Introduction

As sustainable infrastructure gains traction, Bootes Impex Tech Ltd is establishing itself as the first net-zero construction company in India. The company’s development potential, order book strength, and financial future are being thoroughly examined by investors as it prepares to raise ₹1,500 million for its pre-IPO fundraising.

With a strong foundation in both public and private projects, strategic alliances, and a healthy order pipeline valued at ₹130 billion, Bootes is becoming a very attractive pre-IPO investment opportunity.

Company Overview: Bootes Impex Tech Ltd

With a focus on net-zero and sustainable building techniques, Bootes Impex Tech Ltd integrates hydronic cooling, renewable energy, zero liquid discharge, and other cutting-edge, environmentally friendly solutions. The corporation is a significant force in India’s green transformation because its mission is in line with the country’s Net-Zero Mission 2070.

Establishing new standards for sustainability in the infrastructure industry, Bootes is actively involved in government, private, commercial, and residential construction projects.

- Main Area of Expertise: Green building and net-zero solutions

- Technology integration includes zero liquid discharge, hydronic cooling, solar energy, and improved insulation.

- Government, private, commercial, and residential infrastructure are among the sectors served.

- Order Book: INR 130 billion (high visibility for the firm)

With an increasing global and domestic push for sustainable infrastructure, Bootes stands out as a high-growth, high-impact company in the construction sector.

Why Bootes Stands Out – Investment Rationale

1. Market Leadership in Sustainable & Net-Zero Construction

Bootes is pioneering net-zero construction in India, catering to the growing demand for eco-friendly, energy-efficient, and cost-effective infrastructure. The company’s approach focuses on reducing carbon footprint, lowering energy costs, and increasing building durability.

2. Use of Advanced Sustainable Technologies

Bootes integrates cutting-edge technologies that enhance energy efficiency, sustainability, and long-term cost savings.

- Renewable Energy Solutions:

- Solar panels, wind turbines, and biomass integration reduce reliance on grid energy.

- Power cost reduction due to on-site energy generation.

- Eco-Friendly Building Materials:

- Use of bamboo, recycled steel, fly ash blocks, and other green materials.

- High-performance insulation to improve energy efficiency.

- Hydronic Cooling Technology:

- Energy-efficient heating & cooling system using circulating water or glycol-based fluids.

- Reduces energy consumption by 50-75% compared to traditional HVAC systems.

- Zero Liquid Discharge & Water Efficiency:

- Rainwater harvesting, low-flow fixtures, and water recycling.

- Ensures compliance with the Swachh Bharat Mission & UN Sustainable Development Goals.

3. Higher Initial Costs but Significant Long-Term Benefits

Although net-zero construction is initially more expensive (₹ 2,500-4,000/sq.ft) compared to traditional buildings (₹ 1,500-2,500/sq.ft), it offers long-term cost savings and benefits:

- 💰 50-75% Lower Maintenance Costs – Due to durable materials and energy-efficient systems.

- ⚡ Significantly Reduced Power Bills – Buildings generate their own energy through renewables.

- 🏡 Longer Building Lifespan – Net-zero structures last 50+ years, compared to 30-50 years for traditional buildings.

- 🌱 Government Incentives & Tax Benefits – 40% subsidy on solar systems, 80% depreciation on solar installations.

These factors position Bootes as a highly profitable and sustainable business in the long run.

Bootes’ Strong Business Pipeline – Order Book & Projects

Bootes has secured multiple projects across government, private, commercial, and residential sectors, ensuring strong revenue visibility.

- Government Projects:

- Defense infrastructure

- Ayodhya Bhavan & UP Cultural Centre

- Muse India projects (Museums & Heritage buildings)

- Chhattisgarh Library & Hospital

- Private Sector Projects:

- Hospitals & Healthcare Facilities

- Warehouses & Data Centers

- Universities & Educational Institutes

- Hotels & Hospitality Sector

- Commercial Infrastructure:

- IT parks & Business Hubs

- Sports Complexes & Stadiums

- Corporate Towers & Mixed-Use Developments

- Residential & Community Projects:

- Eco-Friendly Housing & Villas

- Old Age Homes & Sustainable Living Spaces

This diverse project portfolio mitigates risks and enhances revenue visibility, making Bootes a stable investment option.

Strategic Partnerships & Technological Advancements

Bootes has built strong partnerships to leverage technology, expertise, and financial resources:

- Univastu (NSE-Listed): Partnership for bidding and execution of government projects.

- Generic (NSE-Listed): Expertise in civil construction, combined with Bootes’ net-zero solutions.

- Muse India: Specializing in museums, theme parks, and heritage buildings.

- Urban Systems: Focus on renewable energy and clean technology solutions in urban infrastructure.

Patents & R&D Innovations

Bootes has developed patented technologies that enhance sustainability in infrastructure:

- Hydronic Cooling Panels: Improves energy efficiency, lowers operating costs, and reduces carbon footprint.

- SAFE Toilets: Waterless sanitation solutions that save 1,50,000 liters of water per toilet annually while generating 500 kg of organic fertilizer every year.

These innovations differentiate Bootes from traditional construction companies and offer a competitive edge in the industry.

Bootes Impex Tech Ltd Pre-IPO Details

In preparation for its eagerly awaited pre-IPO offering, which is scheduled to debut in early 2025, Bootes Impex Tech Ltd. hopes to raise over INR 1,500 million through this pre-IPO deal, offering early investors a substantial chance. Institutional and strategic investors are showing a lot of interest in the offering, which has a predicted upside potential of three to four times.

The money generated will be used wisely to help the business achieve its ambitious expansion goals. In keeping with the global movement for green and ecologically conscious development, a significant amount will go toward the growth of sustainable infrastructure projects. Increasing investments in R&D, especially in the development and improvement of patented technologies that can spur long-term innovation and competitiveness, will also be a major priority.

Financial Performance & Valuation

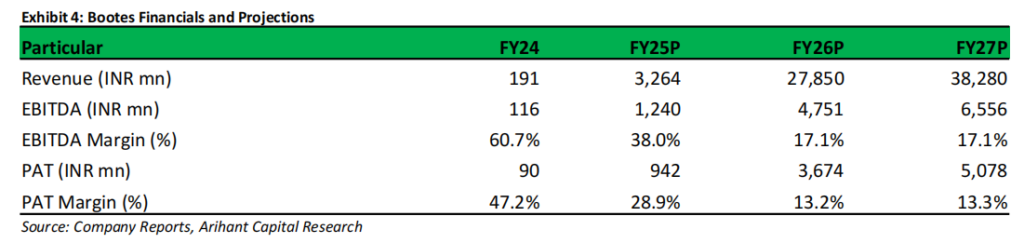

Key Takeaways:

EBITDA Growth: From ₹11.6 crores (FY24) to ₹ 655 crores (FY27)

PAT Growth: From ₹ 9 crores (FY24) to ₹ 507 crores (FY27)

Despite an initial drop in margins, Bootes’ revenue growth offsets lower profitability per project, ensuring high absolute profit growth.

Pre-IPO Valuation & Expected Returns

- Current Valuation: Expected to increase significantly post-IPO

- Projected Upside: 3-4x return over the next few years

- Post-IPO Potential: Expansion into new markets, increased project bidding, and higher institutional investments

The company’s ability to scale operations, secure large projects, and optimize costs makes its Pre-IPO valuation highly attractive.

Conclusion

In order to effectively oversee future major projects, Bootes Impex Tech also intends to improve its execution skills. In order to secure future contracts and promote long-term collaborations, a portion of the cash will also be used to fortify partnerships with both public and private sector organizations.

ALSO READ:

GET IN TOUCH WITH US:

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

Learn, more about Unlisted Company.

Join our Whatsapp Channel: The Market Buzz by Altius