Bharat Hotels Limited: About the Company

Bharat Hotels Limited, established in 1981, is a leading hospitality enterprise in India, renowned for its luxurious accommodations and impeccable service. Under the esteemed brand name of “The Lalit,” the company manages 12 opulent hotels, palaces, and resorts across the country, offering a total of 2,261 rooms. Additionally, Bharat Hotels operates two mid-market segment hotels under The Lalit Traveler brand, strategically located in key business and leisure destinations. Complementing its lodging offerings, the company boasts a diverse portfolio of 45 restaurants, bars, and bakery outlets, including esteemed names like 24/7, Baluchi, and Kitty Su. With 50 banquet and conference halls, Bharat Hotels caters to a wide range of events and gatherings. Furthermore, the company extends its services beyond traditional hospitality, offering outdoor catering, education and training programs for aspiring hospitality professionals, and even aircraft charter services.

| Company Name | BHARAT HOTELS LIMITED |

| Company Type | Unlisted Public Company |

| Industry | Hotel Industry |

| Founded | 1981 |

| Registered Address | Delhi, India |

Product Portfolio

Hotel Operations:

- Sale of rooms and apartments

- Food and beverages (e.g., 24/7, Baluchi, OKO Restaurant, The LaLiT Boulangerie)

- Banquet rentals

- Telecommunication services

- Laundry services

- Business center facilities

- Health center services

- Other related services (e.g., Kitty Su nightclubs, The LaLiT Food Truck Company)

Other activities:

It represents operations relating to renting of shops located within hotel premises and separate business towers operated and other operational activities by the Group.

Management of the Company

Dr. Jyotsna Suri: Chairperson and Managing Director

Dr. Jyotsna Suri has been an integral part of Bharat Hotels since its inception, assuming the role of Chairperson & Managing Director in 2006. Under her leadership, The Lalit Suri Hospitality Group emerged as a top-tier luxury hotel brand in India. The group’s portfolio also includes exclusive rights to manage The LaLiT London. Her remarkable contributions have been acknowledged internationally, notably by the Japanese government, which bestowed upon her the prestigious Order of The Rising Sun, Gold and Silver Star, for her efforts in strengthening economic and tourism ties between India and Japan. She has also received over 30 national and international awards, cementing her reputation as a distinguished leader in both the hospitality industry and diplomatic circles.

Mr. Keshav Suri: Executive Director

Mr. Keshav Suri, the youngest Executive Director at The Lalit Suri Hospitality Group, is a catalyst for innovation and social change. He has led the group’s expansion efforts and spearheaded the creation of inclusive F&B brands like 24/7, Baluchi, and OKO, along with the renowned Kitty Su nightclub. Beyond business, Mr. Suri founded the Keshav Suri Foundation to empower the LGBTQIA+ community, earning global recognition for The Lalit Suri Hospitality Group as one of the most inclusive hotel chains.

.

.

Subsidiary/ Associate Companies

- Jyoti Limited

- PCL Hotels Limited

- Lalit Great Eastern Kolkata Hotel Limited

- Prima Hospitality Private Limited

- Kujjal Hotels Private Limited

- The Lalit Suri Educational and Charitable Trust (an entity controlled by the Company)

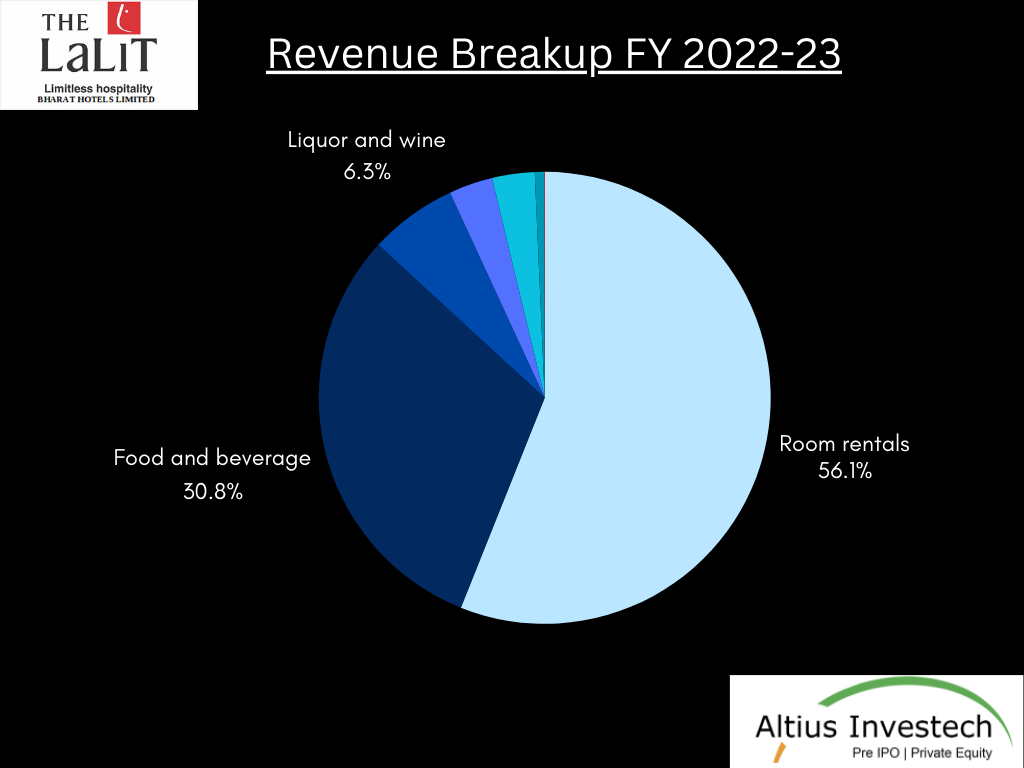

Revenue Breakup

₹ in crore

| Particulars | as of 31st March 2023 |

| Room rentals | 433.17 |

| Food and beverage | 237.91 |

| Liquor and wine | 48.57 |

| Banquet and equipment rentals | 24.23 |

| Other services (including service charge income) | 23.48 |

| Membership programme revenue | 5.11 |

| Traded goods | 0.34 |

| Total | 772.81 |

Bharat Hotels: Strengths

- Long Track Record in the Hotel Industry: Bharat Hotels Limited has over 30 years of experience in the hospitality sector, with a strong brand presence. Dr. Jyotsna Suri, associated with BHL since 1989 and appointed Chairperson & Managing Director in 2006, brings over two decades of expertise.

- Financial and Operational Improvement: Significant enhancement in financial and operational performance during FY22, with a 106% rise in total income. PBILDT margin increased to 36.85% in FY22 from 6.2% in FY21. Improved occupancy levels to 58% in 9MFY23 compared to 33% in FY22, with revenue reaching ₹568.52 crore and PBILDT margin of 46.53%. Gradual rebound in travel demand is expected to further enhance metrics.

- Robust Financial Structure: Completion of a one-time restructuring plan in January 2023, with debt paid off through NCD issuance to Kotak Investment Advisors Limited (KIAL). The debt is secured by a tight waterfall mechanism and maintenance of the Debt Service Reserve Account (DSRA). Geographically diversified assets comprising mature properties and favorable hotel locations.

- Geographical Diversification: Portfolio includes 12 5-star hotels spread across major business and tourist destinations in India, totaling 2,261 rooms. Exclusive rights to manage The LaLiT London, along with commercial and office spaces in Delhi and Mumbai. Established relationships with leading corporate clients, ensuring consistent customer sourcing and revenue.

Bharat Hotels: Weaknesses

- High debt and leveraged capital structure: As of March 31, 2022, BHL’s gearing ratio rose to 2.57x from 2.22x in 2021 due to increased debt and losses, partly from COVID-19 disruptions. They underwent one-time debt restructuring and repaid ₹1,100 crore in bank debt with NCDs to KAIL by January 2023. Principal repayments start in March 2026. BHL’s subsidiaries have minimal repayments until then. They must also establish a Debt Service Reserve Account (DSRA). Despite high leverage, BHL plans no new debt, focusing on structured repayments to improve solvency indicators.

- Vulnerability of revenues to inherent industry cyclicality, economic cycles and exogenous events: The operating performance of the properties remain vulnerable to seasonal industry, general economic cycles and exogenous

factors (geo-political crisis, terrorist attacks, disease outbreaks, etc.). Nonetheless, the risk to revenues is partially mitigated by BHL’s geographically diversified portfolio in prominent business districts, which allows it to withstand any demand vulnerability related to a particular micro-market. - Regional trends in tourism and competition risk: Although the risk is mitigated to some extent owing to the geographical diversification and favorable locations of the group’s projects, going forward, the pace of the recovery in the economic cycle and stabilization of the hotel properties in competitive markets will be critical for the company’s financial risk profile. In segmental terms, the company’s major exposure is towards upscale (luxury) hotels. The company’s ‘The Lalit’ brand faces intense competition from brands like Grand Hyatt, Taj, The Leela, Sahara Star, Hilton, etc.

Industry Overview: Hotel Industry in India

The hotel industry in India stands as a vibrant and dynamic sector, deeply intertwined with the nation’s cultural richness, economic vitality, and burgeoning tourism landscape. With a diverse tapestry of landscapes ranging from majestic mountains to pristine beaches, and a heritage that spans millennia, India beckons travelers from across the globe. The hotel industry in India is poised for significant growth, driven by several key factors such as increasing tourism, rising disposable incomes, and evolving consumer preferences. By 2024, the Indian hotel market is expected to reach a revenue value of US$9.13 billion, with a projected compound annual growth rate (CAGR) of 5.41% from 2024 to 2028.

Market Dynamics

- Revenue Growth: The market is witnessing steady revenue growth, fueled by both domestic and international tourism. Increasing business travel and leisure tourism contribute to the expanding market size.

- User Base Expansion: The number of users in the hotel market is expected to grow to 64.74 million by 2028, reflecting a rising trend of travel and accommodation usage among Indian consumers.

- Shift towards Online Bookings: With the proliferation of online travel agencies (OTAs) and the convenience of booking accommodations through digital platforms, online sales are projected to constitute 61% of total revenue by 2028.

- Average Revenue per User (ARPU): The ARPU is expected to be US$167.80, indicating the average spending per user on hotel accommodations annually.

- Growing Tourism: India’s robust economic growth and rising disposable incomes have spurred domestic travel, while the country’s popularity as a tourist destination has increased globally.

- Business Travel: India’s emergence as a global business hub has led to a surge in business travel, particularly in major cities like Mumbai, Delhi, Bangalore, and Hyderabad, driving demand for premium hotel services.

- Urbanization: Rapid urbanization and infrastructural development have led to the establishment of hotels and resorts in both metropolitan cities and emerging Tier-II and Tier-III cities.

- Technology Integration: The integration of technology in hotel operations, such as online booking platforms, mobile check-ins, and smart room amenities, has enhanced the guest experience and improved operational efficiency.

- Focus on Sustainability: There is a growing emphasis on sustainability and eco-friendly practices in the hotel industry, with many establishments adopting green initiatives to reduce their environmental footprint.

Trends and Developments:

- Eco-Friendly Practices: There is a notable shift towards eco-friendly and sustainable practices within the hotel industry to meet the growing demand for responsible tourism. Hotels are adopting measures such as energy efficiency, waste reduction, and eco-friendly amenities to appeal to environmentally conscious travelers.

- Technology Integration: Hotels are increasingly leveraging technology to enhance guest experiences and streamline operations. This includes the adoption of mobile apps for reservations, keyless entry systems, in-room automation, and personalized services driven by data analytics.

- Diversification of Offerings: To cater to diverse traveler preferences, hotels are diversifying their offerings beyond traditional accommodations. This includes experiential stays, wellness retreats, themed hotels, and boutique properties targeting niche segments of the market.

- Focus on Quality and Service: With growing competition, hotels are placing a greater emphasis on delivering exceptional quality and service to differentiate themselves in the market. This includes investments in staff training, customer service initiatives, and continuous improvement of facilities and amenities.

Key Competitors

- Taj Hotels: A prominent player in the luxury hotel segment, Taj Hotels operates a network of luxury properties across India and abroad, offering world-class hospitality services.

- The Oberoi Group: Known for its luxurious accommodations and personalized services, The Oberoi Group owns and operates upscale hotels and resorts in major cities and leisure destinations.

- ITC Hotels: ITC Hotels is renowned for its luxury accommodations, fine dining, and sustainable practices, with properties located in key business and leisure destinations across India.

- The Leela Palaces, Hotels and Resorts: Offering opulent accommodations and unparalleled hospitality, The Leela Palaces, Hotels and Resorts is a leading luxury hotel chain in India with properties in major cities and tourist hotspots.

- Hyatt Hotels Corporation: As an international hotel chain, Hyatt Hotels Corporation has a significant presence in India, operating luxury and upscale hotels in major cities and airport locations.

Challenges and Opportunities

Competition: Intense competition within the industry necessitates continuous innovation and differentiation to attract guests and maintain market share.

Regulatory Environment: The hotel industry in India is subject to various regulations and licensing requirements, which can impact operational costs and expansion plans.

Despite challenges, the growing demand for hospitality services presents ample opportunities for expansion, particularly in emerging markets and niche segments such as boutique hotels and eco-resorts.

Overall, the hotel industry in India is poised for continued growth, driven by increasing tourism, rising disposable incomes, and evolving consumer preferences. With a focus on innovation, sustainability, and guest-centric services, hotels in India are well-positioned to capitalize on emerging opportunities and maintain their competitive edge in the market.

Awards & Recognitions

The Hotels and Management of Bharat Hotels Limited received numerous accolades and recognitions for their exceptional services and contributions:

1. The LaLiT New Delhi:

- Received the Food for Thought Fest Award Jury’s Favorite by South Asian Association for Gastronomy.

- Recognized with the Star Partners Award 2022 – Travellers’ Review Award by Goibibo.

2. The LaLiT Resort & Spa Bekal:

- Awarded the Best Ayurvedic Spa by Global Spa Awards 2022.

3. The LaLiT Grand Palace Srinagar:

- Honored as the Best Heritage Hotel in the Domestic Hotels category by Travel + Leisure India’s Best Awards 2022.

4. The LaLiT Great Eastern Kolkata:

- The Bakery received the Intach Culinary Heritage Award.

5. The Lalit Suri Hospitality Group:

- Acknowledged as an LGBTQ+ Friendly Organization at The Global DEI Summit 5.0.

- Received a Certificate of Appreciation for Community Partner and Corporate Partner at the Trans Employment Mela 2023.

These prestigious awards and recognitions underscore Bharat Hotels Limited’s commitment to excellence, inclusivity, and innovation in the hospitality industry, as well as the outstanding leadership of Mr. Keshav Suri in advocating for LGBTQIA+ rights and diversity in the workplace.

Share Price of Bharat Hotels (as of 22.04.2024)

- The buy price of Bharat Hotels varies based on quantity, ranging from ₹349 for quantities between 50 – 250 shares to ₹339 for quantities between 2501 – 4878 shares, with corresponding rates per share.

- The 52-week high is ₹365, and the 52-week low is ₹159 indicating the range of fluctuations in the share price

Currently, the Bharat Hotels Share Price is trading at around Rs. 346/share CLICK HERE to Invest.

Financial Metrics for Bharat Hotels (as of 22.04.2024)

| Particulars | Amount |

| Price to Earning Ratio (P/E) | 51.99 |

| Price to Sales Ratio (P/S) | 3.22 |

| Price to Book Value (P/B) | 2.97 |

| Industry PE | – |

| Face Value | ₹ 10 |

| Book Value per share | ₹114 |

| Market Cap | ₹2576.4 Cr |

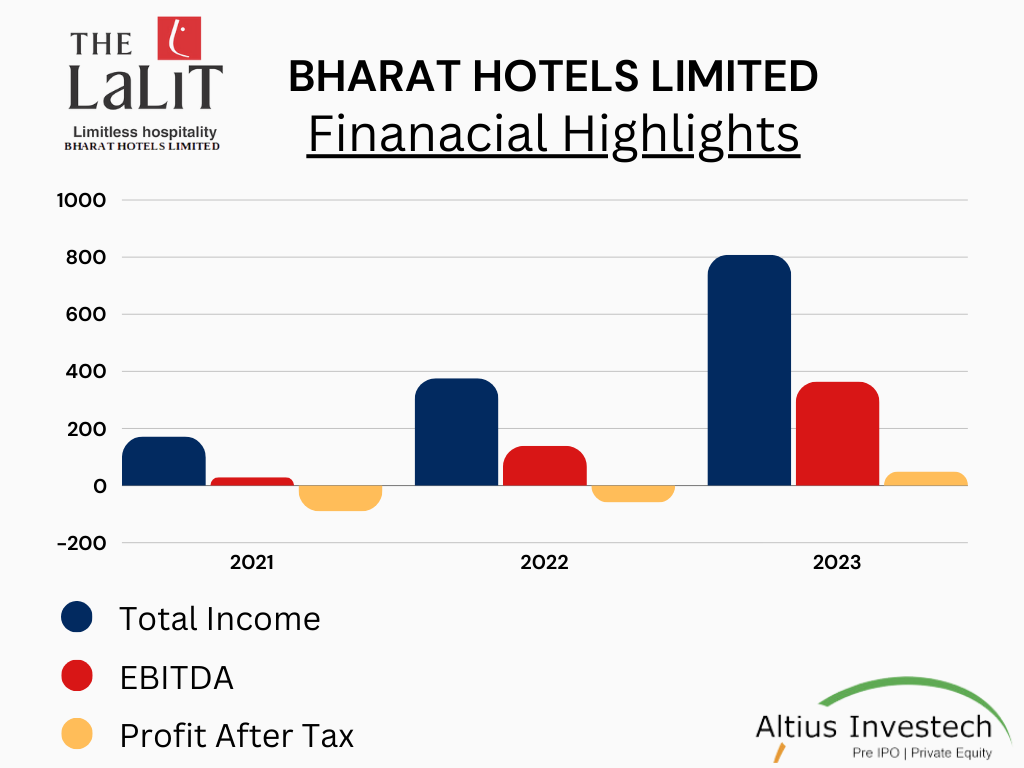

Financial Highlights

₹ in crore

| Particulars | FY 2023 | FY 2022 | FY 2021 |

| Total Income | 808.29 | 375.76 | 171.90 |

| EBITDA | 364.35 | 139.13 | 29.48 |

| Profit After Tax (PAT) | 49.56 | (58.97) | (90.53) |

| Earning Per Share (EPS) | 6.52 | (7.76) | (9.91) |

During the fiscal year 2022-23, Bharat Hotels Limited experienced a gradual improvement in business during the first six months, followed by a substantial revival in the second half, driven by successful vaccination programs, border reopening, and removal of travel restrictions. The company achieved one of its best revenue figures, reflected in its revenue and EBITDA numbers, although recovery from COVID-19 losses will take time. Additionally, the company raised funds through the issuance of 1,10,000 Non-Convertible Debentures via private placement, utilizing the proceeds to repay existing debt and clearing all loans from financial institutions.

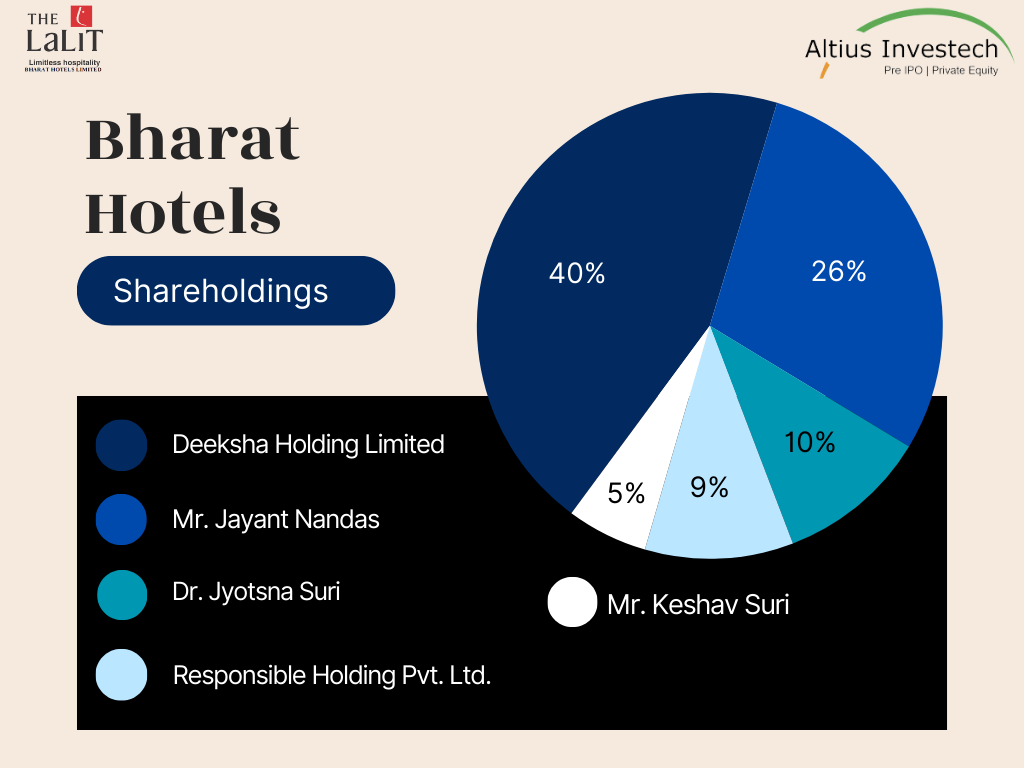

Bharat Hotels: Shareholdings

Shareholders holding more than 5% equity shares in the Company:

| Particulars | % of shares held |

|---|---|

| Deeksha Holding Limited | 40.42% |

| Mr. Jayant Nanda | 26.32% |

| Dr. Jyotsna Suri | 9.55% |

| Responsible Holding Pvt. Ltd. | 9.35% |

| Mr. Keshav Suri | 5.11% |

Peer Comparison

₹ in crore

| Particulars | Bharat Hotels Limited | EIH Limited | Indian Hotels Co Limited |

| Net Revenue | 808 | 2,019 | 5,810 |

| EBITDA | 364 | 600 | 1805 |

| Profit | 50 | 329 | 1053 |

| Market Cap | 2,577 | 28,469 | 86,559 |

| Share Price (as on 24.04.2024) | 345 | 460 | 608 |

| P/E (M.cap/Profit) | 52 | 86.53 | 82.20 |

ESOP

In an effort to incentivize and retain key employees, Bharat Hotels Limited introduced the “Bharat Hotels Employees Stock Option Scheme 2017.” This scheme is designed to reward employees and align their interests with the long-term success of the organization. During the year 2018, the company granted a total of 700,600 stock options to eligible employees. This initiative reflects Bharat Hotels Limited’s commitment to recognizing and rewarding the contributions of its employees, thereby fostering a culture of ownership and accountability within the organization.

Dividend

In view of business losses and the imperative to preserve cash, Bharat Hotels Limited has opted not to propose any dividend to the shareholders for the Financial Year 2022-23.

IPO Plans

Bharat Hotels Limited filed a DRHP for an initial public offering (IPO) with the market regulator, SEBI, on June 28, 2018, but has yet to proceed with the IPO as of 2024. The company had aimed to raise approximately Rs. 1,200 crore through a new issue at that time. However, it appears that the IPO plans have been delayed or put on hold. As of now, there has been no indication from the company regarding any re-filing of the DRHP or a potential timeline for the IPO.

ALSO READ OUR OTHER BLOGS

GET IN TOUCH WITH US:

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

To know, more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

You can also checkout the list of Best 5 Unlisted Shares to Buy in India

To buy unlisted shares Visit – https://altiusinvestech.com/companymain

To know more about How to apply for an IPO? Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/