Belstar Microfinance Limited: Company Overview

Belstar Microfinance Limited, originally established as Belstar Investment and Finance Private Limited in January 1988 in Bengaluru, underwent significant transformations over the years. It acquired a non-banking financial company (NBFC) license from the RBI in March 2001 and transitioned into an NBFC-MFI (Microfinance Institution) in 2013. The Hand in Hand group, a renowned non-governmental organization, acquired Belstar in September 2008.

In 2016, Muthoot Finance, the largest gold loan NBFC in India, made an equity investment in Belstar, holding a majority stake of 57% as of March 31, 2023. Belstar’s portfolio as of that date amounted to Rs 6,192 crore, with operations spanning 18 states and 170 districts.

Belstar Microfinance Limited operates under the Self-Help Group (SHG) and Joint Liability Group (JLG) models, providing financial assistance primarily to marginalized communities such as fishermen, artisans, farmers, and small entrepreneurs. Its average ticket size varies according to the model, with SHGs receiving around Rs 45,000 and JLGs around Rs 25,000.

Over time, the company underwent name changes to reflect its core business activities, ultimately becoming Belstar Microfinance Private Limited in 2019. It transitioned from a private to a public limited company in January 2020. Through these transformations, Belstar Microfinance has remained dedicated to providing microcredit solutions to underserved segments, contributing to the country’s goal of inclusive growth.

| Company Name | BELSTAR MICROFINANCE LIMITED |

| Company Type | Unlisted Public Company |

| Industry | Financial Services- Microfinance |

| Founded | 1988 |

| Registered Address | Chennai, Tamil Nadu, India |

Product and Services

Microenterprise Loan:

Belstar Microfinance provides microenterprise loans to individuals seeking to initiate or enhance small businesses. Borrowers can access loans of up to INR 15,000 per member, either individually or as a group. The repayment period spans up to 12 months, with a 24% interest rate. A one-month moratorium period is provided, and a processing fee of 1% of the loan amount is applicable. This product aims to empower entrepreneurs by providing them with financial support to foster sustainable microenterprises.

Sanitation Loan:

Offers loans to women aimed at improving living conditions through access to clean water, hygiene, and sanitation facilities. Borrowers can access credit at affordable interest rates to facilitate the construction of toilets, installation of water pipes, hand borewells, water purifiers, etc. The loan amount ranges between INR 2,000 to INR 10,000, with an interest rate of 25%. The repayment period extends up to 12 months. This product aims to empower women by enhancing their families’ quality of life through improved sanitation facilities.

Belstar Student Education Loan:

Extends financial support to students in need through student education loans. Eligible students can borrow a maximum of INR 20,000 at a 25% interest rate. The repayment period is 12 months, and a processing fee of 2% of the loan amount is applicable. This product aims to facilitate access to education for students from economically disadvantaged backgrounds.

Small and Medium Enterprise Loan:

Provides microfinance to individuals aspiring to establish small and medium enterprises (SMEs). Borrowers can access loans of up to INR 75,000 in the first cycle, with a 24% interest rate. The repayment period extends up to 30 months, and a processing fee of 1% of the loan amount is charged. This product aims to support entrepreneurship and economic growth by providing financial assistance to SMEs.

Consumer Goods Loan:

Offers consumer goods loans to borrowers seeking funds for household needs. Individuals can borrow up to INR 3,000 per member for the purchase of materials or goods. The repayment period is 10 months, with a 24% interest rate. Additionally, a processing fee of 1% of the loan amount is charged. This product aims to enhance the quality of life for borrowers by providing access to essential household items.

Management of the Company

Dr. Kalpanaa Sankar: Managing Director

Dr. Kalpanaa Sankar serves as the Managing Director on the company’s Board, holding an MBA from TRIUM and a PhD from Mother Teresa Women’s University. She co-founded Hand in Hand India and received esteemed awards such as the Princess Sabeeka Bint Ibrahim AI-Khalifa Global Award for Women Empowerment and the Nari Shakti Puraskar-2016. With her academic prowess and dedication to social causes, Dr. Sankar embodies a leader committed to business excellence and community upliftment.

Mr. Balasubramanian Balakumaran: Executive Director

Balasubramanian Balakumaran serves as a Whole-time Director on the company’s Board, bringing with him a Bachelor of Science degree in agriculture from Andhra Pradesh Agricultural University, Hyderabad. Before joining the company, he had a notable tenure with Indian Bank. Balakumaran’s academic background in agriculture coupled with his prior banking experience underscores his valuable expertise in financial matters and strategic decision-making within the company.

Mr. George Alexander: Non Executive Director

Mr. George Alexander served as a Non-Executive Director on the Board of the company. He held a bachelor’s degree in mechanical engineering from the Faculty of Engineering and Technology, University of Kerala, Thiruvananthapuram, and a master’s degree in business administration from the University of North Carolina, Chapel Hill. With experience in management, Mr. Alexander contributed his expertise to the strategic direction of the company, leveraging his educational background and professional acumen for the benefit of the organization.

Industry Overview

Overall Credit Scenario of India

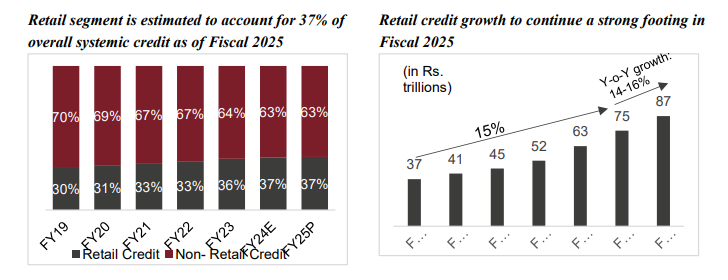

The credit landscape in India is poised for growth, with systemic credit projected to expand at a CAGR of 13%-14% between Fiscal 2024 and Fiscal 2025, predominantly driven by the retail segment. Corporate credit, constituting a significant share, remains pivotal in shaping overall credit growth. Fiscal 2023 witnessed robust systemic credit growth, fueled by pent-up retail demand in housing and vehicle financing, alongside strong credit demand from NBFCs and the trade segment. Despite optimistic projections, potential impacts from the RBI circular on consumer loans may pose challenges.

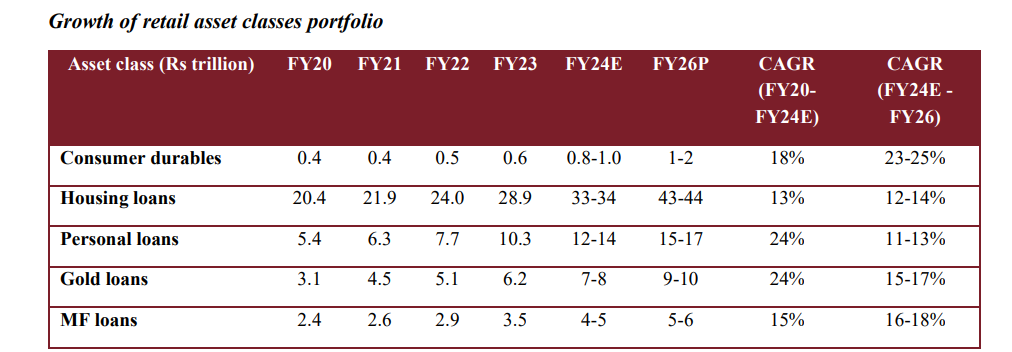

The retail credit market, valued at Rs. 75 trillion as of FY24, has experienced rapid growth at a CAGR of 15% between Fiscals 2019 and 2024, with sustained demand in housing, automobiles, and increasing consumption in credit cards and personal loans. Looking ahead to Fiscal 2025, the retail credit market is expected to maintain momentum at a rate of 14%-16%, presenting opportunities for both banks and NBFCs, although challenges such as regulatory changes and inflationary pressures may temper growth prospects.

Outlook of Overall NBFCs

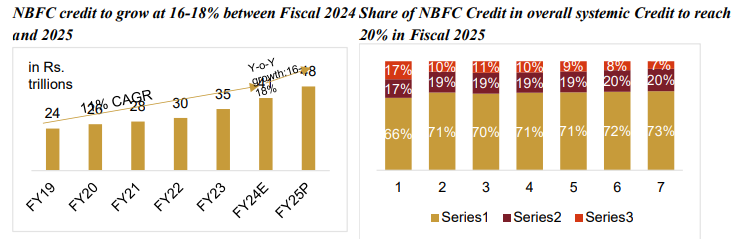

NBFCs have exhibited robust growth over the past decade, outpacing banking credit expansion significantly. From less than Rs 2 trillion AUM at the start of the century, NBFCs have surged to Rs. 41 trillion by the end of Fiscal 2024, demonstrating remarkable resilience and importance in the financial sector. Estimated to have grown at a CAGR of ~11% between Fiscals 2019 to 2024, NBFC credit, particularly in the retail segment, has seen impressive growth at ~14% CAGR over the same period.

Looking ahead, CRISIL MI&A forecasts NBFC credit to accelerate, expanding at a rate of 16-18% in Fiscal 2025. Microfinancing and vehicle financing are anticipated to spearhead growth in the retail segment, with MSME loans driving expansion in the wholesale segment. With NBFC credit expected to comprise 20% of the overall systemic credit in Fiscal 2025, NBFCs are poised to maintain their significance in the Indian credit landscape, leveraging their strength in providing last-mile funding and catering to underserved customer segments.

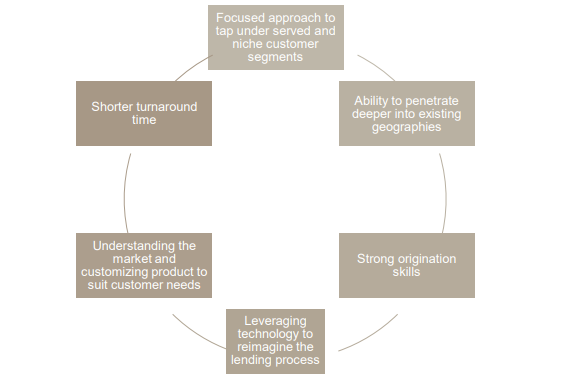

Growth of NBFCs reflects the customer value proposition offered by them

Key Strength of Belstar Microfinance

- Strong Promoter Group Affiliation: Belstar Microfinance Limited (BML) benefits from being a subsidiary of Muthoot Finance Limited (MFL), a flagship company of the Muthoot group. This affiliation provides BML with substantial managerial, financial, and operational support. It enables access to funding, expertise, and strategic advantages, enhancing BML’s competitive positioning and growth prospects.

- Benefits derived from being part of the Muthoot group: MFL’s seven decades of experience in the gold loan business and its robust brand image enhance BML’s credibility and market positioning. Leveraging MFL’s reputation, BML expands its branch network into new geographies, gaining customer trust and confidence, thereby facilitating growth and market penetration.

- Established Track Record in Microfinance Lending: With over a decade of experience in microfinance lending, BML demonstrates expertise in serving underserved segments. This track record enhances investor confidence, contributing to BML’s stability, growth, and ability to cater effectively to the financial needs of its target market.

- Professional Management and Operational Excellence: BML’s proficient management team, led by Dr. Kalpanaa Sankar, ensures efficient operations, strategic planning, and prudent risk management. This operational excellence enhances BML’s performance, resilience, and competitive advantage in the market.

- Adequate Capitalization Levels and Support: BML maintains adequate capitalization levels, supported by equity infusions and financial backing from the Muthoot group. This ensures financial stability, regulatory compliance, and facilitates growth initiatives, reinforcing investor confidence and enhancing BML’s long-term sustainability.

- Continuous Improvement in Scale of Operation: BML demonstrates consistent growth in assets under management (AUM) and branch network expansion, enhancing market reach, customer base, and revenue streams. This continuous expansion strengthens BML’s competitive position, sustainability, and profitability.

- Resilience and Adaptability During Challenges: Despite challenges posed by the COVID-19 pandemic, BML exhibits resilience and adaptability in managing operations effectively. This resilience underscores BML’s robust business model, risk management practices, and ability to capitalize on emerging opportunities, ensuring sustained growth and value creation.

- Strategic Significance and Continued Financial Support: BML’s strategic importance to the Muthoot group ensures continued financial support, alignment with long-term objectives, and access to resources and growth opportunities within the group. This strategic alignment strengthens BML’s competitive advantage, fosters sustainable growth, and enhances shareholder value.

Key Weaknesses of Belstar Microfinance

- Moderately Diversified Resource Profile: BML relies heavily on traditional term loans, with 84% of its borrowings sourced from banks, NBFCs, and financial institutions. Despite some diversification into NCDs and sub-debt, this concentration poses risks. Additionally, its reliance on PSU banks for fundraising exposes vulnerability to market fluctuations.

- Geographical Concentration: The loan portfolio is heavily concentrated in Tamil Nadu, comprising 49% of AUM as of March 2023. Efforts to expand into new regions haven’t significantly reduced this concentration, leaving BML vulnerable to local socio-political risks and regulatory changes.

- Susceptibility to Regulatory and Legislative Risks: The microfinance sector, including BML, faces ongoing vulnerability to regulatory changes and regional issues. Historical events like the 2010 Andhra Pradesh crisis and demonetization highlight this vulnerability. Tighter regulations, high interest rates, and legislative changes present ongoing challenges to BML’s operations.

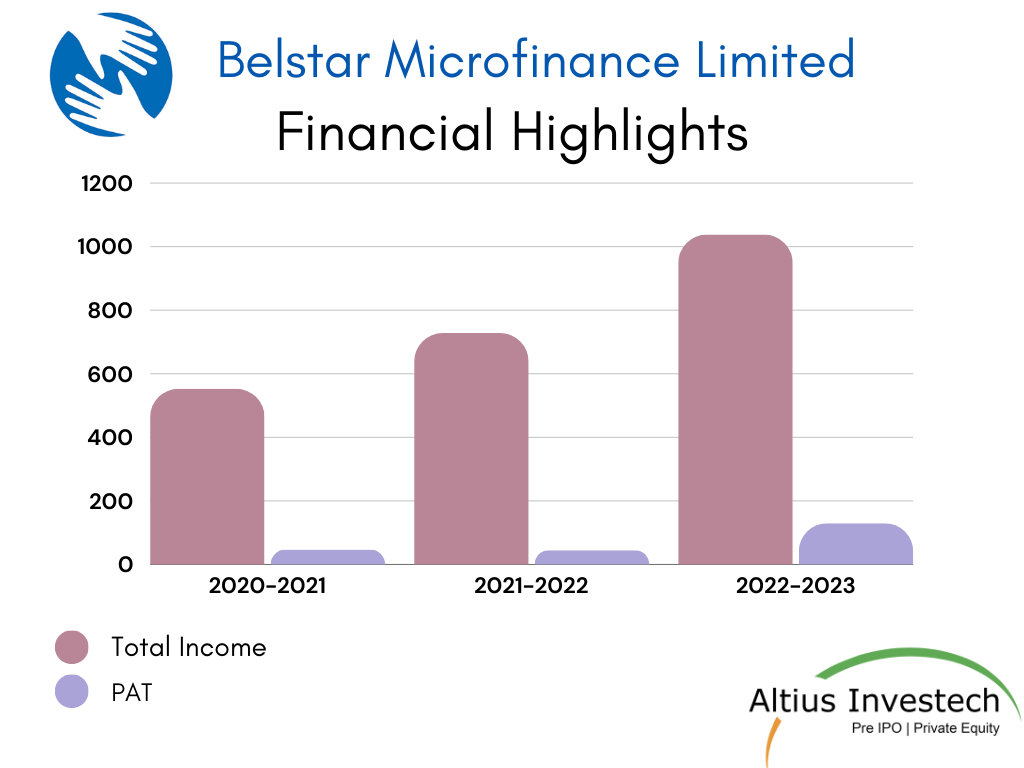

Financial Highlights

₹ in crores

| Particulars | FY 2023 | FY 2022 | FY 2021 |

|---|---|---|---|

| Total assets | 6,227 | 4,560 | 3,467 |

| Total income | 1,038 | 728 | 553 |

| Profit after tax | 130 | 45 | 47 |

| EPS | 27.12 | 12.01 | 12.43 |

| Gross NPAs (in %) | 2.6 | 5.8 | 2.9 |

| Gearing (times) | 4.4 | 4.2 | 5.4 |

| Adjusted gearing (times) | 4.8 | 4.4 | 5.3 |

| Return on assets (in %) | 2.0 | 1.0 | 1.3 |

Corporate Highlights

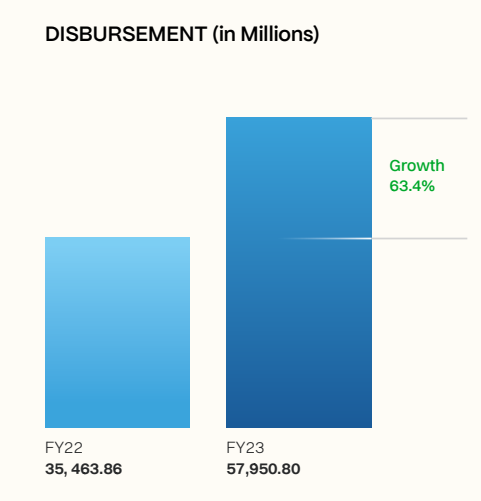

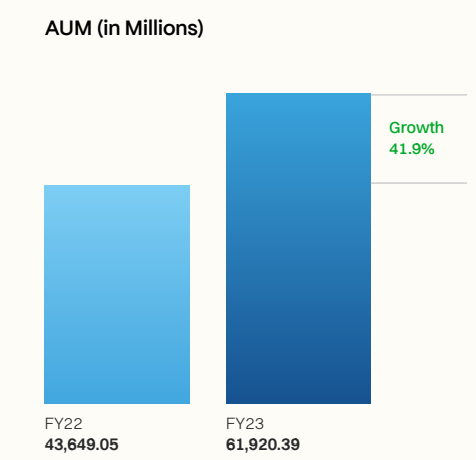

| Particulars | FY 2023 | FY 2022 | Growth % |

| Disbursement | 5,795 | 3,546 | 63.4% |

| AUM | 6,192 | 4,365 | 41.9% |

| Customer Accounts | 2,10,328 | 1,69,383 | 33.6% |

…………………………………………………………………………………………………………………………………………………………………………..

Dividend

Belstar Microfin declared final dividend of ₹0.60 [i.e. 6.0%] per share on the face value of ₹10 each on the equity share capital of the Company, for the financial year ended March 31, 2023. This declaration involves a total cash outflow of ₹2.93 Crore, resulting in a payout of 2.25% of the Company’s net profit for the year.

IPO Plans

Belstar Microfin has filed for a ₹1,300-crore IPO. Managing Director George Alexander Muthoot announced that the IPO is expected to hit the market within the next eight to ten months. The IPO comprises ₹1,000 crore worth of fresh shares and ₹300 crore from the sale of existing investor stakes, as per the DRHP filed with SEBI. The IPO aims to capitalize on Belstar’s strong growth, including a 50% increase in the previous year, and its diverse portfolio, with 57% of its business stemming from loans to self-help groups and the remainder from various other products such as small business loans, education loans, and consumer product loans.

Peer Comparison

₹ in crores- FY 2022-23

| Particulars | Belstar Microfinance Limited | Fusion Microfinance | Midland Microfinance |

| Total Income | 1,038 | 1800 | 394 |

| PAT | 130 | 387 | 47 |

| Net Profit Margin | 12.52% | 21.50% | 11.93% |

| EPS | 27.08 | 38.58 | 10.45 |

| AUM | 6,192 | 9,296 | 1,939 |

| Book Value Per Share | 227 | 283 | 76.22 |

| Shares Outstanding | 4.8 crores | 10.03 crores | 4.5 crores |

| Market Cap (June 2024) | 2640 | 4919 | 879.5 |

| CMP (June 2024) | 550 | 489 | 193 |

| P/E | 20.30 | 12.67 | 18.47 |

| P/S | 2.54 | 2.73 | 2.23 |

| P/B | 2.42 | 1.72 | 2.53 |

Awards and Recognition

- Great Place To Work Certification (OCT 2023-24): Belstar Microfinance achieved the Great Place To Work certification in October 2023-24, recognizing its commitment to providing a positive and inclusive work environment for its employees.

- SME-Empowering India Awards 2021: Belstar Microfinance was honored with the SME-Empowering India Award in 2021, acknowledging its significant contributions to empowering small and medium enterprises in India.

- Global Award for Women Empowerment 2020: Belstar Microfinance received the Global Award for Women Empowerment in 2020, recognizing its efforts in promoting and supporting the empowerment of women on a global scale.

- Women Transforming India Award 2020: Belstar Microfinance was honored with the Women Transforming India Award in 2020, celebrating its role in driving positive change and empowerment for women in India.

ALSO READ OUR OTHER BLOGS

Get in touch with us

For any query/ personal assistance feel free to reach out at support@Altiusinvestech.com or call us at +91-8240614850.

To know, more about Unlisted Company. Click here – https://altiusinvestech.com/blog/what-is-listed-and-unlisted-company

You can also checkout the list of Best 5 Unlisted Shares to Buy in India

To buy unlisted shares Visit – https://altiusinvestech.com/companymain

To know more about How to apply for an IPO? Click- https://altiusinvestech.com/blog/how-to-apply-for-an-ipo/