Parag Parikh : Company Overview

Parag Parikh Financial Advisory Services Ltd., founded in 1992, initially offered advisory and transaction services on the Bombay Stock Exchange and later on the National Stock Exchange. In 1996, it became one of the first firms licensed for Portfolio Management Services (PMS).

While managing the “Cognito” scheme, it stopped accepting new clients over a decade ago. PPFAS Ltd. also sponsors PPFAS Mutual Fund, which launched its first scheme in May 2013 and now manages five schemes.

| Company Name | PARAG PARIKH FINANCIAL ADVISORY SERVICES LTD |

| Company Type | Unlisted Public Company |

| Industry | Financial Advisory Services |

| Founded | 1992 |

| Registered Address | Nariman Point, Mumbai – 400 021. |

Industry Overview

Financial advisory services provide expert guidance in managing assets, from goal-setting to portfolio optimization. They help achieve long-term financial goals, make informed decisions, and avoid emotional pitfalls while ensuring accountability and efficiency. Key services include investment management, risk management, retirement, estate planning, and tax optimization.

India’s financial advisory sector is rapidly growing, expected to reach ₹31,034 crore by 2024, driven by increased disposable income, financial awareness, and complex investment options. Leading firms include Independent Financial Advisors (IFAs), Private Wealth Management Firms, Robo-advisors, and advisory services from banks and insurance companies. When selecting a firm, consider their experience, fees, investment approach, and advisor qualifications.

Products & Services

Parag Parikh Financial Advisory Services Limited (PPFAS Limited) is among India’s first SEBI Registered Portfolio Managers, having secured their license in 1996.

It has two Schemes within its fold, currently:

Cognito

It’s flagship Discretionary Portfolio Management Scheme, in operation since October 1996. However, they are not accepting new clients within this scheme, currently. Minimum investment for Resident Indians, NRIs, HUFs, Partnership Firms, and Corporates is ₹50 Lakhs.

Multi Asset Non-Discretionary

The Multi Asset Non-Discretionary Strategy involves PPFAS providing investment ideas and advice while clients make final decisions. Although PPFAS tracks investments closely, clients retain control over their investment choices.

AUM Under PMS

| Particulars | As on 31.03.2024 ( ₹ in Lakhs) | As on 31.03.2023 ( ₹ in Lakhs) |

| Non-discretionary | 2,990.47 | 2,309.26 |

| Cognito | 3,796.18 | 2,092.39 |

| Total | 6,787.65 | 4,401.65 |

Mutual Funds Schemes

As on Date Aug. 31, 2024

| Scheme Name | AUM (₹ Crores) | NAV (Direct Plan) | NAV (Regular Plan) | Insider Holdings (₹ Cr.) |

| Parag Parikh Flexi Cap Fund | 78,490.29 | 86.6981 | 80.013 | 461.49 |

| Parag Parikh Liquid Fund | 2,318.35 | 1383.596 | 1374.733 | 61.02 |

| Parag Parikh ELSS Tax Saver Fund | 4,152.25 | 32.9397 | 30.9361 | 64.68 |

| Parag Parikh Conservative Hybrid Fund | 2,197.03 | 14.356 | 14.2151 | 9.42 |

| Parag Parikh Arbitrage Fund | 971.38 | 10.6816 | 10.6494 | 27.83 |

| Parag Parikh Dynamic Asset Allocation Fund | 1,028.37 | 10.8267 | 10.8091 | 8.89 |

Management

Neil Parag Parikh |Director |

Neil has been with the firm since June 2004, starting in research before moving to Institutional Equity Dealing. He took a break in 2008 to pursue an MBA at IESE Business School and rejoined in 2010 as Associate VP, Marketing. Neil holds a Bachelor’s in Economics from the University of North Carolina.

..

..

Mr. Rajeev Thakkar | Director |

Rajeev Thakkar has over 15 years of experience in capital markets, including investment banking, corporate finance, and securities broking. He joined PPFAS in 2001, quickly becoming Head of Research. In 2003, he was appointed Fund Manager for PPFAS’s flagship Portfolio Management Service scheme, “Cognito.”

..

..

Shareholding Pattern

| Shareholding Above 5 % | Holding % |

| Geeta P Parikh | 75.35 |

| Rajeev Thakkar | 5.88 |

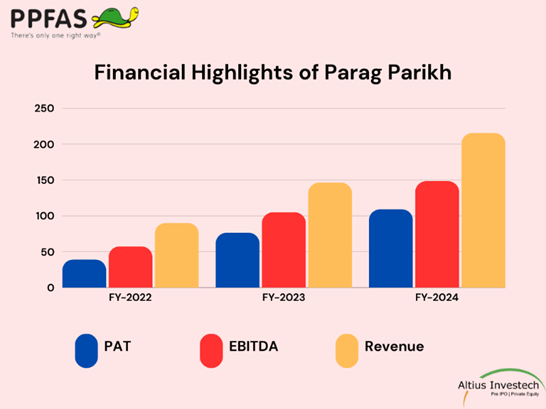

Financial Highlights

| Financials (in crores) | 31st March 2024 | 31st March 2023 | YoY change |

| Revenue | 216 | 146.39 | 47% |

| EBITDA | 148.44 | 104.98 | 41% |

| PBT | 146.32 | 103.05 | 42% |

| PAT | 109 | 77 | 43% |

| EPS (diluted) | 125.27 | 92.29 | 36% |

| PAT Margins | 50.59% | 52.26% | -3% |

Valuation

| Valuations | 31st March 2024 |

| Share Price | 3758 |

| Outstanding shares | 76,68,074 |

| MCAP (in Crs) | 2882 (Approx) |

| P/E Ratio | 30 |

| P/S Ratio | 13.36 |

| P/B Ratio | 48.23 |

| Book value per share | 77.92 |

| Total Equity (in crores) | 59.75 |

Peer Comparison

As on 31st March, 2024

| Financials (in crores) | Parag Parikh | HDFC AMC |

| Revenue | 216 | 3163 |

| EBITDA | 148.44 | 2533 |

| PAT | 109 | 1946 |

| EPS (diluted) | 125.27 | 91.15 |

| PAT Margins | 50.59% | 75.30% |

| Share Price | 3758 | 4406.00 |

| Outstanding shares | 0.76 | 21 |

| MCAP | 3366 | 94,107 |

| P/E Ratio | 30 | 45.40 |

| P/S Ratio | 13.36 | 36.42 |

| P/B Ratio | 48.23 | 13.27 |

| Book value per share | 77.92 | 332 |

SWOT Analysis

Strengths:

- Experienced Leadership: Founded by Parag Parikh, a well-respected figure in the financial advisory sector, with a legacy of expertise.

- Strong Reputation: Known for its focus on long-term wealth creation through equities and commitment to prudent fund management.

- Early SEBI Registration: Among the earliest SEBI-registered Portfolio Management Service (PMS) providers in India, enhancing credibility.

- Diverse Offerings: Provides a range of services including portfolio management, mutual funds, and financial planning.

Weaknesses:

- Limited Client Base Expansion: Ceased accepting new clients for the “Cognito” PMS scheme, potentially limiting growth opportunities.

- Market Perception: Historical performance and market cycles may impact current client perceptions and trust.

Opportunities:

- Growing Market: With the financial advisory market in India expected to grow significantly, there are opportunities to expand services and attract new clients.

- Increased Financial Awareness: Rising financial literacy and disposable income can drive demand for expert advisory services.

- Technological Advancements: Utilizing technology for better client engagement and portfolio management.

Threats:

- Market Volatility: Economic downturns and market fluctuations can impact investment returns and client confidence.

- Regulatory Changes: New regulations or changes in financial policies could affect business operations or compliance requirements.

- Competition: Increasing number of financial advisory firms and fintech solutions could intensify competition.

..

Get in touch with us

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

To know, more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

To buy unlisted shares Visit – https://altiusinvestech.com/companymain

To know more about How to apply for an IPO? Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/

Visit our website homepage: https://altiusinvestech.com/