About DAM Capital Advisors

DAM Capital Advisors Limited is one of India’s fastest-growing investment banks, holding a 12.1% market share in IPOs and Qualified Institutional Placements in FY2024. The firm offers a broad range of financial services, including investment banking and institutional equities. Key highlights include:

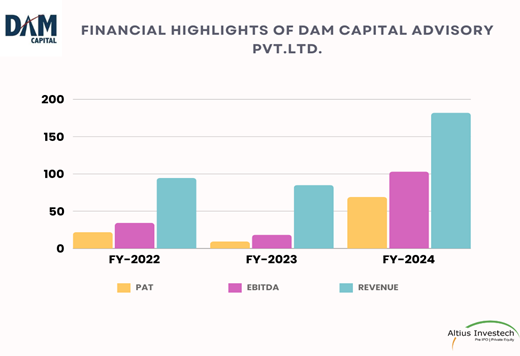

- 38.77% CAGR in total income and 79.46% CAGR in profits (FY22-24).

- Completed 67 ECM transactions and 20 advisory deals since its 2019 acquisition.

- 115 employees, with 54 having 18+ years of experience.

- International operations through DAM Capital (USA) Inc. for U.S. institutional investors.

- Led by Dharmesh Anil Mehta, focusing on India’s growing capital market opportunities.

| Name | Dam Capital Advisor ltd. |

| Date of Incorporation : | 7 May,1993 |

| Category | Investment Banking |

| Industry | Financial Services |

| Listing Status | unlisted |

| Registered Address | Mumbai, Maharashtra |

| Date of Last AGM : | 20 July,2023 |

Timeline:

- Founding Year: DAM Capital Advisors Limited was established.

- Pre-FY 2022: Mr. Dharmesh Mehta took ownership and leadership.

- FY 2022: The company experienced significant growth.

- FY 2023: Continued expansion and market leadership.

- FY 2024: Achieved highest profit margin, 12.1% market share in IPOs and QIPs, executed 67 ECM transactions, and expanded to 111 employees. As of July 31, 2024, it served 257 global clients with 27 research and 33 broking staff.

Industry Overview

India’s financial services sector, encompassing capital markets, insurance, and NBFCs, is experiencing rapid growth. In 2023, gross savings accounted for 30.2% of GDP, while the number of Ultra High Net Worth Individuals (UHNWI) is projected to soar by 63%, reaching 19,119 by 2027. The mutual fund industry has also seen remarkable expansion, with assets under management hitting Rs. 53.40 lakh crore (US$ 641.75 billion) by March 2024. Systematic Investment Plans (SIPs) alone contributed Rs. 2 lakh crore (US$ 24.04 billion) between April 2023 and March 2024. Meanwhile, the stock market has been on a remarkable upward trajectory, with a 25% rise in market capitalization to Rs. 3.15 lakh crore (US$ 3.15 trillion) , and the Sensex reaching an all-time high of 76,009.68 in May 2024.

The Reserve Bank of India and the government have rolled out key reforms, such as the introduction of the Digital Rupee, the establishment of the National Financial Information Registry, and more relaxed regulations for foreign investments. Looking ahead, India’s insurance market is on track to hit Rs. 25 lakh crore by 2025, with life insurance poised for significant growth. The future of India’s financial services sector is filled with dynamic opportunities and expansion.

Business segment

Investment Banking

DAM Capital’s investment banking division is a SEBI-registered merchant banker, providing a wide array of financial services across equity capital markets (ECM), mergers & acquisitions (M&A), private equity (PE) advisory, and structured finance. In ECM, the firm supports corporates in raising funds through IPOs, QIPs, buybacks, and de-listings, securing a 12.1% market share in Fiscal 2024. Their M&A and PE advisory team handles complex domestic and international transactions, with landmark deals like Glenmark Life Sciences and Sterling and Wilson Solar. In structured finance, they assist clients in capital raising through tailored leveraged solutions, working closely with NBFCs, AIFs, and other capital providers.

Institutional Equities

The institutional equities division at DAM Capital Advisors delivers a comprehensive suite of services backed by strong research and a dedicated sales and trading team. Their research team covers 161 companies across 20 sectors, offering in-depth insights through fundamental analysis, macroeconomic perspectives, and thematic reports. The division serves 257 global clients, including institutional investors, through a range of offerings like sales, trading, and corporate access. Revenue is generated through brokerage fees from trade execution and commissions. Additionally, they facilitate investor engagement via conferences, roadshows, and corporate meetings.

Revenue Breakup

₹ in crores

| Particulars | Year ended 3/31/2024 | Year ended 3/31/2023 |

| Stock Broking | 51 | 30 |

| Investment banking | 122 | 51 |

| Unallocated | 6 | 4 |

| Total | 180 | 85 |

Subsidiary

DAM Capital (USA) Inc.

DAM Capital (USA) Inc., a fully owned subsidiary of DAM Capital, is located in New York and operates as a registered Broker-Dealer with the SEC. It is a member of FINRA and SIPC. DAM USA facilitates transactions on a delivery versus payment basis, with settlements for Indian stock market securities processed in India.

Management

Dharmesh Anil Mehta

Dharmesh Anil Mehta is a capital markets expert with over 25 years of experience. He currently serves as the Managing Director and CEO of DAM Capital Advisors, which he co-founded after acquiring IDFC Securities in 2019. Prior to this, he was instrumental in establishing the institutional equities business at ENAM Securities and later led Axis Capital as its CEO after its acquisition by Axis Bank. Under his leadership, Axis Capital was ranked as India’s top investment bank in 2018 for IPOs and QIPs. Throughout his career, Dharmesh has led numerous high-profile transactions, including IPOs, QIPs, M&A, and Private Equity deals, building strong relationships with corporates, investors, and market intermediaries.

MV Nair

MV Nair is the Chairperson and Independent Director of DAM Capital Advisors since August 2024. He holds a bachelor’s degree in science from the University of Mysore. He also chairs the board of BQ Digital Learning and serves as a director for Propelld and various advisory roles for organizations like WestBridge Advisors, GrowX Venture Fund, and Credgenics. Previously, he held senior positions including Chairman of SWIFT India, TransUnion CIBIL, Union Bank of India, and Dena Bank. Nair has vast experience across banking, finance, and technology, advising multiple firms and serving on numerous corporate boards.

Jateen Madhukar Doshi

Jateen Madhukar Doshi is an Executive Director at DAM Capital Advisors, having joined the company in November 2019. He holds a bachelor’s degree in pharmacy from Maharaja Sayajirao University of Baroda and an MBA from B.K. School of Business Management, Gujarat University. He oversees DAM Capital’s institutional equities division, including broking and research functions. Before joining DAM Capital, he worked with Axis Capital as an Executive Director in the Financial Sponsors Group of the Investment Banking Division, and prior to that, he was associated with ENAM Securities and Ketan S Shah, stock brokers.

Recent News

DAM Capital Advisors Announces Historic IPO: First by a Pure-Play Investment Bank in India (11,sept,2024)

DAM Capital Advisors Limited is set to launch its initial public offering (IPO), offering up to 32,064,010 equity shares via an offer for sale by existing shareholders. Trilegal has provided legal counsel to DAM Capital and the selling shareholders, with a team led by Partner Abhinav Maker and supported by Senior Associate Ajo Jomy, along with Associates Debarpita Pande, Ipsita Sahoo, and Hriti Parekh. Chandhiok & Mahajan acted as the legal advisor for Nuvama Wealth Management Limited, the bankers for the IPO. Their team included Partner Niruphama Ramakrishnan, Senior Associate Pranav Gupta, and Associates Shashwat Bhutani, Keshav Srivastava, and Rishika Sharma. This IPO is notable as the first by a pure-play investment bank in India. The draft red herring prospectus was submitted to SEBI and the stock exchanges on September 3, 2024.

Financial Highlights

₹ in crores

| Financials | 31st March, 2024 | 31st March, 2023 | % increase |

| Revenue | 182 | 85 | 114% |

| EBITDA | 103 | 18 | 462% |

| PBT | 95.47 | 11.87 | 704.30% |

| PAT | 69 | 9.28 | 643.53% |

| EPS | 9.98 | 1.23 | 711.38% |

| PAT Margins | 37.91% | 10.91% | 247.42% |

PEER COMPARISON

| Peer Comparison | Total income | EPS Diluted | NAV per share | PE | RoNW |

| Dam Capital | 182 | 9.98 | 23 | 43.37% | |

| ICICI Securities Limited | 5051.1 | 52.22 | 121.4 | 15.48 | 43.25% |

| IIFL Securities Limited | 2231.29 | 16.4 | 58.09 | 17.01 | 28.71% |

| JM Financial Limited | 4832.16 | 4.29 | 115.7 | 21.43 | 0.25% |

| Motilal Oswal Financial | 7130.52 | 40.73 | 147.12 | 17.12 | 27.89% |

SWOT ANALYSIS

Strengths:

- Fast Growth: Fastest-growing investment bank with strong revenue and profit margins.

- Market Leader in IPOs/QIPs: 12.1% market share in FY 2024.

- Diverse Services: Broad offerings across ECM, M&A, structured finance, and institutional equities.

- Strong Research: Covers 161 companies in 20 sectors with a solid institutional client base.

- Major Transactions: Trusted for large deals like Glenmark Life Sciences and Sterling and Wilson Solar acquisitions.

Weaknesses:

- High Dependence on IPOs/QIPs: Vulnerable to market fluctuations.

- Limited Global Reach: Focused primarily on India.

- Small Team: Smaller research and broking teams compared to larger competitors.

- Talent Reliance: Dependent on key professionals for growth.

Opportunities:

- Expanding Capital Markets: Growing retail and institutional participation in India’s markets.

- New Business Verticals: Planned entry into asset management and retail broking.

- Emerging Sectors: Advisory opportunities in AI, clean energy, and tech sectors.

- Global Partnerships: Potential for strategic tie-ups with international banks.

Threats:

- Market Volatility: Exposure to economic downturns impacting IPOs and deals.

- Competition: Intense rivalry from domestic and global players.

- Regulatory Changes: Shifts in financial regulations may affect profitability.

- Fee Pressure: Increasing competition could lead to reduced margins.

- Talent Retention: Risk of losing key professionals to competitors.

GET IN TOUCH WITH US

Get in touch with us

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

To know, more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

To buy unlisted shares Visit – https://altiusinvestech.com/companymain

To know more about How to apply for an IPO? Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/

Visit our website homepage: https://altiusinvestech.com/

Read More