Sale Dynamics of Kurlon Enterprises

The mattress industry major is attempting to diversify into furniture retail and establish an online presence by choosing to spend Rs. 300 crore in the furniture rental company. Will the plan be successful?

Sheela Foam, the company that makes Sleepwell mattresses and, based on market share, the largest mattress producer in India, announced two deals at once last month.

- The purchase of a controlling interest in Kurlon Enterprise Ltd, the second-largest mattress manufacturer in the nation, for Rs 2,035 crore.

- A 300 crore rupee investment for a 35% interest in the startup furniture rental company Furlenco.

This is strange. Rahul Gautam, chairman and CEO of Sheela Foam, however, attributes it to coincidence. Talks on both deals began last year, and it was just a question of timing that both happened simultaneously, he says. “For an inorganic growth to happen, there has to be a seller, and there has to be a buyer. And this time that combination, coordination or that unique configuration just happened.” It helped that both the businesses had high debt and weak financials and were looking for a way out

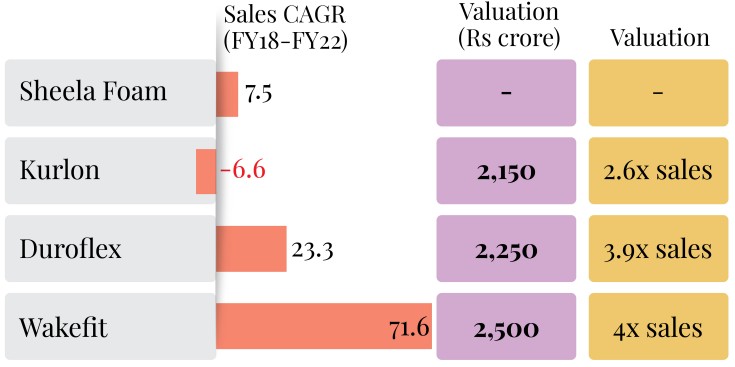

The reactions to the two acquisitions were very different. For obvious reasons, the Kurlon agreement seemed more compelling and beneficial. First of all, since it would enable the top brand, Sleepwell, to dominate the mattress industry (with the inclusion of rubberized coir goods) and penetrate new regions (particularly the south and east). Second, the price at which Sheela Foam acquired Kurlon—2.6 times its projected sales for 2021—was less than that of several of its competitors.

Thus, the market rewarded the purchase of Kurlon by increasing Sheela Foam’s shares by 15% on July 18, the day after the announcement of the transaction. The stock has now corrected and is now down 6% as of Friday’s close, or around 30% below its 52-week peak in September 2022.

This might be due in part to the obscure Furlenco transaction. Why did an 11-year-old furniture rental startup that is losing money, has been drowning in debt, is short on cash, and has been unable to provide for its clients, Sheela Foam, a traditional mattress company formed in 1971, decide to place a wager? The startup’s numerous problems were covered in detail here.

To add to that, there is also a contrast in valuations. As mentioned above, for the Kurlon deal, the valuations were 2.6x the – sales, while for Furlenco, the valuations were at 6x the sales for 2021-22. According to a retail analyst, who asked not to be named, Kurlon was a “fair deal” but with Furlenco, Sheela Foam paid a “premium”.

According to appearances, Gautam’s investment in Furlenco was a response to the flood of new direct-to-consumer mattress firms including Wakefit, SleepyCat, and The Sleep Company. Between 2016 and 2018, these digital-first companies started to gain traction, and in just a few years, they completely changed the online-offline mattress market, which had for a very long time been primarily unorganised and offline. In fact, industry research firm Mordor Intelligence reports that the proportion of online outlets has more than doubled since then.

Nevertheless, only approximately 40% of the Rs 20,000 crore mattress business is organised. Only 10% of the organised space is made up of internet commerce. However, internet sales are anticipated to rise at the highest rate. While organized players as a whole are seeing 12-13% growth, online players are seeing 25-30%.

Every bit the traditional businessman, Gautam insists the market will remain largely offline as mattresses are a “touch and feel” product. “DC is not the best of places to be in, ” he says. “However, it will [continue to] have a place. But the share will taper off. I agree there has been a lot of noise, but the noise is not commensurate with total market share.”

So what then drove him to take a bet on Furlenco and invest Rs 300 crore, far from pocket change for Sheela Foam whose net profit for all of the 2022-23 fiscal was Rs 200 crore?

A tech Bet

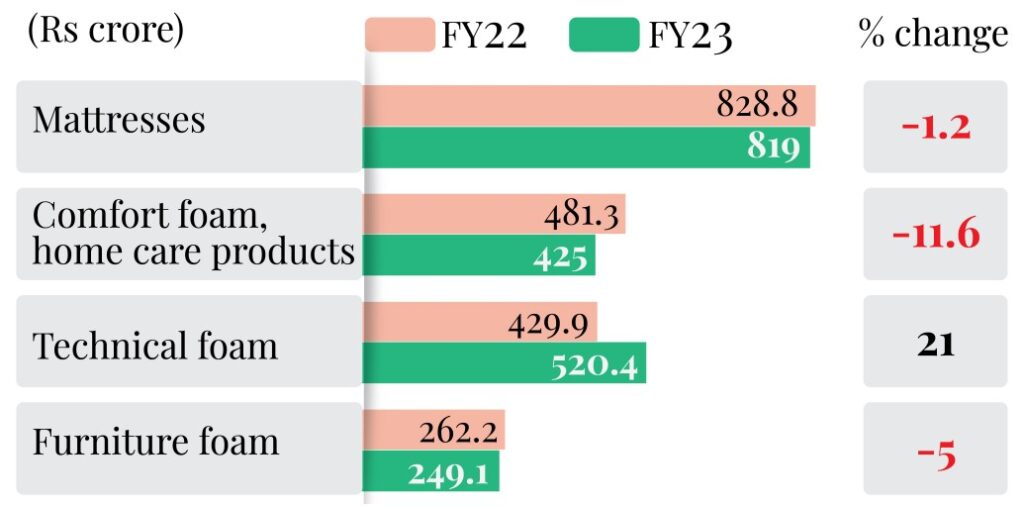

The more than 50-year-old Sheela Foam company began as a tiny business in Sahibabad, Uttar Pradesh, founded by Rahul Gautam and his mother Sheela Gautam. The business introduced the Sleepwell brand in 1994, right in the middle of the financial changes of the 1990s. Since then, Sheela Foam has progressively expanded into the largest polyurethane foam manufacturer in the nation. It operates in the B2B and B2C markets, which are further divided into the four product categories of mattresses, comfort foam, technical foam, and furniture foam.

In the 2021-22 fiscal, its technical foam business, where it supplies foam to automobile seat manufacturers, auditoriums and hospital bed makers, among others, saw a 22% jump in sales year-on-year while the other three categories, including the mattress business, saw a dip. Mattress sales a B2C business, are the largest revenue driver, contributing a substantial 40% to the company’s revenue.

In light of that, it would probably be wise to invest in a young company like Furlenco. It aids Sheela Foam in diversifying and entering the rapidly expanding industry for branded furniture and furniture rental. We’ll get to that in a moment, but let’s first examine Furlenco’s line of work.

In 2012, the company began as a company that rented out furniture, but it has since made a few changes, the most recent of which was to focus on selling furniture in 2021. According to the most recent statistics, mattresses make up 65% of Furlenco’s sales while furniture makes up roughly 20% of its revenue, per a report from the trading firm Keynote Capitals.

Furlenco’s deal requirement was crystal clear: fresh cash infusion during a financial winter. It had recorded a loss of Rs 150 crore in 2021-22 and as of 31 March 2022, had only about Rs 14 crore in cash and investments left.

In contrast, Kurlon, according to a report by ICICI Securities, has profit margins that are comparable to Sheela Foam and greater than the third-largest mattress player, Duroflex, despite losing market share. Sheela Foam actually achieved an EBITDA margin of 12% and a nat margin of 7.5% between 2017–18 and 2019–20. EBITDA margin remained constant while Kurton’s net margin slightly decreased to 7.2%.

According to data from Euromonitor, Sheela Foam has had its market share decline by 3% to 10.4% over the past five years, but Kurlon has experienced a significantly more pronounced decline. In the same time frame, its market share nearly fell in half to 6%.

Effectively, in the same period, Sheela Foam’s top line grew by 7.5%, while that of Kurlon shrunk by 6.6%, according to data from ICICI Securities

Ankur Bisen, senior VP, retail and consumer products at Technopak Advisors, claimed that startups like Furlenco had overstated the market potential and underestimated the expense of servicing that market but were now facing a reality check. These businesses are now available for cheap due to the funding crisis, and Sheela Foam saw an opportunity. This is comparable to what Reliance Industries did when it acquired Urban Ladder (at a substantial discount from its valuation),” the speaker continues.

In the end, Sheela Foam had to pay more for its share of Furlenco. “Reliance is regarded as a skilled dealmaker.” Sheela Foam, in contrast, made a modest premium payment. But this is also to do with how much you need that deal to go through and what you get from it,” says Satish Meena, a senior e-commerce analyst

The main draw for Gautam was Furlenco’s switch to furniture sales. He believed that Sheela Foam will benefit from this in the future. According to the company’s BSE filing, it intends to join the branded furniture sector, which is substantially larger than the market for mattresses (about 6-7%). It is similar and mostly a “touch and feel” product at the same time. Additionally, there are synergies in the furniture industry because Sheela Foam currently provides furniture foam to the B2B market.

possibly with the Furlenco agreement. In an effort to gain a larger portion of the home interiors market, Sheela Foam is seeking to take after bigger businesses like Asian Paints and Havells. The paint giant, through its acquisitions in the kitchen and bathroom fittings space, and the electricals major, by getting into consumer durables, have attempted this with some success. The alm appears to be to turn Sheela Foam into a multi-product player rather than just a mattress maler

Other market participants are likewise moving in this manner. Wakefit announced revenues of Rs 630 crore in 2021–22, which is a four-year compound annual growth rate of 70%. Sales increased after it entered the furniture market, notably in the previous two years. Additionally, the business has created experience stores across the nation where customers may view the furnishings on offer before making an online purchase.

Gautam has a positive outlook on Furlenco’s financial situation. He claimed that because it had to raise money at astronomical rates, its debt grew rapidly. However, he is optimistic that the company will become EBITDA positive by October thanks to the cash infusion from Sheela Foam. Furlenco has “basic unit economies and everything is in place,” he claims.

Sheela Foam probably has its sights set on the potential for future business expansion rather than merely Furlenco’s current financial success. Gautam claimed that his business valued Purlenco based on 2023–24 sales, or 4.5 times yearly sales. He predicts that when the company’s revenue reaches Rs 600–800 crore in the upcoming years, the purchase would start to make sense.

In addition, Furlenco’s technology is a factor in the deal. According to Gautam, “Furlenco is not (just) an e-commerce company; the entire system is based on a technological backbone.” He asserts that buyers will mostly rely on online options for furniture rentals. Whereas, for furniture, sales are expected to be largely offline through their stores, with an unline element. “For the majority of the young generation, the search for purchase begins online, even if you eventually buy offline.

This explains why Sheela Foam had to pay more: rather than hiring a chief technology officer to start from scratch, the company decided to purchase an existing tech platform. But where will it get the money for the deals?

Risky Business

Sheela Foam is under pressure to fund the deals and Furlenco’s cash burn in addition to the valuation, integration difficulties, and entry into a market it has no prior experience in. The total sale value of Rs 2,300 crore is approximately comparable to the company’s standalone top line from the previous fiscal year. The business intends to borrow roughly Rs 600 crore through loans and then scrape together the remaining Rs 1,700 crore through cash accruals and a new stock offering.

While these measures are not expected to make its financial situation precarious, rating agencies are nonetheless watchful. According to CRISIL, raising debt to fund the deal is expected to have a “moderate” financial risk in the near term on the company’s books. The rating agency has kept its long term rating on “watch” until the deal’s completion, which is expected by 30 November this year

The mattress market is predicted to experience a wave of consolidation as a result of these purchases, particularly among the emerging D2C brands. It’s the industry’s logical next move, according to Mordor Intelligence, because “as the Indian mattress industry matures, inorganic growth through acquisition or partnership would continue to result in a consolidated market with a few leaders.”

This opinion is shared by Gautam, who does not rule out other acquisitions, including D2C mattress brands, if they provide a unique offering and have fair prices.

Sheela Foam appears to have abandoned its regular strategy for the time being in an effort to grow its market. There are restrictions on the risks it will take, though, as well as how long. As Gautam says, “if that [the furniture business turning profitable by the year-end) does not happen, it’s not for us. We are very weak-hearted people, it is not like us to burn money.”

Sheela Foam’s new foray will be keenly watched.

Kurlon Enterprises share price is Rs.570/sh, Click Here to invest

In case you need any personal assistance, you can reach out to us @ +918240614850 or support@altiusinvestech.com