face Value | ₹ 10 |

| Book Value | ₹ 214 |

| Market Cap | ₹5320.34 Cr |

| Dividend | 222 |

| Dividend Yield | 24 % |

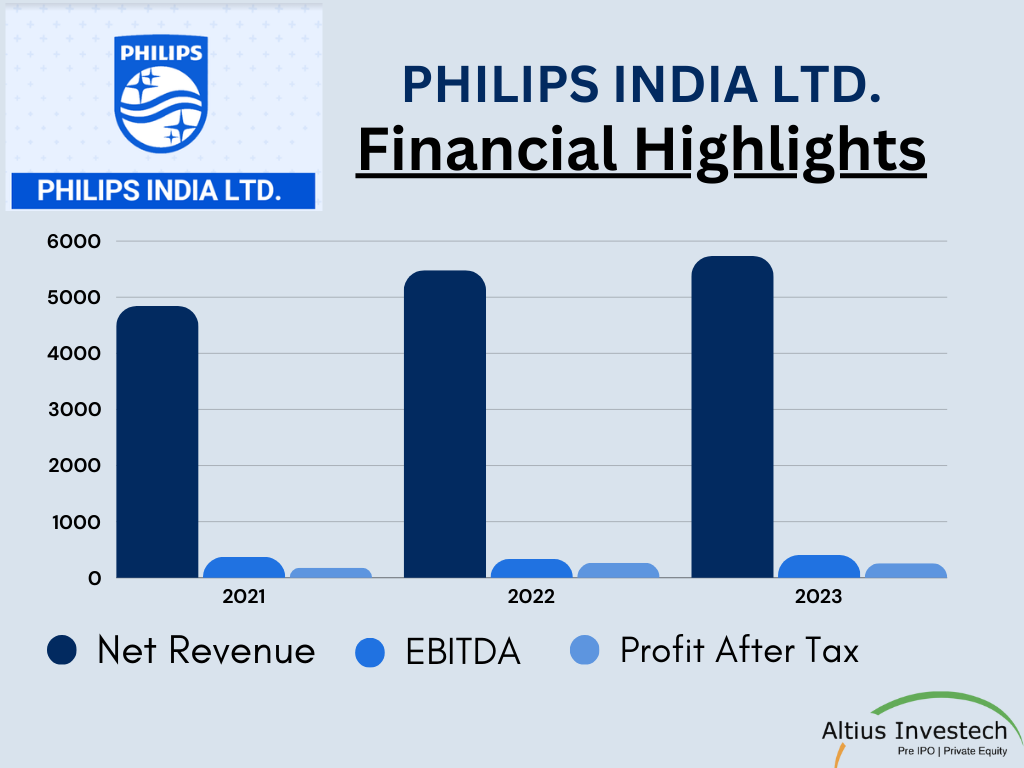

Financial Highlights

₹ in crore

| Particulars | FY 2023 | FY 2022 | FY 2021 |

| Net Revenue | 5734.00 | 5481.40 | 4842.70 |

| EBITDA | 403.80 | 334.10 | 371.80 |

| Profit After Tax (PAT) | 260.00 | 265.90 | 176.00 |

| Earning Per Share (EPS) | 45.21 | 46.23 | 30.61 |

- 2 Years Revenue CAGR: 8.8%

- 2 Years PAT CAGR: 21%

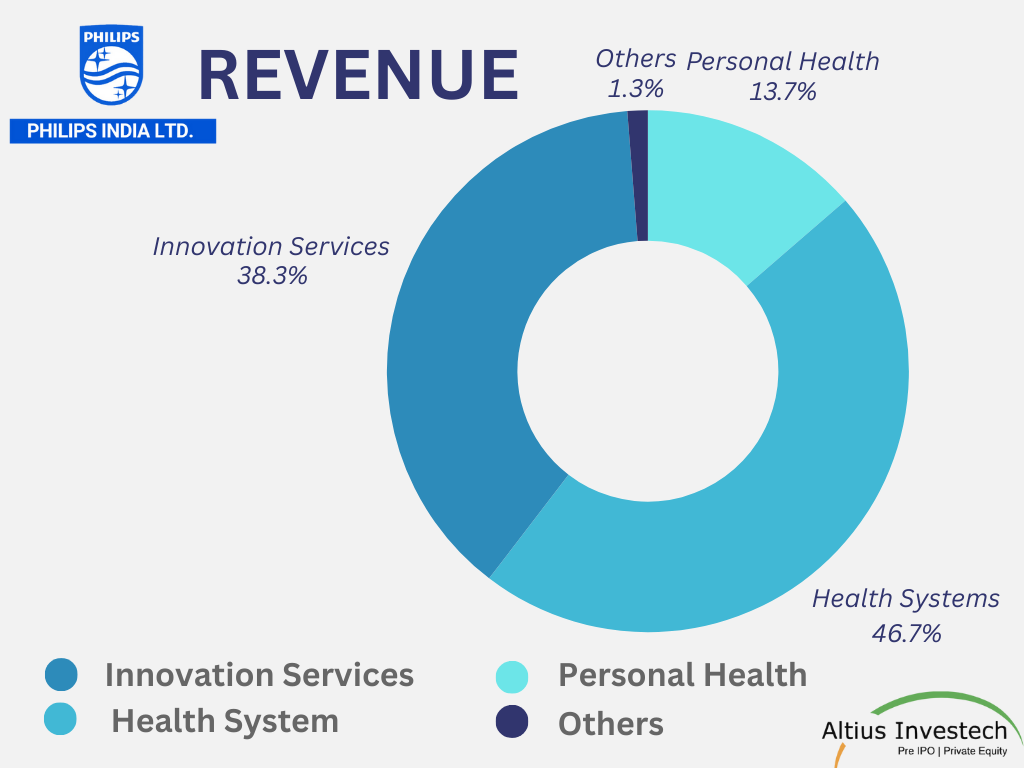

Revenue Breakup

| Segment | Sales 2022-23 |

|---|---|

| Health Systems | 26,493 |

| Innovation Services | 21,729 |

| Personal Health | 7,746 |

| Others | 714 |

| Total | 56,682 |

Dividend

During the year ended 31 March 2023, Philips India Limited has declared an interim dividend of Rs. 222 per share on the fully paid equity shares.

Delisting of Equity Shares and Investment Opportunities in Philips India Limited

Following a takeover by Philips Electronics NV in 2004, the equity shares of Philips India Limited were delisted from the stock exchanges in India. Despite this delisting, certain retail shareholders still retain equity shares in the company. However, post-delisting, these shares are not traded on any stock exchange in India.

Nevertheless, interested investors can still buy and invest in Philips through Altius Investech. CLICK HERE to Invest.

Relisting/IPO Plans

As of now, there are no plans from the company’s side for relisting its equity shares on the stock exchanges in India.

Peer Comparison

₹ in crores (FY 23)

| Particulars | Philips India Limited | Poly Medicure Limited | Schneider Electric Infrastructure |

| Net Revenue | 5734 | 1153 | 1804 |

| EBITDA | 404 | 267 | 168 |

| Profit After Tax | 260 | 179 | 124 |

| Market Capital | 5320 | 16142 | 19343 |

| Share Price (as on 15.05.2024) | 930 | 1682 | 809 |

| P/E | 20.46 | 89.99 | 156.47 |

| P/S | 0.93 | 14 | 10.72 |

Shareholding Pattern

| Shareholding Above 5% | Holding % |

|---|---|

| Koninklijke Philips N V | 96.13 |

| Other | 3.87 |

Key Strengths of Philips

- Market Leadership in Healthcare Segment: PIL holds a dominant position in premium medical equipment in India, driven by cutting-edge imaging technology and comprehensive solutions for medical centers.

- Growth in Innovation Services: PIL’s innovation services segment, catering to KPNV’s global technological requirements, saw a remarkable revenue surge of ~25% in fiscal 2023. This growth trajectory is expected to continue with increased investment in innovation.

- Steady Expansion in Personal Care: Excluding the demerged domestic appliances segment, PIL recorded a solid ~12% revenue growth in its personal care division in fiscal 2023. Continued growth is anticipated, particularly in sub-segments like male grooming.

- Maintained Market Position: CRISIL Ratings foresees PIL retaining its established market position, supported by new product launches and a renewed focus on core healthcare post the demerger of domestic appliances.

- Healthy Financial Profile: PIL maintains a robust financial risk profile with strong cash accruals and a substantial net worth exceeding Rs 1,200 crore as of March 31, 2023, despite significant dividend payouts. Debt protection metrics are expected to remain strong, with interest coverage projected over 15 times in the medium term.

- Technological Support from Parent Company: As a 96.13% subsidiary of KPNV, PIL benefits from strategic support and technical expertise. KPNV’s involvement in decision-making and provision of technological support fortify PIL’s operations, ensuring alignment with global restructuring plans.

Key Weaknesses

- Modest Healthcare Segment Profitability: PIL anticipates modest operating margins of around 4-5% in the healthcare segment over the medium term, despite its significant revenue contribution of approximately 47% in fiscal 2023. The operating margin of PIL will be influenced by the performance of both the healthcare and software segments.

- Competitive Landscape: PIL contends with fierce competition from industry giants like General Electric Co (GE) and Siemens AG in the healthcare division. Nonetheless, PIL leverages its robust brand presence, diverse product portfolio, and extensive distribution network to maintain its competitive edge.

Awards and Recognition

- 5G Connected Ambulance Computable Award 2021

- Best Performance & Utility (Hatke) Gadget of the Year award for the Philips Fresh Air Mask

- ET Best Brands Award 2020 for Philips Personal Care

- Bronze at Indian Digital Marketing Association Awards 2020 for Male grooming campaign – Trim @Home

- Gold & Bronze at the Maddies 2020 for Mother and Child Care campaigns

- CII Industrial Award 2020 for Philips Innovation Campus Bangalore

- ICMG Best Digital Architecture in Healthcare Award 2019 for HealthSuite Reference Architecture

ALSO READ OUR OTHER BLOGS

GET IN TOUCH WITH US

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.